Weekly market wrap

A View from the Peak

Key points:

- The April consumer price index (CPI) report released last week soothed fears that a new wave of inflation pressures was emerging. While inflation is still too high for comfort, the latest data signaled that consumer price pressures are gradually moderating.

- Stocks rallied and interest rates pulled back on the combination of better-than-expected inflation (supporting a case for Fed rate cuts at some point this year) and strong corporate earnings announcements.

- The stock market reached a new all-time high last week. While we anticipate more bumps along the way as we advance, we don't think this represents the ultimate peak for equities, with the combination of ongoing economic growth, rising profits, and a less-restrictive Fed offering a positive backdrop for the bull market to continue.

Not only do peaks have two sides, the ascent and descent, they can also represent opposing conditions. A player for your favorite team peaking during the playoffs – good. Your blood pressure peaking as your team misses the playoffs – not so good. The relationship between inflation and the stock market has been particularly acute for some time now, with the peak in the former playing a key role in that of the latter. It matters which side of the peak you're on.

We'd assert that, currently, we're on the favorable side of each. Inflation is descending and equities are on the ascent. Now the question is: "Can both continue?" The Dow reached a new summit last week, briefly touching 40,000, thanks to a better-than-expected inflation report. Here are a few perspectives on why we think inflation's peak will remain in the rearview mirror and the peak in equities is still further down the road:

The inflation report the market needed.

- The peak:

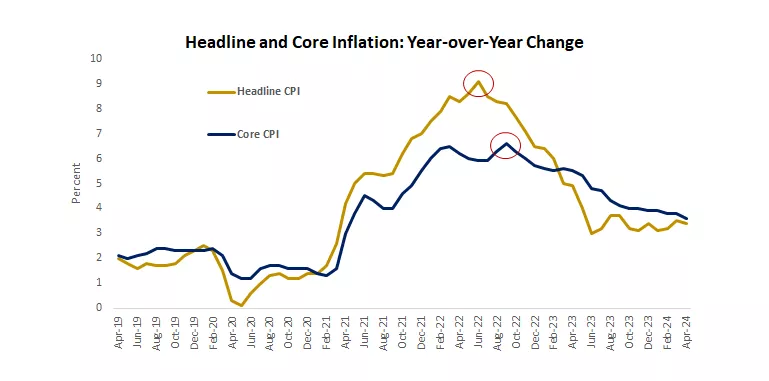

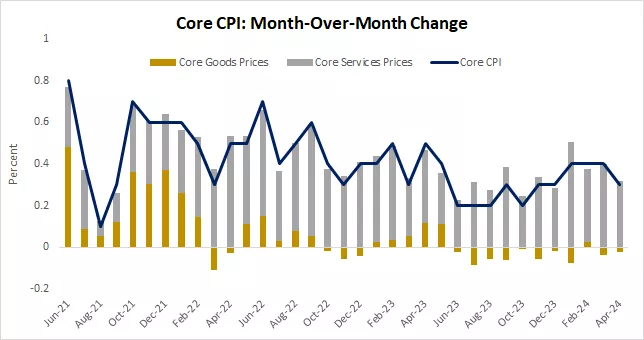

- Overall inflation peaked in 2022, with headline CPI topping out in the summer amid surging food and energy prices. Core CPI peaked in September, as supply chains began to heal, input prices started moderating, and restrictive Fed policy started to bite1. While consumer prices across the board were reaching 40-year highs due to pandemic impacts, notable drivers of surging core inflation were increases in the prices of used cars, leisure and hospitality services, and shelter (home prices and rents).

Inflation is well off the peak, but it is still too high.

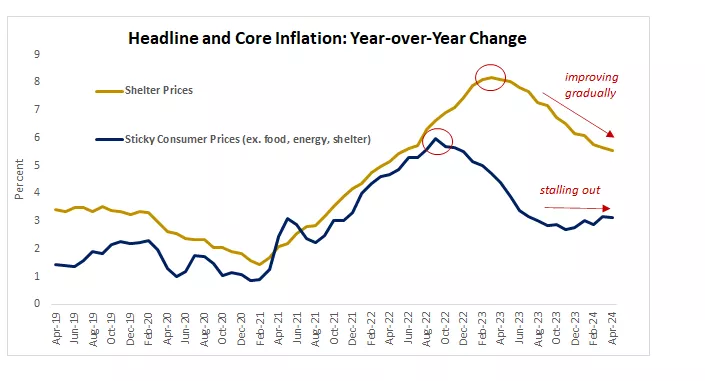

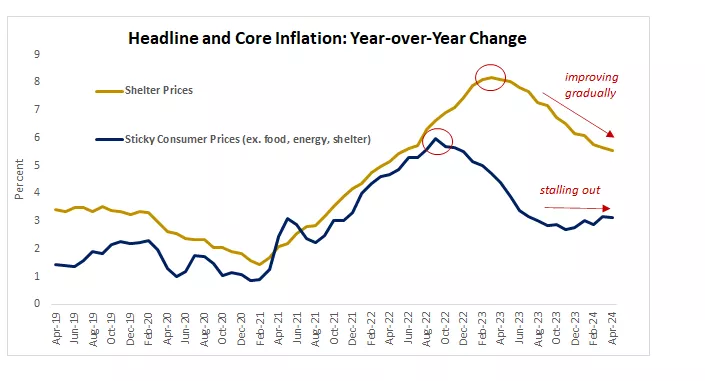

This chart shows the YoY percent change in the core and headline inflation which peaked in early to mid-2022 and has since fallen.

This chart shows the YoY percent change in the core and headline inflation which peaked in early to mid-2022 and has since fallen.

- The descent:

- Last week brought the release of the much-anticipated April CPI (consumer price index) report. The outcome was just what the market was hoping for, with inflation appearing to resume its trend of moderation after a string of hotter-than-expected reports in the last few months sparked a bout of market anxiety, as investors fretted the likelihood that the Fed would need to wait longer before cutting rates.

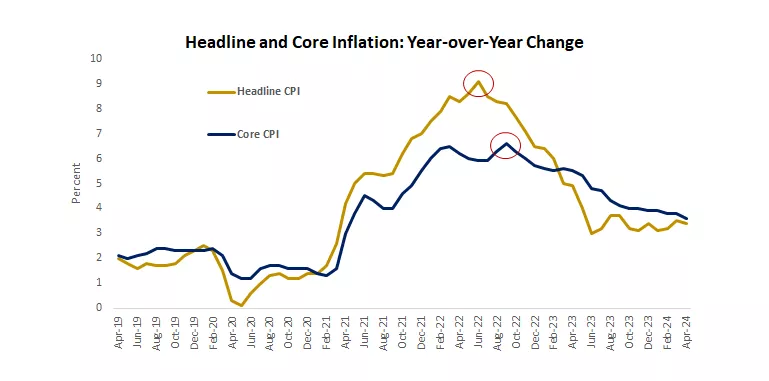

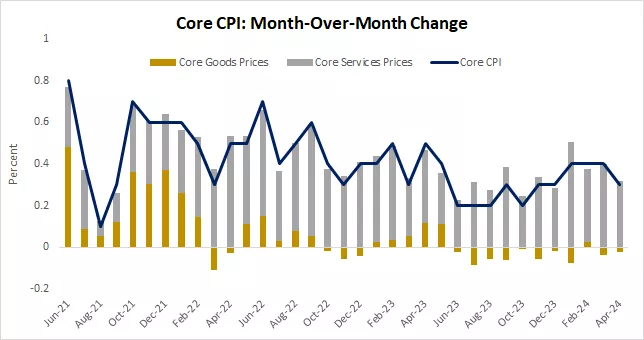

- The underlying trends in the CPI release were encouraging. Overall core CPI fell to 3.6% on a year-over-year basis, the lowest reading in three years. The recent source of upward pressure has been insurance premiums, which showed some early signs of abating last month. Similarly, prices for services, which have remained stubbornly high of late, eased in April, while goods prices continued to decline outright, helped by falling auto and home-furnishing costs1. Shelter remains the fly in the ointment, with prices moderating, but only gradually.

Core inflation cooled in April, thanks to relief in services prices.

This chart shows the good component of the CPI has seen negative inflation in recent months, but services has been the major driver of CPI growth in recent months.

This chart shows the good component of the CPI has seen negative inflation in recent months, but services has been the major driver of CPI growth in recent months.

- The path ahead:

- The good news is that inflation looks to us like it will remain on its broader path of moderation. April's CPI report went a long way to soothing fears that inflation pressures were reigniting, which we think keeps the prospects of a rate cut from the Fed on the table, though likely not until much later in the year.

