Building tax-free assets today to help manage taxes in retirement

As you're planning for retirement, it's important to consider not only how much you save, but also the types of accounts you're contributing to. Accounts that provide the potential for tax-free distributions in retirement, like Roth IRAs, Roth 401(k)s and health savings accounts (HSAs), play an important role in your retirement strategy. Because qualified distributions from these accounts are tax-free, they offer the following benefits when it comes to managing your income and taxes in retirement:

Greater certainty of income and taxes

With a Roth IRA or Roth 401(k), you pay taxes when you contribute instead of in retirement. While this means paying more in taxes today, it also means you won't have to worry about setting aside part of your withdrawal for taxes in retirement — you effectively prepay them. And, with HSAs, you don't pay taxes on contributions or distributions for qualified medical expenses, which tend to be a significant expense for retirees. Eliminating some unknowns in retirement may make it easier to plan for your income needs and give you greater comfort with your strategy.

Enhanced flexibility in managing your income and tax liability

Unlike withdrawals from traditional accounts, qualified distributions from Roth accounts and HSAs don't add to your taxable income in retirement. Strategically tapping these accounts to meet your spending needs in retirement can help lower your overall tax liability and help keep your income below thresholds that push you into a higher tax bracket, increase Medicare premiums or trigger higher taxation of Social Security benefits.

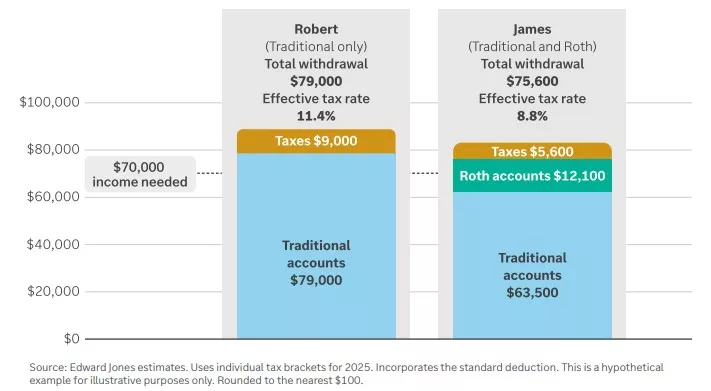

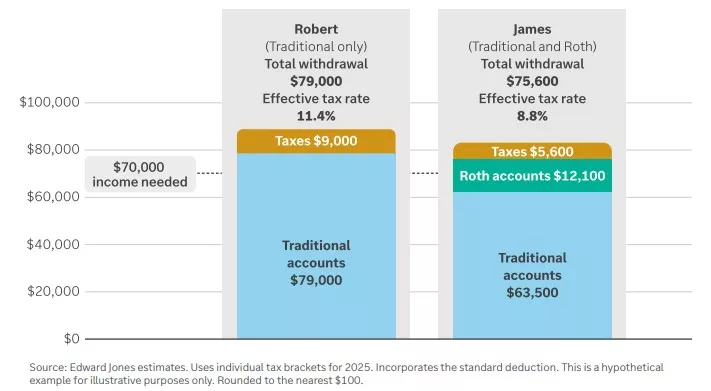

Consider the following example of how Roth accounts can help manage taxes in retirement:

Robert and James are both retired and need roughly $70,000 in after-tax income to meet their retirement spending needs each year. Robert has all his money in traditional accounts, while James has assets in both traditional and Roth accounts. Because Robert’s full distribution is taxed, he must withdraw a larger amount and has a higher effective tax rate than James, who can strategically tap his Roth account to help manage his taxes in retirement.

The chart above shows the differences in Robert’s and James' withdrawal strategies and their effective tax rates.

Robert will have to withdraw $79,000 from his traditional accounts to meet his $70,000 spending need and the $9,000 he’ll owe for taxes on the withdrawal. Robert’s effective tax rate is 11.4%.

James withdraws $63,500 from his traditional accounts and $12,100 from his Roth accounts to meet his $70,000 spending need and the $5,600 he’ll owe for taxes on the traditional account withdrawal. James' effective tax rate is 8.8%.

The chart above shows the differences in Robert’s and James' withdrawal strategies and their effective tax rates.

Robert will have to withdraw $79,000 from his traditional accounts to meet his $70,000 spending need and the $9,000 he’ll owe for taxes on the withdrawal. Robert’s effective tax rate is 11.4%.

James withdraws $63,500 from his traditional accounts and $12,100 from his Roth accounts to meet his $70,000 spending need and the $5,600 he’ll owe for taxes on the traditional account withdrawal. James' effective tax rate is 8.8%.

More control over when you take withdrawals

Another advantage of Roth accounts is that they aren't subject to required minimum distributions (RMDs) at a certain age like traditional IRAs and 401ks. This means you can leave the money to grow in the account and make withdrawals only when it makes sense for you. If you pass your Roth account to your heirs, their withdrawals are also generally tax-free. RMDs don't apply to HSAs either, but you'll generally want to use your HSA assets for you and your spouse — they're not favorable for nonspouse heirs. If you don't need the full amount for medical expenses, distributions for nonqualified expenses are taxed as ordinary income (without penalty) starting at age 65.

Alternate strategies for Roth accounts

Making direct contributions is the easiest way to allocate funds to a Roth account. However, there are additional ways to access a Roth account:

1. If your income is too high to make direct contributions to a Roth IRA, consider making a backdoor Roth contribution. This can be done on an annual basis by making a nondeductible contribution to a traditional IRA and then immediately converting it to a Roth IRA. Note, though, that this strategy generally works best when you have few to no pretax assets in any traditional IRA.

2. If you're seeking to contribute more than the annual salary deferral limits to your employer retirement plan, a mega backdoor Roth strategy could be appropriate. This involves making an after-tax contribution to your plan, which is subject to higher contribution limits, and then immediately converting it to a designated Roth account within the plan or rolling it into a Roth IRA. Not all employer plans offer these options; check with your plan administrator to determine whether these features are available in your plan.

3. A Roth conversion is another way to fund a Roth account that involves moving funds from a traditional retirement account to a Roth account. With a Roth conversion, you pay taxes now to convert your funds, but you can gain access to tax-free distributions in the future as well as other benefits Roth accounts offer. Unlike direct, backdoor Roth and mega backdoor Roth contributions, a Roth conversion doesn't increase the amount of assets you have in a tax-advantaged retirement account. Rather, a Roth conversion changes the mix of your existing retirement assets.

Review your retirement savings and tax strategies with trusted advisors

Planning now for your taxes in retirement can help better position you to meet your goals. The sooner you get started, the more flexibility you have to reduce your taxes over time. Your financial advisor can help design an appropriate retirement strategy for you. Since these strategies generally involve taxes, you should also consult a tax professional.

Important information:

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your attorney or qualified tax advisor regarding your situation.

This content is intended as educational only and should not be interpreted as specific recommendations or investment advice. Investors should make decisions based on their unique investment objectives and financial situation.