Kevin Warsh nominated as next Fed Chair

Key takeaways:

- Kevin Warsh — Federal Reserve Board member from 2006-2011 — has been nominated by President Trump to succeed Jerome Powell as Fed chair. Powell's role as chair ends in May 2026, while his Board term runs through January 2028.

- Warsh likely represents a dovish shift on interest rates versus Chair Powell, though his influence should be tempered by the Fed's design, which includes a 12-person voting FOMC (Federal Open Market Committee).

- Confirmation appears likely1, but timing is uncertain, as some U.S. senators have raised concerns with the Department of Justice (DOJ) investigation of Chair Powell.

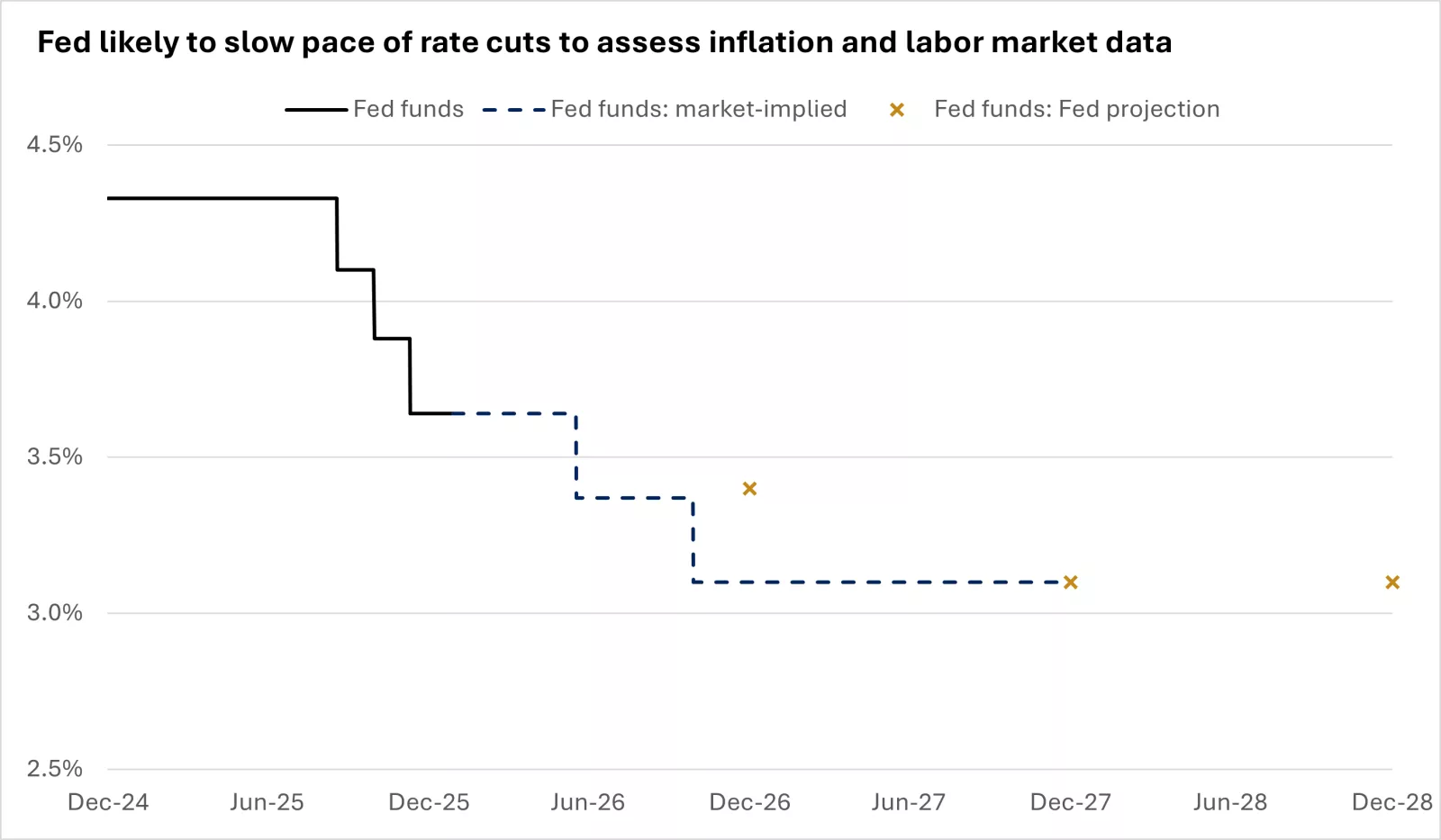

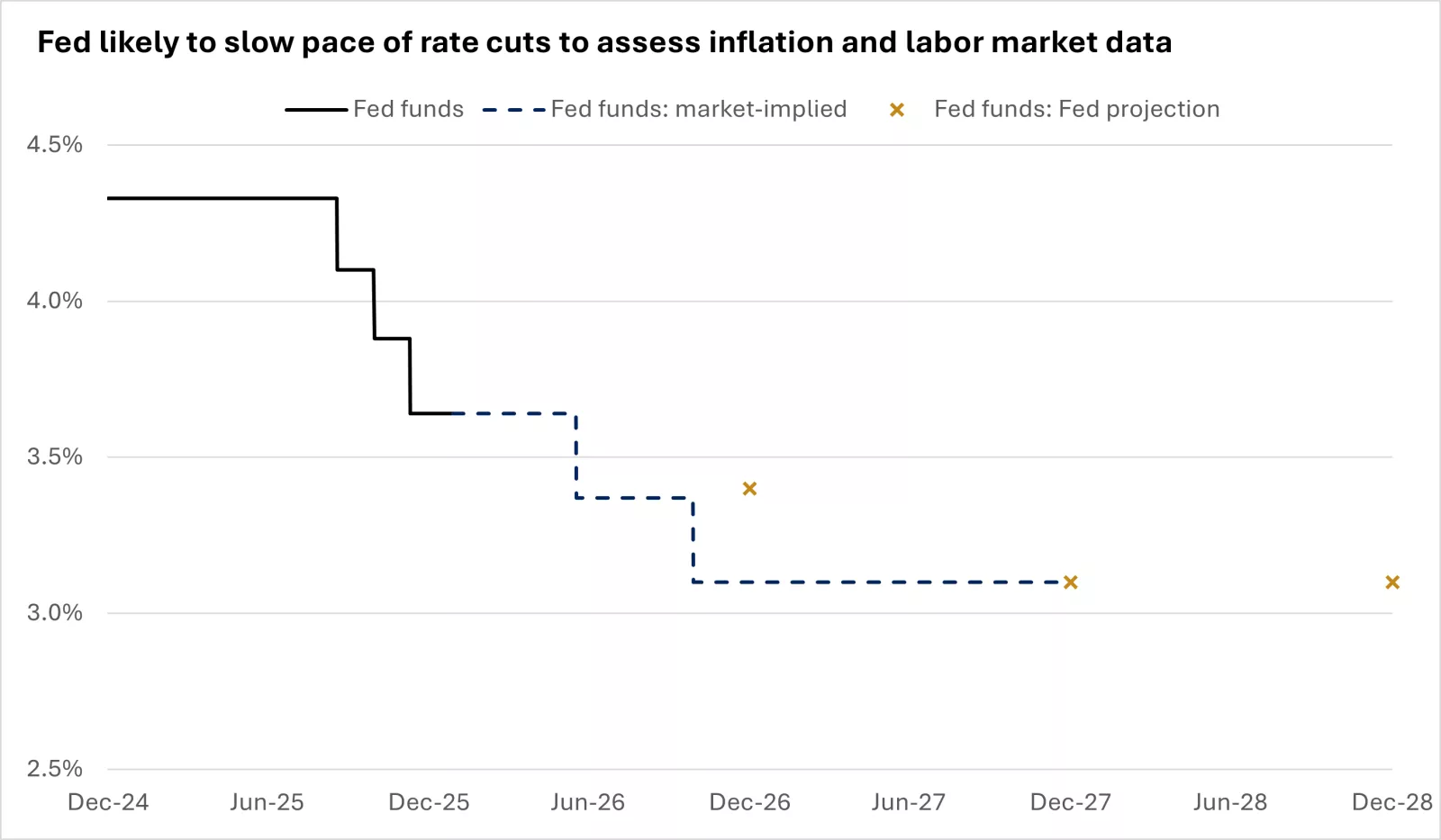

- We continue to expect the Fed to cut rates once or twice this year, targeting 3.0%-3.5% for the fed funds rate. This should help to keep 10-year Treasury yields contained in the 4.0%-4.5% range and help support equities relative to fixed income.

Warsh likely represents dovish shift

Warsh brings credibility and experience, including a key role during the 2008 financial crisis. While his monetary-policy views have been mixed2, we expect Warsh to be more supportive of rate cuts than his predecessor. He contends that the U.S. may be entering a period of higher productivity — driven by new technologies (including AI) and potential deregulation — which could support faster growth with contained inflation2. He has criticized the Fed's approach to inflation forecasting as outdated, advocating for broader perspectives in policy-setting2.

