AI anxiety rising, but broader fundamentals remain supportive

Key Takeaways

- Last week was jam-packed from an economic data perspective. Reports that spanned household consumption, the labor market and inflation helped provide a timely check-in on the health of the U.S. economy.

- These data were not universally positive, but we think in aggregate they paint a picture of improving economic fundamentals and help keep the Fed on track to cut interest rates later this year.

- Despite these encouraging signs, we are starting to see bouts of volatility creep into markets, particularly in tech, but also in those sectors perceived to be at threat from potential disruptions from AI.

- We remain constructive on equities, but given rising volatility and ongoing rotations, we recommend remaining well-diversified across sectors and regions in 2026.

Last week was action-packed, containing a flurry of economic data, bouts of market volatility, and rising AI concerns. Let's start by digging into the economic headlines to test the health of U.S fundamentals.

Consumers take a breather

December retail-sales data were disappointing*. Headline sales were flat, while the control group that strips out some volatile categories fell 0.1% month-over-month (m/m) in December*. This implies a decline of around 0.3%-0.4% when we account for inflation*. Worse, the increase in sales over November was revised lower, adding to the sense that we saw some slowdown in consumer spending toward the end of 2025*.

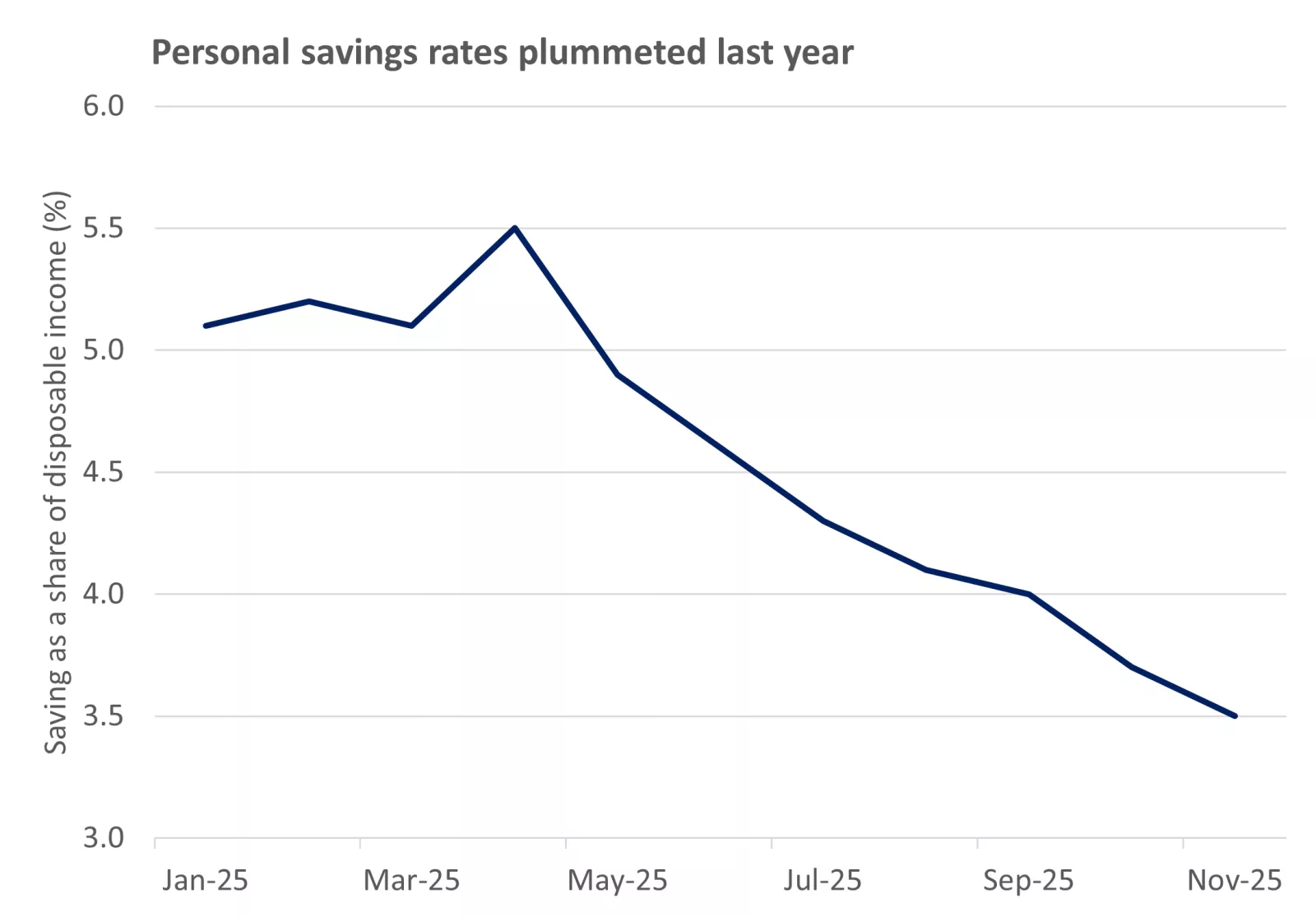

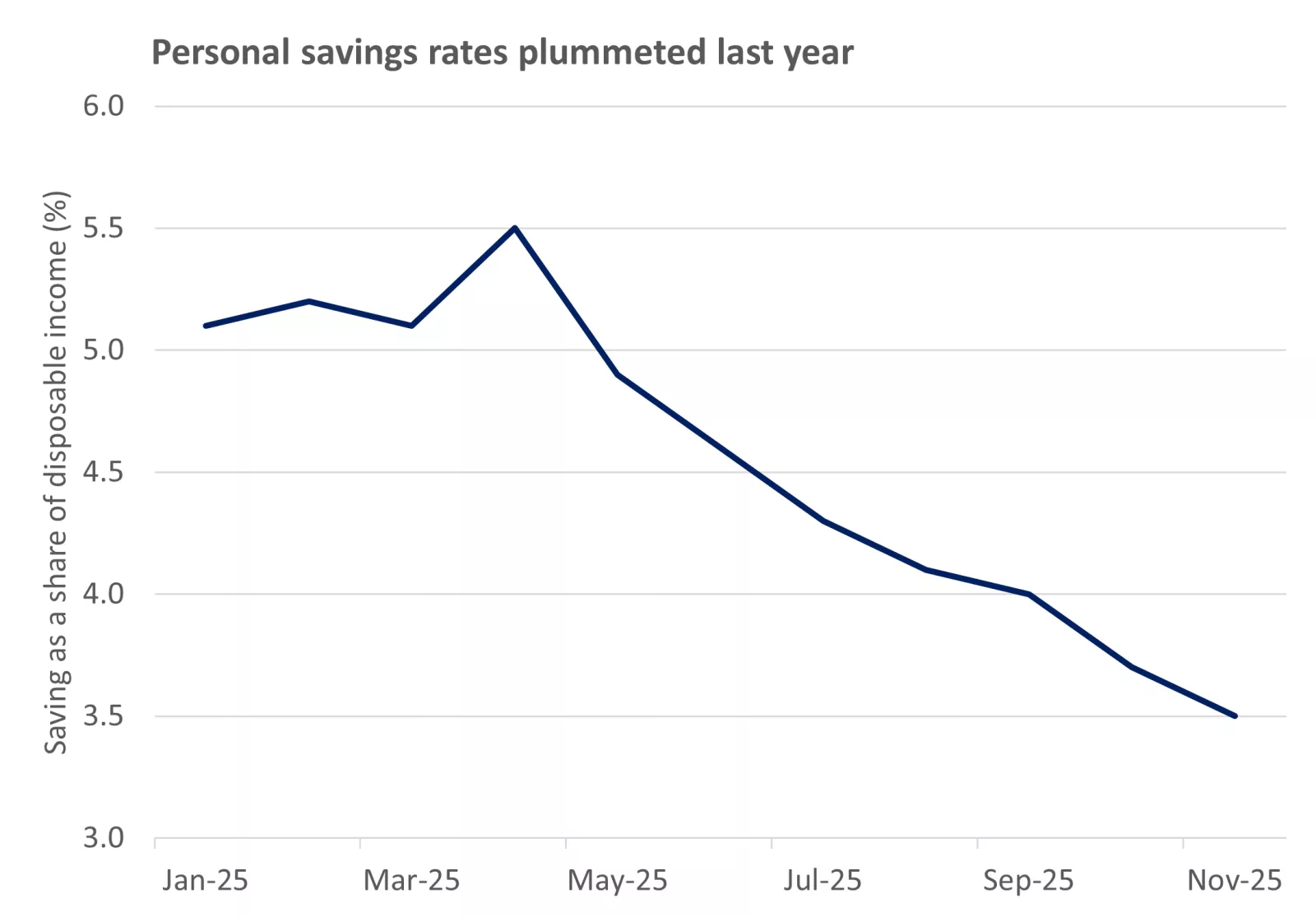

Stepping back, these disappointments should perhaps not be too surprising, in our view. Spending had been on a robust run through 2025, running comfortably in excess of income growth for U.S. households*. In practice this meant that consumers were saving less each month to finance this spending, which can happen when they are feeling positive around their personal finances*. However, there are limits to how far savings can sustainably fall, in our view, and we probably need to see some improvement in incomes in 2026 to drive the next acceleration in consumer spending.

This chart shows that U.S household savings as a share of income fell through 2025.

This chart shows that U.S household savings as a share of income fell through 2025.

Importantly, there are a couple of forces that we think will deliver this stronger income backdrop.

First will be the effect of tax cuts, which were passed last year, but will impact personal finances in 2026 through tax refunds and adjusted withholdings. The Congressional Budget Office thinks these might add up a $150 billion boost to households in 2026**.

Second, the labor market is showing signs of thawing after a freeze in hiring over 2025, which weighed heavily on income growth*.

