What can I do now to save for retirement?

There are lots of things in life you can't control, but your savings for the future doesn't have to be one of them. At Edward Jones, we partner with you to understand why you're saving and can then help you determine what you can do today to get there.

So what can you do today to make a difference down the road? When it comes to saving for retirement, we think there are three main things to think about.

You control time and money. And while you may think you have little control over the return, you actually control more than you think. You control the "how," or how you have your money invested. That's because how much you have in cash or fixed income versus growth investments can greatly affect your return potential. Use our investment calculator to see the impact a few changes to your savings plan can make.

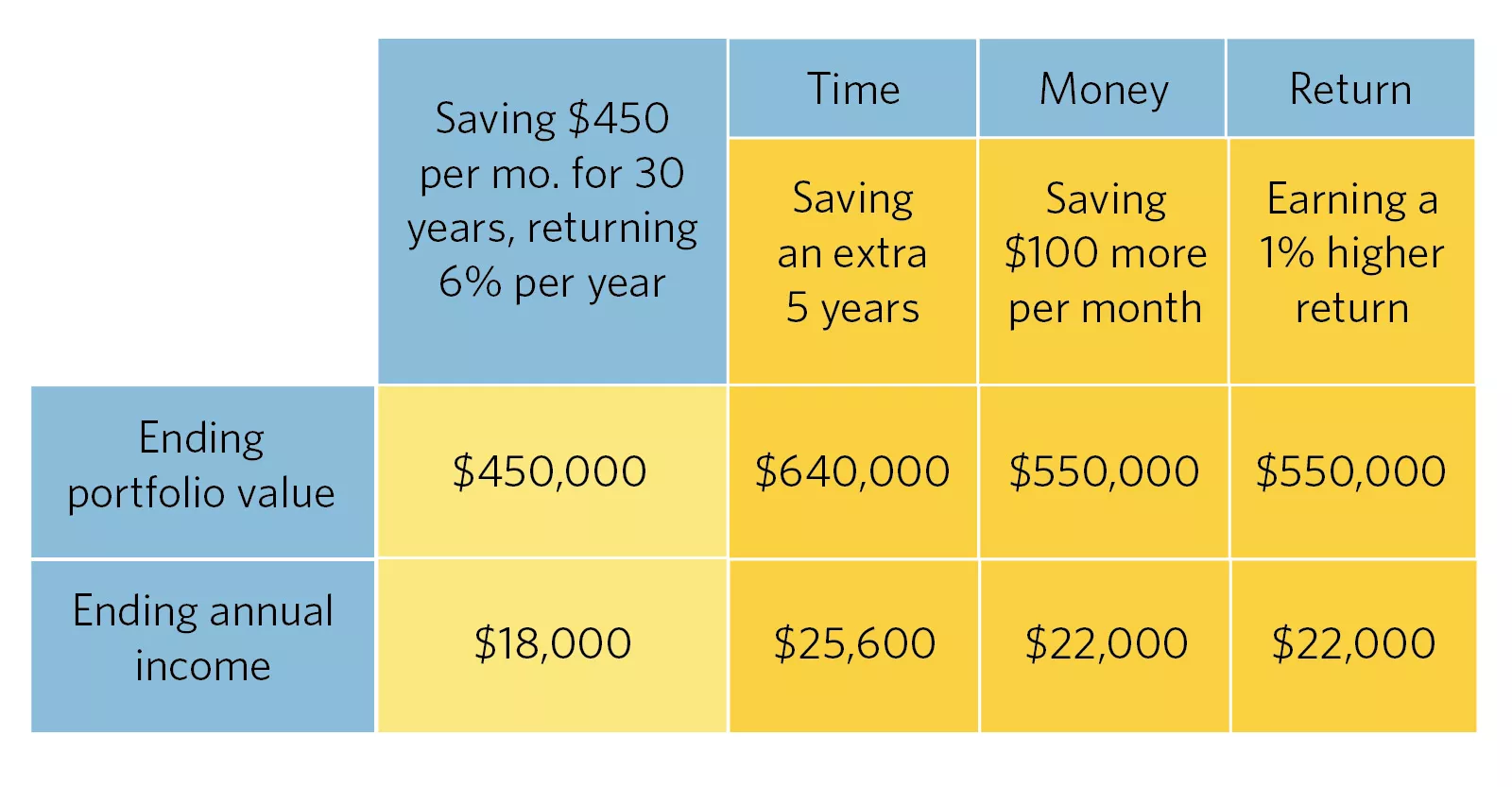

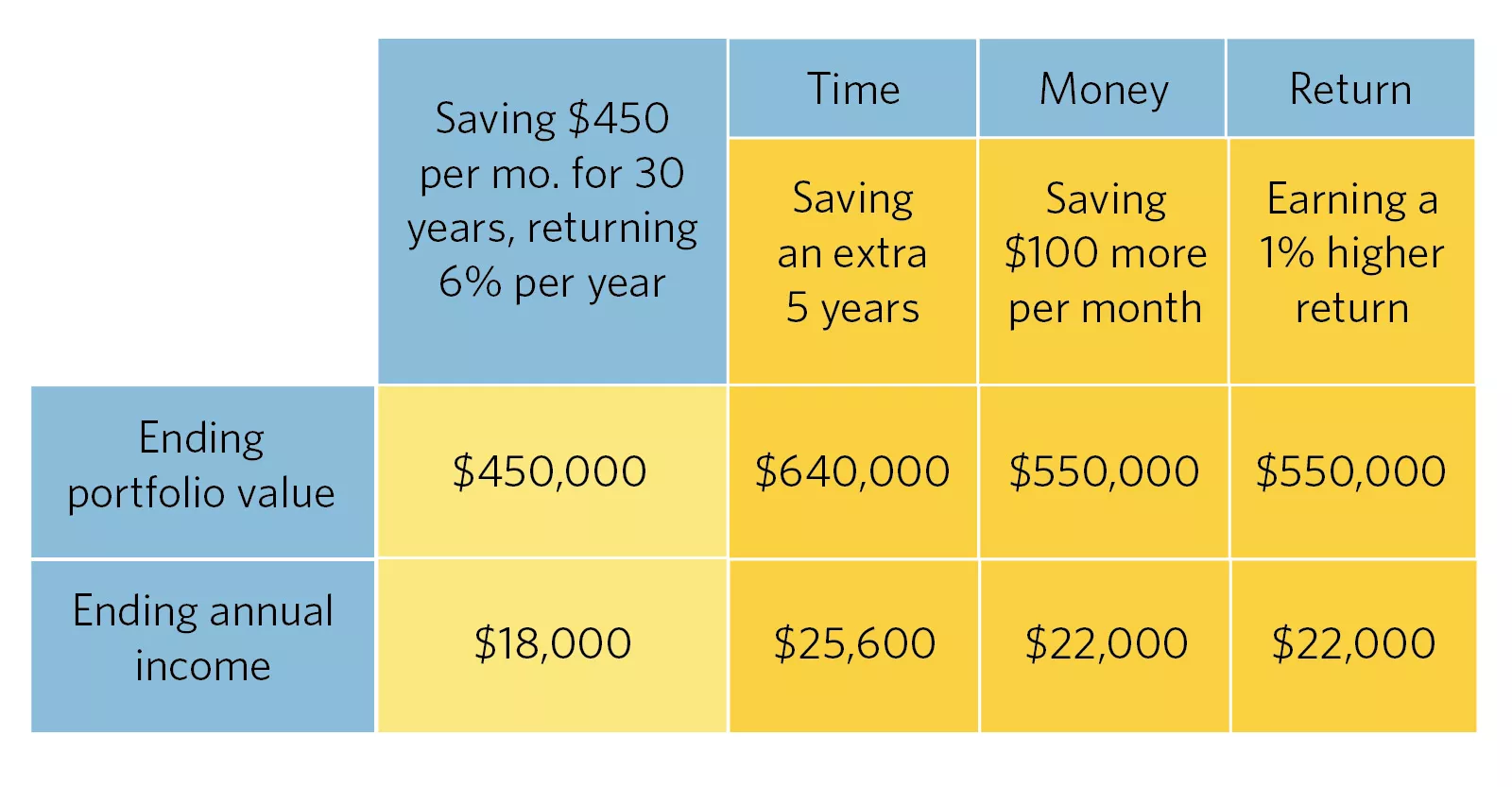

The table below shows how small changes in each (or in all three) of these can help you better meet your goals.

Source: Edward Jones. This hypothetical example is for illustrative purposes only and does not reflect the performance of a specific investment. Income based on a 4% initial withdrawal rate. Portfolio value rounded to the nearest $5,000.

This chart demonstrates the power of saving money over time. The example starts with a portfolio valued at $450,000, which is the result of saving $450 per month for 30 years, returning 6% per year. When you save an extra five years, the portfolio value increases to $640,000; save $100 more per month or earn a 1% higher return and that same portfolio increases to $550,000.

One simple way to incorporate investing into everyday life is through systematic investing. For example, by automatically investing a set amount of money each month into an individual retirement account at Edward Jones, you can help make sure you're putting as much money away as you can. This may help you reach retirement even sooner.

If you want to see how some of these changes can impact the big picture and better position you to reach your goals, just ask your Edward Jones financial advisor. You can review different scenarios together to see what makes the most sense for you. Even small changes, such as saving a bit more, can be beneficial over the long term.