Warsh has also been a vocal critic of the Fed's balance sheet2. He believes the Fed's bond holdings expanded excessively through multiple rounds of quantitative easing2. In his view, inflation risks associated with rate cuts (monetary easing) could be mitigated by shrinking the balance sheet (monetary tightening)2. Warsh asserts that this policy mix can support growth, based on his view that low interest rates benefit the economy more than maintaining a large Fed balance sheet2.

Kevin Warsh's Key Views: |

|---|

Likely to be more supportive of rate cuts than Powell |

| Contends U.S. productivity is set to rise — driven by technology and deregulation — which could help contain inflation |

| Critic of Fed balance sheet as too large |

| Asserts shrinking Fed balance sheet could help mitigate inflation risks of rate cuts |

| Believes Fed's approach to inflation forecasting is outdated |

Shrinking the balance sheet likely reduces bank reserves — deposits that banks hold at the Fed that are widely regarded as among the highest-quality, most liquid assets in the banking system. Reducing reserves to the extent Warsh proposes likely requires broad agreement among Fed officials, as it could involve transitioning from its "ample reserves" regime back to "scarce reserves" employed prior to 20193. Lower reserves can tighten liquidity and increase volatility in money-market and short-term funding rates, especially during periods of stress. In our view, the Fed would likely need to address this risk if balance-sheet reduction proceeds.

Confirmation process could take time

