Weekly market wrap

Rotation, Repricing and the Return of the “Old Economy”

Key Takeaways

- AI disruption fears, surging tech spending, and softer risk appetite in speculative assets have driven near term volatility. But the weakness has been concentrated in tech, not the broader market.

- "Old economy" sectors are taking the lead as investors rotate away from crowded mega cap growth and toward industries supported by improving growth expectations as the industrial cycle shows signs of strengthening.

- For portfolios, we think this rotation is creating opportunities to diversify, eases concentration risk, and helps normalize valuations after years of tech driven leadership.

- While Rotation, Repricing, and waning Risk appetite may contribute to choppier markets, one “R” we do not expect in 2026 is Recession, supporting our constructive view on the bull market.

Up until February, equities had largely remained insulated from the elevated volatility that currencies and commodities have been experiencing in the early days of 2026. That changed last week as the S&P 500 gave up its gains for the year, driven by broad weakness across technology, particularly software, which has fallen almost 25% over the past three months*.

Even so, the S&P 500 sits less than 2% below its all‑time high, and the Dow hit new records later in the week*. In our view, this dynamic suggests that market action reflects rotation and repricing, rather than broad deterioration in underlying fundamentals.

Here’s our take on the notable market shifts now underway.

Rotation: "Old economy" sectors step back into the spotlight

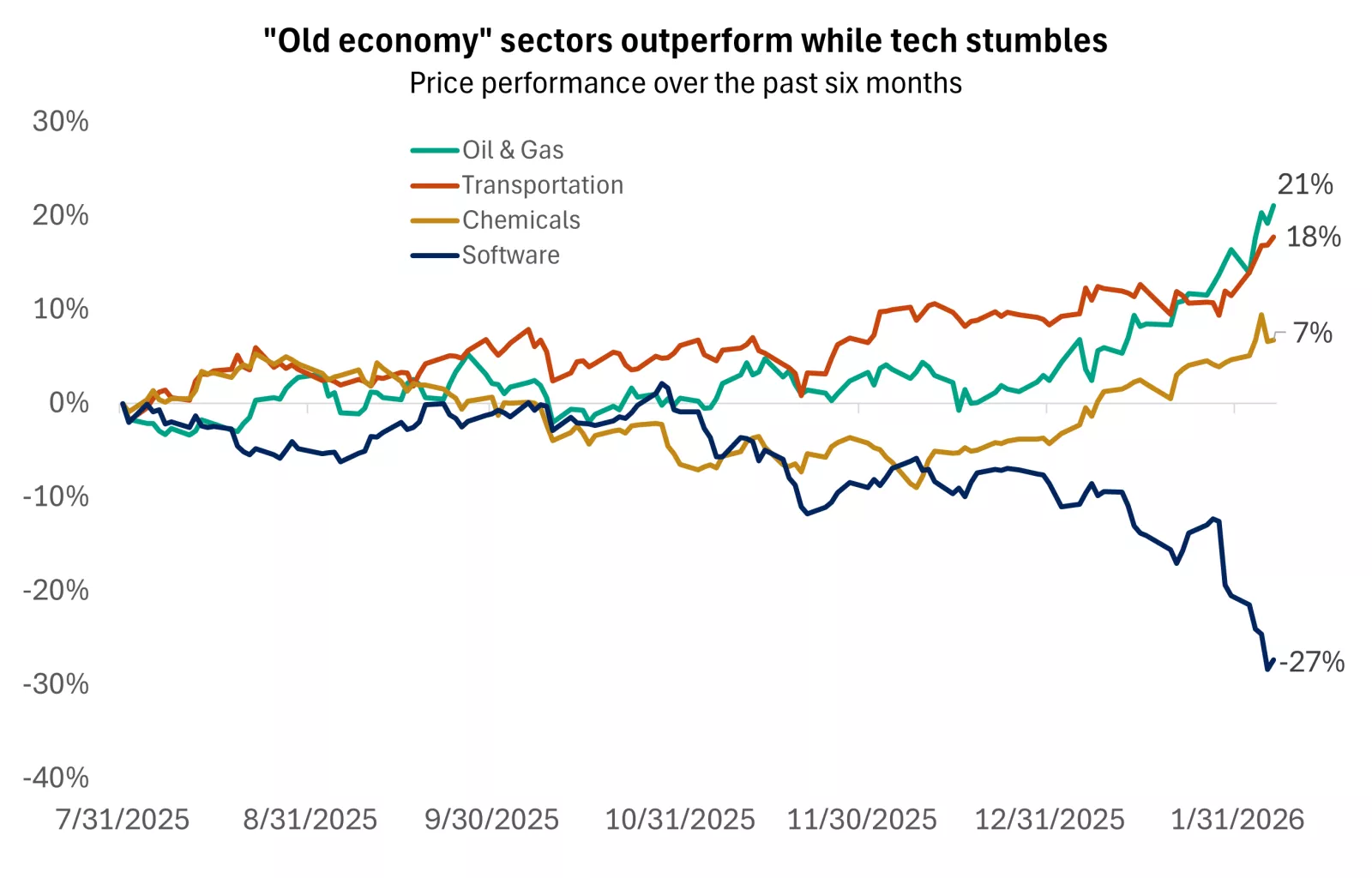

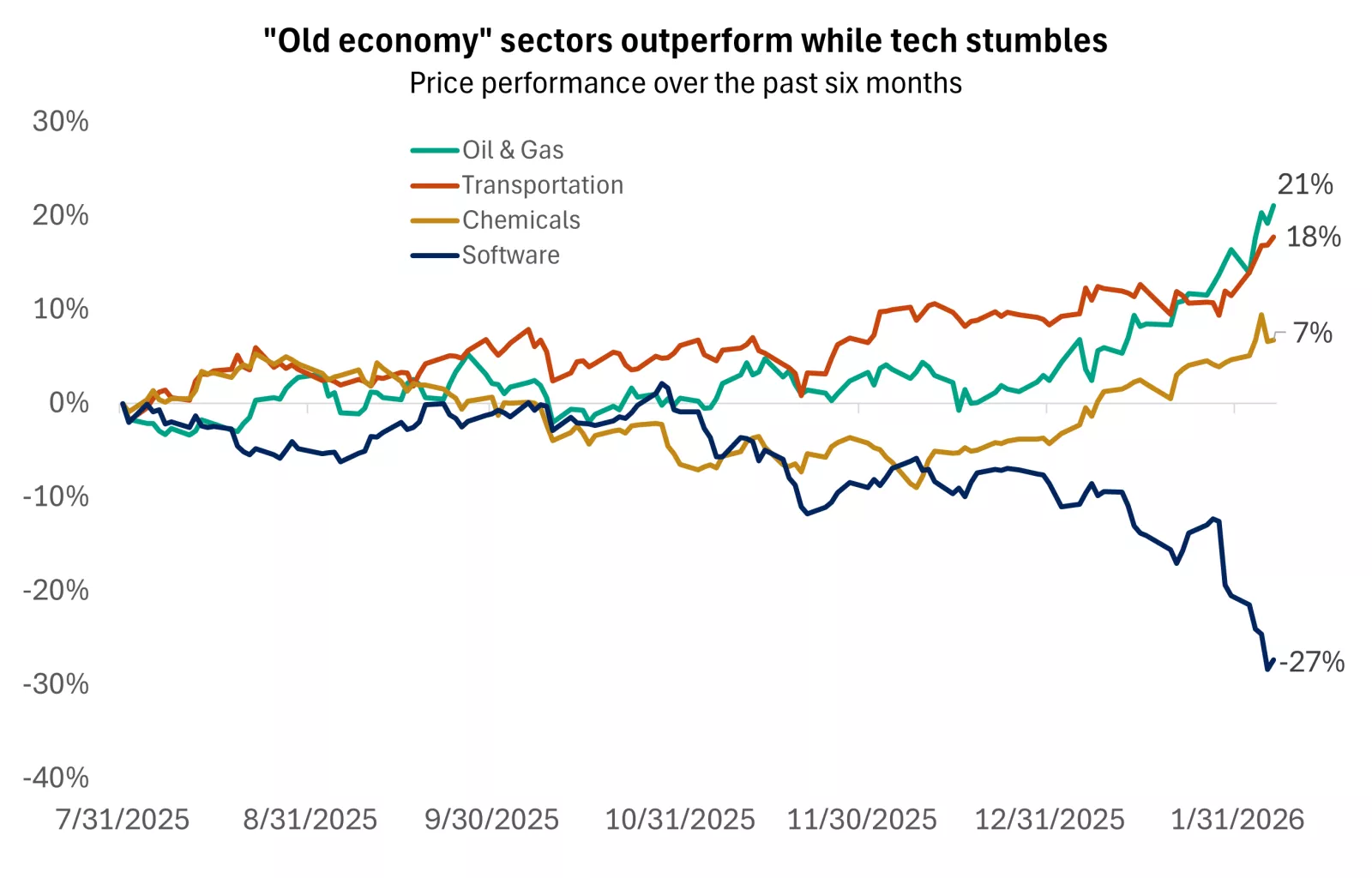

After years of tech-led dominance, the market is experiencing a meaningful rotation toward traditional “old economy” sectors. Investors appear to be gravitating toward real‑asset businesses and industries that had previously fallen out of favor—oil & gas, chemicals, transportation, consumer staples, and regional banks—all of which have been outperforming since high‑flying tech stocks began losing momentum late last year*.

The graph shows that "old economy" sectors like transports, chemicals and oil & gas are taking the lead as investors rotate away from software companies. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

The graph shows that "old economy" sectors like transports, chemicals and oil & gas are taking the lead as investors rotate away from software companies. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

We see this shift as supported by three key factors: more attractive valuations, accelerating earnings growth, and a desire to diversify away from crowded mega‑cap growth exposures. The current macroeconomic backdrop also helps provide investors with viable alternatives to tech for growth, in our view, something that was harder to find in prior years.

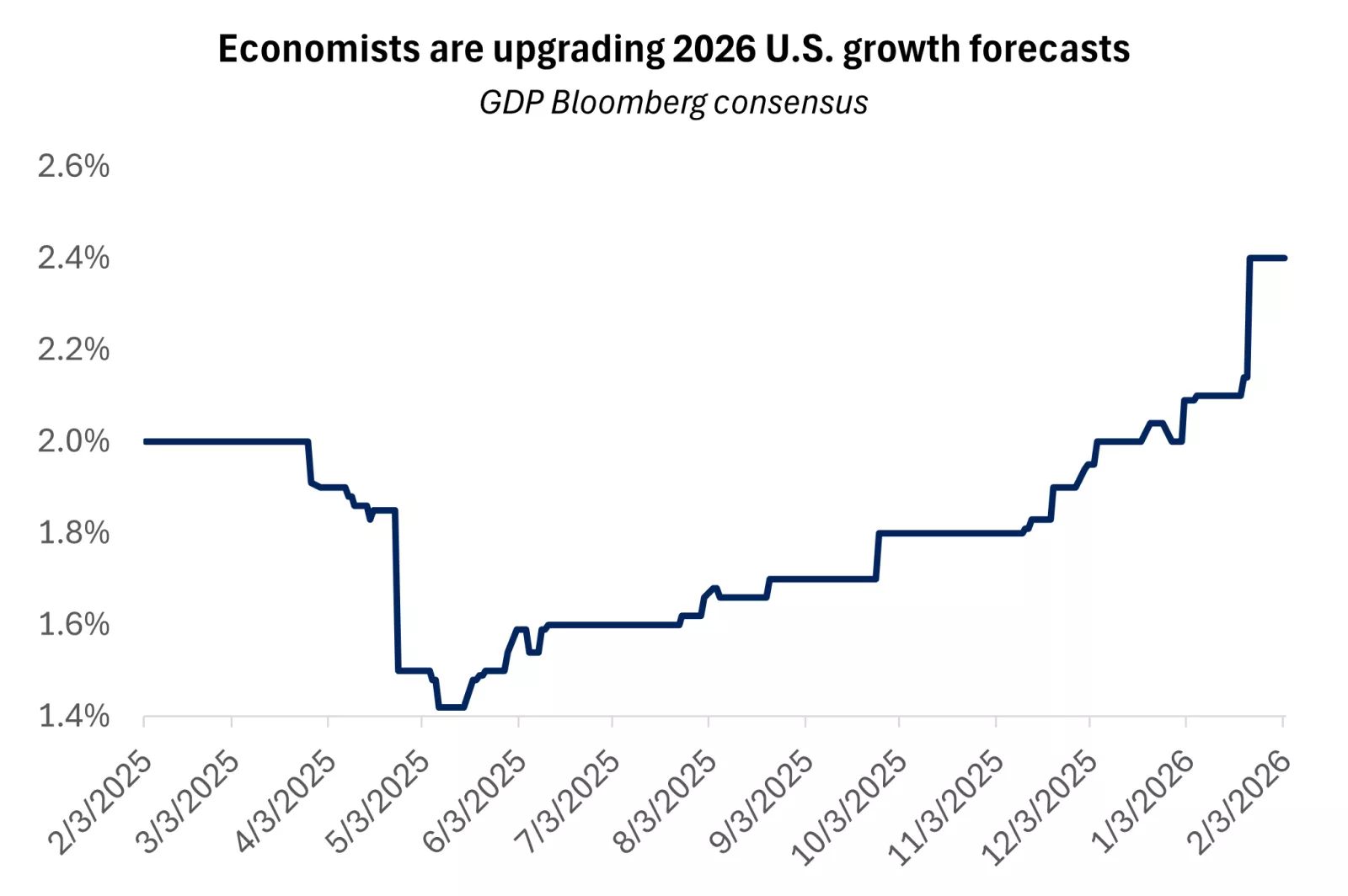

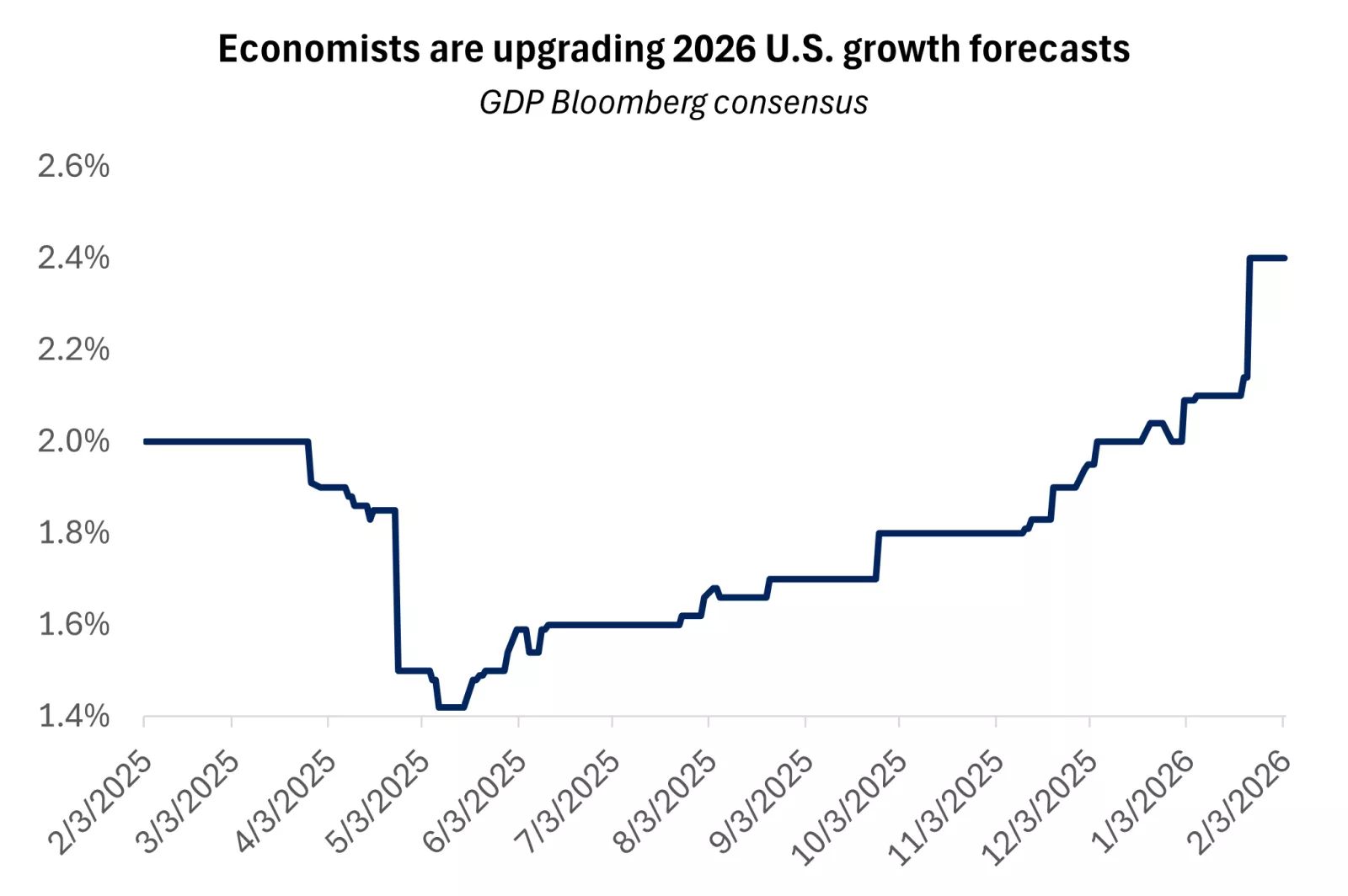

We think today’s economic environment is being buoyed by several tailwinds: solid consumer spending from higher‑income households, fiscal support from last year’s tax bill which should lead to larger tax refunds and incentivize business investment, and elevated AI‑related capital spending. Taken together, in our view, these drivers suggest the U.S. economy remains well‑supported, with the potential for above‑trend growth that can help lift revenues across a broader set of sectors.

