New year, new you: Setting financial resolutions for 2026

Even as motivation wanes, Americans are aiming higher next year

After a year of economic uncertainty, Americans are ready to turn the page. Even though a significant share said they felt fatigued about their finances heading into the end of 2025, optimism is already beginning to take hold for the new year, at least for some. According to new research from Edward Jones and Morning Consult, two out of five Americans (41%) said their 2026 goals are larger and more ambitious than those set in 2025.

The top three financial resolutions include increasing income, building up a savings account and paying off credit card debt, showing Americans’ focus on tangible financial progress.

Inflation still rules decisions

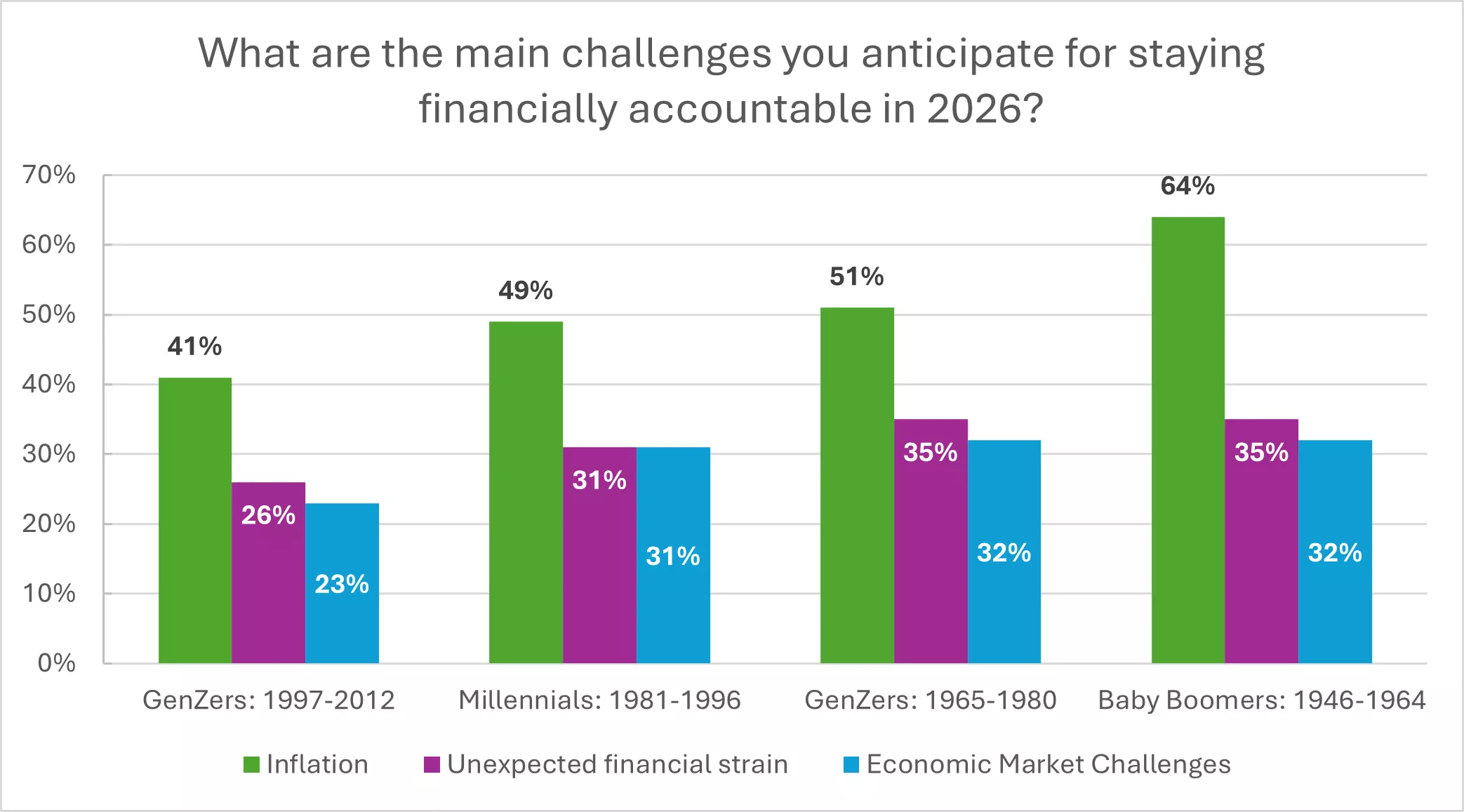

The survey revealed that inflation continues to influence Americans’ financial lives. It was cited as the top reason people couldn’t maintain their 2025 resolutions (49%) and remains the biggest anticipated obstacle for 2026 (52%). And the majority (82%) say it’s impacting their daily life, especially grocery spending (69%) and saving (62%), driving shifts in everyday spending habits and prompting consumers to make tradeoffs on where their money goes:

- 44% of respondents expect to spend less on restaurants in 2026 compared to 2025.

- 34% of respondents expect to spend more on groceries in 2026 compared to 2025.

- 32% of respondents expect to spend less on travel in 2026 compared to 2025.

Even as people plan to adjust their spending patterns to better align with their financial goals, challenges remain:

Accountability and human connection over AI

When it comes to staying accountable to their financial goals, Americans still trust traditional budgets and people more than AI. A striking 81% said budgeting is the most helpful tool for setting and sticking to their 2026 goals, followed by family and friends (58%) and online tools or apps (56%). These methods all share one thing in common: accountability that helps people stay on top of their goals.

By comparison, only 42% said AI tools are helpful, and nearly one in five (19%) said the technology is not helpful at all. While technology can be a complementary tool, real progress often comes from guidance that feels personal and relatable, not automated. That can come through a well-planned budget, encouragement from family or from the help of a financial advisor.

Confidence grows with guidance

In 2026, many are planning to invest more in their financial futures. Nearly one-quarter (23%) expect to contribute more to investments in 2026 compared to 2025, reflecting a new dedication to their financial goals and long-term stability.

And as more look to increase their investments, some are turning to professionals for help, with one in five (22%) engaging with a financial advisor to kick start their financial goals. This number slightly increases to 26% for Americans who feel confident they will stick to their 2026 financial resolutions.

Some of these conversations are already in the works, with one-third of Americans (33%) planning to meet with their financial advisor about their 2026 goals before the new year starts. Another 44% aren’t far behind, planning to meet with their financial advisor between January and March to action on their financial resolutions and continue to build their confidence.

Methodology

Edward Jones, in partnership with Morning Consult, conducted a nationwide online survey (fielded between Oct. 27-30, 2025) among a sample of 3,019 U.S. adults. Results from the full survey have a margin of error of +/-2 percentage points.