We expect Warsh to ultimately be confirmed by the Senate, but the process may take time. Republicans hold a narrow 13-11 majority on the Senate Committee on Banking, Housing and Urban Affairs (Senate Banking Committee), which reviews Federal Reserve Board nominees — including the chair — before sending them to the full Senate for final confirmation. Republican committee member Thom Tillis has indicated he will oppose confirmation of any Fed nominees until the DOJ investigation into Jerome Powell around Fed building renovations is resolved.

If Warsh's confirmation extends beyond the end of Powell's term as chair in May 2026, Vice Chair Philip Jefferson would temporarily serve as acting chair. Powell's term on the Fed Board ends in January 20283, though how long he might remain is unclear. In response to the DOJ investigation, Powell stated that he intends to continue in his role, citing the need for public servants standing firm in the face of threats3.

Fed Chair: outsized but tempered influence

The Fed chair is a highly visible role with notable influence over monetary policy, communications, hiring and research priorities. However, that influence is intentionally tempered by the Fed's structure, which is designed to preserve independence, including

- Staggered 14-year terms for the seven Board members;

- Independent board appointments of the 12 regional Federal Reserve Bank presidents to five-year terms;

- Removal only "for cause," which has never occurred3. "Cause" is not explicitly defined but has historically been interpreted to mean neglect of duty or malfeasance (wrongdoing or misconduct by a public official); and

- Equal votes for all 12 voting members, who routinely express independent views.

