Monthly international market focus

Gold’s 2025 Boom: Overextended or Structural Shift?

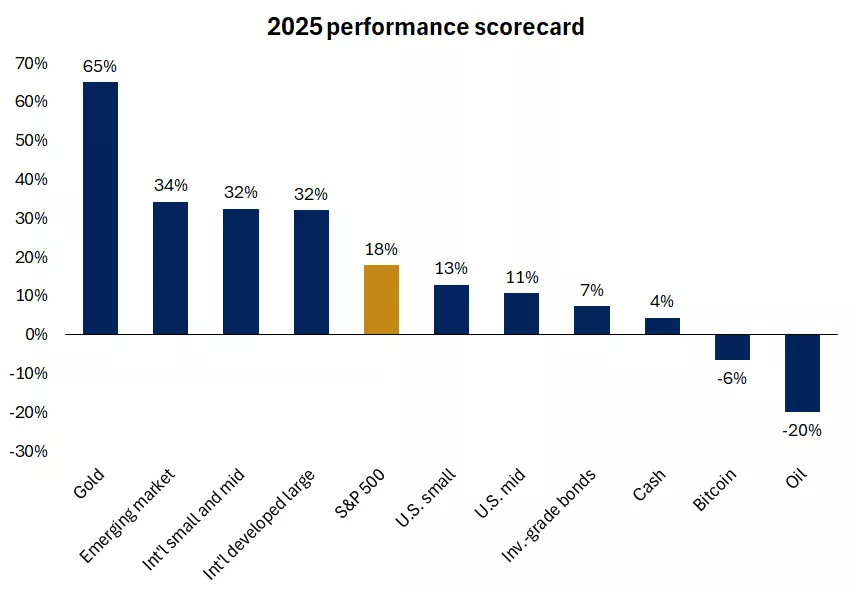

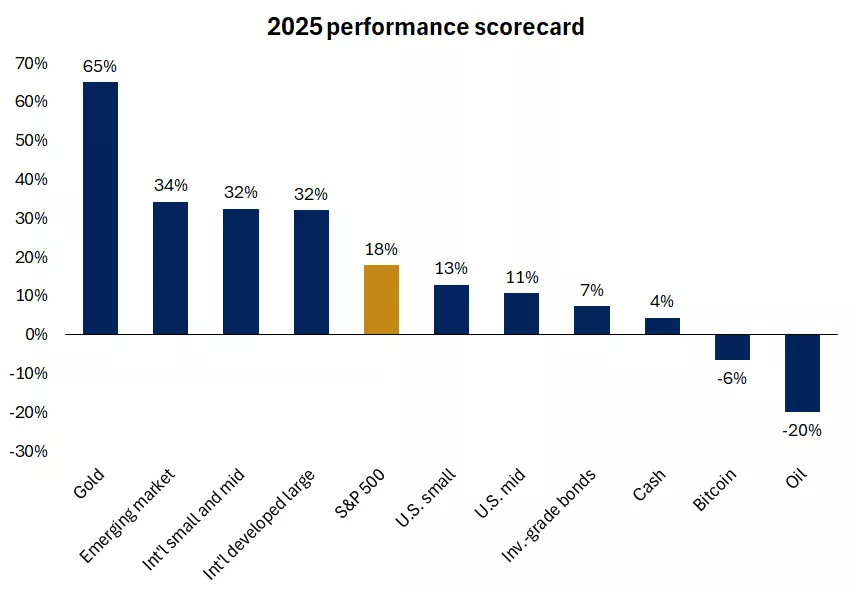

International equities delivered a stellar performance in 2025, outperforming U.S. equities by the widest margin since 1993 and boosting returns for well-diversified portfolios*. Yet, one investment shone even brighter: gold. Precious metals had an extraordinary year, with gold surging 65%, its strongest annual gain since 1979, outpacing all major asset classes, including technology stocks and other equities*. The question now is: Can this rally be repeated, and how should investors view gold as an asset class going forward?

This chart shows the performance of the following assets in 2025: Gold: 65%, Emerging-markets/MSCI Emerging-markets: 34%, Int'l small- and mid/MSCI EAFE SMID: 32%, Int'l developed large/MSCI EAFE: 32%, S&P 500: 18%, U.S. Small-cap/Russell 2000: 13%, U.S. Mid-cap/Russell Mid-cap: 11%, U.S. inv.-grade bonds/ Bloomberg U.S. Aggregate: 7%, Cash/Bloomberg Treasury Bellwethers 3-month: 4%, Bitcoin: -6%, Oil: -20%.

This chart shows the performance of the following assets in 2025: Gold: 65%, Emerging-markets/MSCI Emerging-markets: 34%, Int'l small- and mid/MSCI EAFE SMID: 32%, Int'l developed large/MSCI EAFE: 32%, S&P 500: 18%, U.S. Small-cap/Russell 2000: 13%, U.S. Mid-cap/Russell Mid-cap: 11%, U.S. inv.-grade bonds/ Bloomberg U.S. Aggregate: 7%, Cash/Bloomberg Treasury Bellwethers 3-month: 4%, Bitcoin: -6%, Oil: -20%.

What has been driving the gains?

This historic rally was fueled by a mix of factors that boosted gold’s appeal to investors. Some drivers are short-term and may prove temporary, while others are more structural. Together, they created the perfect storm for gold’s surge:

- Favorable macroeconomic conditions

- U.S. dollar weakness

- Declining real interest rates

- High uncertainty and risk

- Trade uncertainty and deglobalization trends

- Rising geopolitical risks

- Fiscal concerns and debt sustainability

- Strong demand dynamics

- Robust central bank purchases

- Price momentum and increased investment flows

Because gold is an asset that doesn’t generate cash flow or pay dividends, its appeal often depends on the opportunity cost of holding it. Real interest rates are a key driver. When they decline, gold typically benefits, and when they rise, gold tends to lag. Similarly, a weaker U.S. dollar lowers the relative cost for global investors, adding to gold’s attractiveness.