Signs of life in the U.S. labor market

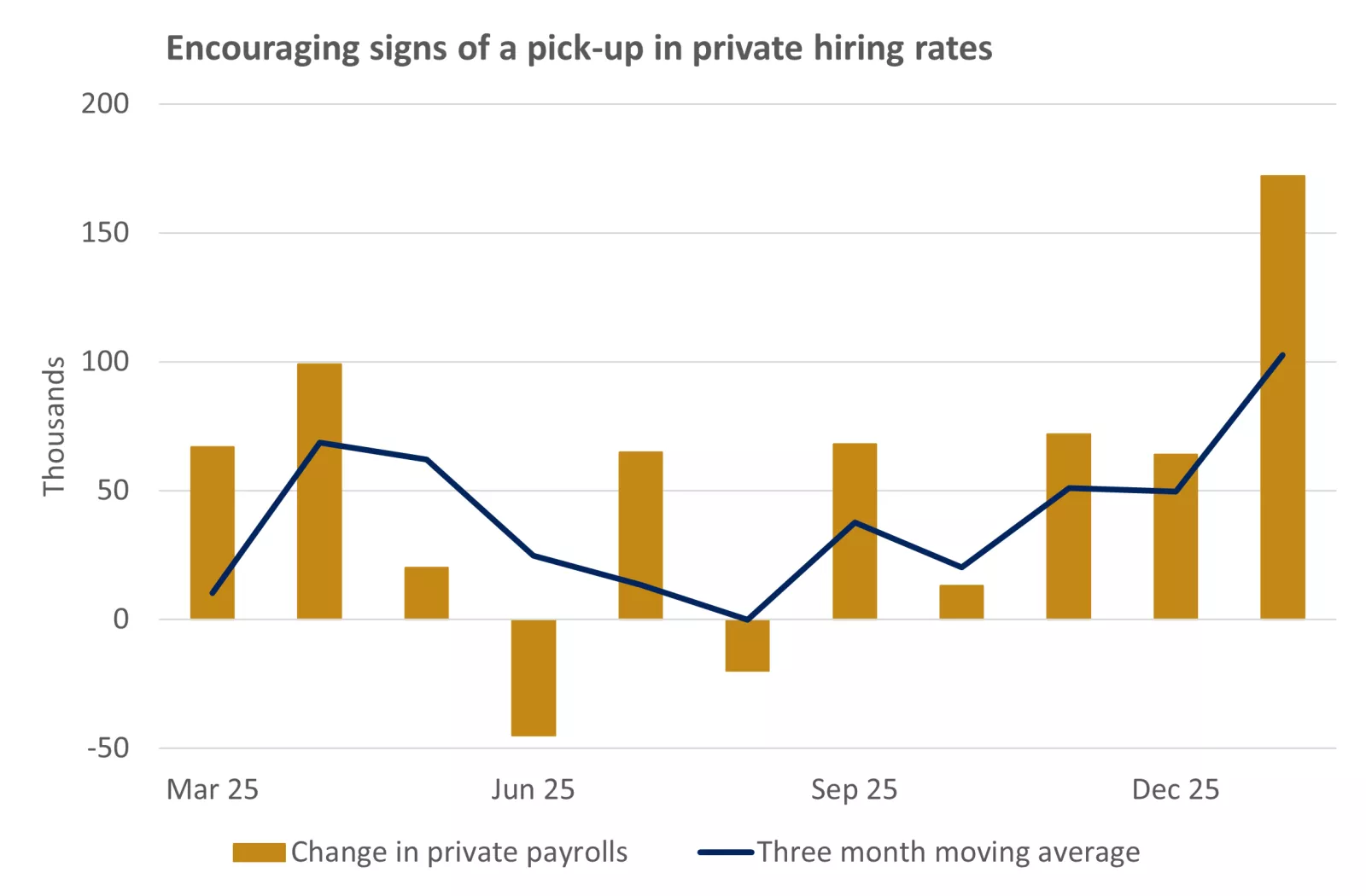

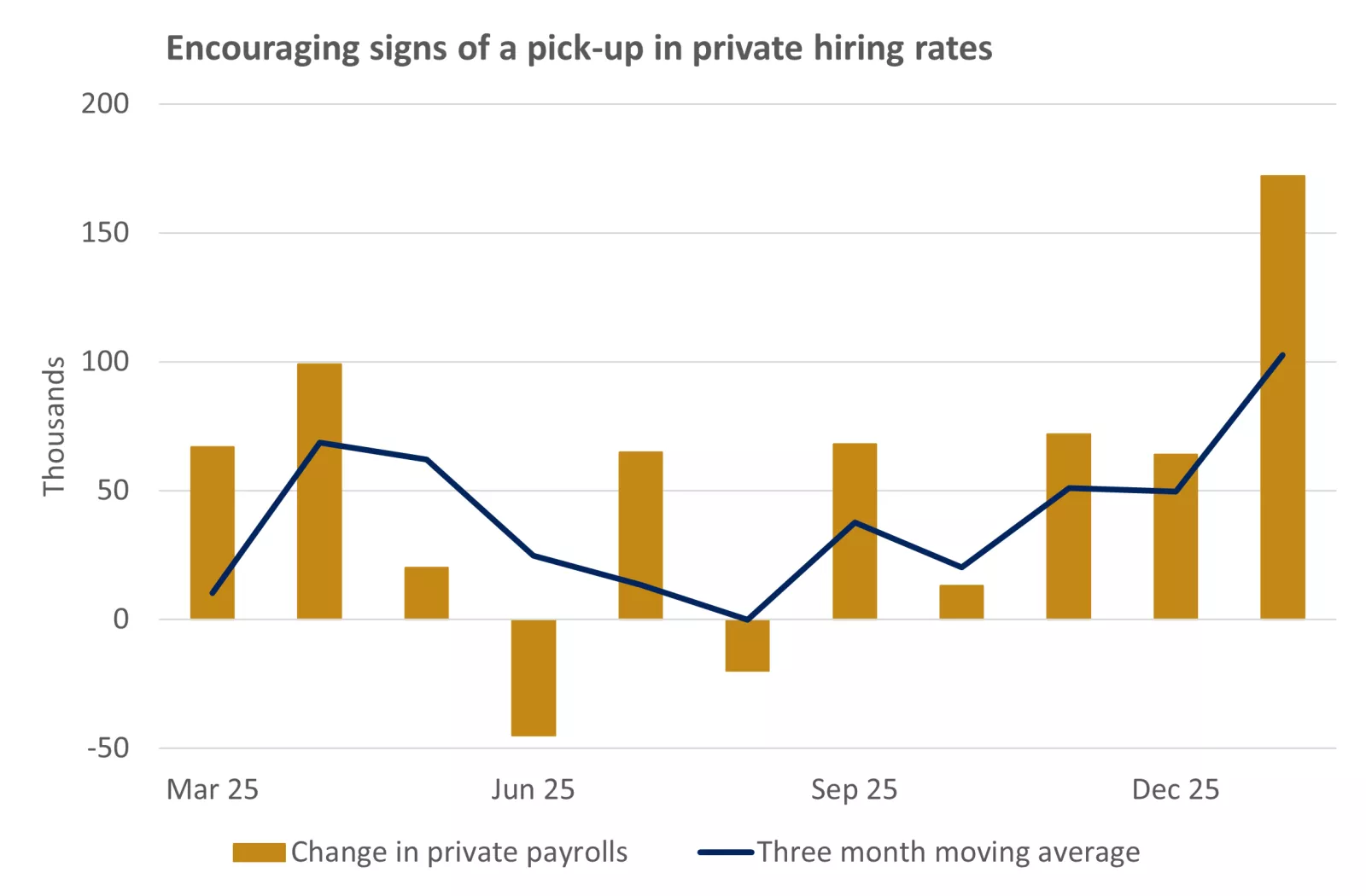

Last week's labor report delivered a clear upside surprise, with payrolls growth at 130,000 in January*. Additionally, if we strip out the ongoing drag from cuts to federal employment, the increase in private payrolls stands at 172,000 at the start of 2026, equating to an average gain of 100,000 over the past three months*. This represents a clear improvement on the nearly stagnant hiring in 2025, with private payrolls rising on average just 30,000 each month last year*. We had expected a modest pick-up in hiring in 2026 as the caution seen after last year's spike in trade policy uncertainty fades, with this an important tailwind for household incomes, in our view.

