Zachary D. Gildehaus, CFA®, CFP®, CEPA, Senior Strategist, Client Needs Research

In 1981, Diana Ross and Lionel Richie’s “Endless Love” topped the charts, Raiders of the Lost Ark became a blockbuster, and 30-year mortgage rates hit their highest levels ever at 18.5%. While “Endless Love” and Indiana Jones may have held up, interest rates fell for the next 40 years.

This has created a generation of borrowers unaccustomed to paying higher borrowing costs. And even those who did experience higher rates may have forgotten what they’re like.

As rates have crept back up from their multiyear lows, it’s important to revisit your debt management strategy.

Current interest rate landscape

| February 2021 | February 2024 | |

| 30-year fixed mortgage1 | 2.75% | 7.00% |

| 6-year auto loan2 | 5.00% | 8.50% |

| Student loan3 | 2.75% | 5.50% |

| Credit card4 | 14.75% | 21.50% |

As interest rates go up, the costs associated with borrowing money go up as well. While existing fixed-rate loans aren’t impacted, new or refinanced fixed-rate loans will come with higher rates. And those with variable interest rates, like most credit cards, will feel the impact.

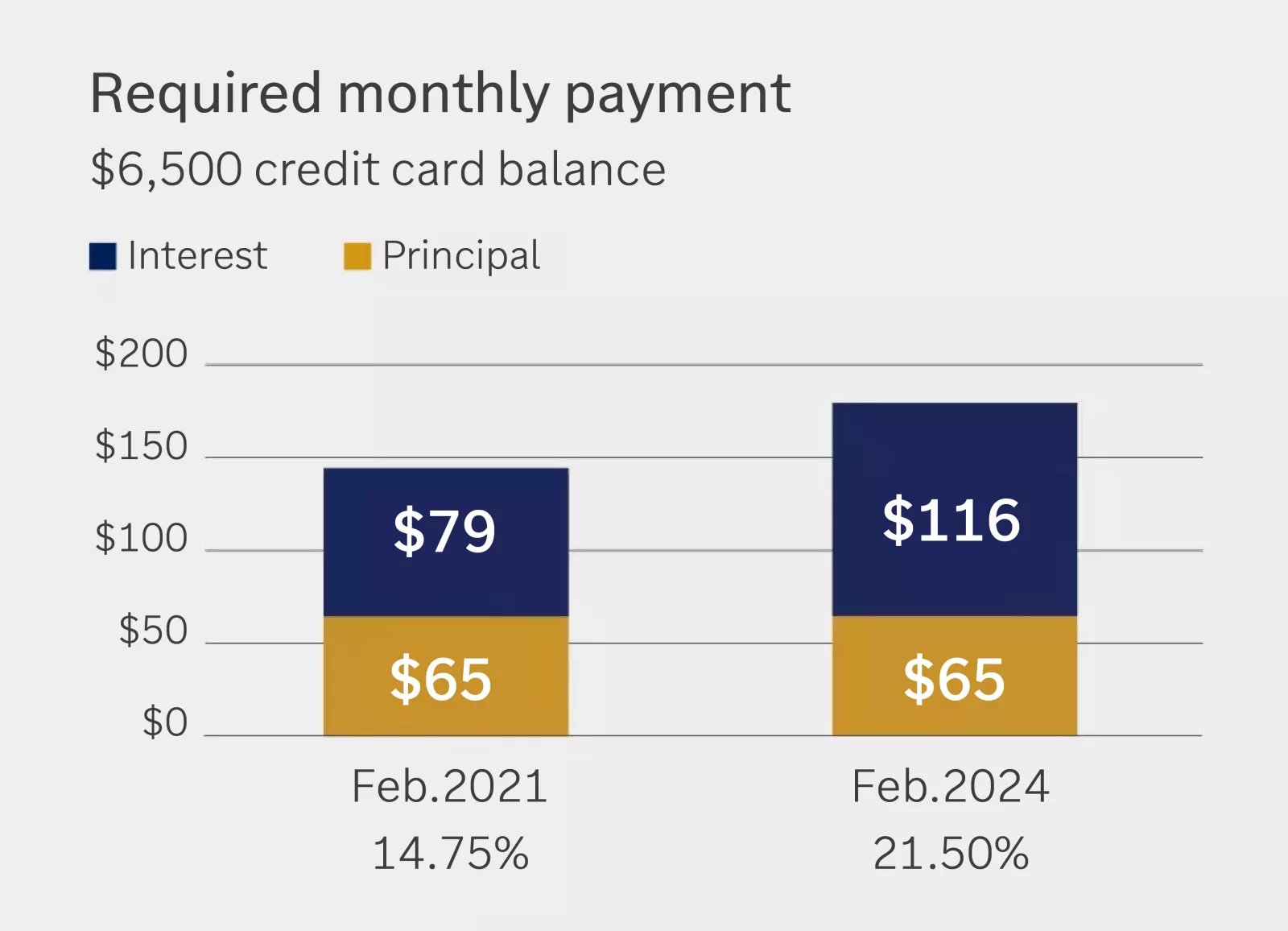

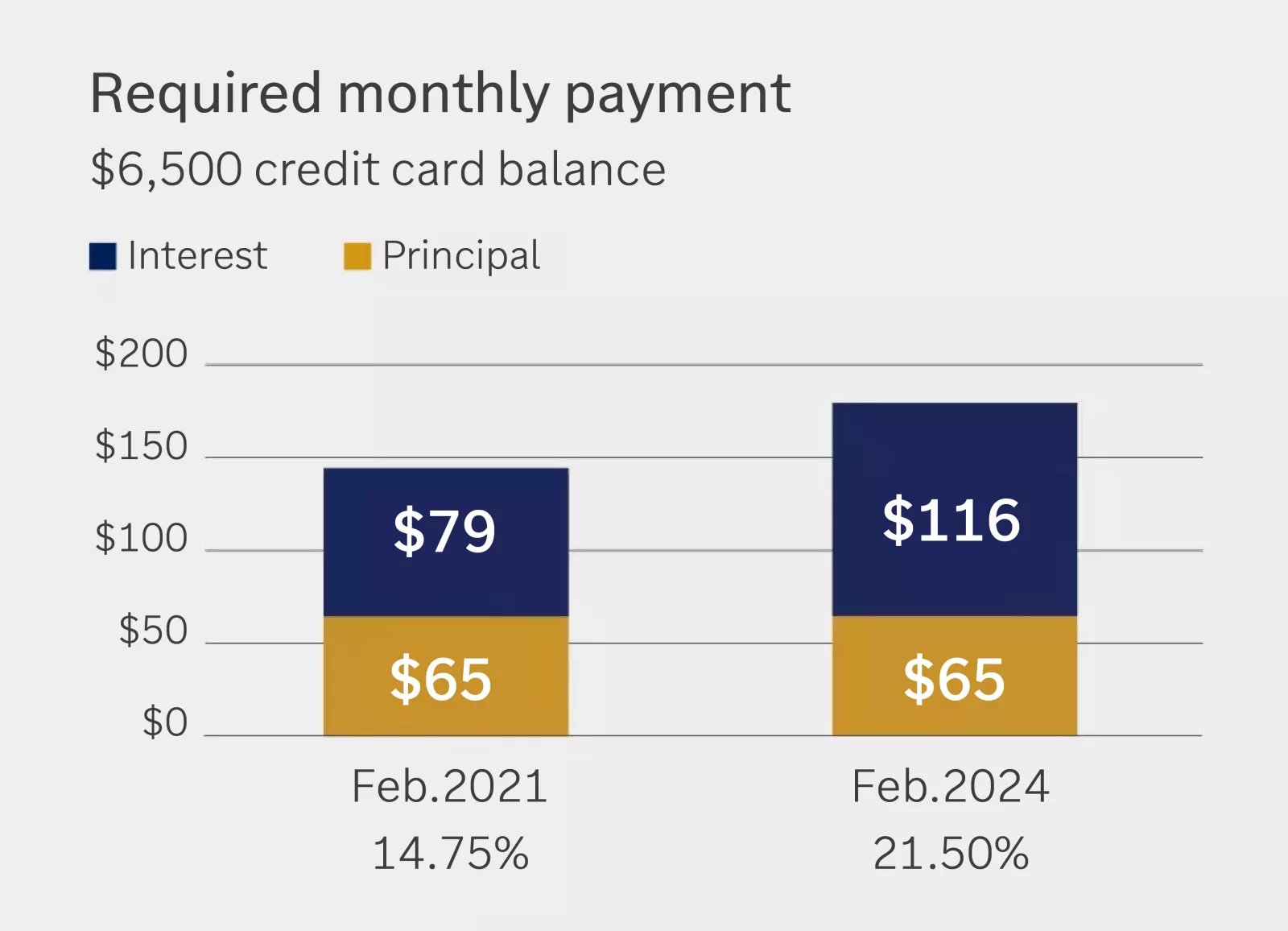

These higher rates can create a strain on your budget, especially if you have a variable-rate loan. For example, let’s calculate the interest on a $6,500 credit card balance. The graph below shows a hypothetical increase to the required monthly payment on that balance from February 2021 to February 2024.5,6

Steps to tackling your debt

The good news is there are ways to manage debt. This can put you in control and may even reduce the interest cost you pay over the long term. Here’s how to start.

- Add it all up. Make note of the type of debt (credit card, student loan, auto payment, etc.), the total amount owed, the minimum payment and the interest rate being charged.

- Check your credit report. Credit reporting bureaus must provide your credit report for free annually, and mistakes are incredibly common. Make sure everything is accurate. Negative errors can mean paying more for your debt. Visit annualcreditreport.com for more information.

- Consolidate debt. The idea of debt consolidation is fewer payments with balances being charged lower interest rates. While there are many ways to do this, be aware of any fees that may be charged, as well as the potential impact to your credit score if a creditor is doing a hard inquiry, to help ensure you’re ultimately benefiting from the consolidation. Also keep in mind, many predatory companies take advantage of people struggling with debt. Be sure you’re working with reputable professionals.

- Make a plan to pay it down. Determine how much money you have available to reduce debt, and then make a plan for paying it down.

When to pay it down — and when not to

While it may sound intuitive, every dollar you use to pay down debt is a dollar you’re not able to save or spend elsewhere. This means it’s important to know when and how to efficiently pay down debt.

When balancing multiple financial goals, making extra payments toward debt may not always be the best choice. Follow these tips to start paying down your debt:

- Always make minimum payments. Nearly every loan requires a recurring minimum payment. It’s important to make these payments as scheduled, or you may incur costly penalties and fees. It could also result in a lower credit score, which could further increase your cost of borrowing. This can make it difficult to make progress toward paying off your debt.

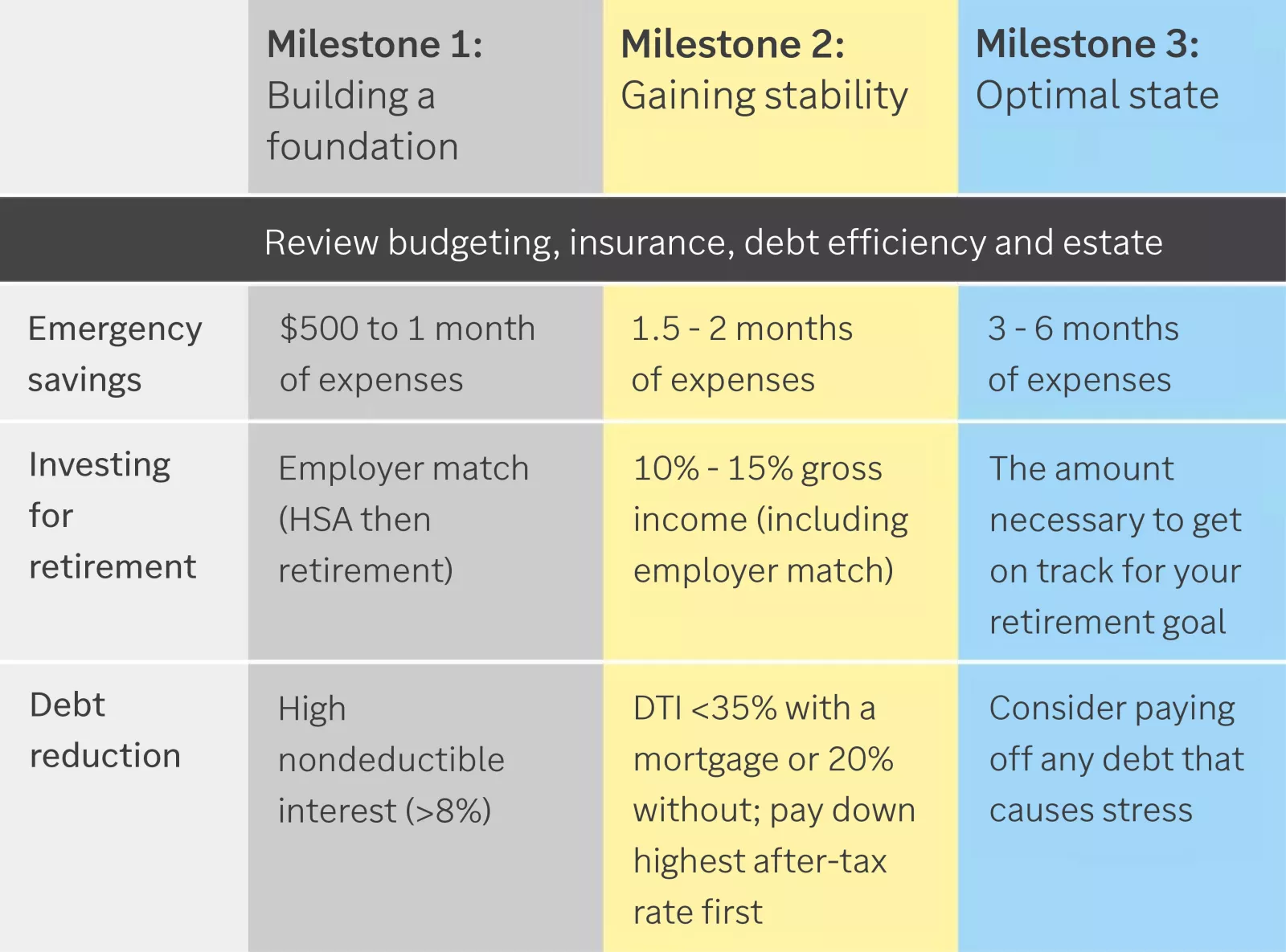

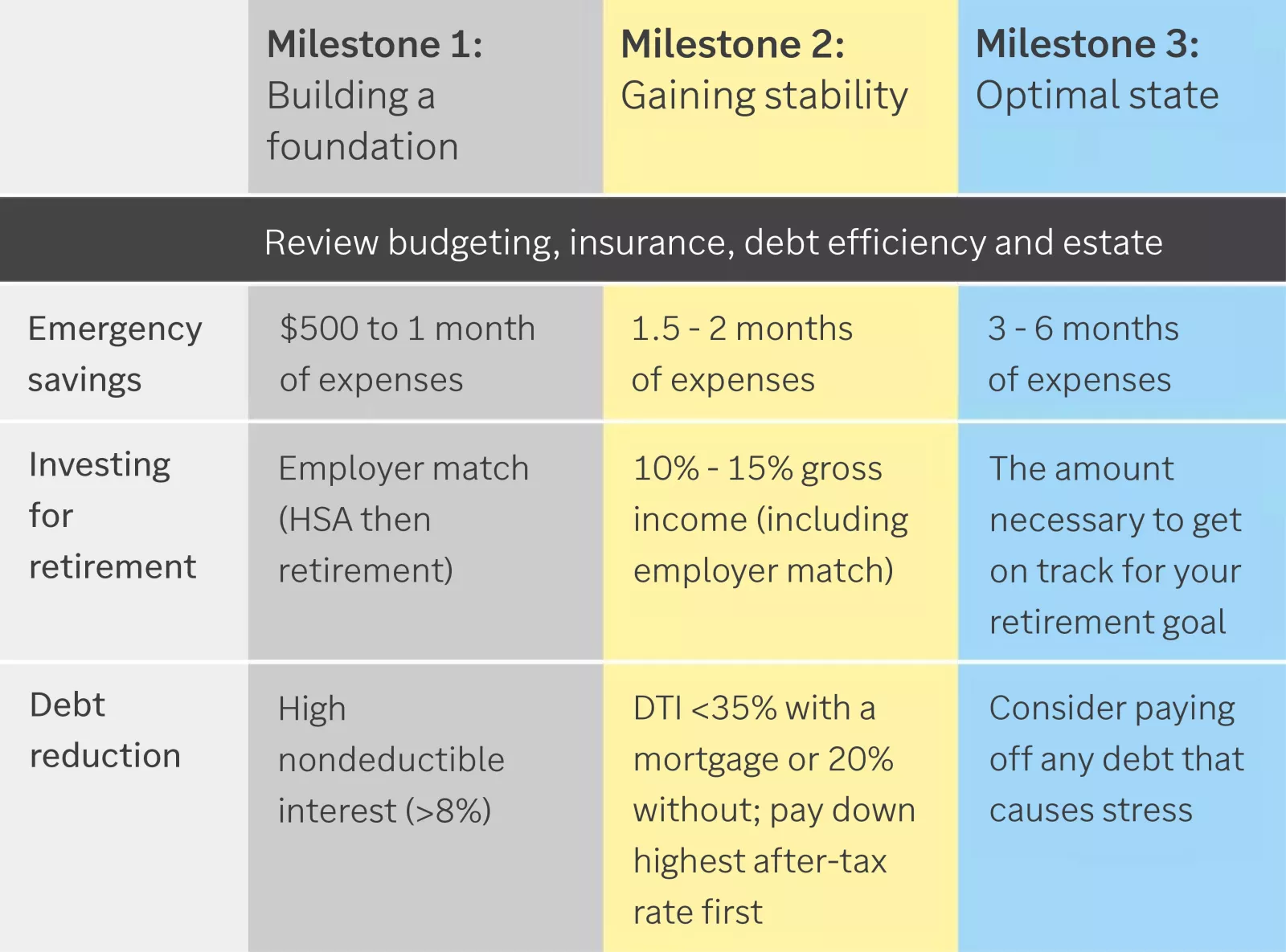

- Start an emergency fund. Aim for at least $500 to one month’s worth of expenses in an account dedicated for unexpected expenses before making extra payment on debt. This amount has been shown to help people better weather an unexpected expense or income disruption. Without an emergency fund, these unexpected events may require you to take on additional debt, making it more difficult to pay off.

- Get your employer match. Many employer-based retirement plans and health savings accounts (HSAs) offer an employer match to your account when you contribute a certain amount of money. This match is typically available on an annual basis, and if you don’t take advantage each year, you can’t recoup it. In other words, you may be leaving money on the table.

- Pay down higher interest rate loans. If you still have extra money, pay down any debt with an interest rate of greater than 8%. Paying down loans with the highest interest rates first will typically have the best financial impact, but it may be motivating to pay off loans with lower balances. Choose the method that works for you.

The chart below shows how we recommend paying down debt when you also need to build your emergency fund and save for retirement. Use the milestones on your journey to pay down debt and build stability and flexibility in your financial life.

What about student loans?

If you have student loans, you may have more options and flexibility in paying them down. Check out these student loan repayment strategies to learn more.

Your financial advisor can help

While paying down debt can seem like a big task, your financial advisor can help you come up with a strategy to tackle it. They understand the trade-offs of balancing multiple goals and can help you work through them to create a strategy that works best for you.

Important information:

1 For a mortgage taken out in the month identified. Source: St. Louis Fed, “30-Year Fixed Rate Mortgage Average in the United States.” Rounded to the nearest quarter of a percent.

2 For an auto loan taken out in the month identified. Source: St. Louis Fed, “Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 72 Month Loan.” Rounded to the nearest quarter of a percent.

3 Federal Unsubsidized Undergraduate Loan taken out in the month identified. Source for February 2021: StudentAid.gov, "Previous Years' Interest Rates.” Source for February 2024: StudentAid.gov, "Interest Rates and Fees for Federal Student Loans.”

4 St. Louis Fed, “Commercial Bank Interest Rate on Credit Card Plans.” Rounded to the nearest quarter of a percent.

5 Minimum payment based on standard minimum payment formula (the greater of $25 and 1% of balance, plus interest). Interest rate based on national average as of the time of writing (21.5%).

6 Minimum payment assumes 1% of the balance is due per month. Source: Edward Jones.