Several Fed officials have recently reiterated the importance of central-bank independence3. While some members may show some deference to the chair, we expect continued diversity of views and data-dependent decisions.

We believe central-bank independence matters because it is associated with economic stability and lower long-term inflation globally4. If Fed independence were called into question, markets might react by pricing in uncertainty, potentially lifting intermediate- to long-term yields, steepening the yield curve, and pressuring bond prices.

What this means for investors

1. Fed to shift to more gradual rate-cutting path

This announcement does not change our outlook for the Fed to cut rates once or twice this year, targeting 3.0%-3.5% for fed funds. The pace of easing is expected to slow, as the Fed's preferred inflation gauge — the Personal Consumption Expenditure (PCE) price index — has moderated but remains above the 2% target, and the pace of disinflation has slowed.

With the federal funds target range at 3.5%-3.75%, policy appears close to neutral, in our view. PCE inflation is running at 2.8% annualized, and a neutral policy rate is generally estimated at roughly 0.75%‒1% above inflation for the U.S.5

The Fed should be able to resume rate cuts, in our view, assuming price pressures continue to ease. We think a stabilizing labor market — characterized by modest hiring and limited layoffs — should afford policymakers time to confirm that inflation is cooling toward the target.

This chart shows that the pace of Fed rate cuts is expected to slow.

This chart shows that the pace of Fed rate cuts is expected to slow.

