How to start an investment portfolio

Tom Larm, CFA®, CFP®

Portfolio Strategist

Investments can play an important role in helping you achieve your financial goals. Building an investment portfolio, though, can feel overwhelming. There are so many different ways to invest and save for your future. Working with someone you trust and focusing on a defined set of steps, centered around what you’re trying to achieve, can make the process much easier and personalized to you.

Therefore, we recommend working with your financial advisor on these steps to building a portfolio:

One of the many important things your Edward Jones financial advisor does is get to know you, to understand your financial needs and what’s important to you—and why—and then work with you to create a portfolio to help you achieve your goals. So how does your financial advisor actually go about doing this?

They start with your goals. Why do you want to invest money? It could be for your retirement, your kid’s college tuition, or a Florida mansion to see out your days.

Next your financial advisor will consider three key risk considerations:

First, how comfortable are you with the ups and downs that come with investing? It’s important to be honest with yourself about this. Sometimes you think you’re fine with risk, until the market goes down, along with your account. Higher tolerance for market swings might steer you toward a more aggressive portfolio; lower tolerance, a less aggressive portfolio.

Second, when will you need your money for your goals? Let’s say you are comfortable with high-risk investments and the ups and downs of the market don’t give you ulcers—do you have enough time to recover from a market downturn if you plan to retire in 5 years? A longer time horizon might support a more aggressive portfolio; a shorter time horizon, a less aggressive portfolio.

Finally, there’s the third big question. How much do you really need and what kind of return will it take to get you there? Requiring a higher return to meet your objective may also require higher risk and perhaps a more aggressive portfolio. Extra money is always welcome, but too much risk and you may not meet your goals—which could be one of the biggest risks of all.

Your financial advisor helps you select an investment strategy which balances your needs and risk considerations, and then helps you build a portfolio designed to deliver on that strategy.

Each strategy has recommendations about where and how much to invest. How much of your money should be invested in U.S. or international bonds? Or U.S. or international stocks? We also make recommendations about what areas you should invest in such as tech, banking, or energy. Spreading your investments in this way may help manage risk, as one type of investment goes down, another may go up.

We know that you may have preferences about how your money is invested. You may choose not to invest in tobacco for example, or have special tax needs. Your financial advisor can balance these needs and preferences with our investment strategy recommendations to ensure your portfolio still supports achieving your goals.

You shouldn’t need a financial degree to understand how your portfolio was built. That’s what your financial advisor is for. Your financial advisor uses time-tested processes and Edward Jones strategies to build a portfolio that helps you achieve your financial goals. Trust your strategy and reach out to your financial advisor if your goals change or when you're thinking about making a change to your portfolio.

When it comes to creating an investment portfolio, it all starts with you and your aspirations. Before you begin choosing how to invest, we want you to think about why you’re investing, as well as your motivations and the values driving them.

What matters most to you? It’s important that your investment portfolio is based on an objective that helps you achieve your unique financial goals. After all, the biggest risk you face is not in the stock market — it’s not reaching your long-term goals.

Additionally, you likely have multiple goals, each with a distinct purpose and time horizon. Your financial advisor can help you balance and prioritize all you're working to achieve. Together, you can develop a financial strategy that incorporates your investment objectives by considering topics such as:

Assessing your comfort with risk is important because it’s unlikely you’ll reach your long-term goals if you abandon your strategy during the inevitable short-term market decline. Determining and periodically revisiting your comfort level with risk can help you avoid some emotional investing mistakes, such as chasing performance.

Growth investments, such as stocks or stock mutual funds, may experience more market volatility than more income-oriented investments, such as bonds or bond mutual funds, but can provide opportunities for higher returns. Appropriate diversification across quality, long-term investments can help align the risk of your portfolio with your comfort level. Finding that right balance can help you stay on the path toward your investment strategy.

Typically, your financial advisor will ask you to complete a questionnaire that can gauge how you might react to risk in different situations. If you’re building an investment portfolio with your partner or spouse, this is an important topic to discuss with each other.

You need to determine when you’ll need your money, which is directly related to your financial goals. Each financial goal will probably have its own time horizon. For example, if you’re saving for retirement, think about when you want to retire. If another goal is saving for college, your time horizon will be based on when your children will reach college age and how many years of school you plan to pay for.

Typically, the longer you have to invest, the greater your ability to recover from potential market declines, possibly allowing you to consider investments with greater return potential. As your time horizon shortens, we recommend shifting to more conservative investments that typically have smaller price fluctuations.

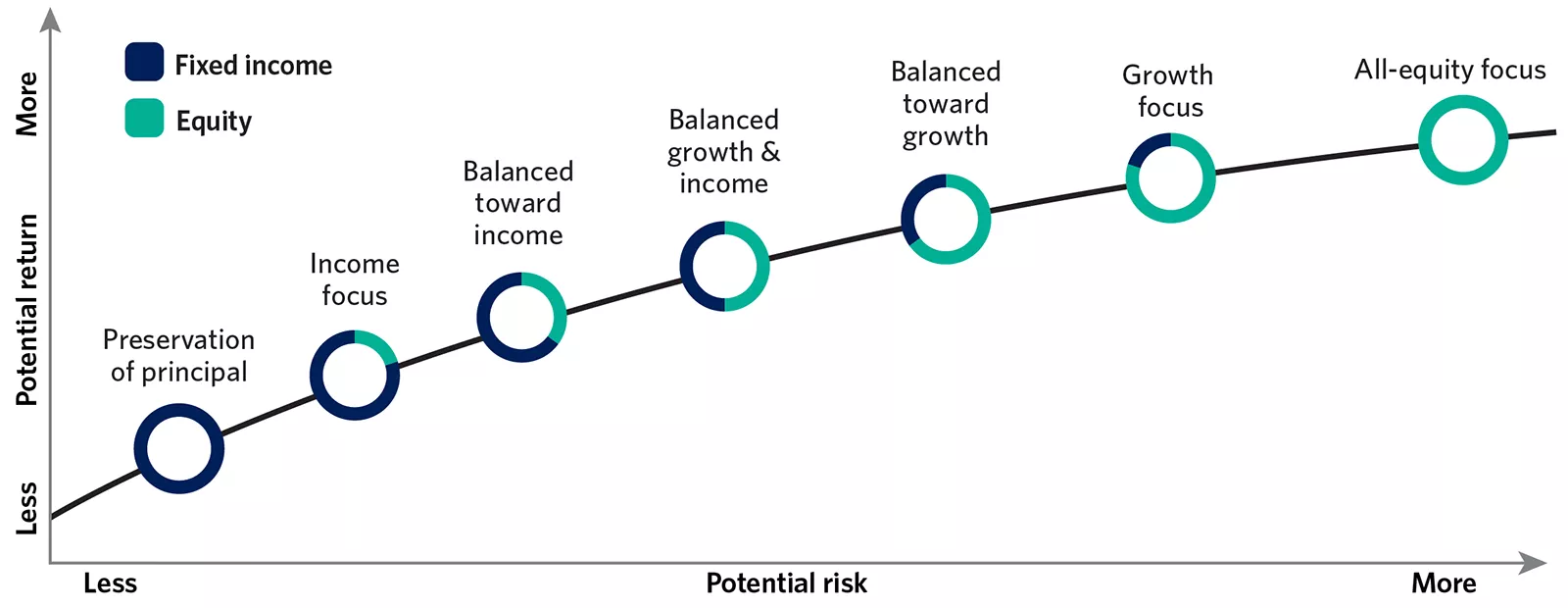

There are risk and return expectations associated with each investment you choose. If an investment portfolio is made up primarily of fixed-income investments, it will likely have lower risk and lower return expectations. If an investment portfolio is more focused on equities, it will likely have higher risk and higher return expectations.

Investing is all about balance. For your portfolio, we recommend choosing an appropriate mix of equity and fixed-income investments based on your unique situation, starting with your comfort with risk, time horizon and financial goal(s). Considering additional factors — such as your retirement income needs, existing savings and whether you want to leave a legacy — can also help you decide the most appropriate allocation to stocks and bonds.

To help you through this step in the process, evaluate how the risk and return characteristics of our portfolio objectives align with your situation. This illustration can help you visualize the risk-return trade-off as you move across portfolio objectives:

Source: Edward Jones

This graphic demonstrates the tradeoff between risk and return. Higher return is typically accompanied by higher risk. Over the long run, we expect equities to provide potential for higher returns than bonds, but they are also generally more volatile and subject to greater risk than bonds. The amount of equity increases as you move across portfolio objectives on the graphic from left to right, which increases estimated returns as well as estimated risk.