Reflecting this brighter outlook, economists have been revising estimates higher and now expect U.S. GDP to grow 2.5% in 2026*.

The graph shows that economists have been revising 2026 U.S. GDP growth estimates higher.

The graph shows that economists have been revising 2026 U.S. GDP growth estimates higher.

Repricing: Tech adjusts to new narratives

The technology sector continues to deliver strong profit growth, with earnings expected to rise around 30% from a year ago, the fastest pace among all 11 S&P 500 sectors**. Yet recent weakness has been driven entirely by valuation compression, as the forward price-to-earnings (PE) ratio has fallen from 32 to 24**. Investors appear to be reassessing how much they are willing to pay for the growth profiles of these companies, and two forces are driving this repricing, in our view:

1) Concerns about AI-driven competitive disruption

The recent sell-off in software stocks has been partly fueled by the rapid emergence of new AI tools that automate tasks in areas such as legal, marketing, and finance, functions traditionally served by established software providers*. These AI agents, including new offerings like Anthropic’s legal assistant, have heightened fears that existing business models could be disrupted faster than incumbents can adapt. Investors worry that this wave of automation may intensify competition, pressure pricing, or in the worst case, render parts of legacy software suites obsolete.

Thus far, selling within software stocks has been broad and indiscriminate, and in some cases, valuations may already reflect a significant degree of disruption risk relative to current fundamentals. At a recent industry conference, NVIDIA’s CEO Jensen Huang pushed back on these fears, arguing that AI will continue to rely on and build upon existing software frameworks rather than replace core tools from scratch. Ultimately, we expect clear winners and losers to emerge, but we think distinguishing between them today is challenging. As a result, volatility is likely to remain elevated across the software landscape. For investors looking to add exposure, a diversified approach across companies and business models may offer a more prudent path, in our view.

2) A surge in AI capital spending

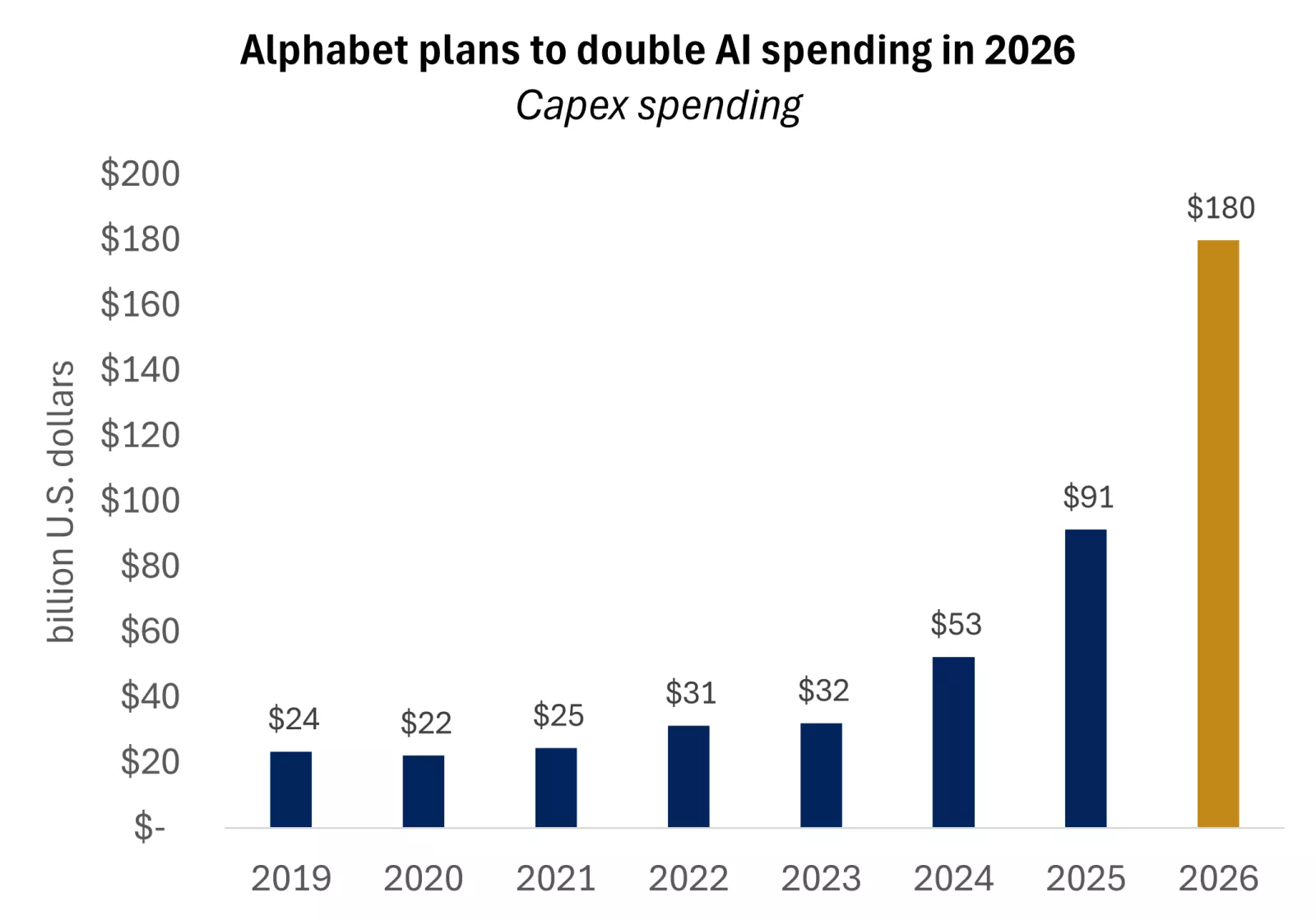

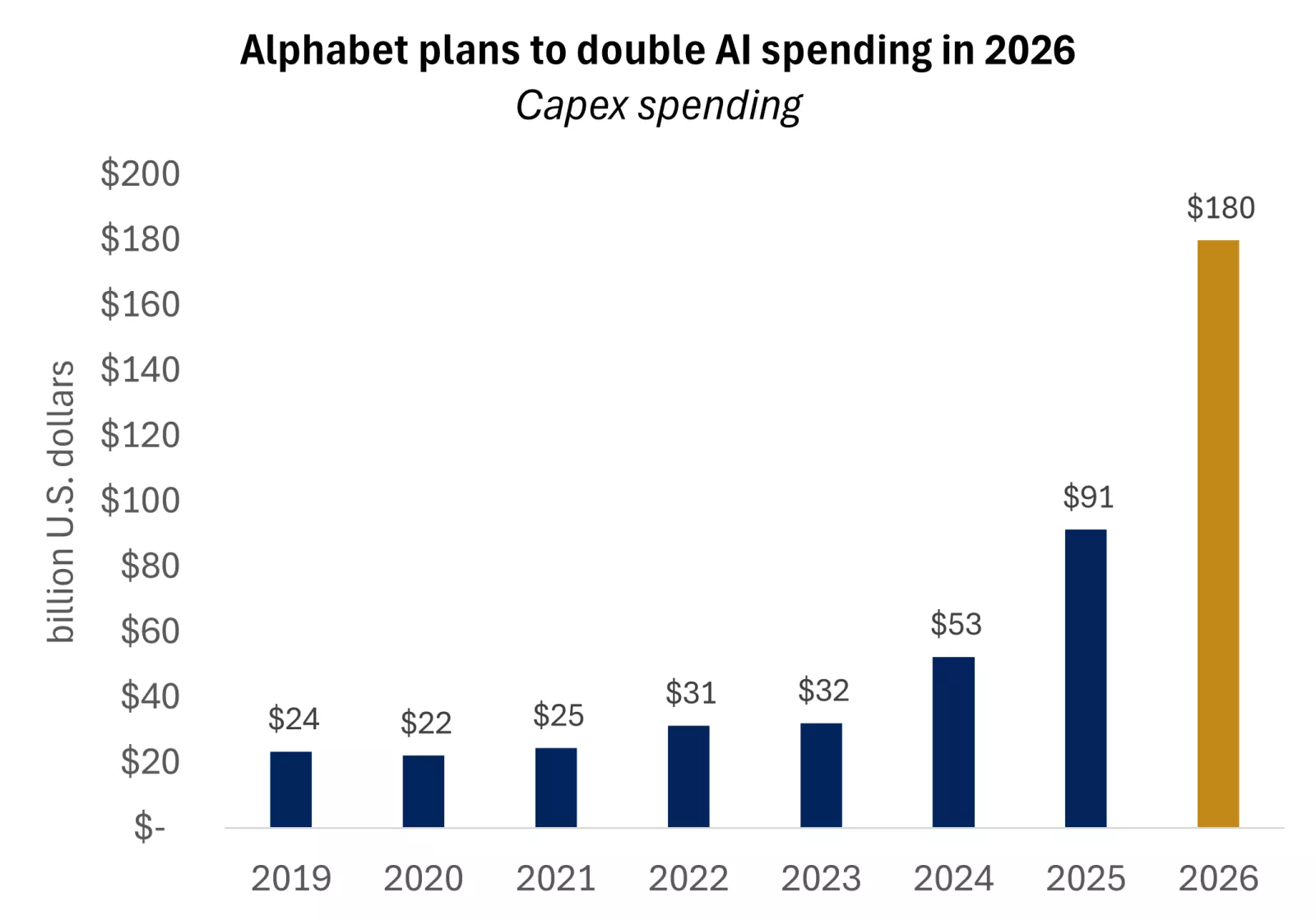

Adding to the broader worries, major technology firms reporting fourth‑quarter results are ramping up AI‑related capital spending far more aggressively than expected as they race to capture the opportunity and stay ahead of intensifying competition. Alphabet, for example, indicated that 2026 capital expenditures could nearly double 2025 levels to around $180 billion. Amazon likewise reported plans to invest about $200 billion in capital expenditures in 2026, a 50% increase from last year, a move its CEO said is necessary to keep pace with “very high demand.”*

These massive investments—primarily in chips, data centers, and AI infrastructure—are supporting revenue growth for other parts of tech, like the semiconductor companies, and contributing positively to the broader economy. However, they are also raising questions about whether such spending will ultimately generate sufficient returns. And while much of this investment is funded through internal cash flow, mega‑cap technology companies are starting to rely more heavily on debt to finance the rapid expansion as they transition away from historically capital‑light business models.

These shifts appear to be making some investors uneasy, contributing to the pullback in tech valuations as the market grapples with the uncertainty surrounding the scale, timing, and profitability of these AI‑driven investments.

The graph shows Alphabet recently announced that 2026 capital expenditures could nearly double 2025 levels to around $180 billion.

The graph shows Alphabet recently announced that 2026 capital expenditures could nearly double 2025 levels to around $180 billion.

