Monthly investment portfolio brief

Seeing clearly amid blurry headline flurry

What you need to know

- January brought a flurry of headlines, with news related to geopolitics, tariffs, central bank policy, and a partial government shutdown challenging the market's resilience.

- Markets remained largely unfazed, with some segments—small-cap and emerging-market equities, as well as materials and energy sectors—delivering solid gains.

- U.S. tech has weakened, but broader market leadership is taking shape, supportive of a diversified portfolio approach.

- Build your path with clarity. Define well-balanced, strategic targets and maintain portfolio alignment to plan your future with confidence.

- Be timely, but with discipline—consider opportunities across global markets to avoid over-dependence on any single investment or sector.

Portfolio tip

Active portfolio management can help enhance return potential, but take a measured approach to help manage risks. Consider overweighting multiple asset classes so you don't become too dependent on the performance of any single investment.

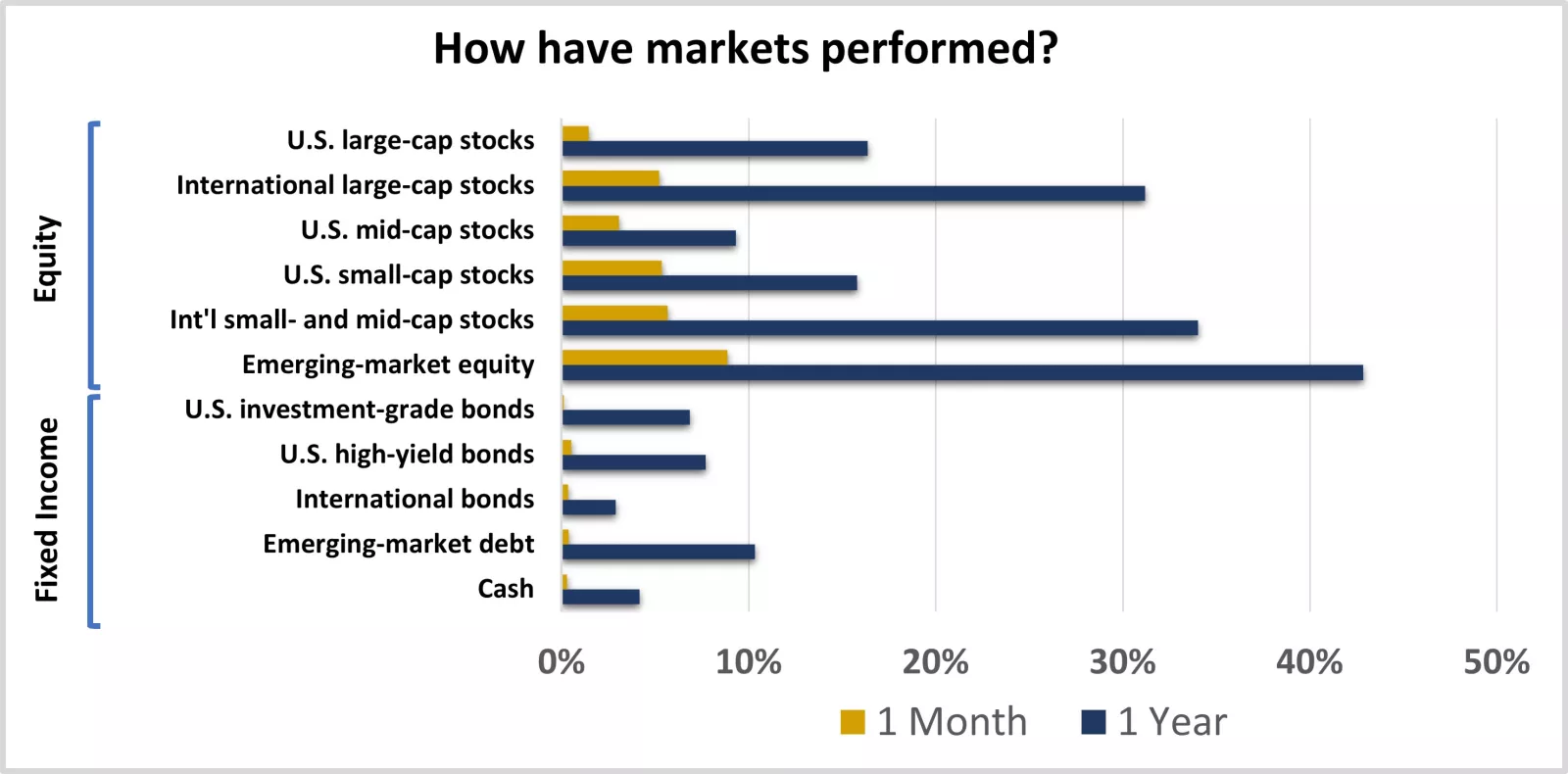

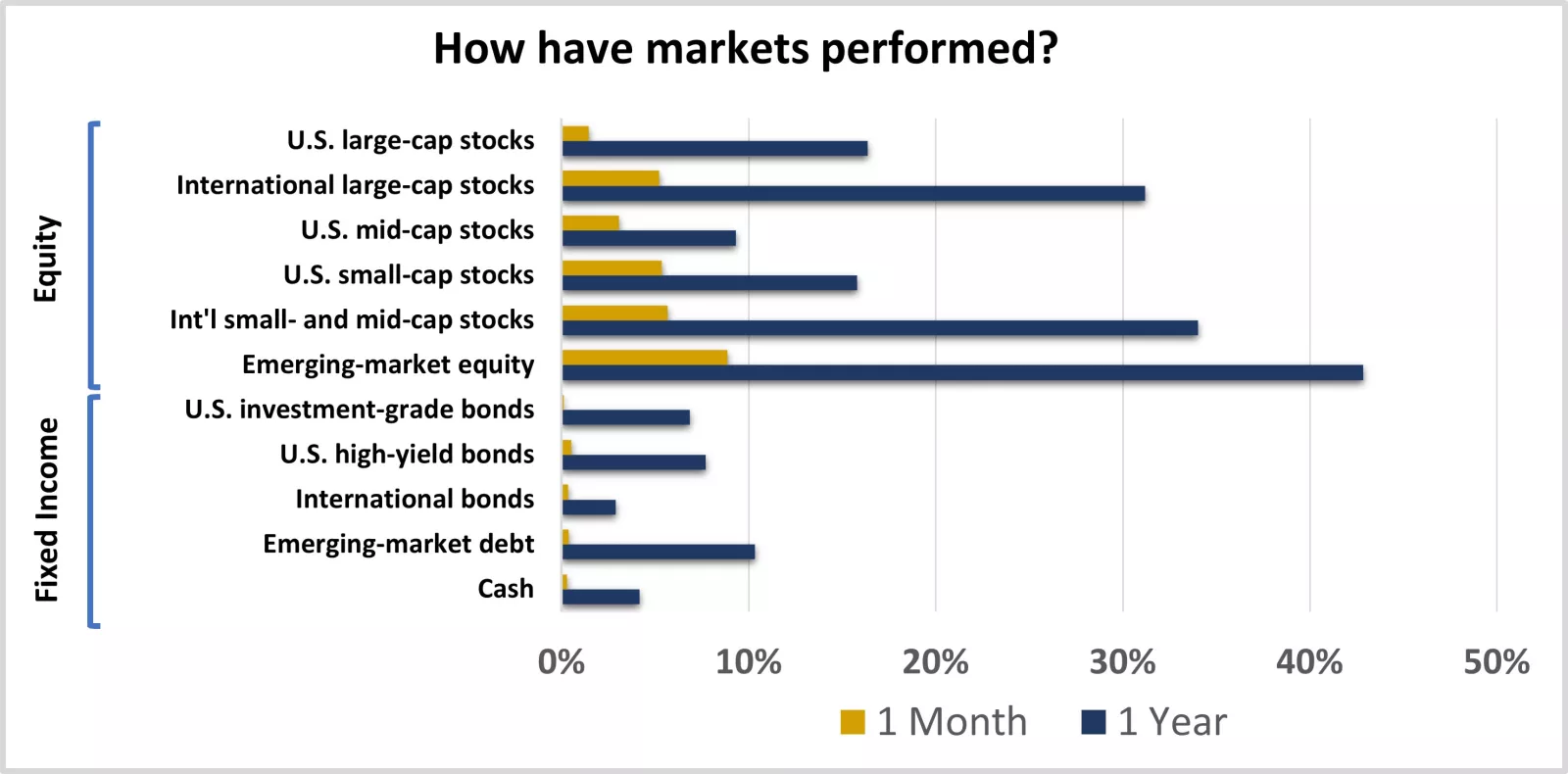

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

January's flurry of headlines tested the market's resilience, but markets showed little sign of distraction. Rounds of geopolitical uncertainty and renewed tariff threats from the U.S. administration had investors weighing potential impacts from shifting relationships abroad. The impending U.S. government shutdown and central bank developments also commanded attention, including fresh monetary policy decisions and the presidential nomination of Kevin Warsh as the next Federal Reserve chair.

Despite the pressure from headlines, markets remained largely unfazed, gaining support from corporate earnings reports and signs of solid economic momentum. With interest rates ticking higher, bonds were relatively flat, leaving stocks to outperform. Strength within emerging-market and small-cap stocks provided the greatest contribution to well-diversified portfolios as market leadership continued broadening beyond mega-cap tech.

U.S. tech weakens, but strength elsewhere reinforces a key theme: broadening market leadership. Multiple U.S. tech giants reported earnings in January, which drew mixed market reactions. While longer-term growth drivers remain intact, investors were left questioning capital expenditure plans and current stock valuations within the sector—uncertainty that has persisted in recent months.

Notably, technology sector performance has diverged across regions. The U.S. large-cap tech sector dropped 2% in January and 6% over three months, causing the asset class to be a laggard relative to other stock alternatives. Conversely, the tech sector within the emerging-market equity asset class rose around 18% over both periods, partially due to a falling dollar and a draw toward broader tech opportunities outside the U.S, helping the overall asset class become the top performer.

Elsewhere, the Bloomberg Commodity Index—a basket of energy, metal and agricultural products—returned over 10% in just one month, nearly approaching its full-year 2025 gain of around 15% before pulling back toward month end. Higher commodity prices helped propel the materials and energy sectors across domestic and international markets, further underscoring the potential for leadership beyond U.S. tech.

Recent commodity strength has been led by precious metals, such as gold and silver, alongside a spike in energy prices amid heightened geopolitical tensions. Though, precious metals fell precipitously following the Fed chair announcement, paring back some earlier gains across commodities and materials.

