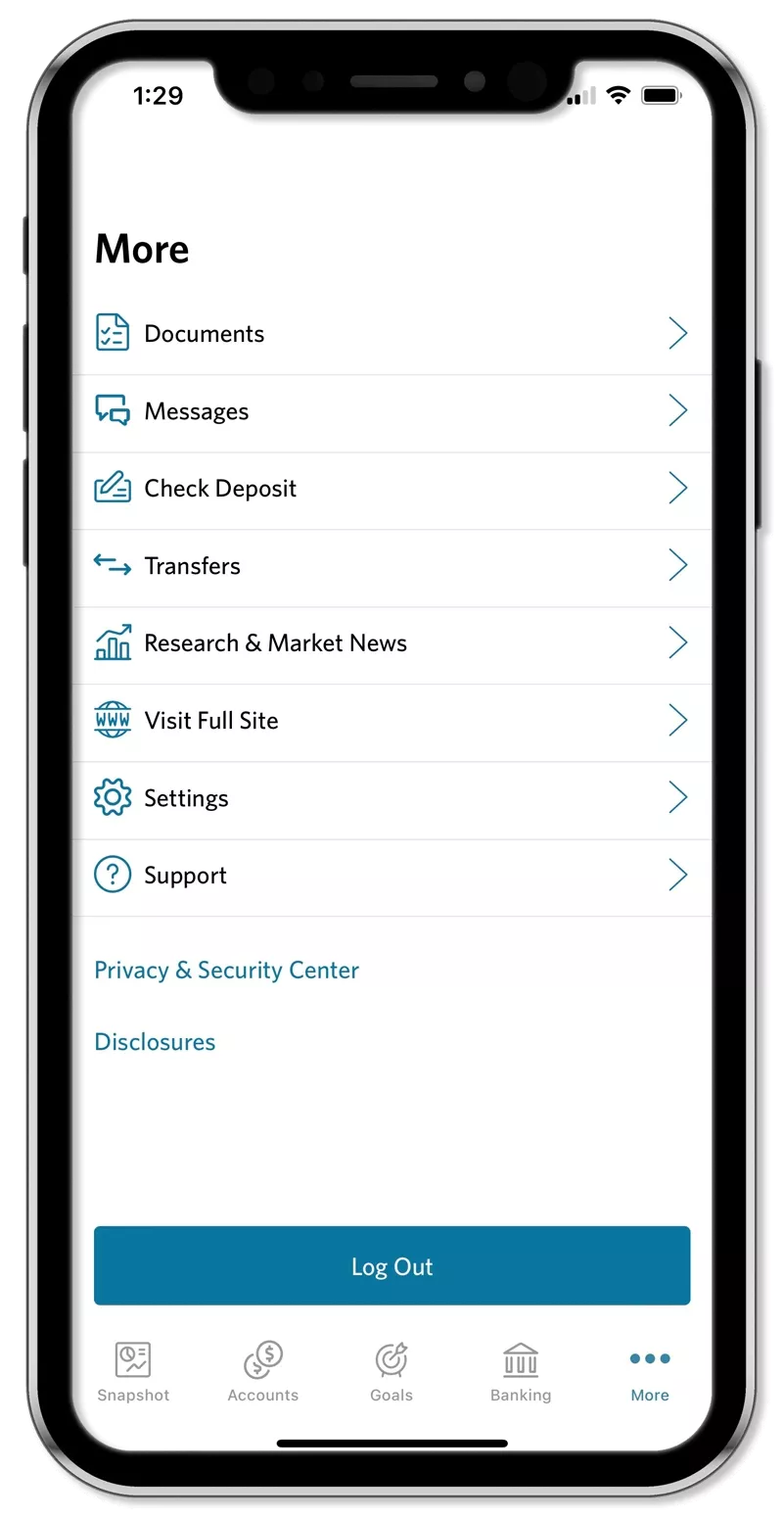

Only Edward Jones clients who have Online Access and have eligible accounts can use mobile check deposit.

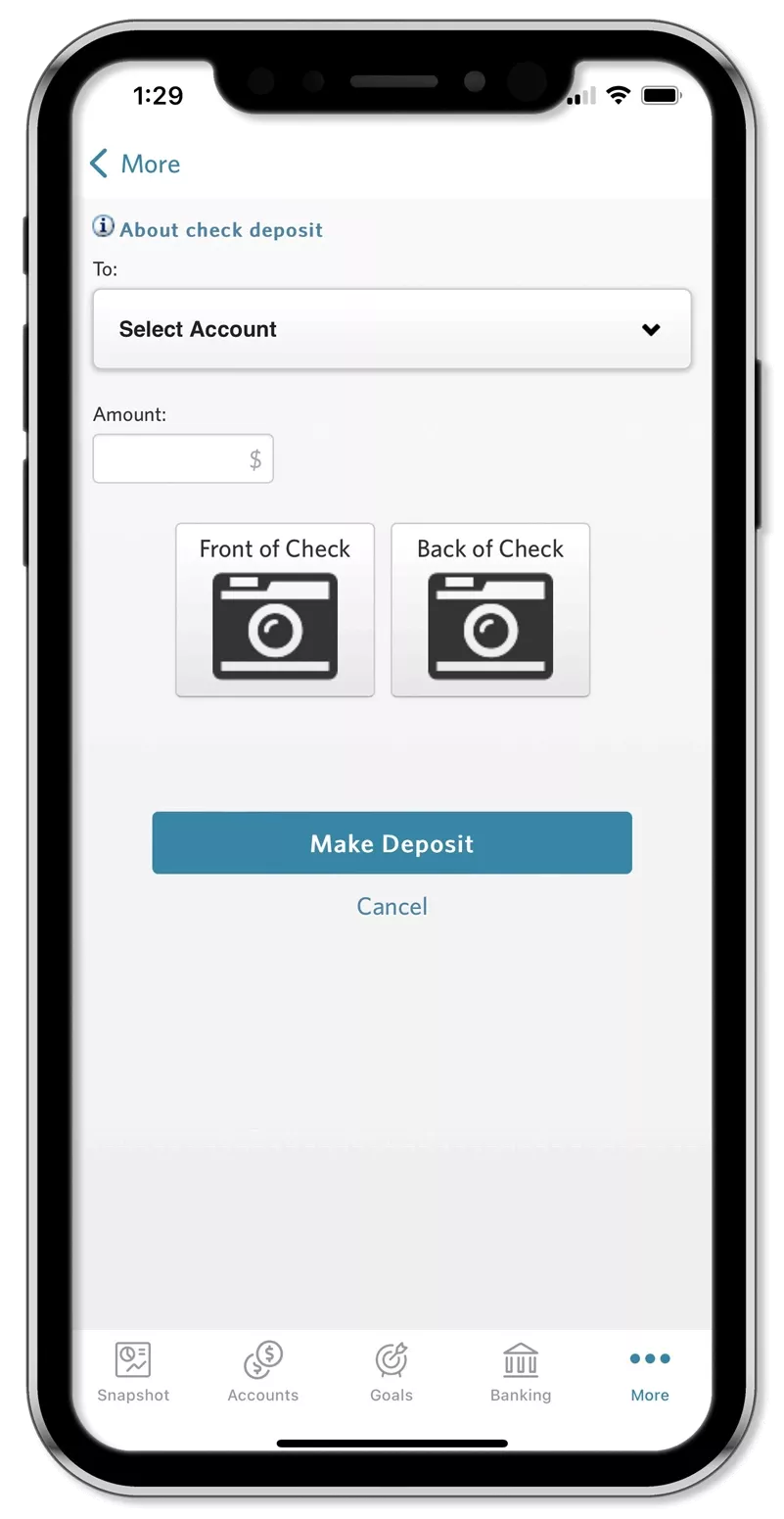

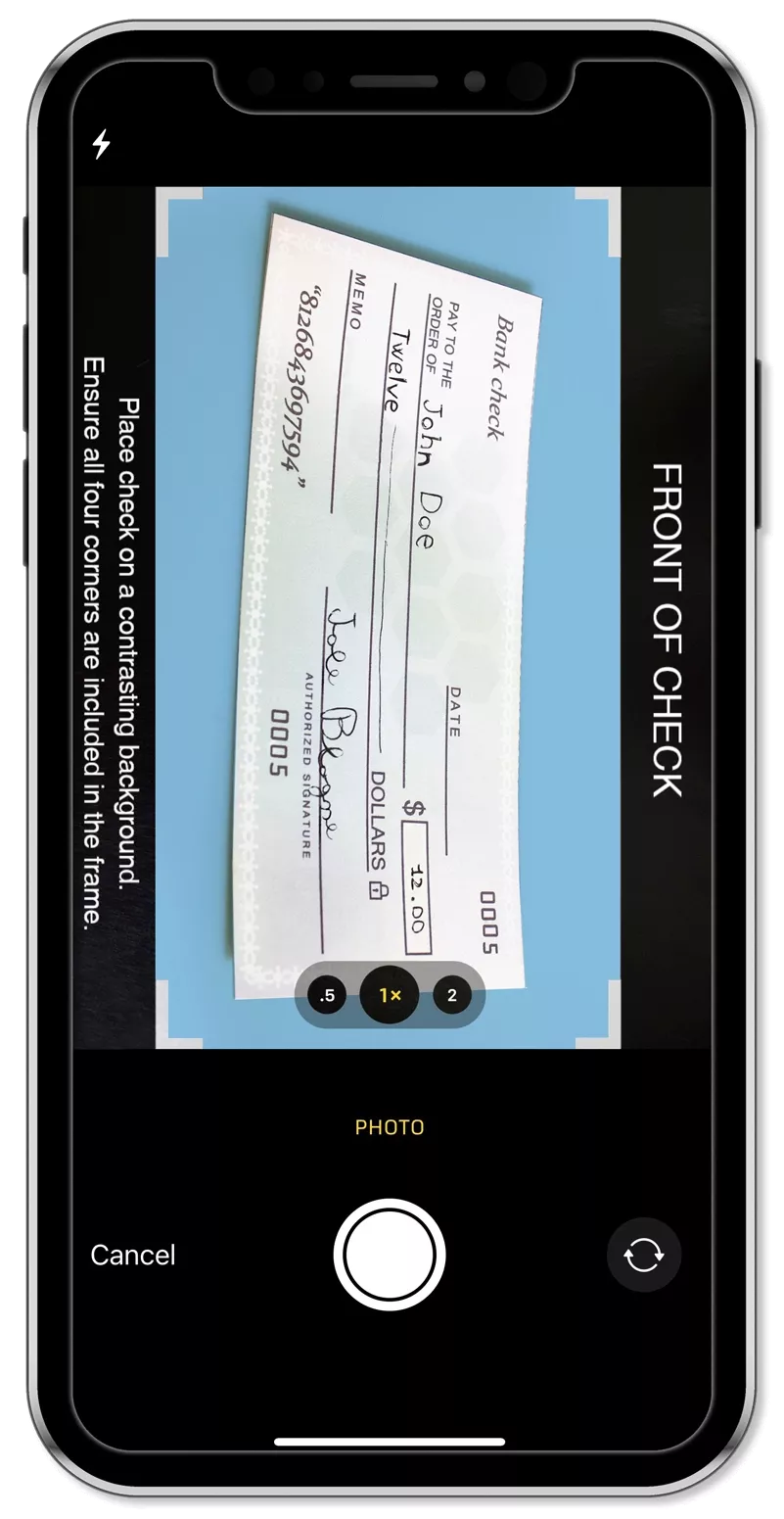

Mobile check deposit can only be used with the Edward Jones app available in the App Store and Google Play Your device must have a working camera to take an image of the check.

No. Only clients with iPhone or Android devices can use this service.

There is no cost to use mobile check deposit.

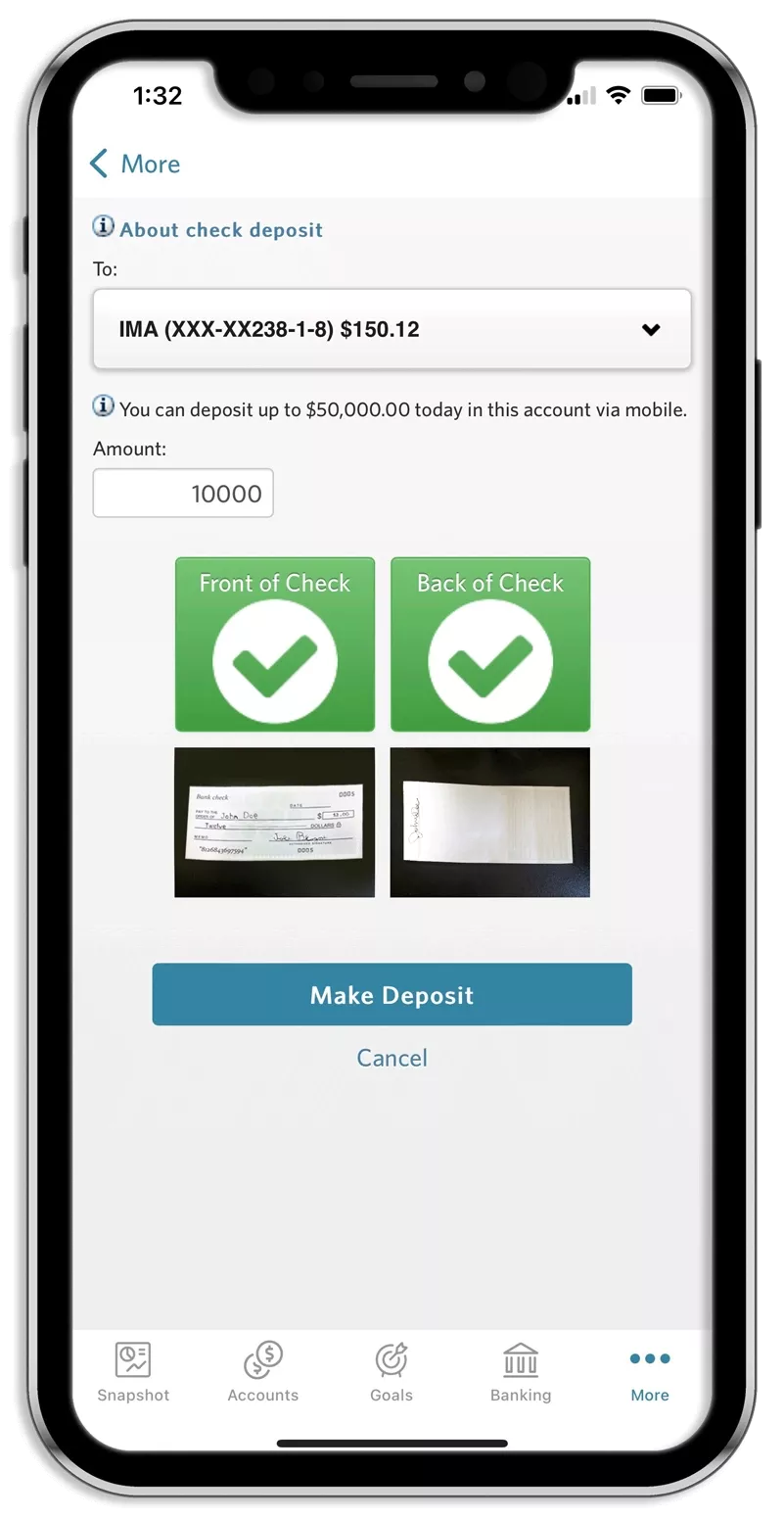

Once your deposit is processed, the amount will be reflected in your activity and you will receive a confirmation by email. If your check is submitted during normal business hours, this usually happens within one business day. Funds are generally available for withdrawal after three business days. There is a 10-business-day hold on checks deposited in accounts open 30 days or fewer. Deposits are subject to daily and monthly limits.

No. There is not a limit on the number of checks that can be deposited, but there are limits on the amounts that can be deposited.

Yes. Clients who have been investing with Edward Jones for less than six months may deposit up to $10,000 per day and up to $20,000 per month. Clients who have been investing with Edward Jones for more than six months may deposit up to $50,000 per day and $100,000 per month. Deposits for additional checks can be made at your Edward Jones office.

You may use mobile check deposit for most account types. You will be notified that you are unable to proceed if you do not have any eligible accounts.

Yes. Checks can be deposited to pay a fee or contribute to your retirement account. Currently, we do not accept rollover or transfer checks.

Yes, if the account is eligible to have funds deposited via mobile check deposit. There is a 10-business-day hold on checks deposited in accounts open 30 days or fewer.

Yes. Deposits can cover service fees for retirement accounts.

Except for rollover and transfer checks, most check types are accepted.

Edward Jones cannot accept checks that were originally written to someone else and then endorsed as payable to you. We also cannot accept rollover and transfer checks.

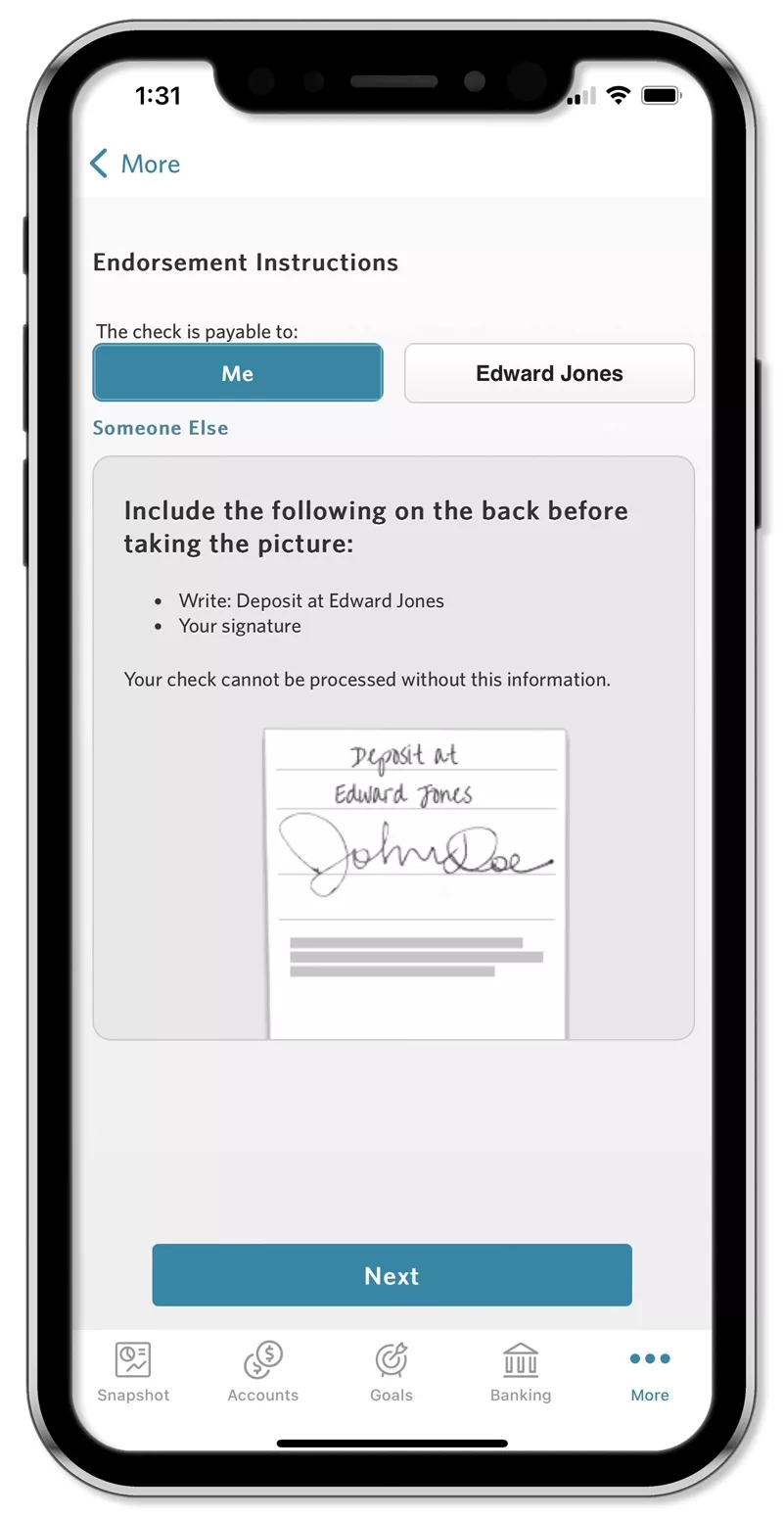

If the check is payable to you, then you must write "Deposit at Edward Jones" and endorse with your signature on the back of the check.

If the check is payable to Edward Jones, no endorsement is necessary.

We recommend that you write "Mobile deposit" on the check and retain it for five business days. Once you have verified the check has successfully processed, you can securely dispose of the check.

If the amount does not show in your history, the check was likely rejected. Contact your Edward Jones team to find out why.

Here are the most common reasons a deposit has been rejected:

- Not endorsed with a signature and "Deposit at Edward Jones"

- Written to someone other than the authorized account owner and then endorsed as payable to you

- Postdated or has a date that is more than six months old

If you didn't endorse the check, you can do so and resubmit it through the mobile app. Otherwise, contact your Edward Jones team to understand why your check was rejected.

No. While the Edward Jones app does access your camera, it does not save an image of your check in your photo library.

Once your deposit is processed, the amount will be reflected in your activity and you will receive a confirmation by email. If your check is submitted during normal business hours, this usually happens within one business day.

You will receive a confirmation email that serves as your receipt.

Your Edward Jones office will receive a notification if your check was accepted or rejected.