Risk appetite: Speculative assets lose momentum

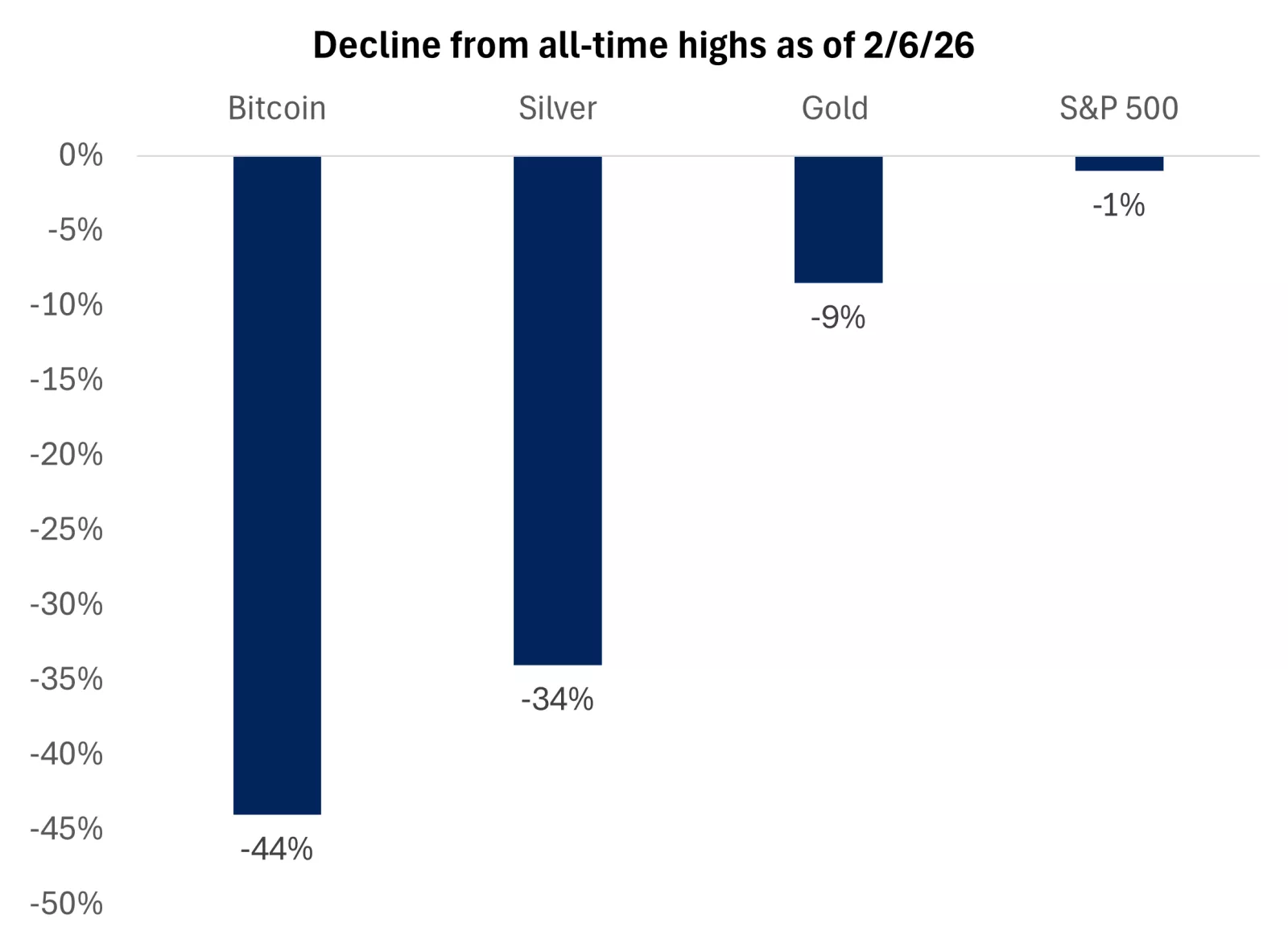

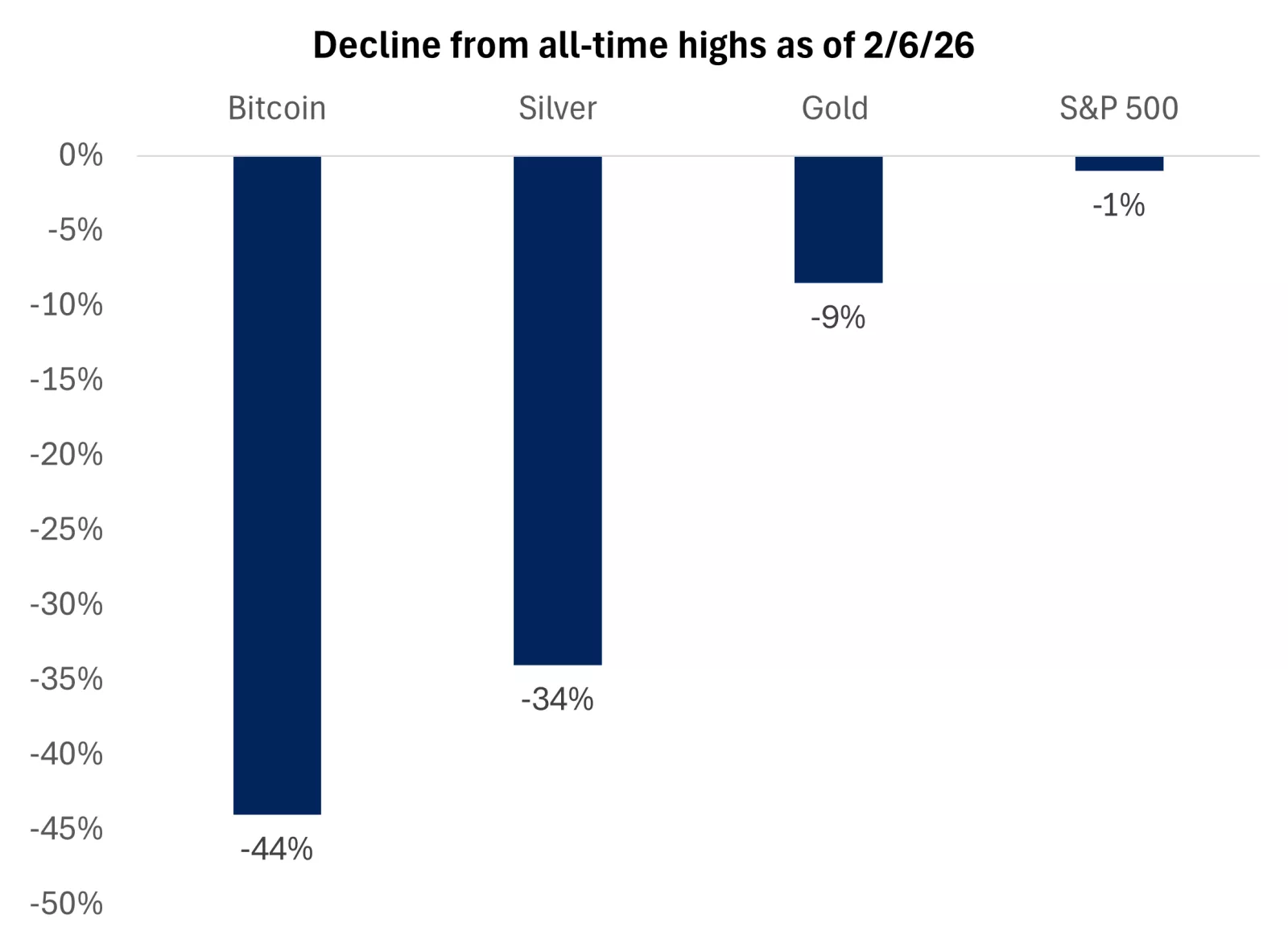

Risk appetite softened more broadly last week as speculative assets came under pressure. Cryptocurrencies saw sharp declines, with bitcoin falling nearly 50% over the past four months*. Silver and gold have also pulled back meaningfully, though both remain well above year‑ago levels*. In our view, these reversals in momentum‑driven trades add to the overall risk‑off tone and signal a broader cooling in speculative behavior—potentially influenced by the Fed’s recent messaging that interest-rate cuts may remain on pause for an extended period.

We remain skeptical of bitcoin’s inherent value and long‑term utility. In precious metals, we recently highlighted that prices appeared overextended and therefore vulnerable to correction. But unlike bitcoin, we think gold may offer diversification benefits and uncorrelated returns relative to other asset classes. For investors concerned about tail risks, we think a modest allocation may serve as a form of “insurance.” However, over long horizons, gold has historically delivered higher volatility and lower returns than equities, often with extended stretches of sideways action and long recovery periods*.

The graph shows the percent decline from highs, with Bitcoin falling nearly 50% from its prior peak.

The graph shows the percent decline from highs, with Bitcoin falling nearly 50% from its prior peak.

Road ahead: Why we remain constructive

Despite recent volatility, we remain constructive on the economic cycle and confident in our call for investors to double down on diversification this year. We view the current phase as a rebalancing, one that is creating opportunities across sectors and helping normalize valuations after an extended period of concentrated growth leadership.

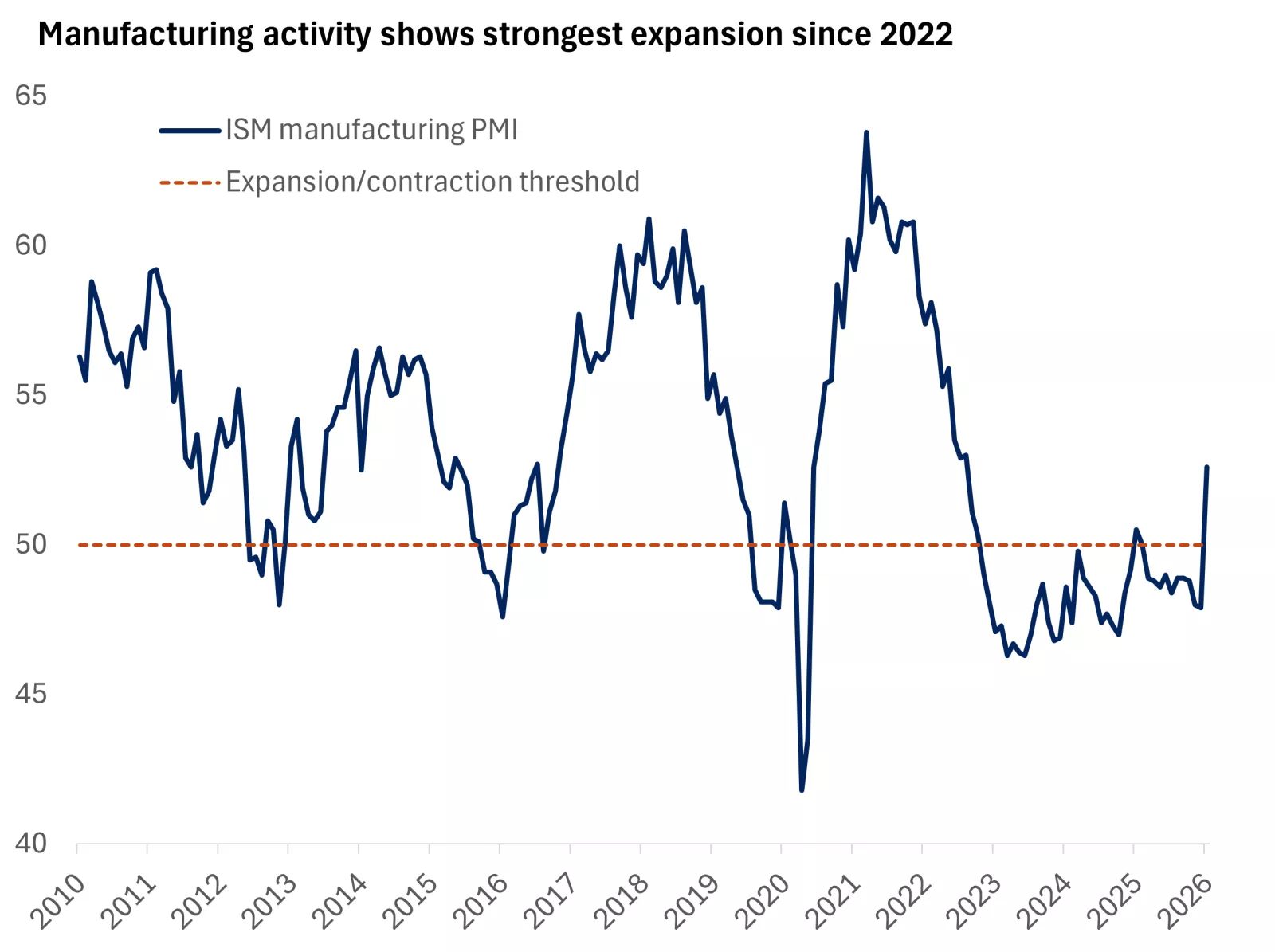

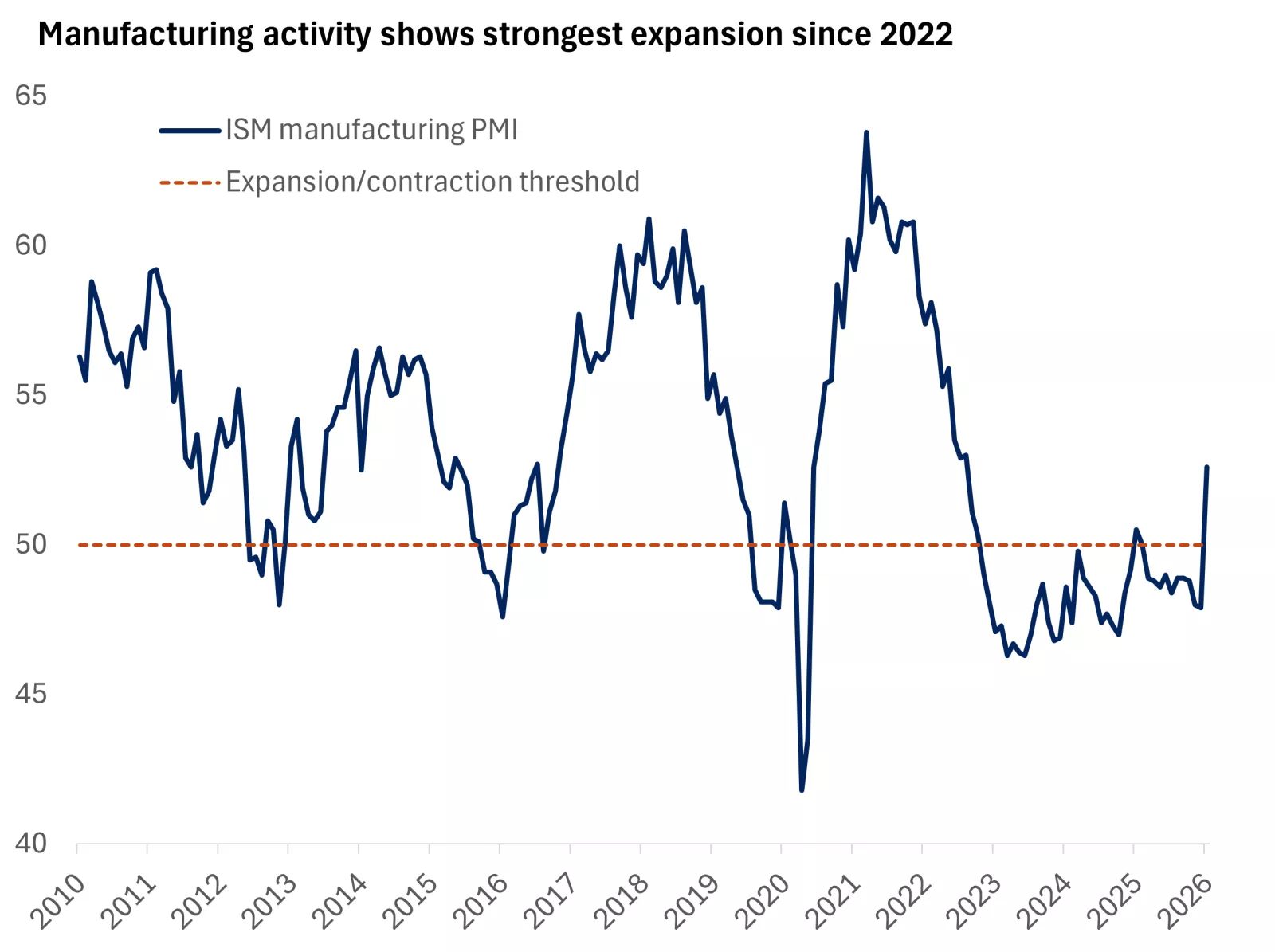

The Rotation, Repricing, and waning Risk appetite we’re seeing may contribute to choppy market conditions in the near term. But one “R” we do not expect in 2026 is a Recession, an outcome that would threaten the durability of the bull market. In fact, several indicators suggest growth may be firming as the industrial cycle turns a corner. The latest ISM Purchasing Managers Index showed the strongest expansion in U.S. manufacturing activity since 2022, with broad-based increases in new orders, production and backlogs*. After several years of stagnation, we think this rebound points to a reacceleration in economic activity that typically benefits cyclical, economically sensitive sectors and helps support the ongoing broadening of equity market performance*.

For portfolios, we believe the rotational nature of the market is creating opportunities to diversify and is easing valuation concerns, particularly as tech earnings continue to outpace price performance. The S&P 500 tech sector now trades at a P/E ratio below its five‑year average and roughly in line with its 10‑year historical range**. For investors who are underexposed to the sector, this risk‑off phase may present opportunities to add to tech and U.S. large‑cap positions, though many investors may find they are already overweight. We see compelling opportunities in U.S. mid‑caps, international developed small- and mid‑cap equities, and emerging markets. Within the U.S., we continue to favor industrials, consumer discretionary, and health care.

The graph shows the ISM Purchasing Managers Index which indicates the strongest expansion in U.S. manufacturing activity since 2022.

The graph shows the ISM Purchasing Managers Index which indicates the strongest expansion in U.S. manufacturing activity since 2022.

Angelo Kourkafas, CFA

Senior Global Investment Strategist

Weekly market stats

| INDEX | Close | Week | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 50,116 | 2.5% | 4.3% |

| S&P 500 Index | 6,932 | -0.1% | 1.3% |

| NASDAQ | 23,031 | -1.8% | -0.9% |

| MSCI EAFE* | 3,029 | -0.5% | 4.7% |

| 10-yr Treasury Yield | 4.21% | 0.0% | 0.0% |

| Oil ($/bbl) | $63.46 | -2.7% | 10.5% |

| Bonds | $100.13 | 0.0% | 0.3% |

Sources: *Bloomberg, **FactSet

Source: FactSet, 02-06-2026. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *4-day performance ending on Thursday.

The Week Ahead

Important economic data for the week ahead includes retail sales, unemployment, and inflation data.

Review last week's weekly market update.

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.