Financial goals:

- Buying a home is the top long-term financial goal for Millennials, with many actively planning or saving for it.

- Investing for the future is important, including interest in building wealth, retirement savings, and owning assets like real estate.

- They are also focused on financial independence, aiming to live comfortably without financial stress or reliance on others.

- Some also aspire to travel, start a business, or build generational wealth for their families.

Financial concerns:

- High debt burdens, particularly student loans and credit card debt, are a major stressor.

- Many feel they’re behind on savings, especially for retirement and emergencies.

- They express distrust in financial institutions and skepticism about financial advisors.

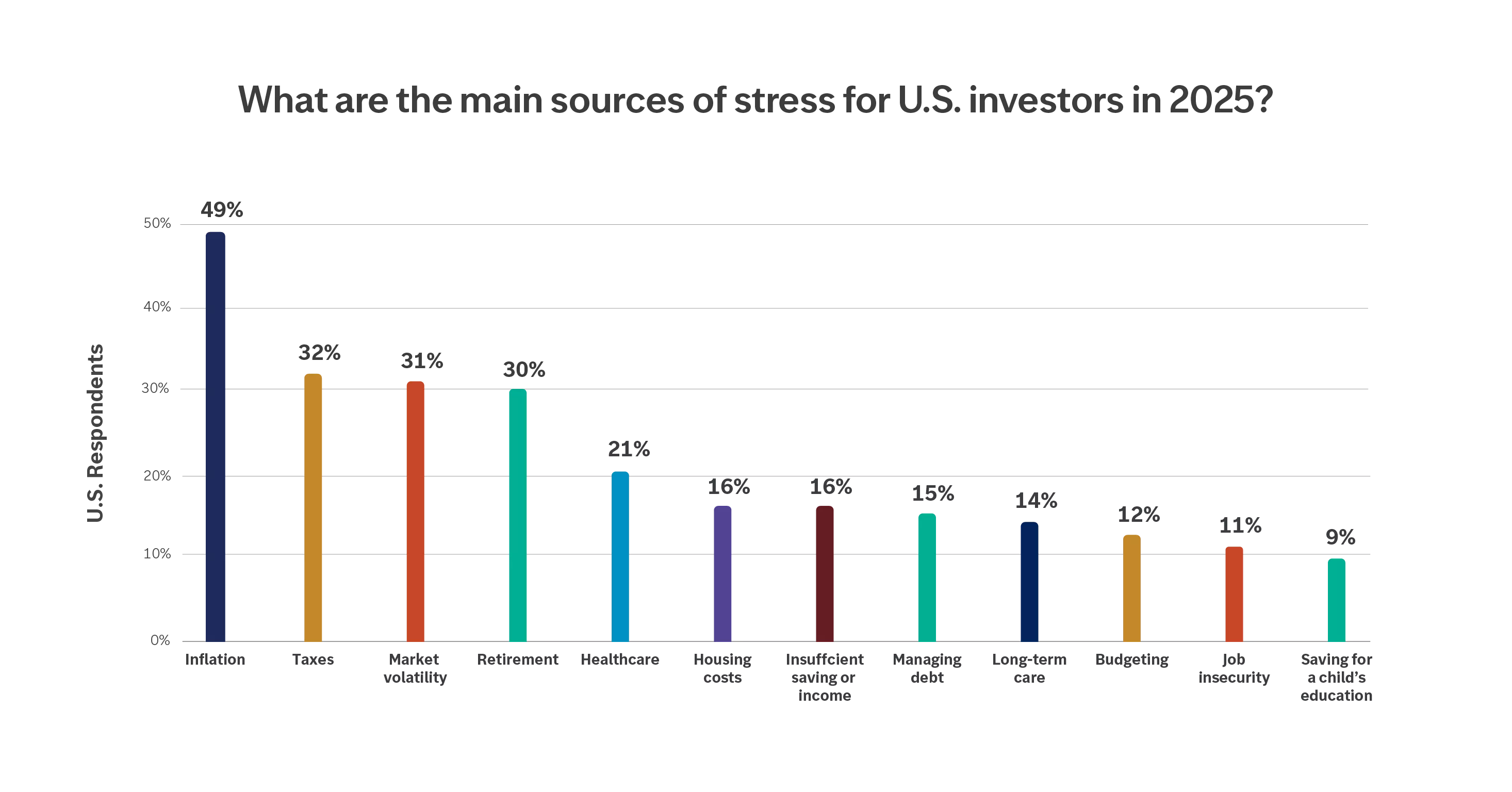

- There is concern about economic instability, including inflation and the rising cost of living.

- Some are overwhelmed by the complexity of financial products and decision-making, wanting simple, transparent guidance.

Financial goals:

- Retirement Planning is the dominant long-term goal. Gen Xers are focused on maximizing contributions to 401(k)s, IRAs, and other retirement accounts, often while they’re in their peak earning years.

- Many aim to create multiple income streams for retirement (e.g., rental properties, dividends).

- They also value minimizing taxes through smart planning and timing of income and investments.

- Some plan to downsize or relocate to manage retirement expenses more effectively.

- Estate planning and the desire to leave a financial legacy for their children are also priorities.

Financial concerns:

- Job insecurity and unemployment are top concerns, especially with rising costs and uncertain economic conditions.

- Many worry about inflation, housing affordability, and market volatility, all of which could derail their retirement timelines.

- Caring for aging parents is a growing financial and emotional burden, often forcing Gen Xers to put their own goals on hold.

- There is a shared fear of unexpected expenses (medical emergencies, home repairs) disrupting their financial plans.

- Some feel they are “behind” financially and are concerned they may not be able to retire comfortably.

- Political and economic instability (tax changes, national debt, healthcare costs) adds to their long-term uncertainty.

Financial goals:

- Preparing for retirement is a top priority—many are focused on maintaining their lifestyle while managing expenses like healthcare and housing.

- They aim to eliminate debt before or shortly after retiring, including mortgages, credit cards, and remaining education costs for their children.

- Supporting adult children financially (e.g., helping with education, housing) is a major goal, both during their lives and through inheritance.

- Boomers are focused on enjoying retirement, with plans for travel, leisure activities, and spending more time with family.

- Estate planning and wealth transfer are key priorities—they want to ensure a smooth, meaningful transfer of assets and values to the next generation.

Financial concerns:

- Rising healthcare costs and the potential need for long-term care are significant sources of anxiety.

- Many fear outliving their savings, especially with people living longer than previous generations anticipated.

- There’s concern about being unable to enjoy retirement due to economic uncertainty, inflation, or unexpected financial burdens.

- Helping children financially—while important—can strain their own resources, especially if done without careful planning.

- Family conflict over inheritance is a worry for many, particularly when estate plans aren’t clearly communicated.

- Some Boomers are uneasy about their children’s ability to responsibly manage inherited wealth.