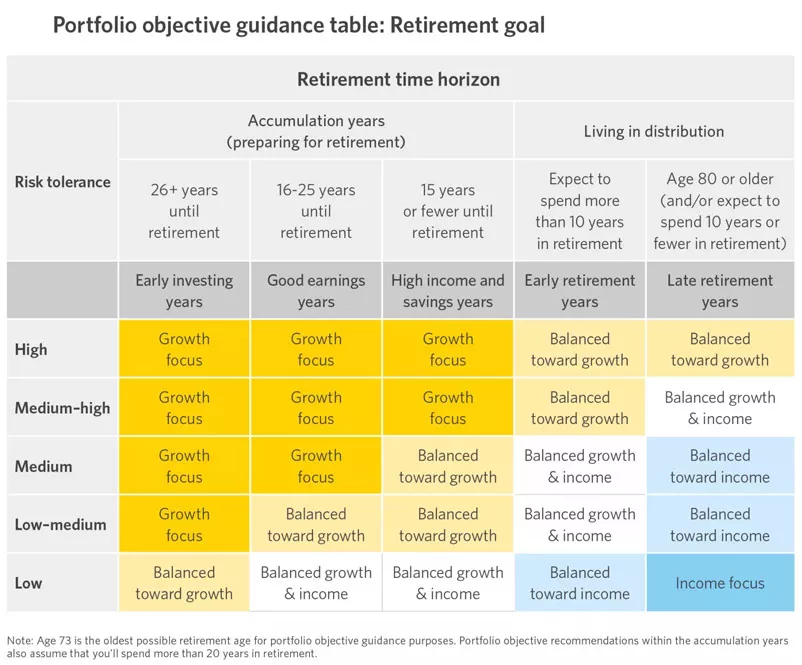

The table above represents our guidance on how to select a portfolio objective for a retirement goal, which we provide as an example. For retirement goals, we recommend considering your life stage, as well as your comfort with risk and time horizon.

We’ve identified five investing stages of life related to retirement goals, dividing them into two categories — accumulation stages and distribution stages. Accumulation stages represent when you’re saving for retirement. Distribution stages represent when you’re already retired and using your investments to support your income needs.

Use this table as a guide to help you determine your unique portfolio objective for your retirement goal. First, find your life stage and time horizon across the top. Then, estimate your risk tolerance using the descriptions on the left side.

For example, if you’re in your early investing years and have a high risk tolerance, a growth focus portfolio objective may be right for you. If you’re in your late retirement years and have a low risk tolerance, an income focus portfolio objective may be more appropriate.

The table above represents our guidance on how to select a portfolio objective for a retirement goal, which we provide as an example. For retirement goals, we recommend considering your life stage, as well as your comfort with risk and time horizon.

We’ve identified five investing stages of life related to retirement goals, dividing them into two categories — accumulation stages and distribution stages. Accumulation stages represent when you’re saving for retirement. Distribution stages represent when you’re already retired and using your investments to support your income needs.

Use this table as a guide to help you determine your unique portfolio objective for your retirement goal. First, find your life stage and time horizon across the top. Then, estimate your risk tolerance using the descriptions on the left side.

For example, if you’re in your early investing years and have a high risk tolerance, a growth focus portfolio objective may be right for you. If you’re in your late retirement years and have a low risk tolerance, an income focus portfolio objective may be more appropriate.

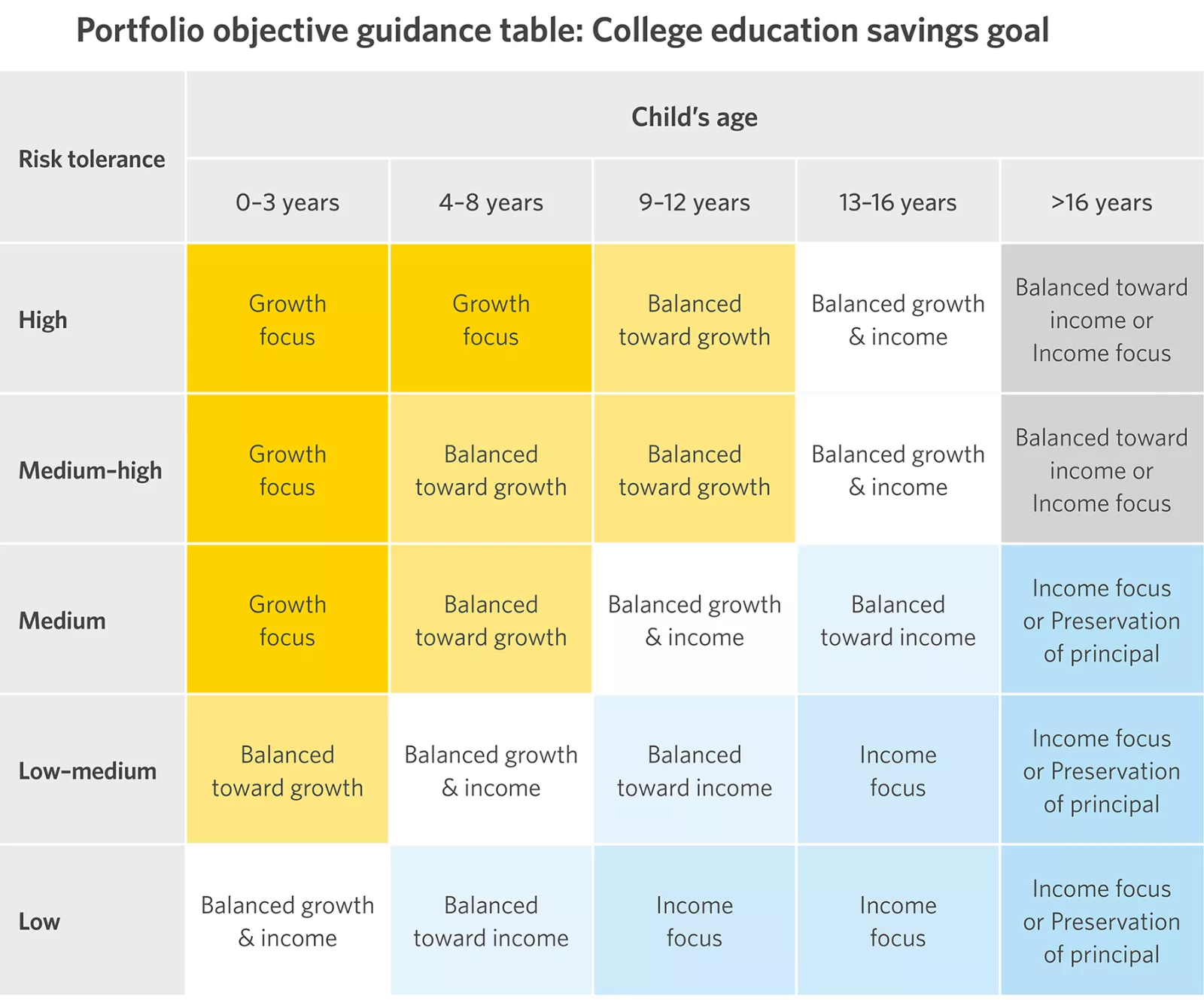

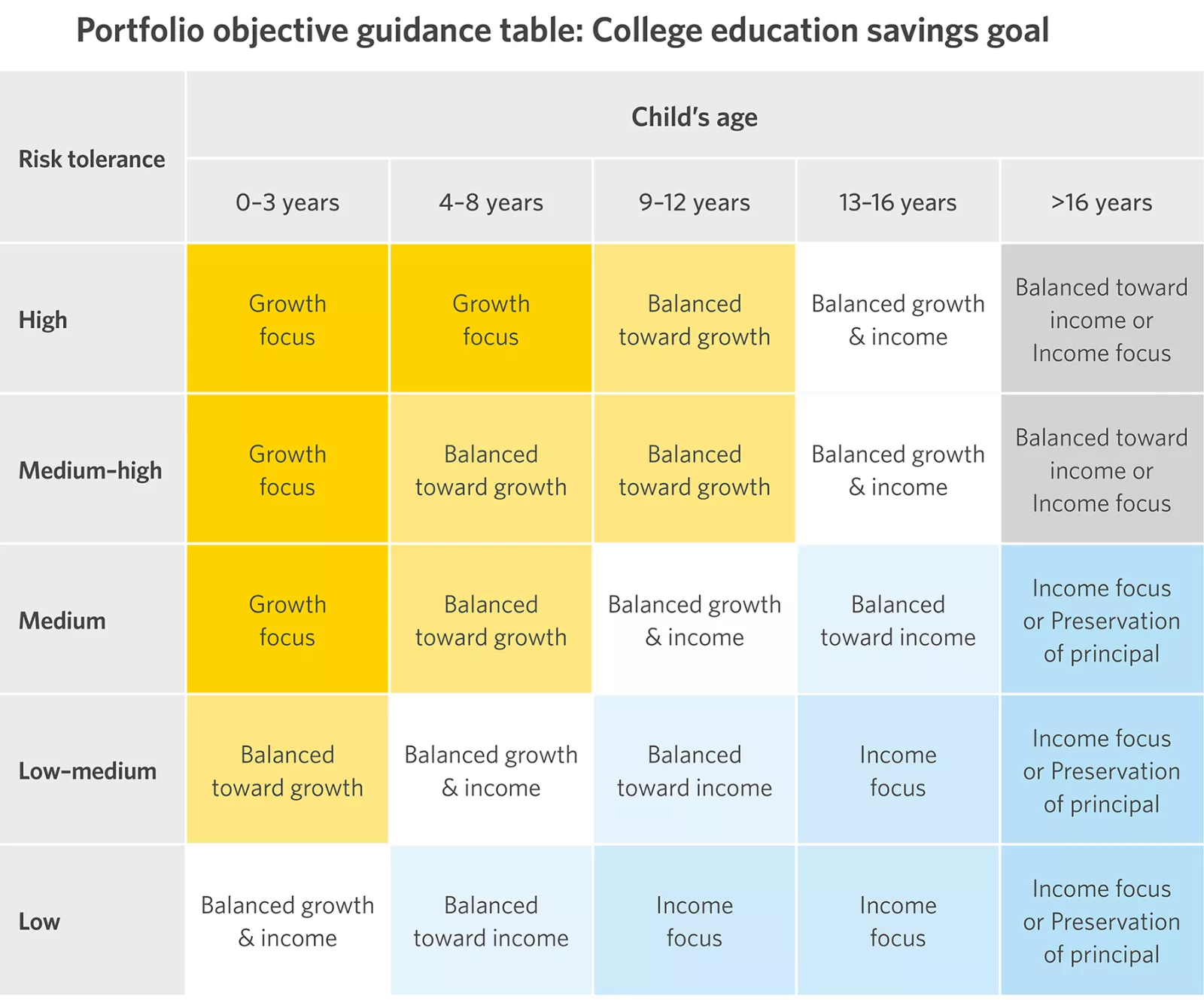

The table above represents our guidance on how to select a portfolio objective for a college savings goal, which we provide as another example. For college goals, we recommend considering your child's age (assuming they go to college at age 18), as well as your comfort with risk.

Use this table as a guide to help you determine your unique portfolio objective for your college goal. First, find your child's age across the top. Then, estimate your risk tolerance using the descriptions on the left side.

For example, if your child is 5 years old and you have a high risk tolerance, a growth focus portfolio objective may be right for you. If your child is 17 years old and you have a medium risk tolerance, an income focus or preservation of principal portfolio objective may be more appropriate.

The table above represents our guidance on how to select a portfolio objective for a college savings goal, which we provide as another example. For college goals, we recommend considering your child's age (assuming they go to college at age 18), as well as your comfort with risk.

Use this table as a guide to help you determine your unique portfolio objective for your college goal. First, find your child's age across the top. Then, estimate your risk tolerance using the descriptions on the left side.

For example, if your child is 5 years old and you have a high risk tolerance, a growth focus portfolio objective may be right for you. If your child is 17 years old and you have a medium risk tolerance, an income focus or preservation of principal portfolio objective may be more appropriate.

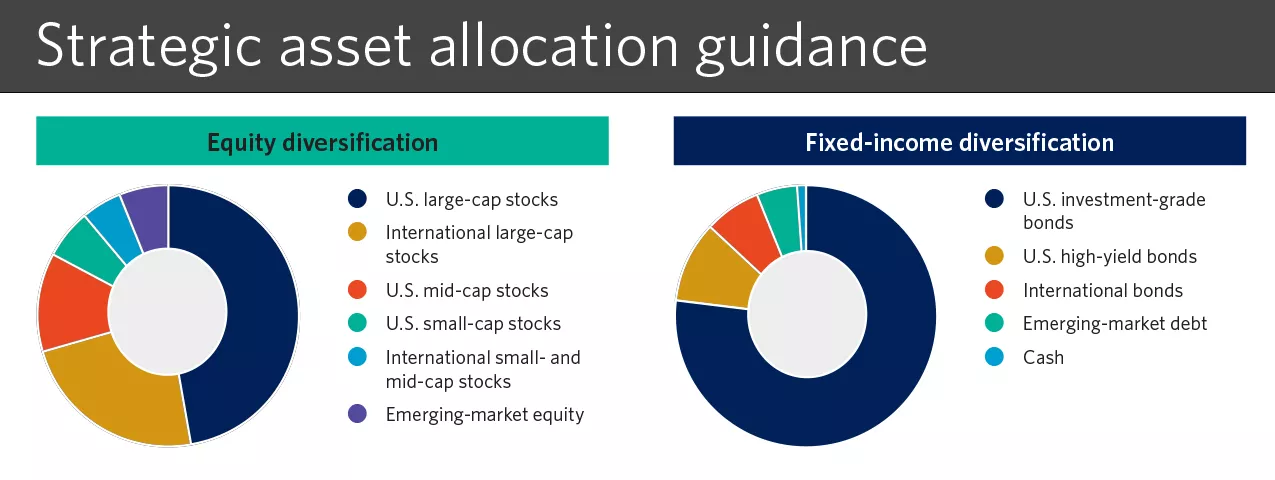

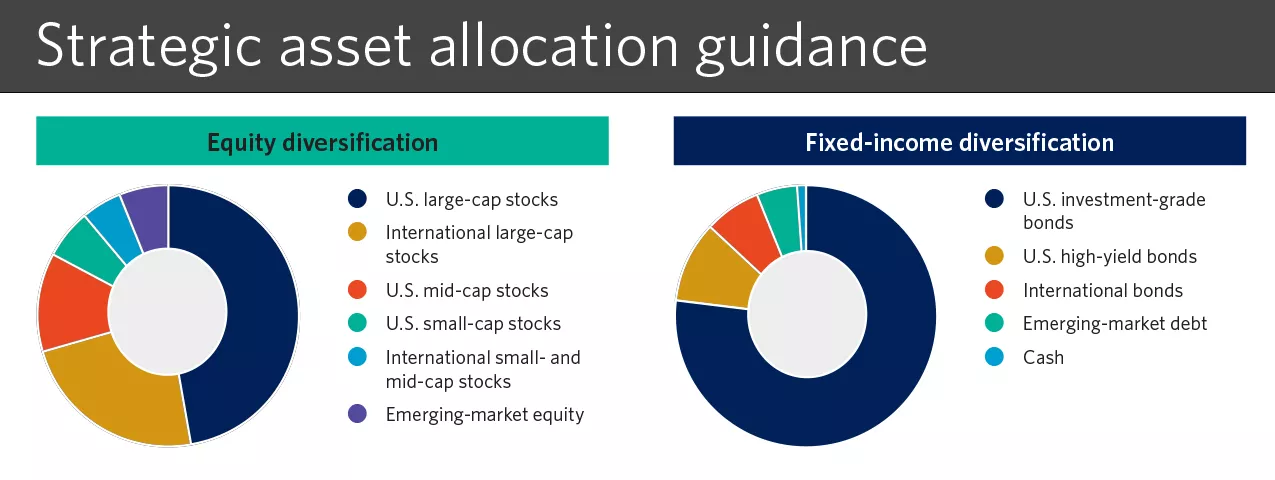

Once you’ve agreed on the mix of equity and fixed-income investments that aligns with your situation, we recommend building a portfolio diversified across a variety of asset classes. Asset classes are groups of investments that share similar risk and return characteristics. Asset classes behave differently over time, and it’s impossible to know which may be the best performer in any given year.

Having a diversified portfolio helps manage risk, creating a more solid foundation. But keep in mind that diversification does not guarantee a profit or protect against loss in declining markets.

Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our global outlook over the next 30 years. Our recommended allocation to each asset class depends on the mix of equity and fixed-income investments you have chosen for your situation, as defined by our portfolio objectives.

Source: Edward Jones

This graphic shows how we recommend dividing investments across a variety of asset classes within the equity and fixed income portions of a portfolio based on our long-term outlook. The exact weighting to each asset class will depend on your optimal portfolio mix between equity and fixed income investments as discussed above and displayed by our portfolio objectives. We call these recommended weightings to each asset class our long-term, strategic asset allocation guidance.

Diversifying within each asset class, not just across asset classes, can also strengthen the foundation of your portfolio. Within equity asset classes, consider investing in stocks representing different sectors or styles. Within fixed income, consider investing in bonds representing different sectors, categories or maturities. Mutual funds and exchange-traded funds (ETFs) can provide a convenient way to diversify your investments as you begin building your portfolio.

Making sure you have the right investment portfolio for your financial goals can be easier to achieve when you partner with the right financial advisor. Edward Jones will help you build an investment portfolio that aligns with your financial goals now and in the future.

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charterholder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.