Social Security benefits typically receive a cost-of-living adjustment (COLA) each year, but many don't understand what this adjustment is, how it applies to their benefits, or how they can make the most of it.

What is the Social Security COLA?

The COLA is an inflation adjustment that increases Social Security benefits to help recipients maintain their standard of living. For 2025, the COLA is 2.5%.

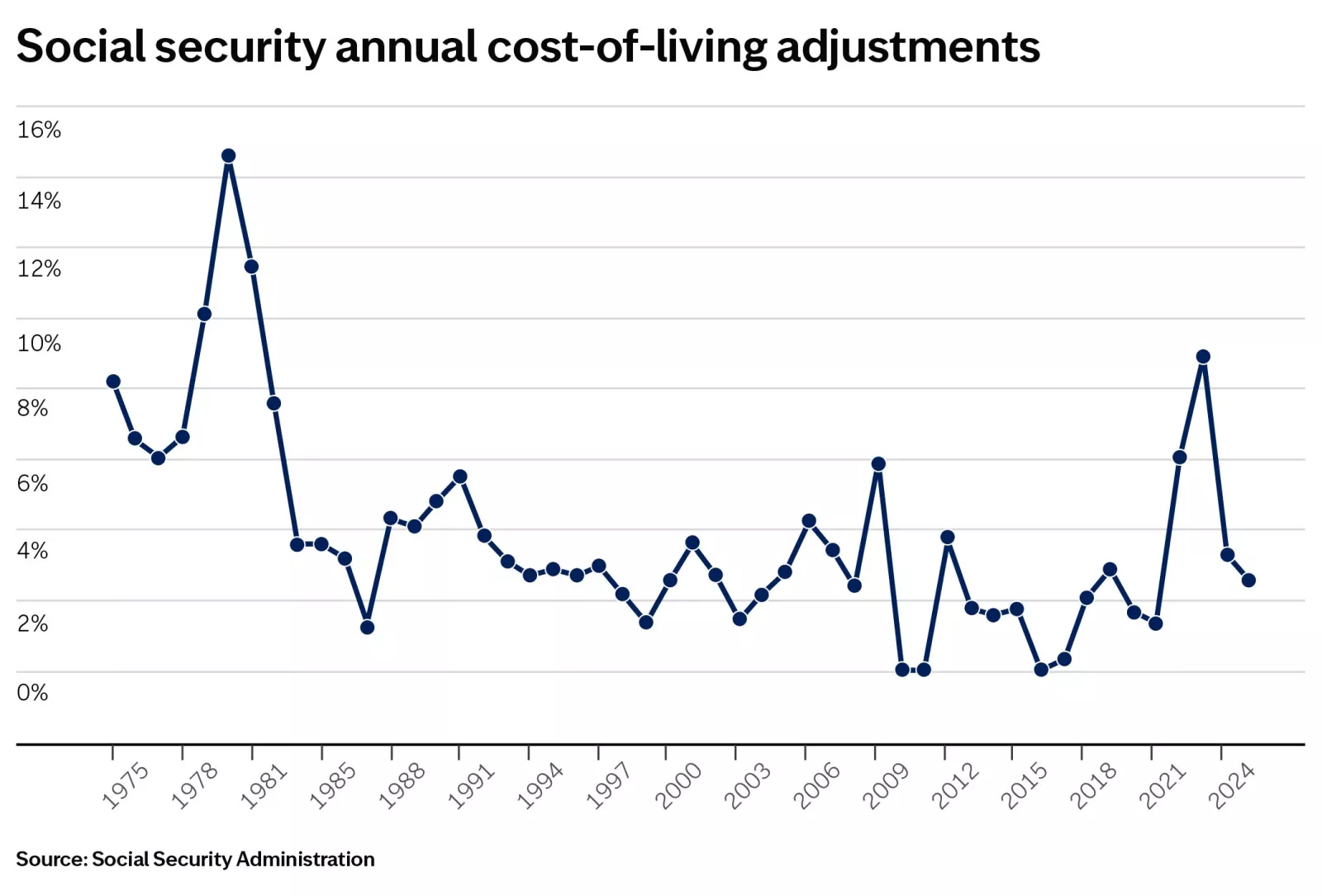

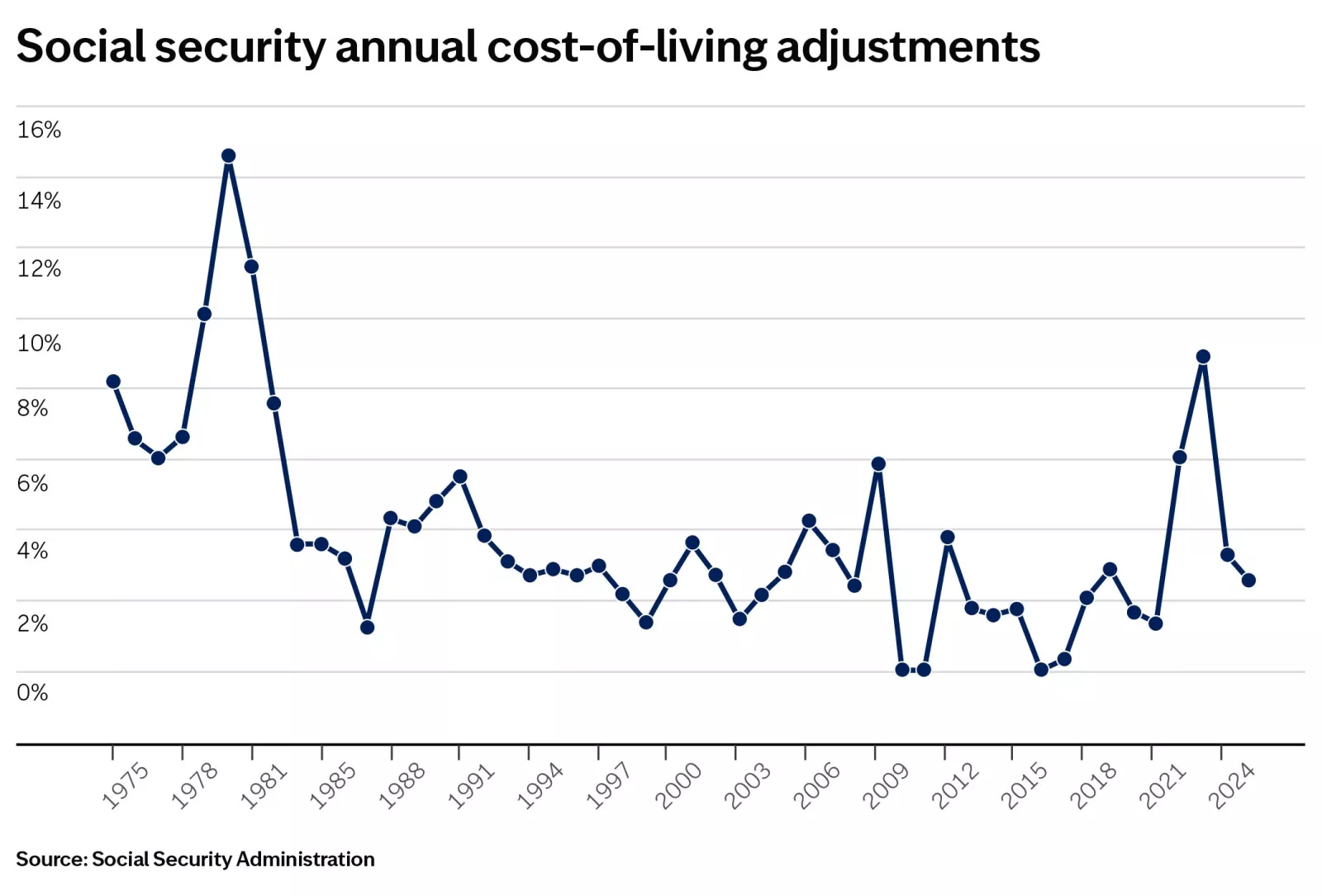

The annual COLA has varied over time but has averaged roughly 2.6% over the last 20 years. While there's no limit on how high a COLA can go, it can't fall below 0%. The chart below displays the COLA for each year since its start in 1975 , ranging from 0% to 14.3%.

The above chart provides the annual cost-of-living adjustments (COLA) for Social Security from 1975 through 2025. The highest annual COLA during this time period was 14.3% and the lowest was 0%.

The above chart provides the annual cost-of-living adjustments (COLA) for Social Security from 1975 through 2025. The highest annual COLA during this time period was 14.3% and the lowest was 0%.

How will the COLA affect my Social Security benefits?

The COLA is calculated by comparing the change in an inflation index (specifically, the CPI-W) from the third quarter of last year to the third quarter of this year. Your Social Security benefit is then increased (approximately) by the percentage change in the inflation index, starting in January the following year. For example, if your monthly Social Security benefit is $2,000 this year and the COLA for the upcoming year is 3%, your new benefit will be approximately $2,060 (or, $2,000 * 1.03) in January.

However, it's important to know that if your Medicare Part B premium is deducted from your Social Security paycheck, an increase in your premium may offset the increase in your Social Security benefit, in part or in full. For certain higher-income individuals, the increase in Medicare premiums could even exceed the amount of their benefit increase, resulting in a reduced Social Security paycheck.

If I'm not claiming Social Security benefits, will I receive the COLA?

Many wonder if they'll miss out on the COLA when they delay claiming Social Security benefits. The good news is, you won't. That's because the COLA increases your Social Security benefit base each year. So, any increases you would have received are included in your benefit when you ultimately claim.

Delaying Social Security can also make your COLA even more powerful. By delaying Social Security, you can increase your benefit amount (up to age 70 in most cases). The higher your benefit amount, the larger the dollar amount of the COLA. And, this benefit compounds over time because the COLA will be applied to a higher benefit amount each subsequent year.

How can I make the most of my Social Security COLA?

Because the COLA is designed to help offset the effects of inflation, you'll likely use the increase to help pay for the general rise in your expenses. However, if you don’t need it to offset higher expenses, here are some ways you can use it to enhance your financial strategy:

- Withdraw less from your portfolio. Your increase could help reduce your withdrawal rate, which is the percentage you withdraw from your investment portfolio each year. Even small reductions in your withdrawal rate, such as reducing your withdrawals when the inevitable down market occurs, can have a meaningful benefit to your portfolio's longevity.

- Build your cash reserves. Your unspent COLA could also help you build your cash reserves. Maintaining appropriate cash reserves can help you prepare for potential market declines, ensuring your retirement spending needs can be met while allowing your stocks more time to recover. We generally recommend retirees maintain a year's worth of portfolio withdrawals in a separate spending account and another 3 to 5 years of withdrawals in a CD or short-term fixed income ladder. We also recommend retirees hold 3 to 6 months of living expenses in a separate account for emergencies.

- Give it to a loved one or charity. Giving your increase to a loved one can sometimes have a dual benefit of helping you and them. By making a 529 contribution, you may be eligible for a tax deduction on your state tax return. Alternatively, you may be able to receive a tax deduction for contributions to charity. Consult a qualified tax professional to determine the potential impact on your taxes.

Meet with a financial advisor to understand how 2025's COLA affects you

While your cost-of-living adjustment is a welcome addition, it's a good opportunity to review your retirement income strategy and broader financial goals. Contact your Edward Jones financial advisor to get a better sense of how this year's increase affects your overall financial strategy.

Important information:

This content is provided for educational purposes only and should not be interpreted as specific investment, tax, or legal advice. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should make investment decisions based on their unique investment objectives and financial situation.

Work with the Social Security Administration for a full discussion of your available benefits and options.