What do we recommend going forward?

Build a path with clarity amid the blur of headline flurry. Regardless of the potential for headlines to distract markets, your financial goals should remain the foundation of your investment decisions. To define a clear path, we suggest talking through this disciplined process with your financial advisor:

- Define your goal-focused, well-diversified investment strategy. Use your comfort with risk, time horizon, and financial goals to determine an appropriate mix between stocks and bonds for your circumstances. Our strategic asset allocation guidance below can then help shape broadly diversified target allocations to guide your path and plan your future with confidence.

- Rebalance to maintain your portfolio's alignment with your plan. Given the meaningful, yet uneven, outperformance of stocks over bonds, now may be an important time to rebalance by trimming positions that have become too overweight. Ensuring your portfolio hasn't drifted too far from your target allocations helps maintain diversification, avoid performance surprises, and uphold the reliability in the plan you've laid out for your goals.

- Maintain appropriate risk and return expectations. Over the long term, we expect the annual return for stock asset classes to average 7%-9%, with fixed-income asset classes falling into the 4%-6% range, which further highlights the strength of recent market gains. But markets fluctuate, and so do investment portfolios, even if smoothed by diversification.

Therefore, don't let potential pullbacks surprise you, particularly following a strong multi-year period for stocks. Maintain perspective by viewing short-term fluctuations as part of the journey toward your longer-term goals, particularly if your portfolio is aligned with your investment strategy.