This chart shows that the pace of private payroll creation accelerated through the turn of 2026 following a very weak 2025.

This chart shows that the pace of private payroll creation accelerated through the turn of 2026 following a very weak 2025.

There was other positive news from the labor report. The unemployment rate, perhaps the cleanest read on how the labor market is evolving at present, fell to 4.3%*. Rising unemployment rates last year pointed to a deteriorating labor market and helped catalyze Fed rate cuts***. Unemployment is now down from its recent peak of 4.5%, pointing to at least some stabilization in the labor market, and perhaps a tentative improvement, in our view*.

Inflation continues its slow grind lower

Finally, January inflation data provided some upbeat headlines, even if price growth, in our view, remains a little too hot for comfort for the time being.

Headline inflation came in lower than expected at 0.2% m/m in January, taking the year-over-year (y/y) change down to just 2.4%*. This slowdown was helped by lower energy prices, and the core measure that excludes these volatile components was firmer at 0.3% m/m and 2.5% in y/y terms*.

The slowdown in the y/y consumer price index (CPI) inflation rates brings us closer to the 2% Fed target and sparked a positive reaction in bond markets*. However, there are a couple of caveats here. First, inflation has been dampened by the effects of the government shutdown, with the Bureau of Labor Statistics (BLS) assuming that some prices it could not collect in October were flat*. Second, the Fed targets the personal consumption expenditures (PCE) measure of inflation, which captures consumer spending across a broader range of goods and services. The December core PCE reading is forecast to remain elevated at 2.9% y/y*.

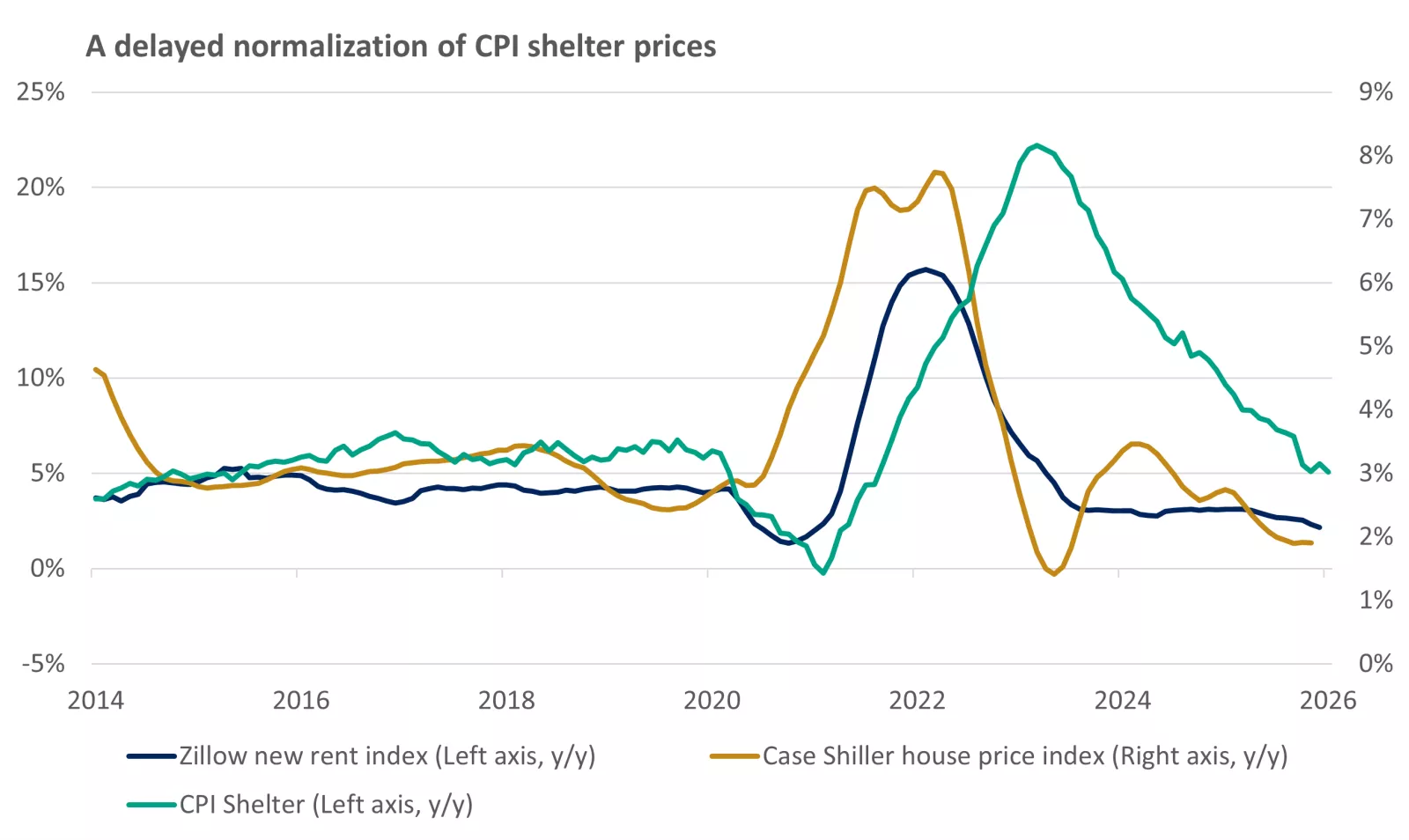

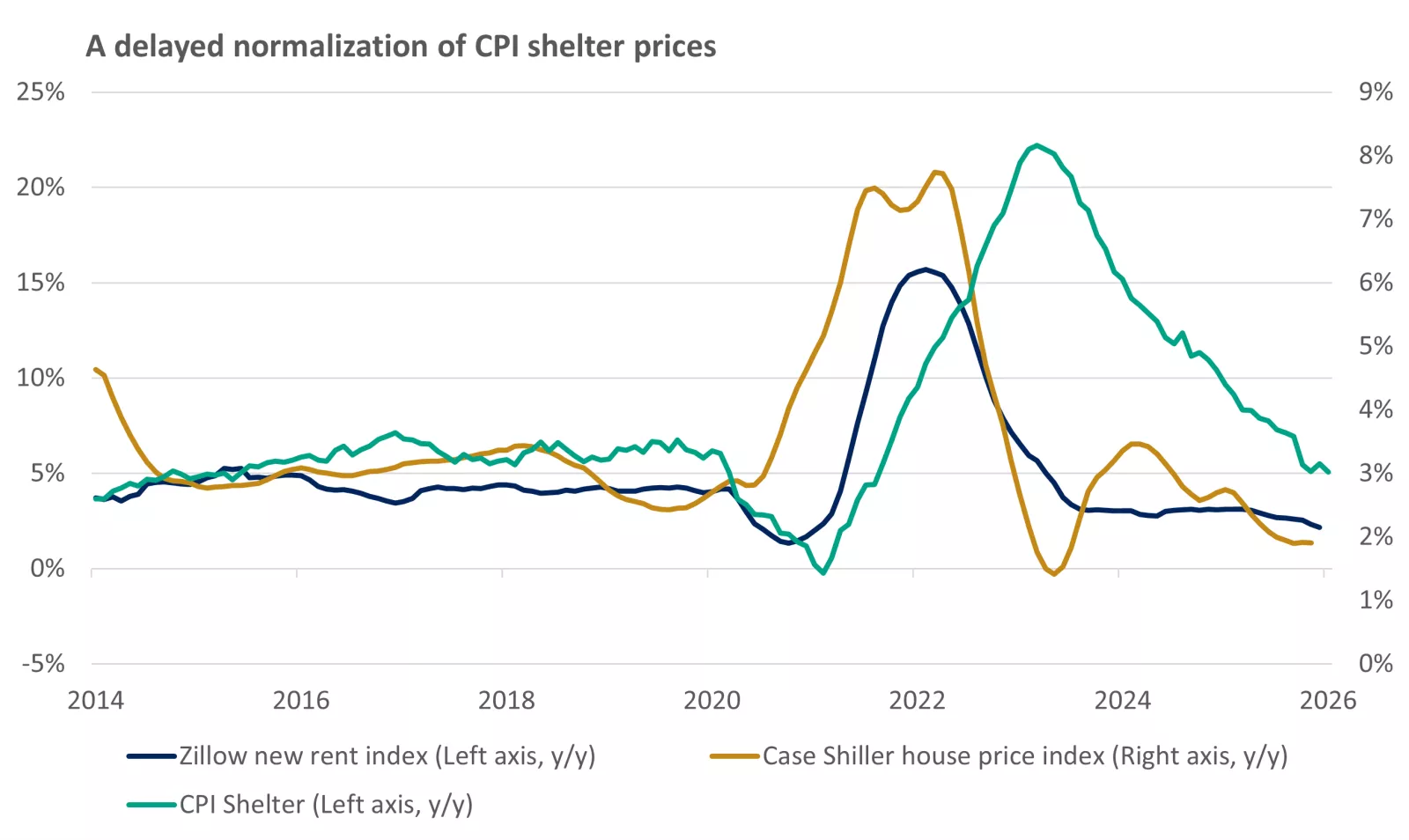

Still, there were encouraging signs in last week's CPI report, particularly the continued easing in shelter inflation*. We know that house prices and rents have slowed over recent years, but this takes time to show up in official CPI figures due to the BLS methodology*. We are now seeing clearer evidence of slower shelter inflation*, which should help drag inflation rates back toward target in our view, especially when some of the impacts of tariff inflation fade.

This chart shows that the slowdown in market rents and house price growth seen in 2022 and 2023 has only just been realized in the CPI measure of shelter prices.

This chart shows that the slowdown in market rents and house price growth seen in 2022 and 2023 has only just been realized in the CPI measure of shelter prices.

On tariffs, there were further signs of a pass-through from higher tariff rates to goods prices*. Excluding used car prices, which fell sharply at the start of the year, core goods prices increased 0.4% m/m*. There may be more tariff inflation on the way in coming months in our view, especially after a 10% decline in the dollar over the past 12 months, which has also made foreign goods more expensive*. However, we do expect these pressures to moderate as we move through 2026.

Overall, the CPI report looks to be consistent with still somewhat elevated short-term inflation pressures, but the trajectory for price growth remains lower in our view, even if this continues to be a bumpy and uneven process.

Fed on hold until at least the summer

For the Fed, we don't think the CPI report will shift its thinking in the near term. Jerome Powell has clearly telegraphed that the central bank is on hold for the time being*, and we think the better labor-market data this week will likely cement that stance at his final two meetings as chair (March, April).

Markets expect Powell's proposed successor, Kevin Warsh, to deliver at least a couple of cuts over 2026 after he takes the hotseat in June*. We agree that there is scope to cut rates once or twice more this year, albeit the urgency to ease policy is lower given signs of improving labor-market conditions. The exact timing of these adjustments will depend on how much more progress on inflation the Fed sees in coming months, in our view.

Solid macroeconomic fundamentals but wavering markets

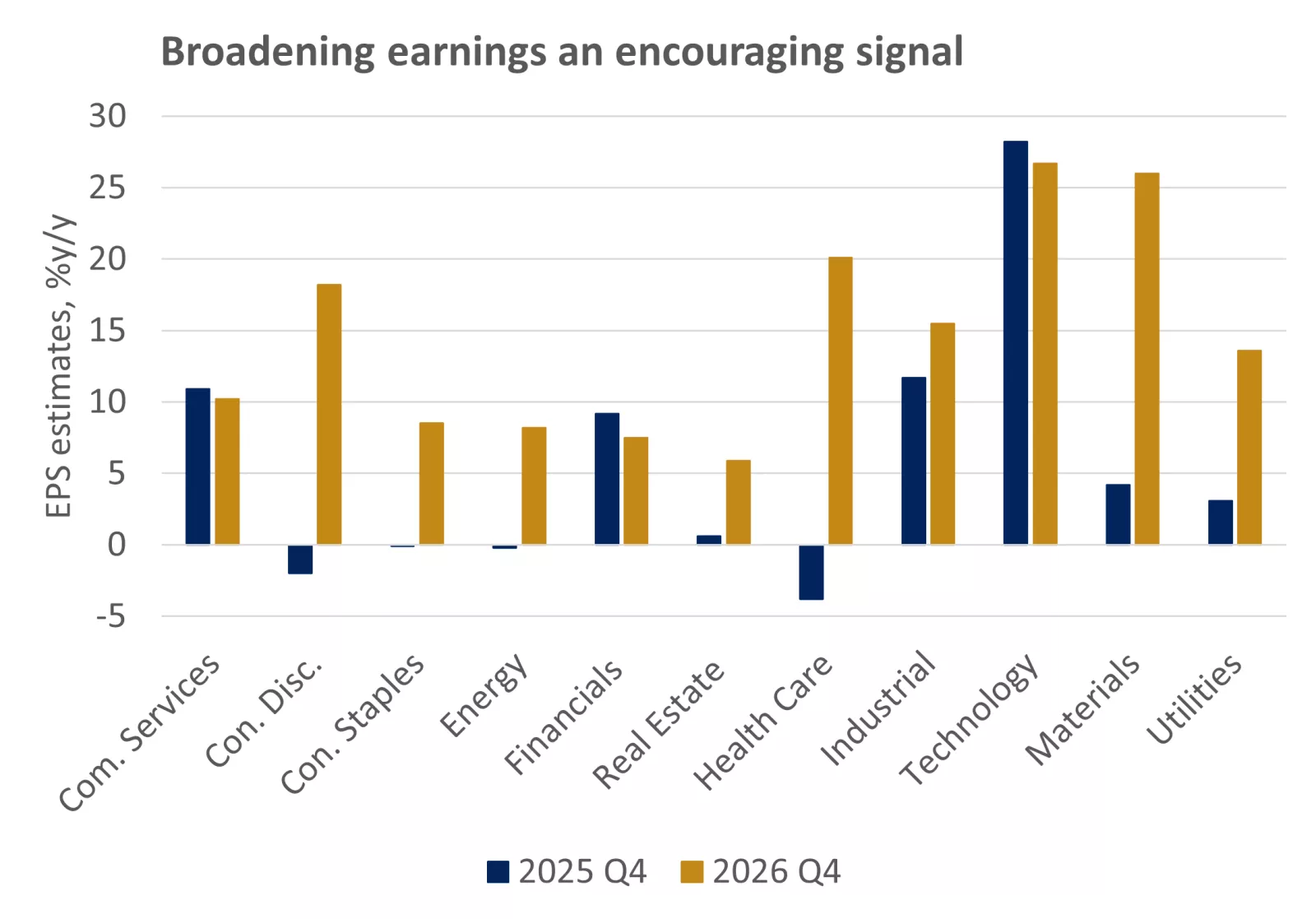

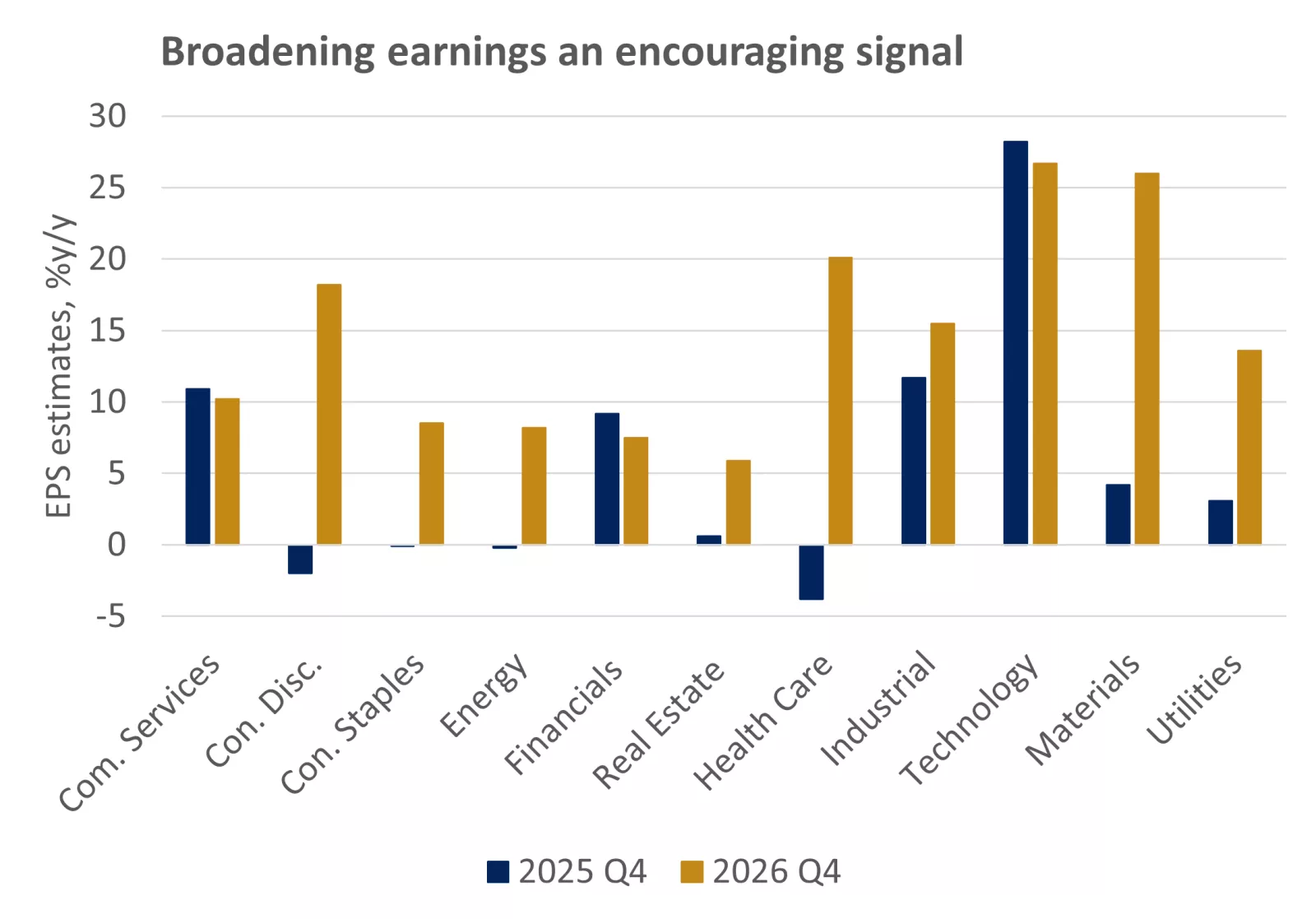

All in, the catalysts that we think will underpin a broadening in corporate earnings this year – namely tax cuts, lower interest rates, and solid growth – all remain in place, in our view. And consistent with this, we have seen generally solid earnings reports in early 2026, and expectations for further gains*.

This chart shows that analysts expect positive earnings growth across all S&P sectors this year, compared to patchier performance over 2025. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows that analysts expect positive earnings growth across all S&P sectors this year, compared to patchier performance over 2025. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

However, while this backdrop remains positive, volatility has started to pick up over recent weeks. This has been led by selling across the mega-cap technology companies, with the Magnificent 7 down 2% last week, taking losses in 2026 to near 7%*.

Last week we saw signs of broader spillovers from this weakness as investors start to price disruptions from AI across other parts of the corporate sector, highlighted by sell-offs in financial services and insurers, real estate and even trucking and logistics*.

Thus far, these fears are speculative and not reflected in changes to revenues or business models, in our view. However, they seemingly represent a shift toward choppier trading in risk markets broadly. Last week's equity sell-off included other risk assets like cryptocurrencies and precious metals, while we also saw a push into more "safe haven" like assets, such as U.S. Treasury bonds and defensive equity sectors such as utilities*.

Bottom line – Diversification remains key

Stepping back, despite the market rotations and volatility, we continue to remain constructive on equities given the solid fundamental drivers of a growing economy and healthy corporate profitability.

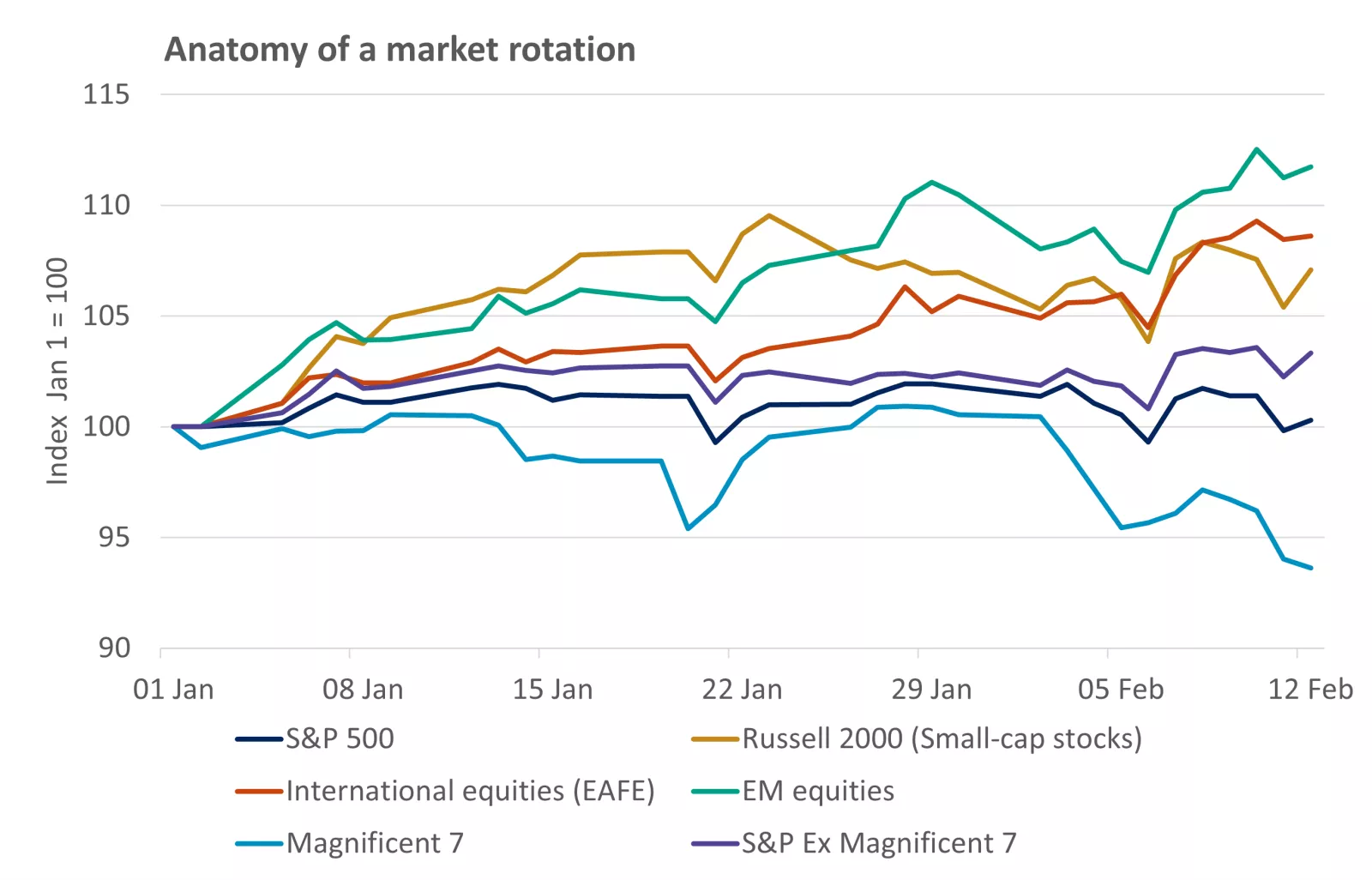

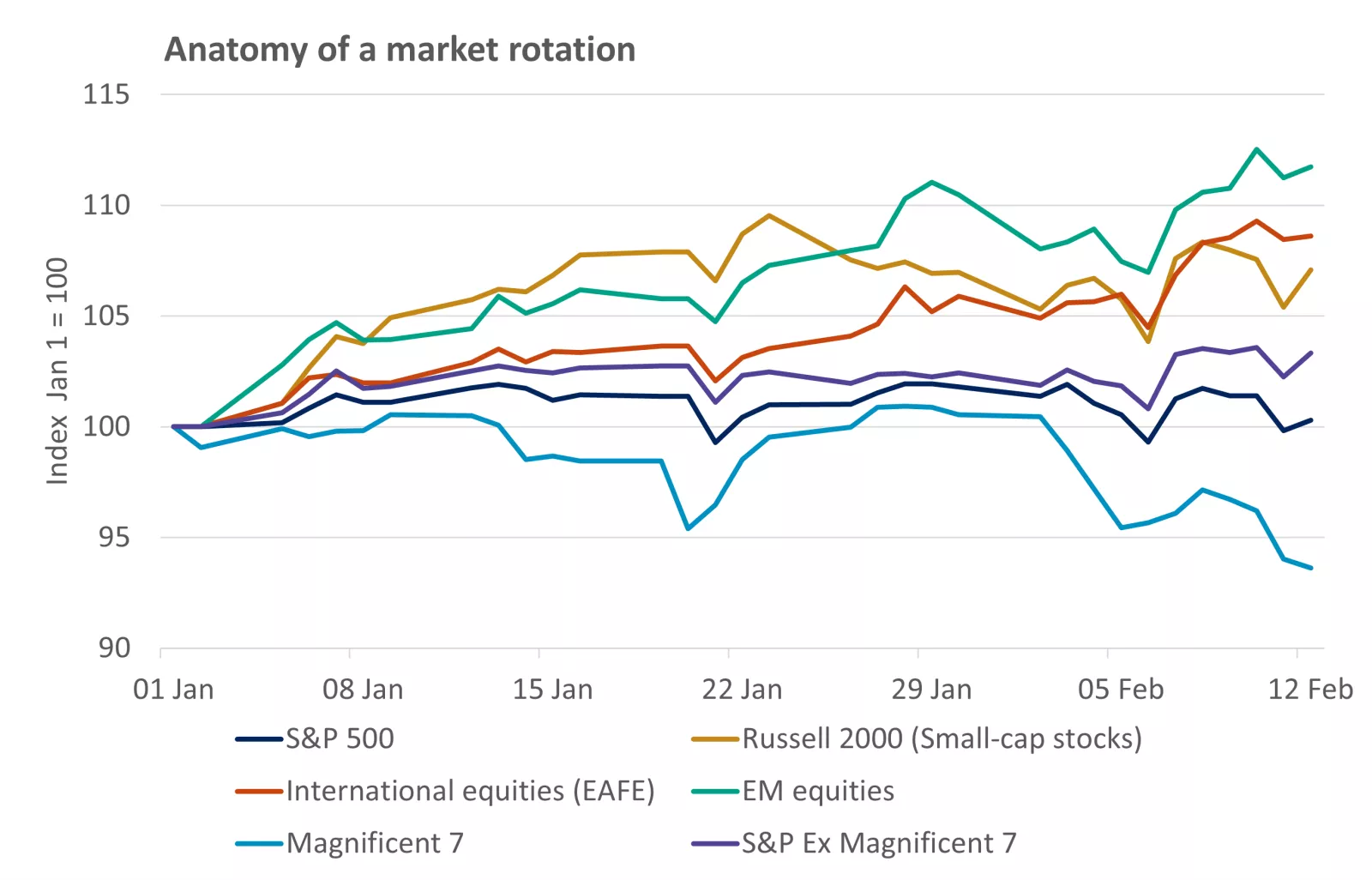

However, amid episodes of volatility*, and increasingly abrupt rotations within equity markets*, we continue to argue for a diversified, quality approach across equity allocations that span market-cap, sectors and regions.

More specifically, we think exposure across larger- and mid-cap U.S. equities, small- and mid-cap international stocks, and emerging-market equities should help ease concentration risks and tap into the broadening in market leadership we are seeing emerge in 2026.

This chart shows the relative performance of major U.S and international equity indexes over 2026 so far, with the Russell 2000, international developed markets and emerging market benchmarks all outperforming. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the relative performance of major U.S and international equity indexes over 2026 so far, with the Russell 2000, international developed markets and emerging market benchmarks all outperforming. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

James McCann

Senior Economist

Sources: *Bloomberg, **Congressional Budget Office , ***Federal Reserve

Weekly market stats

| INDEX | Close | Week | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 49,501 | -1.2% | 3.0% |

| S&P 500 Index | 6,836 | -1.4% | -0.1% |

| NASDAQ | 22,547 | -2.1% | -3.0% |

| MSCI EAFE* | 3,116.61 | 1.9% | 7.6% |

| 10-yr Treasury Yield | 4.05% | -0.2% | -0.1% |

| Oil ($/bbl) | $62.80 | -1.2% | 9.4% |

| Bonds | $100.99 | 0.9% | 1.1% |

Source: FactSet, February 13, 2026. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct, February 17, 2026.

The Week Ahead

Important economic data for the week ahead includes housing, GDP, inflation, and PMI manufacturing and services data.

James McCann

Senior Economist

Thought Leader In:

- Economic issues impacting the lives of everyday Americans.

- The effects of government spending, taxes and regulation changes on our clients.

- Building diversified portfolios to help investors reach their long-term financial goals.

“The economic, political and policy landscape is shifting dramatically, making it ever more challenging for our clients to navigate their personal finances. In this environment, it's our deep, research-driven insights that can help clients stay on track to reach their financial goals."

James McCann

Senior Economist

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.