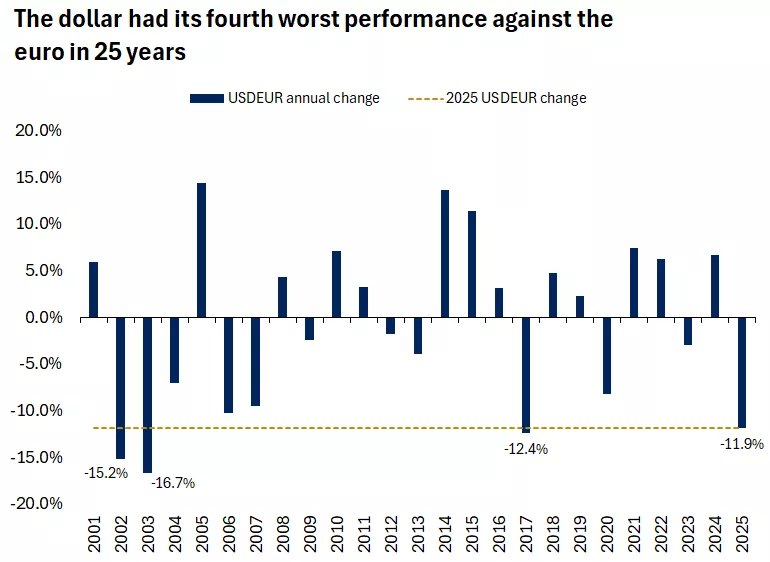

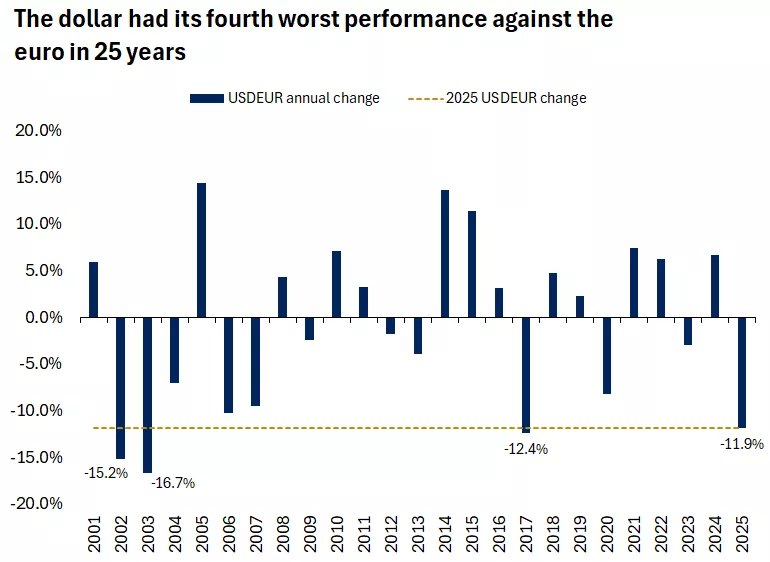

In 2025, both forces were in play. Central banks, including the Fed, shifted from restrictive to more neutral policy as inflation normalized, pushing real rates lower. At the same time, the U.S. dollar posted its worst calendar year since 2017, with the DXY down 9.5%, driven by a 12% depreciation against the euro*. Together, these dynamics alongside provided a powerful tailwind for gold.

Additional support came from elevated geopolitical uncertainty, initially sparked by Russia’s invasion of Ukraine, compounded by conflicts in the Middle East, and most recently the capture of Venezuelan leader Nicolás Maduro and protests in Iran. Concerns about Fed independence and government debt sustainability further reinforced gold’s role as a hedge against systemic risks. In an environment shaped by sanctions, trade wars, and a push toward deglobalization, gold has served as a safe-haven asset against tail risks. Some central banks have also accelerated diversification away from a dollar-centric system, stepping up gold purchases over the past three years, reinforcing demand.

The graph shows that the dollar declined 12% against the euro in 2025 driving the dollar index lower and helping boost gold prices.

The graph shows that the dollar declined 12% against the euro in 2025 driving the dollar index lower and helping boost gold prices.

Tactical lens: Is gold overextended?

Gold's move in 2025 was historic, marking the fourth strongest annual return since the end of the Bretton Woods system in 1971, which suspended the dollar convertibility into gold*. But the question now is what happens next. To explore this, we look at (1) lessons from history and (2) what current macro conditions imply.

1) Lessons from History

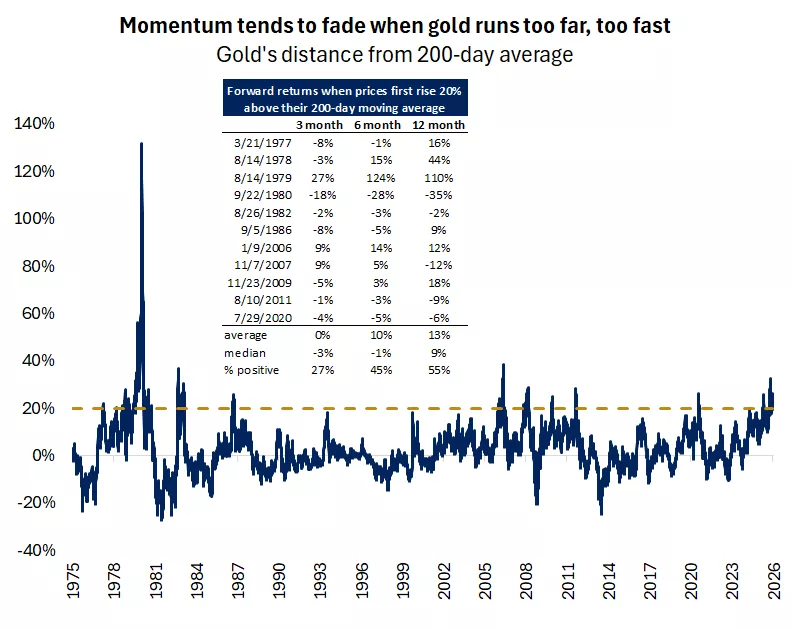

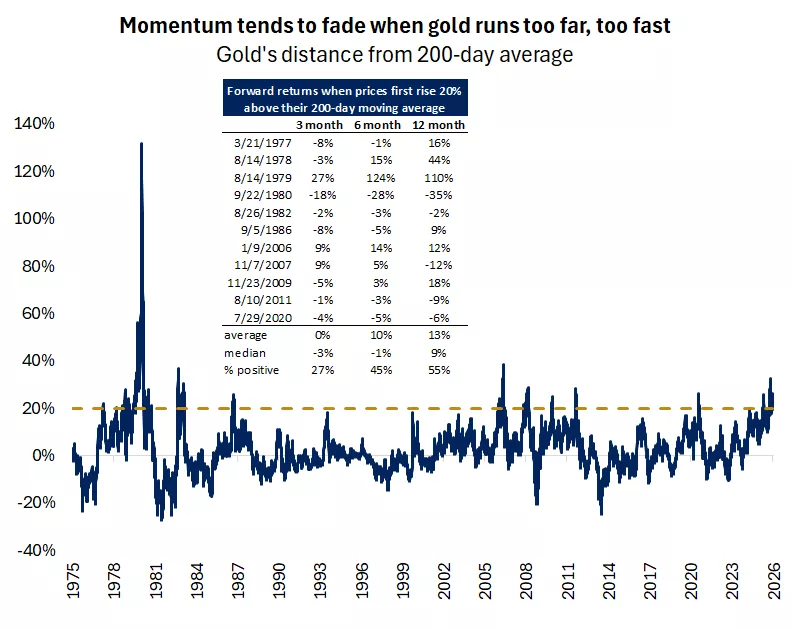

There have been 11 historical instances where gold surged 20% above its 200-day moving average, a sign of extreme momentum*. Forward returns after such strength have been mixed at best, with many periods showing muted or negative performance. Outside of a few standout winners (1978, 1979), upside momentum often fades*. However, crashes are rare. Historically, buying gold at extremes tends to lead to cooling, consolidation, or mild corrections. Flat-to-slightly negative returns have been the norm*.

2) Macro Backdrop for 2026

Last year, global trade uncertainty and tariff headwinds dominated headlines, yet growth proved resilient. For 2026, we expect steady economic growth, slightly looser Fed policy alongside an ECB pause, modest fiscal stimulus tied to the new U.S. tax bill, and fading tariff uncertainty. Lingering inflation pressures should prevent aggressive easing, and while geopolitics remains a wild card, an oversupplied oil market reduces the risk of energy price spikes*. We also don’t anticipate another sharp U.S. dollar decline, though a modest softening is likely. Taken together, these conditions could keep gold rangebound, with a risk of correction if growth surprises to the upside and long-term yields fail to decline further.

Bottom Line: After 2025’s parabolic move, we expect gold’s momentum to cool with history suggesting the potential for consolidation or a correction, though not collapse.

The graph shows that forward gold returns after prices rise 20% above their 200-day moving average. Historically, momentum tends to fade when gold runs too far, too fast.

The graph shows that forward gold returns after prices rise 20% above their 200-day moving average. Historically, momentum tends to fade when gold runs too far, too fast.

Strategic lens: A portfolio diversifier

With prices potentially overextended, we believe investors should avoid chasing gold higher. Gold has had three standout periods of strong performance—the 1970s, the 2000s, and the past five years*. But over longer horizons, it has delivered higher volatility and lower returns than equities, often with extended stretches of sideways action and long recovery periods*. Once it peaked in 1980, it took until 1999 to make a new high. Since 1970, the S&P 500 has returned 11% annualized (including dividends) versus 9% for gold*.

However, the case for gold is not about seeking above-average returns, but rather its diversification and stability benefits. Historically, gold has shown low correlation to both stocks and bonds, meaning its returns tend to move independently of traditional assets*. This decoupling, especially during periods of market stress, makes gold a useful diversifier, helping smooth returns across cycles and improve portfolio efficiency.

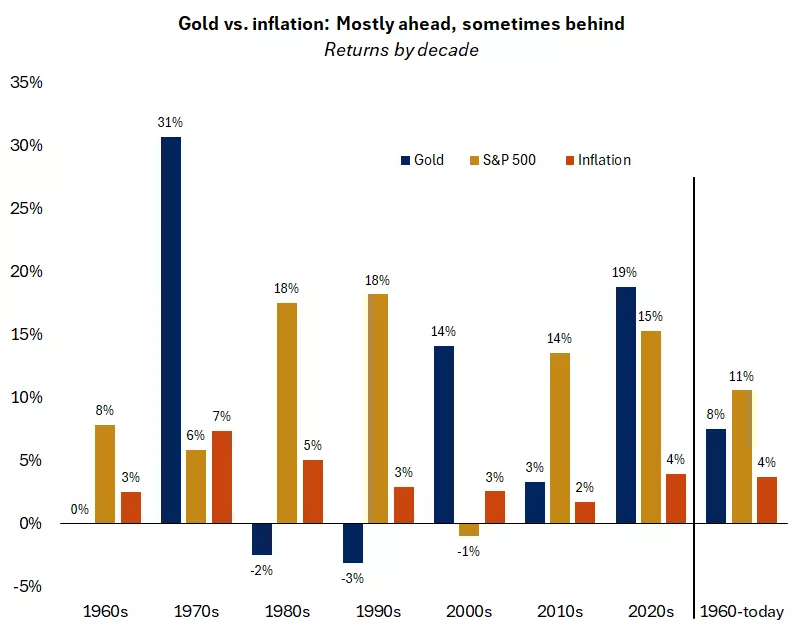

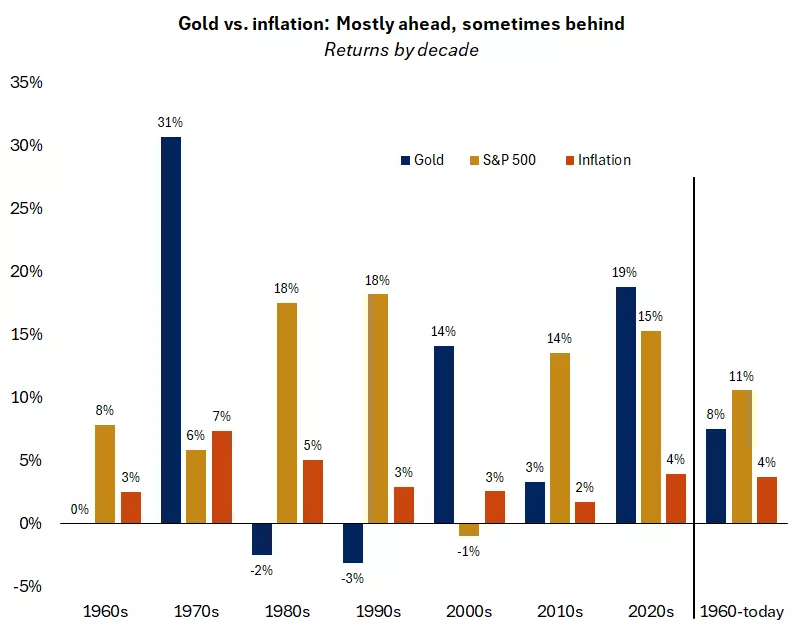

From a fundamental perspective, gold has historically acted as a hedge against large, unexpected inflation spikes, when both stocks and bonds typically struggle. However, unlike a diversified stock portfolio, it offers limited protection against smaller or gradual price increases, which explains why gold lagged inflation during the 1960s, 1980s, and 1990s. Gold has also tended to provide some protection during severe geopolitical, economic, or financial shocks (e.g., 2008)*.

Bottom line: Stocks have more consistently protected an investor’s purchasing power over time, but gold can serve as a strategic hedge against extreme uncertainty and help smooth volatility, complementing stocks and bonds in a diversified portfolio. Although our target allocation for commodities, which includes gold, remains 0%, for investors seeking to enhance diversification with precious metals or mitigate equity market volatility amid heightened fiscal, inflationary, and geopolitical risks, we believe a gold allocation of up to approximately 5% may be appropriate within the more aggressive portion of a well-diversified portfolio.

The graph shows returns for gold, stocks and inflation by decade. While gold has outpaced inflation over time that was not the case in the 1960s, 1980s and 1990s.

The graph shows returns for gold, stocks and inflation by decade. While gold has outpaced inflation over time that was not the case in the 1960s, 1980s and 1990s.

Additional considerations:

- If the goal is diversification and crisis protection, we think investors consider funding the gold allocation from equities.

- If the goal is inflation protection (against large, unexpected spikes), investors may consider reallocating from bonds.

- An equity-and-bond portfolio can still provide meaningful inflation protection and diversification without precious metals. However, for those seeking an additional layer of crisis resilience and inflation hedging, gold can be a complementary allocation.

Senior Global Investment Strategist

Sources: * Bloomberg, Edward Jones

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important information:

Investing in equities involves the risk of loss. The value of an investors shares can fluctuate, and investors can lose money. Small-and mid-cap stocks tend to be more volatile than large company stocks.

Diversification does not ensure a profit or protect against loss in a declining market.

This report is provided for intended as educational only and should not be interpreted as specific recommendations or investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.