Be timely, but with discipline—consider overweight positions in multiple stock asset classes and sectors to avoid over-dependence on any single investment or theme. While we recommend using your strategic target allocations as the starting point for your portfolio, we believe now is an opportune time to lean further into stocks, underweighting bonds.

While periodic pullbacks may occur, we expect stocks to have an edge over bonds this year due to:

- A fiscal boost from across regions, including from the 2025 U.S. tax bill,

- Lagging impacts from central bank rate cuts, with the potential for more cuts later this year,

- Broad corporate earnings growth,

- Solid global economic momentum, and

- Additional tailwinds from tech-related investment and infrastructure buildout.

We believe this set of conditions opens a range of investment opportunities across global markets, as has already been demonstrated in 2026, given the shifts in market leadership. We expect the broadening theme to continue unfolding over the course of the year, which we believe supports a diversified approach to managing a portfolio's active positioning (allocations that are overweight or underweight when compared to a portfolio's strategic targets).

Therefore, instead of holding an outsized overweight position in any single investment or theme in your portfolio, we suggest taking a more measured approach by expanding your opportunity set—consider overweighting multiple stock asset classes and sectors to capture broad opportunities.

Given the macroeconomic conditions, we favor relatively cyclical asset classes, such as U.S. mid-cap stocks, international small- and mid-cap stocks, and emerging-market equity, particularly given their valuations when compared with global large-cap stocks. International stocks have also benefited from strong momentum recently, which we believe could continue, especially if the dollar softens.

We also believe U.S. large-cap stocks remain attractive, despite their elevated valuations, given their exposure to tech and the potential for above-trend economic growth in the U.S. Overweighting a mix of consumer discretionary, health care, and industrials sectors may also help your portfolio benefit from tech tailwinds and the increasingly supportive policy backdrop. We'd suggest balanced allocations between value- and growth-style stocks to help further manage concentration and valuation risks.

We’re here for you

Defining well-balanced, strategic targets and maintaining portfolio alignment can help build and execute a goal-focused plan with clarity and confidence, helping to navigate headline flurry that can create feelings of blur. Active portfolio management can be beneficial, but we suggest a measured approach. Talk with your financial advisor about building timely investment opportunities into your portfolio while upholding the reliability of the plan you've laid out for your goals.

If you don’t have a financial advisor, we invite you to meet with an Edward Jones financial advisor to build a clear, consistent focus on your financial goals into your portfolio—no matter the potential blur created by flurries of headlines.

Strategic portfolio guidance

Defining your strategic investment allocations helps keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity style, U.S. equity sector and U.S. investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks, U.S. mid-cap stocks, international small- and mid-cap stocks and emerging-market equity; neutral for U.S. small-cap stocks; underweight for international large-cap stocks.

Fixed income — underweight overall; neutral for emerging-market debt and cash; underweight for U.S. investment-grade bonds, U.S. high-yield bonds and international bonds.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks, U.S. mid-cap stocks, international small- and mid-cap stocks and emerging-market equity; neutral for U.S. small-cap stocks; underweight for international large-cap stocks.

Fixed income — underweight overall; neutral for emerging-market debt and cash; underweight for U.S. investment-grade bonds, U.S. high-yield bonds and international bonds.

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

Our opportunistic equity sector guidance follows:

• Overweight for consumer discretionary, health care and industrials

• Neutral for communication services, energy, financial services, materials, real estate and technology

• Underweight for consumer staples and utilities

Our opportunistic equity sector guidance follows:

• Overweight for consumer discretionary, health care and industrials

• Neutral for communication services, energy, financial services, materials, real estate and technology

• Underweight for consumer staples and utilities

Our opportunistic U.S. investment-grade bond guidance is neutral in interest rate risk (duration) and credit risk.

Our opportunistic U.S. investment-grade bond guidance is neutral in interest rate risk (duration) and credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a portfolio strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charterholder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Diversification does not ensure a profit or protect against loss in a declining market.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Rebalancing does not guarantee a profit or protect against loss and may result in a taxable event.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

The opinions stated are as of the date of this report and for general information purposes only. This information is not directed to any specific investor or potential investor, and should not be interpreted as a specific recommendation or investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.