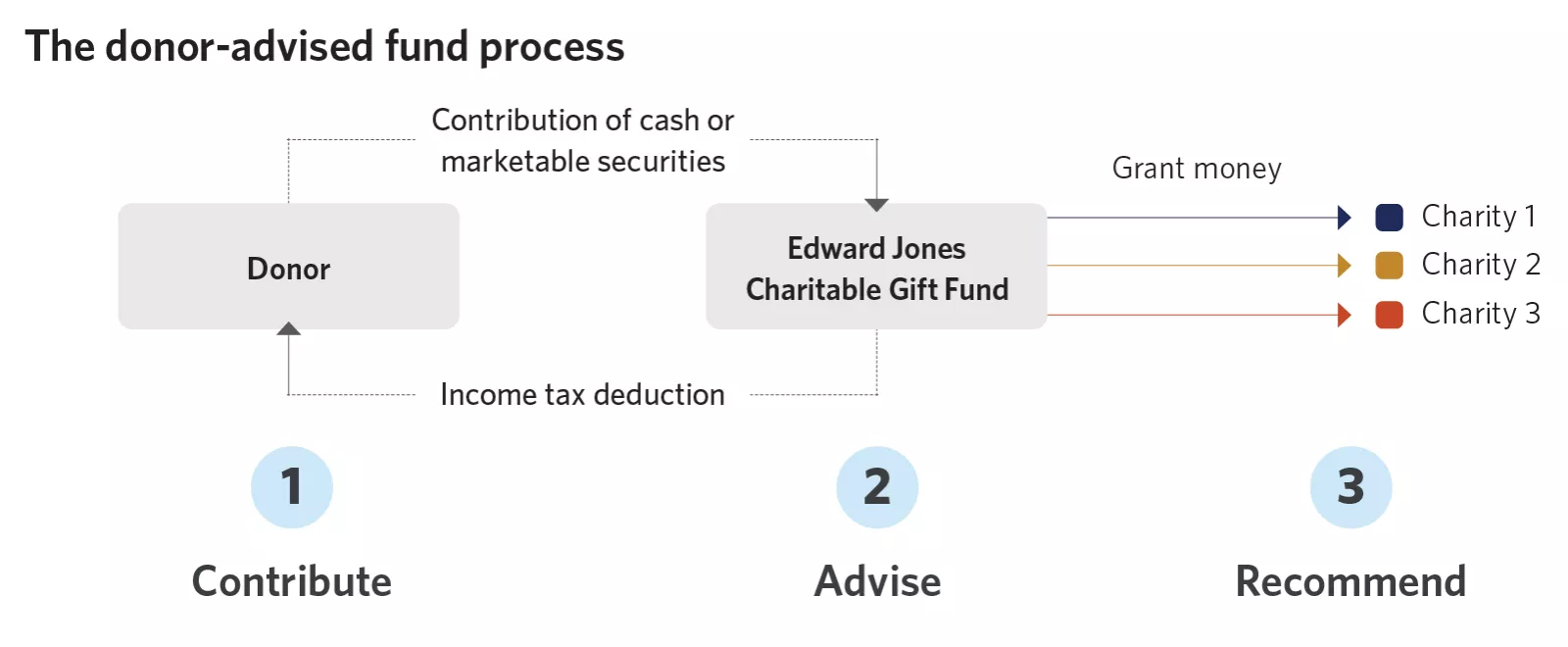

Learn how donor-advised funds like the Edward Jones Charitable Gift Fund can help you support the causes you care about while potentially receiving tax deductions for your contributions.

How does a donor-advised fund work?

A donor-advised fund, or DAF, is a vehicle for charitable giving that lets you make an irrevocable contribution to the fund, for which you receive an immediate tax deduction.

It is operated by a sponsor or sponsoring organization that invests and manages the donated assets.

DAFs have grown in popularity amid heightened interest in charitable giving. A recent report from the Giving USA Foundation reported that charitable giving in the United States reached a record $471 billion in 2020.

Donor-advised fund tax benefits

The main advantages of DAFs are that they offer a simple and convenient way to maximize charitable giving while receiving an upfront tax deduction.

Several other potential DAF tax-related benefits are worth noting:

- Front-loading your giving: If you plan to make consistent charitable contributions, you can use a DAF to “front-load” your charitable gifts by making the equivalent of multiple annual gifts in one year. This means you may be able to itemize your deductions and realize a larger deduction in the current tax year, and you can request a grant be made to the charities you support over subsequent years. Remember: You’ll receive the tax deduction in the year you contribute to the fund, not when the money is granted to the charity.

This strategy may be beneficial if you have had an unusually high-income year when your marginal tax rate is also typically higher, so the benefits from charitable giving in those years would be greater than in subsequent, lower-income years. Similarly, you may want to consider giving now if you expect your taxable income to be lower in the future.

- Lowering capital gains: If you own investments that have significantly increased in value, contributing them to a charity or DAF allows you to avoid paying taxes on the capital gains. This means the charity receives more of the proceeds than if you were to sell the security and gift the after-tax proceeds. You can also take an income tax deduction for donations of securities.

Giving $100,000 of stock to charity with $90,000 of long-term capital gains.

This is an example of the difference between giving a stock to a DAF versus selling it for cash and how each affects capital gains tax and/or amount given to charity.

| | If you give the stock to a DAF | If you sell the stock for cash |

|---|

| Capital gains tax1 | $0 | $18,000 |

| Amount given to charity | $100,000 | $82,000 |

1 Assumes 20% capital gains tax rate and no fluctuation in value.

- Cutting estate taxes: Assets you contribute to a DAF are not included in your estate, so they don’t count toward your total estate value. Investing in DAFs can therefore reduce the size of your taxable estate.

- Helping with your taxes: Using a DAF may improve your recordkeeping for tax reporting purposes. Donating first to the fund and then granting to multiple charities allows for a single donation receipt. And as part of their services, the third-party administrators responsible for the day-to-day operations of a DAF will ensure the charities you support are approved by the IRS before fulfilling your grant request, making certain your donations are eligible for an income tax deduction.

A DAF has several other advantages beyond the potential tax benefits listed above:

- A DAF allows your contributions to be invested, providing an opportunity for the money you put toward your charitable gifts to grow over time, tax-free.

- These funds allow for joint or supervised charitable giving, which means you can pass along your values to your loved ones by sharing with them the principles of charitable giving. And naming your children or other people as successor advisers lets them continue making charitable gifts in your name after your death.

- A DAF can be a beneficiary of your will, trust, annuity, insurance contract, retirement plan or investment account.

- While family foundations offer more control over investment options, administration and granting, DAFs can offer many of the same benefits at a lower cost to set up and maintain.

- Some people may wish to maintain a close relationship with each charity they support, while others may find the resulting volume of solicitations undesirable. With a DAF, you can remain anonymous to the charities you support.

- A DAF lets you honor a loved one’s legacy in two ways: You can designate a grant to be made in memory of your loved one, or a new DAF can be set up in their memory for friends and family to make contributions.

What is the Edward Jones Charitable Gift Fund?

The Edward Jones Charitable Gift Fund is a donor-advised fund offered by Edward Jones in conjunction with the Renaissance Charitable Foundation Inc. (Foundation), which manages and administers the Edward Jones Charitable Gift Fund. Edward Jones Charitable Gift Fund offers donors the opportunity to make tax deductible, irrevocable charitable contributions to an individual DAF while retaining certain advisory privileges over the charitable purposes for which those contributions are ultimately used.

How much do I need to participate in the Edward Jones Charitable Gift Fund?

The minimum initial contribution to the Edward Jones Charitable Gift Fund is $10,000. As a donor, when you contribute cash or securities to a DAF, you’ll receive an immediate tax deduction. Any growth to the assets you contribute is tax-free.

Donors can contribute to the fund as often as they like and request that distributions be made to IRS-approved public charities of their choosing.

The Edward Jones Charitable Gift Fund invests in actively managed mutual funds, passively managed ETFs and open−end index mutual funds from most major asset classes. Mutual funds and ETFs may also invest in additional asset classes, such as real estate investment trusts (REITs), natural resources, and emerging markets. The investments are managed according to the portfolio objectives you set with your financial advisor.

What should I consider when using donor-advised funds?

As outlined above, DAFs have several key benefits, but there are important trade-offs to consider, too:

- Contributions are irrevocable (once you contribute to the fund, you cannot access that money for anything other than charitable giving). Grants can only be made to IRS-approved charities.

- There are potential risks associated with the investments in the fund. Edward Jones Charitable Gift Fund offers seven professionally managed portfolios ranging from conservative to more aggressive. You can invest in up to two of these portfolios to align to the expect time horizon and risk tolerance of your granting. Every portfolio will carry some risk of loss.

- While a DAF can be cost-effective and offers streamlined administration, using one restricts the range of investments available to you. Other giving strategies may offer greater control. See the chart below for a comparison of various giving strategies.

- While a DAF is a low-cost alternative to a private foundation, it still has investment management and other fees associated with it.

Understanding Donor Advised Funds versus private foundations

When choosing between a foundation and a donor advised fund, a few of the main considerations are administrative burden, cost, flexibility, and annual tax deduction limits.

| | Foundation | DAF |

|---|

| Primary benefit | High level of control and flexibility | Current year income tax deduction

with ability to grant over time |

| Suggested minimum donation amount2 | $1,000,000 | $ 10,000 3 |

| Estimated set up cost4 | $10,000+ | None |

| Ongoing cost (as percent of assets) | 7%5 | 1%-1.5% |

| Excise tax | 1.39% of net investment income | 0% |

| Required distributions | 5% of net asset value annually | None |

| Tax deduction limits | 30% of adjusted gross income for cash; 20% for long-term, appreciated securities | 60% of adjusted gross income for cash; 30% for long-term, appreciate securities |

Ongoing flexibility and control of: investments, granting, changing beneficiaries | High | Medium |

Ongoing administrative burden – including tax filing, audits, and compliance | High | Low |

| Option to support charities anonymously | No | Yes |

2) The suggested amount is a good starting point for comparing giving options, but individual circumstances may require more or less than this amount.

3) Represents Edward Jones minimum. Other firms may have different minimums.

4) Estimated set up costs are for comparative purposes. Actual costs will vary based the size and complexity of charitable giving vehicle being established

5) Represents the median expense ratio of the largest 10,000 Foundations - Boris, E.T., Renz L., Barve A., Hager M., & Hobor G. (2006). Foundation Expenses & Compensation: How Operating Characteristics Influence Spending. Urban Institute, Foundation Center, & GuideStar

Comparing donor-advised funds with other ways to give

This table explains how to contribute to a DAF along with other details about each option.

| | Edward Jones Charitable Gift Fund | Cash | Charitable lead or remainder trust | Private foundation |

|---|

| Types of organizations you can support | IRS-approved public charities | Public charities, private foundations and individuals (not all are eligible for an income tax deduction) | IRS-approved public charities and some foundations | As long as the grant is made for charitable purposes, many different organizations and individuals |

| Setup cost, maintenance and time to establish | Lower | Lower | Higher | Higher |

| Potential to grow the assets | Yes | No | Yes | Yes |

| Investment options | One of seven professionally managed portfolios | N/A | A broader set of investment options | A broader set of investment options |

| Income tax deduction limit as a percentage of AGI | 60% for cash, 30% for appreciated securities | 100%* | Depends on the type of charity and trust | 30% for cash, 20% for appreciated securities |

| Tax on investment income | 0% | N/A | Depends on the nature of the trust | 1.39% of net investment income |

| Ability to donate to the charity anonymously | Yes | No | Yes | No |

*The CARES Act increased this amount from 60% to 100% through 2021. In 2022, the limit you can deduct in any calendar year will revert to 60% with a five-year carry forward. These limits may be changed by law or regulation.

Additional considerations and rules:

- The minimum grant size is $250. A DAF may not be suitable if you wish to give smaller amounts.

- There is a delay when you request a grant and when it is given to a charity. Grants generally cannot be used for specific fundraising events.

- Large gifts may reduce your tax bracket to a point where it may be more advantageous to split them between multiple years. Work with your tax professional on potential multiyear tax planning.

- As with any strategy involving taxes, there is a potential for laws and tax rates to change, making the strategy less effective than expected.

How can I invest in a donor-advised fund?

The Edward Jones DAF is called the Edward Jones Charitable Gift Fund (PDF). Investing in DAFs typically follows the three-step progression summarized below: