6 ways to protect yourself against cyber threats

Paul Simmons, CFA®, CFP®”

Senior Analyst, Client Needs Research

As a long-term investor, you know following time-tested investment principles can help you manage financial risk. Using the same principles can mitigate cyber risk. Building awareness, following a process and monitoring your accounts can help ensure your private information remains just that.

Here are some tips you’ve likely heard while investing that can also work to help keep you cyber safe.

1. Diversify | Use a different password for each login. A password manager can help you keep track of your passwords.

Multifactor authentication and biometrics add layers of protection, especially for financial and email services. |

2. Rebalance | Change your passwords quickly if there has been a breach.

Back up your data regularly using a backup service, cloud storage or an external hard drive to protect against potential data loss. |

3. Focus on the long term | Don’t immediately click a link or open an attachment, particularly if it arrived unexpectedly. Check the sender and the file type, and look for misspellings or strange file names.

Be wary of any communication that requires immediate action, payment or updates to your account information. |

4. Partner with trusted professionals | Ensure your apps, devices, password managers and antivirus software come from reputable companies with a track record of security. Research the developer or manufacturer and use official app stores.

If you’re in doubt about a situation, talk with someone you trust. This can help you identify a potential scam. |

5. Limit your high-risk exposure | Be careful when you log in to services on shared computers or over public networks.

Consider freezing your accounts with credit reporting agencies, which makes it more difficult for thieves to open accounts under your name.

Check your privacy settings on social media and be careful about posting personal information. |

6. Check in regularly | Be sure to update your devices, apps and software regularly.

Monitor your account activity by reviewing your statements and checking your credit report annually. |

Protection is important, but so is your reaction if you should become a scam victim. What should you do if you’ve experienced a scam?

At Edward Jones, we’re committed to keeping your personal and financial information secure. Our face-to-face approach helps us identify unusual activity. We also use firewalls and encryption, regularly test our security systems, and consult industry-leading security firms to identify potential vulnerabilities. For more information, visit edwardjones.com/privacy.

Spoofing/phishing — The fraudster pretends to be a trusted company, family member or friend, hoping you’ll click an unsafe link or attachment or share personal information. Thieves usually want you to act fast.

Business email compromise — The thief sends an email that appears to be from a trusted source, asking you to wire funds.

Charity fraud — Scammers create fake charities to seek donations, typically after a high-profile disaster.

Grandparent scam — The fraudster poses as a loved one in an emergency, such as an accident or arrest in a foreign country, and asks for money to be wired quickly or sent via gift cards or prepaid cards.

Romance scam — The thief meets you online and works to gain your trust, eventually asking you to send money to pay for big-ticket items.

Tech support scams — You get a phone call, pop-up warning or email telling you there is a problem with your computer. The scammer convinces you to pay for services you don’t need and could also gain access to your computer.

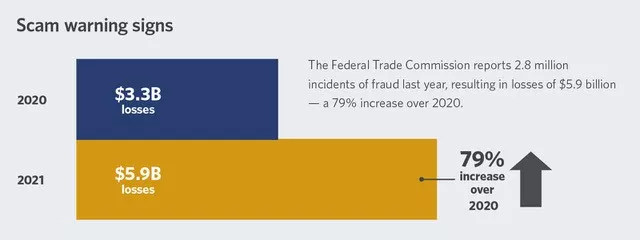

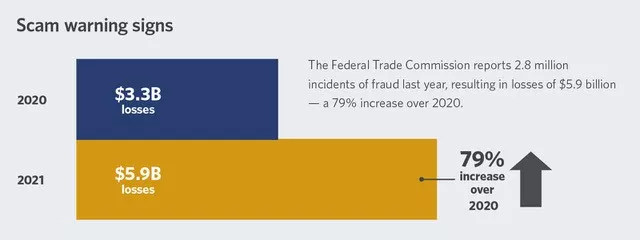

The Federal Trade Commission reports 2.8 million incidents of fraud last year, resulting in losses of $5.9 billion — a 79% increase over 2020. This risk is evolving as newer technologies are introduced.

According to the FTC, scams tend to exhibit the following: