5 changes that could impact your retirement

The new year ushered in several changes for retirement accounts. Be sure to understand how these five changes could impact your retirement strategy.

1. 401(k) plan access for certain part-time employees

Beginning in 2024, part-time employees who are at least 21 years old and have at least 500 hours of service for three consecutive years generally must be allowed to contribute to their employer’s 401(k) plan if one is offered. This new requirement could provide additional part-time employees with access to a 401(k) plan and potentially an employer match if available.

If you think you may qualify, contact your employer to learn how to get started. You should try to contribute at least enough to earn the full match if one is offered — it’s effectively free money.

2. New employer plan options for emergency savings and student loan payments

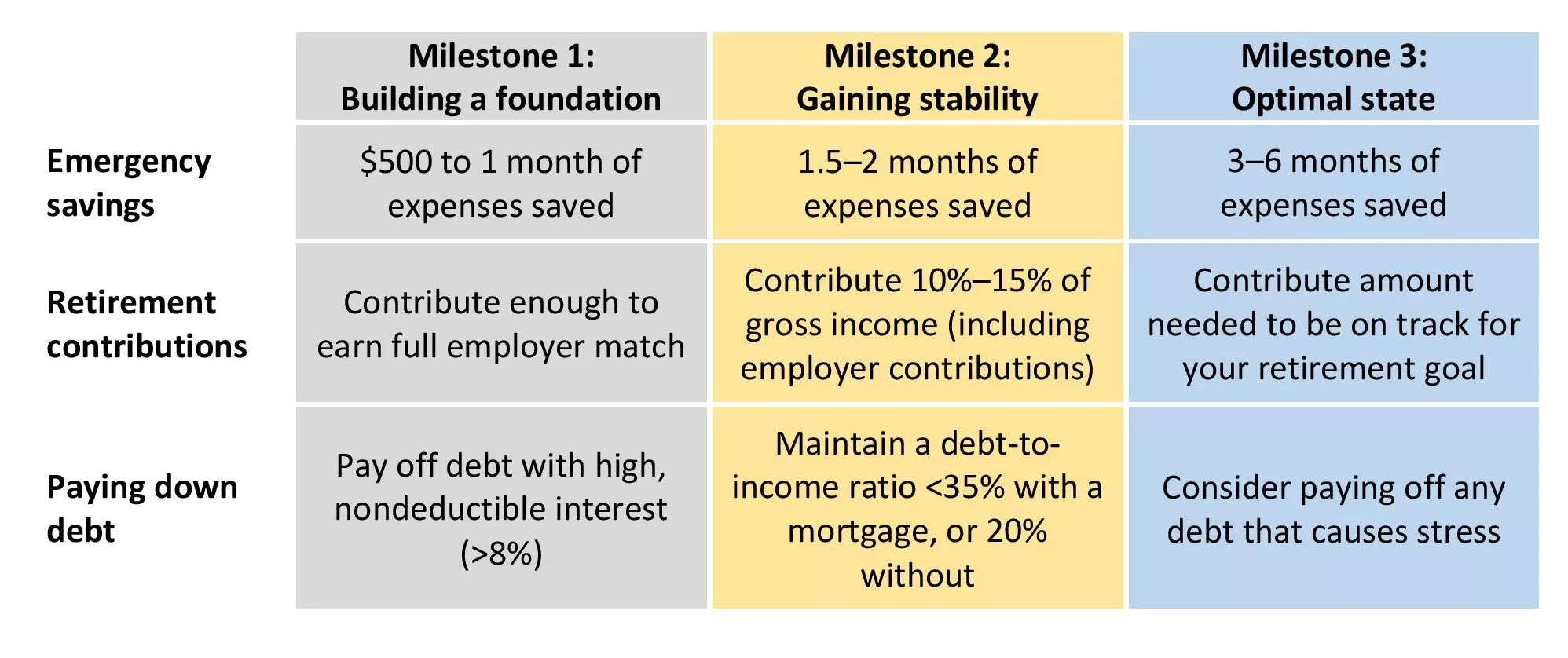

If you’re balancing saving for retirement with building an emergency fund or paying down student loan debt, employer plans offer two new options that could make this balancing act easier.

Beginning in 2024:

- 401(k) plans can offer an in-plan emergency savings account. It’s funded with Roth contributions (up to a maximum balance of $2,500) that you can access without taxes or penalties, and you can even receive matching contributions toward retirement.

- Plans can offer matching retirement contributions for qualified student loan payments.

Check with your plan administrator to find out whether either option is available to you. Then work with your financial advisor to develop a strategy that can help you progress toward all three goals.

Key milestones to help you work toward financial stability and flexibility

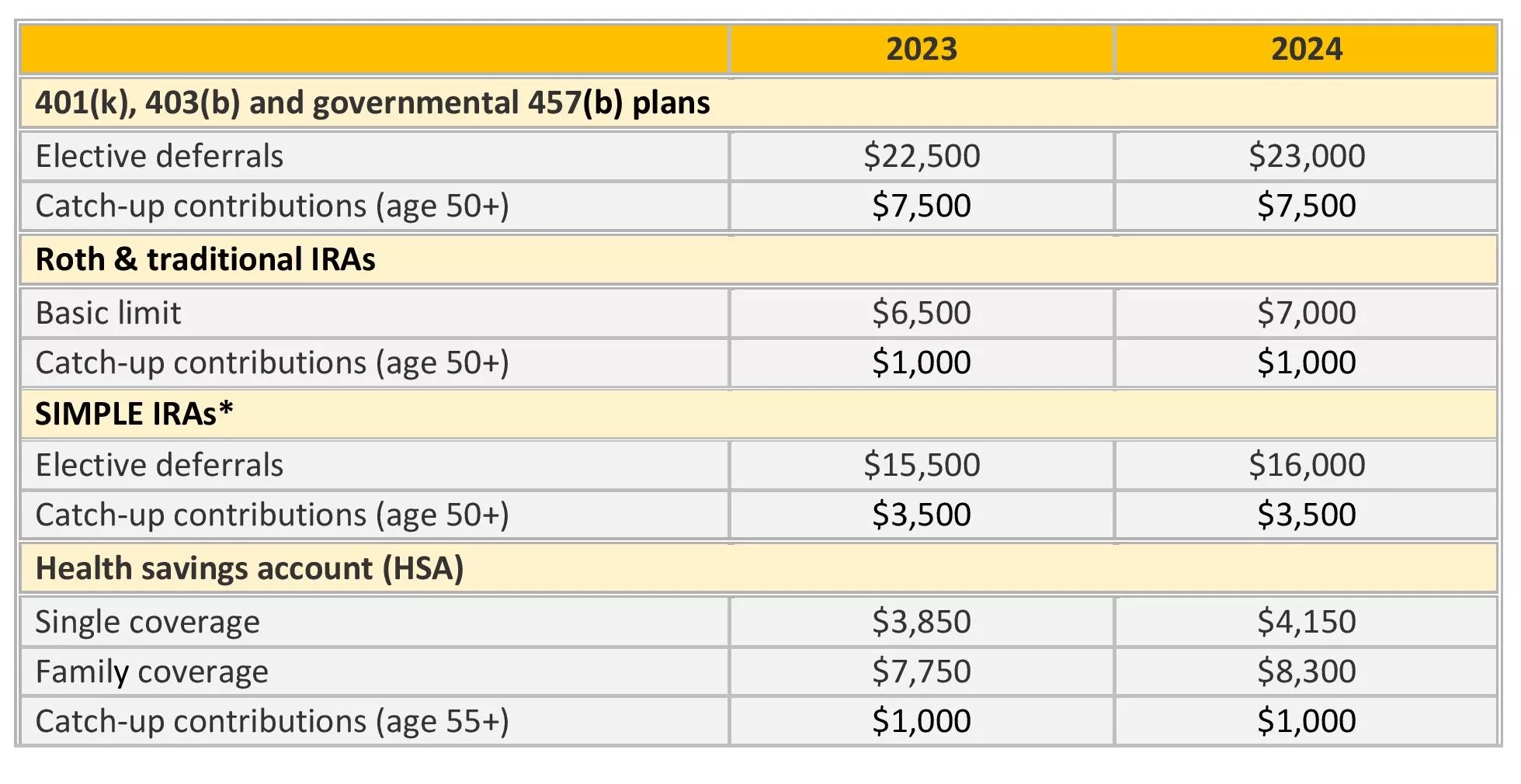

3. Higher contribution limits

As with most years, the 2024 contribution limits increased for inflation. This allows you to set aside more for retirement on a tax-advantaged basis.

Additionally, beginning in 2024, certain SIMPLE IRA plans are eligible for even higher contribution limits due to the SECURE 2.0 Act. Employers with 25 or fewer employees can allow deferrals and catch-up contributions of up to 110% of the SIMPLE IRA limits shown in the table below. Employers with 26 to 100 employees can allow the 110% limit if they meet certain criteria.

- If you aim to maximize your retirement contributions, be sure to adjust your contribution amounts to take advantage of this year’s higher limits.

- If you aren’t maxing out yet, consider increasing your contribution rate by at least 1% each year to progress toward the next savings milestone. Some plans even offer an auto-escalation feature that will do this for you.

Annual contribution limits

*Participants of eligible SIMPLE plans can contribute 110% of normal contribution limits, including catch-up contributions.

4. Increased Medicare premiums

After declining in 2023, monthly Medicare Part B premiums increased 6% in 2024 to $174.70. Part B and Part D premium surcharges — additional amounts charged to individuals with income above a certain level — also increased 6%.

If you have a health savings account (HSA), you can use it tax free to pay the premiums for Medicare Parts B and D and Medicare Advantage (but not Medigap). You can also use your HSA tax free to pay your deductibles, co-pays/coinsurance and other qualified medical expenses.

Using HSA distributions allows you to cover medical costs without increasing your taxable income, benefiting you in the year of distribution and two years into the future. That’s because your Medicare premiums are based on your modified adjusted gross income (AGI) from two years prior. (For most people, modified AGI is taxable income plus tax-exempt interest.) Lower modified AGI can mean lower Medicare premiums.

- Roth distributions can also be used to meet your retirement spending needs and manage future Medicare premiums. Like HSAs, qualified Roth distributions won’t increase your taxable income. However, using your Roth account means fewer tax-free assets to use in future years or pass along to your heirs.

You don’t have to wait until you’re approaching 65 to begin preparing for Medicare expenses. In fact, the sooner you begin preparing, the better. If you’re pre-Medicare, work with your financial advisor and tax professional to determine whether it makes sense to contribute to an HSA and/or Roth account to provide you with greater flexibility to manage your taxes in retirement.

5. RMDs no longer required from Roth 401(k) accounts

Beginning in 2024, required minimum distributions (RMDs) are no longer required from Roth 401(k) accounts (for the original account owner), aligning them with the RMD rules for Roth IRAs. Keep in mind, though, that if you turned 73 in 2023 and waited to take your first RMD until April 1, 2024, you’ll still need to take that RMD because it’s for the 2023 tax year.

Talk with your Edward Jones financial advisor and tax professional about whether these changes could impact your progress toward achieving the retirement you want.

Katherine Tierney

Katherine Tierney is a Senior Retirement Strategist on the Client Needs Research team at Edward Jones. The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Katherine has more than 15 years of financial services and retirement experience. She is a contributor to the Edward Jones Perspectives newsletter and has been quoted in various publications.