2. Bond yield advantage over cash widens

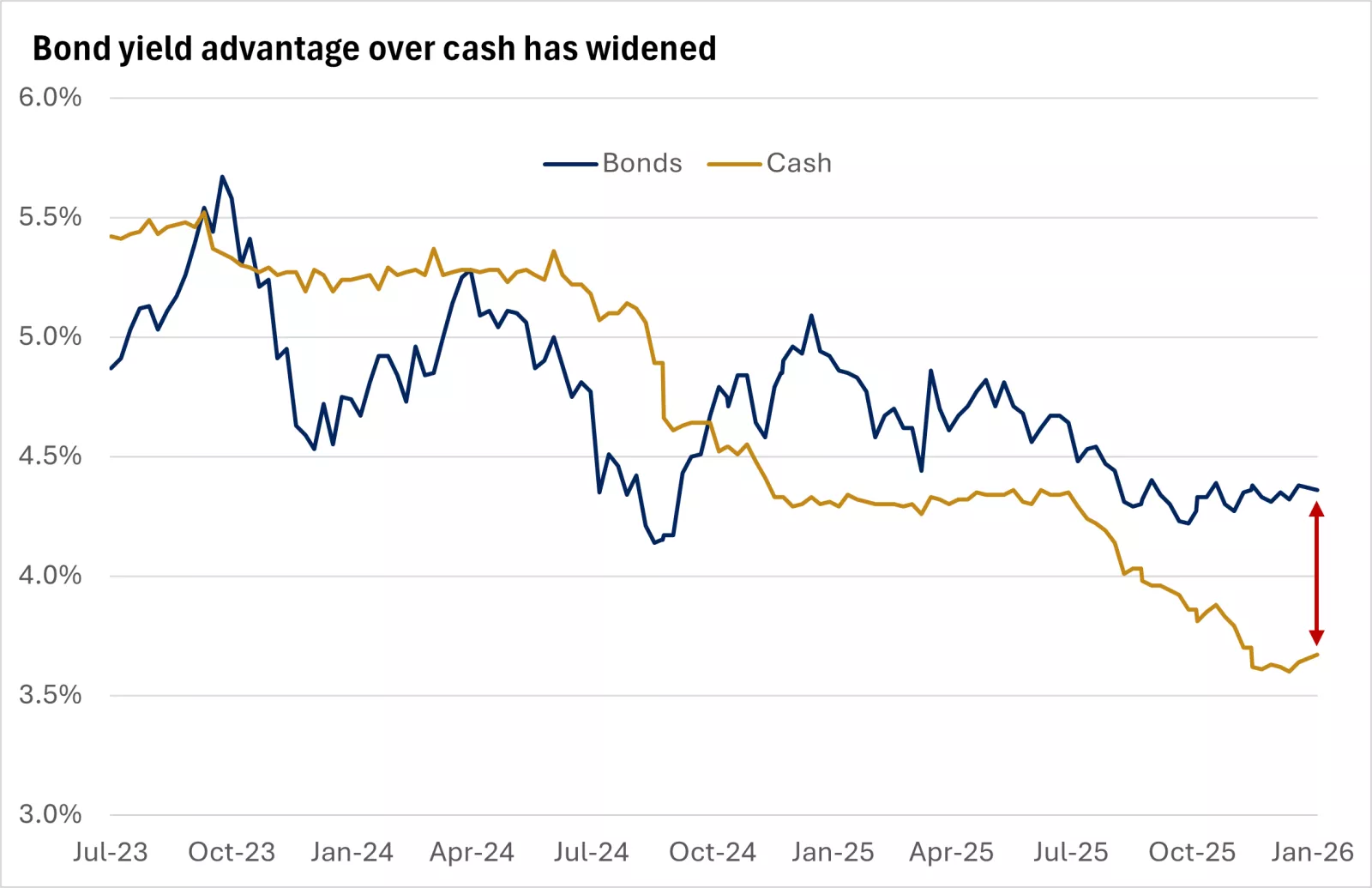

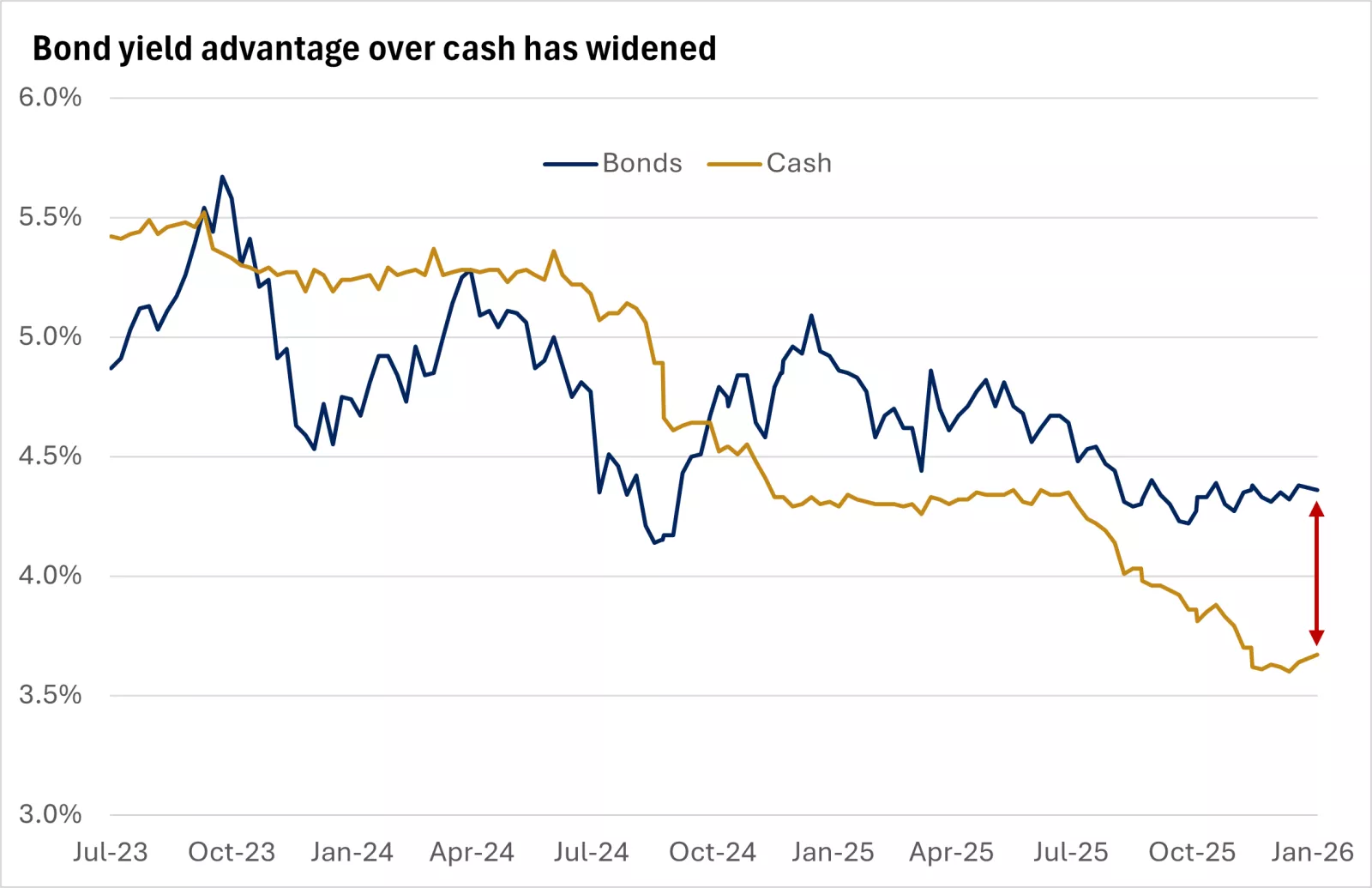

Cash yields have fallen in recent years alongside Fed rate cuts. Additional Fed Treasury bill purchases should help anchor the short end of the yield curve near fed funds, likely pushing cash yields lower.

By contrast, we expect the 10-year U.S. Treasury yield to remain largely within the 4.0%-4.5% range this year — still near the upper end of its range over the past two decades6. A positive yield curve should help keep intermediate-term bond yields above fed funds. Resilient growth, persistent budget deficits, and inflation risks typically drive yields higher, making a sustained drop unlikely, in our view.

Some investors may be overweight cash-like investments, including money-market funds, which drew significant inflows amid elevated yields6. Consider gradually reinvesting excess cash into either quality bonds that carry more attractive yields or equities aligned with your goals and comfort with risk.

This chart shows that yield advantage of bonds over cash has widened.

This chart shows that yield advantage of bonds over cash has widened.

3. Diversification may add value

In our view, the Fed is likely to modestly lower interest rates, regardless of the new Fed chair in place. We think this easing interest-rate backdrop, together with resilient growth and rising corporate profits, should be supportive of equities relative to fixed income. We favor U.S. large- and mid-cap stocks, where we expect leadership to continue to broaden. International developed small- and mid-cap and emerging-market equities may benefit from global economic resilience, lower valuations, and potential U.S. dollar softness. Within fixed income, international bonds can add diversification through exposure to different economic and interest-rate cycles, while emerging-market debt can also enhance income potential.

The bottom line — little change to Fed outlook

In our view, Warsh's nomination likely represents a dovish shift for the Fed chair role, but the impact should be tempered. We continue to expect one or two Fed rate cuts this year, assuming price pressures continue to ease. This interest-rate backdrop, together with resilient growth, rising corporate profits, and potential U.S. dollar softness, helps support the case for diversification and a broadening of equity-market leadership, in our view.

Sources: 1. Polymarket 2. Hoover Institution 3. U.S. Federal Reserve 4. Federal Reserve Bank of St. Louis 5. Federal Reserve Bank of New York 6. FactSet

Brian Therien

Brian Therien is a Senior Fixed Income Analyst on the Investment Strategy team. He analyzes fixed-income markets and products, and develops advice and guidance to help clients achieve their long-term financial goals.

Brian earned a bachelor’s degree in finance from the University of Illinois at Urbana–Champaign, graduating with honors. He received his MBA from the University of Chicago Booth School of Business.

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice. Content is intended as educational only and should not be interpreted as a specific recommendation or investment advice.

Investing in equities involves the risk of loss. The value of an investor's shares can fluctuate, and investors can lose money. Small-and mid-cap stocks tend to be more volatile than large company stocks.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates, and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Diversification does not guarantee a profit or protect against loss in declining markets.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.