- We're watching a few key trends: 1) we're going to need to see more help from shelter prices. Timely data on rents suggests to us that we'll get that help in the months ahead, but this is likely to be slower than anyone would like. Also, we think the low-hanging fruit of disinflation that has come from improving supply chains has largely been realized. Persistent consumer price measures have leveled out, and goods prices, while still in decline, are likely to provide less help ahead. This is where some softening in the overall pace of economic growth and consumer demand can have a silver lining, as it should allow consumer prices, particularly in the more enduring services segments, to moderate further.

The next leg lower for inflation will require more help from shelter prices.

This chart compares stick inflation and shelter inflation. Shelter inflation has been gradually falling in recent months, but sticky inflation has somewhat plateaued.

This chart compares stick inflation and shelter inflation. Shelter inflation has been gradually falling in recent months, but sticky inflation has somewhat plateaued.

The elevation the market deserves.

- The peak:

- The stock market's post-pandemic peak came just a few days into 2022 following a stimulus- and economic-reopening-driven surge in stock prices through 2021. That party came to an end in 2022 at the hands of Fed rate hikes aimed at snuffing out the inflation fire mentioned above.

- Stocks fell more than 25% in 2022, bottoming in October, as markets found footing from the peak in inflation and a growing view that the eventual end of Fed rate hikes was within sight1.

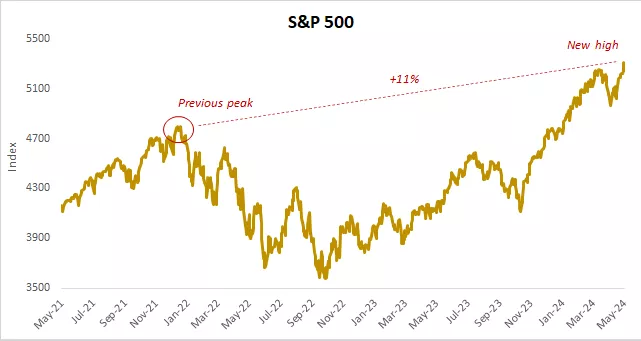

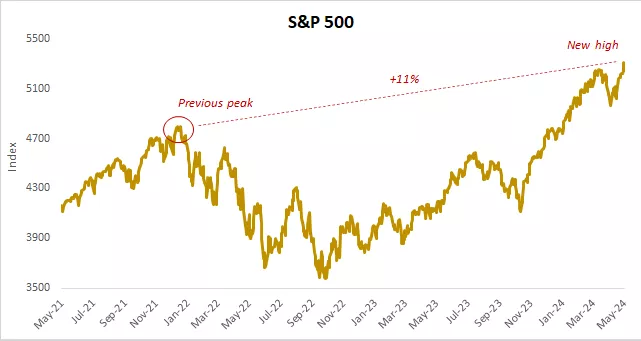

The stock market hit a new high last week.

This chart shows the 11% gain in the S&P 500 from its previous peak towards the end of 2021, but not before falling and gradually recovering during 2022 and 2023.

This chart shows the 11% gain in the S&P 500 from its previous peak towards the end of 2021, but not before falling and gradually recovering during 2022 and 2023.

- The climb:

- The new bull market that began in October 2022 has not been without its setbacks, which have largely come from episodes of indigestion around the Fed keeping rates high for longer. Nevertheless, the S&P 500 has had a return of nearly 52% since then, including rising more than 10% so far in 2024, which was aided by a better-than-1% gain last week, the fourth consecutive weekly gain for the index1.

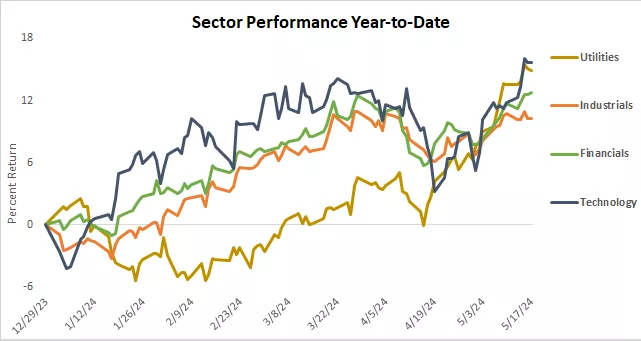

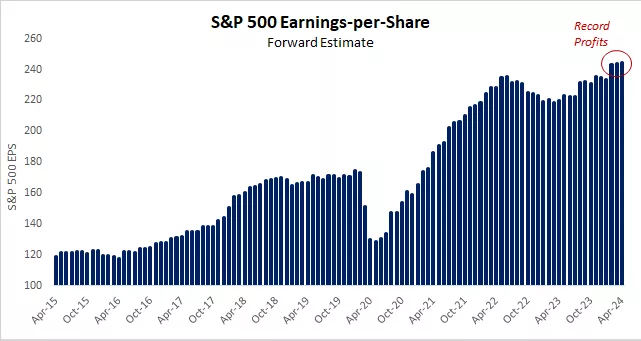

- While a good portion of the market's ascent since 2022 has been powered by the prolific gains in the technology sector (and the so-called "Magnificent 7" and enthusiasm around AI in particular), we'd point out that leadership has begun to broaden more recently, which we view as a positive sign for the longevity of this bull market. We've seen leadership in recent weeks come from cyclical areas, like industrials and financials, as well as more defensive and rate-sensitive areas, like utilities1.

The rally to new highs has been driven by more balanced leadership.

This chart shows the performance of sectors within the S&P 500 since the end of 2023, with Utilities and Technology outperforming industrials and Financials.

This chart shows the performance of sectors within the S&P 500 since the end of 2023, with Utilities and Technology outperforming industrials and Financials.

- The path ahead:

- There is little doubt in our mind that both the stock and bond markets will continue to take their performance cues from the expectations for upcoming Fed policy moves. That should be a pillar of broader support, given our expectation that the next move from the Fed will be a cut. In that regard, the April CPI report was key in preserving hope that the Fed could act at some point this year. However, we doubt upcoming inflation readings will be consistently better than expected, which likely introduces some bouts of volatility, as the market wrings its hands over the exact timing of a potential cut.

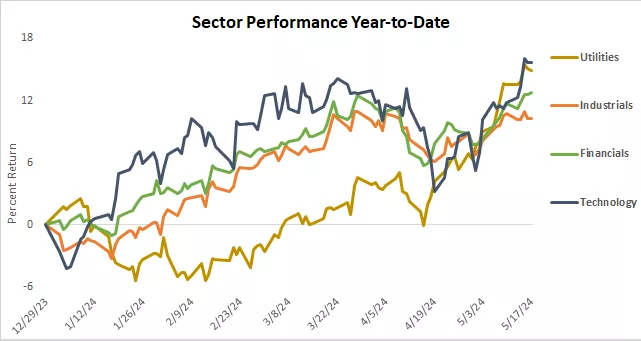

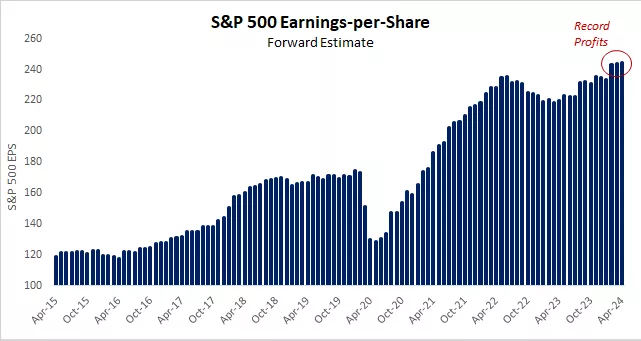

- Lost in this peak obsession over the Fed, however, is another peak that we think will provide the horsepower for this bull market to continue: corporate earnings growth. Corporate profits, should, in our view, reach a new high this year. Helped by ongoing economic growth and less punitive interest rates, we think the growth in earnings – currently expected to rise by double-digits in 2024 – will set the pace for equity-market gains ahead.

- Stocks hit a record high again last week, having now gained 10% since reaching a new high-water mark at the beginning of this year1. The upshot: history shows that after surpassing previous peaks, stocks have, in most cases, gone on to log strong gains1.

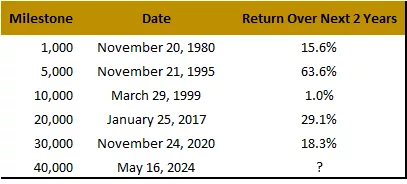

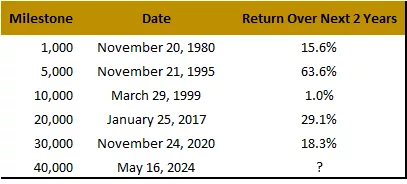

Stocks have typically extended gains after surpassing prior peaks.

This tables compares all-time highs in the stock market and the return over the next 12-months and the next market peak which are generally positive.

This tables compares all-time highs in the stock market and the return over the next 12-months and the next market peak which are generally positive.

We think rising earnings will support further market gains over time.

This chart shows the earnings of the S&P 500 which have recently set new highs as corporate profit reaches record levels.

This chart shows the earnings of the S&P 500 which have recently set new highs as corporate profit reaches record levels.

Other peak perspectives.

- Dow 40k:

- The Dow briefly eclipsed the 40,000 mark for the first time ever on Thursday of last week. Is this significant? Well, no more so than Dow 39,9271. It's human nature to focus on round numbers or milestones like this, but the figure itself is not particularly significant. Instead, what is significant is what that represents, as it reflects a sizable rally in stock prices over the last few months, as well as over the last few years. During that stretch, there were growing choruses citing economic and Fed policy risks, along with the allure of elevated money-market and CD yields. Yet, the strong gains in equities are another reminder of the power of a longer-term perspective and an opportunistic investment approach.

The Dow since 1980.

This chart shows the peaks in the Dow Jones which recently passed the 40,000 mark.

This chart shows the peaks in the Dow Jones which recently passed the 40,000 mark.

How has the Dow fared after hitting round-number milestones?

This chart shows the return over the following two years of the peaks in the Dow Jones, which have generally been positive.

This chart shows the return over the following two years of the peaks in the Dow Jones, which have generally been positive.

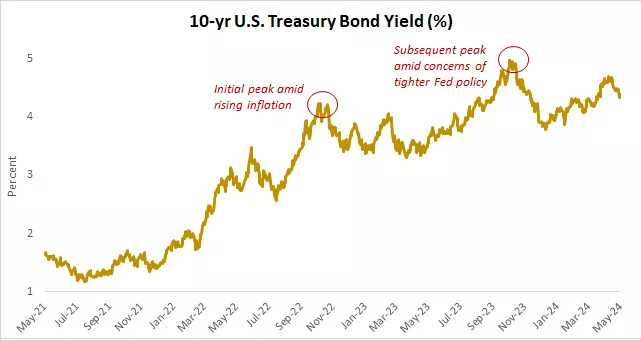

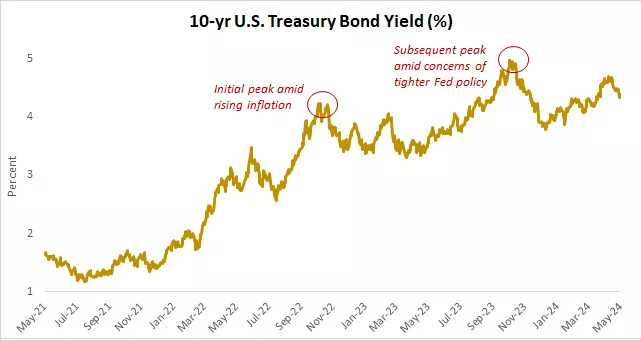

- Interest rates:

- We think the 5% mark that the 10-year yield touched last October will prove to be the peak within this Fed-tightening cycle. After a run from 3.8% to 4.6% to start 2024, we've seen yields move lower in recent days, as the latest inflation data and commentary from the Fed have eased concerns of more restrictive policy moves ahead1.

We think longer-term interest rates have peaked for this cycle.

This chart compares the initial peak in 10-year yields as inflation fears rose, and the subsequent-higher peak in late 2023 as investors feared higher Fed interest rates.

This chart compares the initial peak in 10-year yields as inflation fears rose, and the subsequent-higher peak in late 2023 as investors feared higher Fed interest rates.

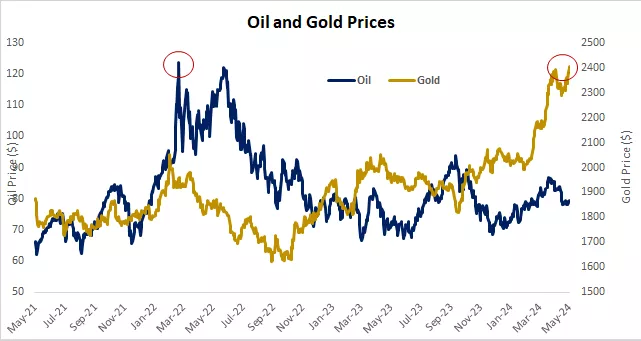

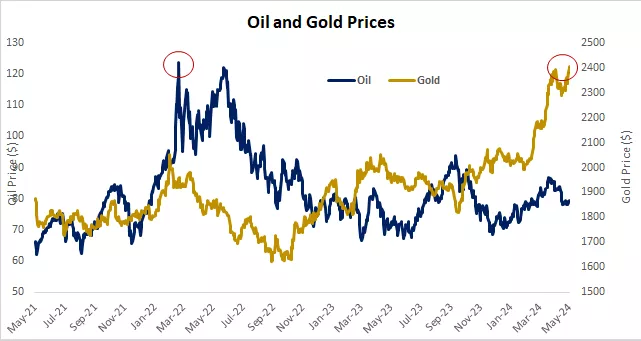

- Oil and Gold:

- Oil's recent peak above $120 per barrel came amid the reaction to both the reopening of the global economy as well as the war between Ukraine and Russia1. While recent tensions in the Middle East and Iranian involvement pose uncertainties to global oil production, oil prices have failed to respond with a dramatic move higher, now sitting more than 35% below that 2022 peak. Meanwhile, gold prices have moved notably higher of late, reaching a new peak above $2,4001. While some of this run earlier this year was likely a response to hotter inflation readings, we suspect there may also be some growing demand for gold coming from global central banks, as well as some defensive posturing within the markets even as equities have rallied to new highs.

Gold and oil performance has diverged recently.

This chart shows the peaks in Oil and Gold prices, which gold prices recently reaching new highs while oil process have fallen from earlier highs in early 2022.

This chart shows the peaks in Oil and Gold prices, which gold prices recently reaching new highs while oil process have fallen from earlier highs in early 2022.

- The return of meme mania:

- Last week brought shades of 2021 and a reminder of another peak – the peak in the speculative-asset mania during that time that saw the rise of the so-called "meme stocks." Last week, shares of GameStop and AMC found their way back in the headlines after shares spiked dramatically. The chart below shows how this compares with the mania peaks in 2021. We'd also point out that despite AMC shares rising more than 100% in a matter of days last week, this gain barely shows up on the chart, a sign of just how far these share prices have fallen from their highs during that 2021 speculative bubble1. We don't view this as a sign that we're returning to the level of speculation or investor sentiment that we saw during that period, but we do think this is somewhat indicative of the risk-taking that tends to emerge during strong market runs.

Meme stocks that peaked in 2021 were back in the headlines last week.

This chart shows the volatility of GameStop and AMC as retail investors have tried to profit off short-sellers in the market.

This chart shows the volatility of GameStop and AMC as retail investors have tried to profit off short-sellers in the market.

Craig Fehr, CFA

Investment Strategist

Source: 1. Bloomberg

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 40,004 | 1.2% | 6.1% |

| S&P 500 Index | 5,303 | 1.5% | 11.2% |

| NASDAQ | 16,686 | 2.1% | 11.2% |

| MSCI EAFE* | 2,382 | 1.5% | 6.5% |

| 10-yr Treasury Yield | 4.42% | -0.1% | 0.5% |

| Oil ($/bbl) | $79.53 | 1.6% | 11.0% |

| Bonds | $96.81 | 0.6% | -1.0% |

Source: FactSet, 5/17/2024. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *4-day performance ending on Thursday.

The week ahead

Important economic releases this week include data on home sales and the S&P Global Manufacturing PMI.

Review last week's weekly market update.

Craig Fehr

Craig Fehr is a principal and the leader of investment strategy for Edward Jones. Craig is responsible for analyzing and interpreting economic trends and market conditions, along with constructing investment strategies and asset allocation guidance designed to help investors reach their financial goals.

He has been featured in Barron’s, The Wall Street Journal, the Financial Times, SmartMoney magazine, MarketWatch, the Financial Post, Yahoo! Finance, Bloomberg News, Reuters, CNBC and Investment Executive TV.

Craig holds a master's degree in finance from Harvard University, an MBA with an emphasis in economics from Saint Louis University and a graduate certificate in economics from Harvard.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.