Key Takeaways:

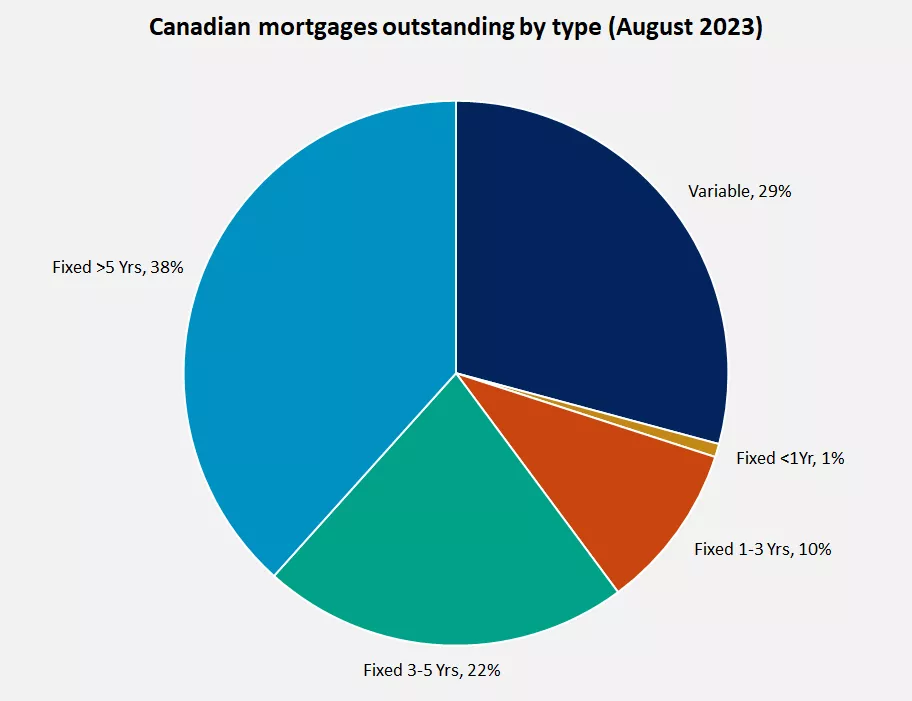

- After years of low interest rates, Canadian mortgage rates have surged to multidecade highs. The unique structure of the Canadian mortgage market, which is comprised largely of variable-rate and shorter-term fixed-rate mortgages (typically five years or less), makes households more sensitive to higher rates and more likely to experience rising mortgage bills.

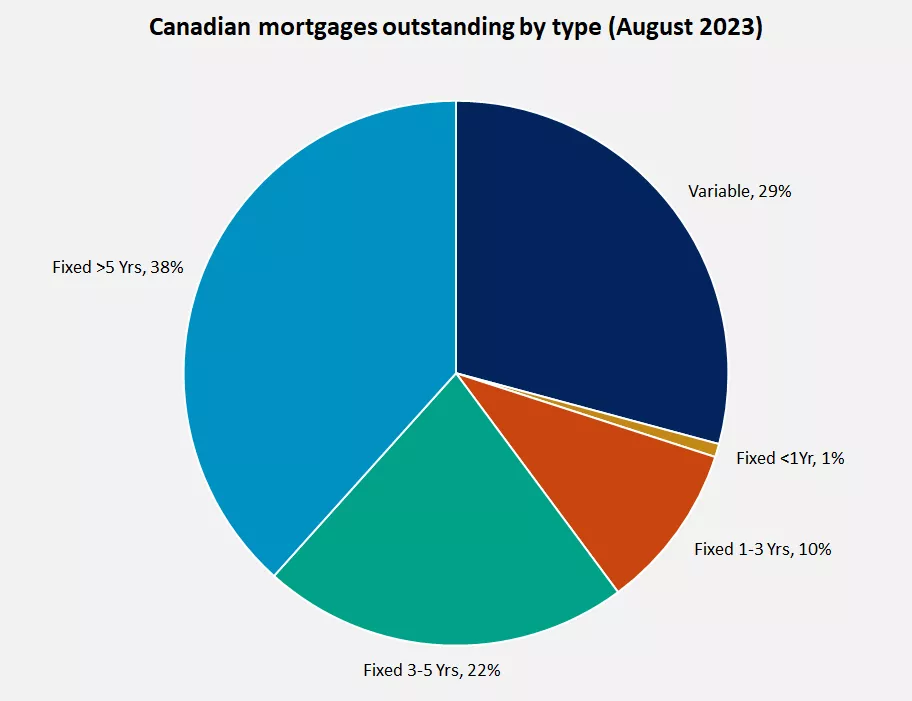

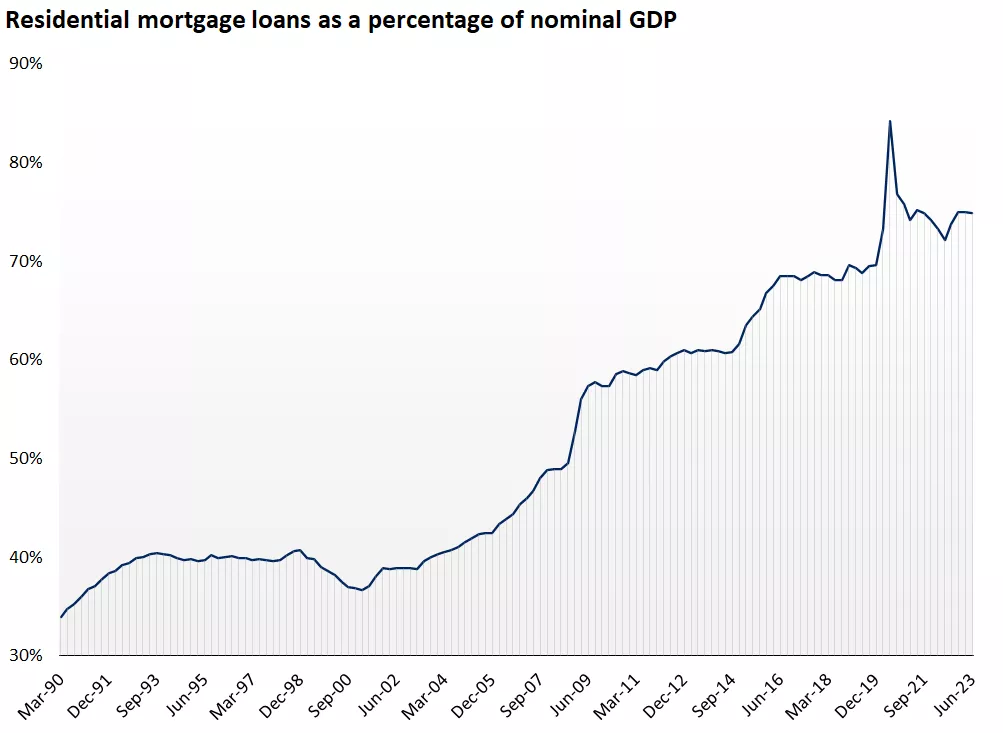

- Household debt overall in Canada has risen to a historically elevated level. Residential-mortgage debt now represents over 70% of Canadian GDP, while total household debt represents over 100%.2 This could further weigh on housing-market activity and consumer spending in the near term as households may be forced to prioritize debt-service payments over discretionary purchases.

- Despite elevated household debt and high mortgage rates, strong Canadian population growth and potential interest-rate cuts from the Bank of Canada over time could offer support for the domestic housing market over the long term and highlights the importance of maintaining appropriate allocations to Canadian equities and bonds. However, international allocations could help offset risks in your portfolio from these dynamics within the Canadian economy. In the current environment, we recommend investors underweight Canadian large-cap stocks in favor of U.S. large-cap stocks.

The Canadian housing market is unique: Given the extended and significant rise of the domestic housing market over the past two decades, housing investment in Canada has become a material contributor to the overall economy. Residential-mortgage loans now total about C$2.1 trillion, equivalent to around 75% of Canadian GDP (gross domestic product), compared with under 40% in the early 2000s.2 Nearly 60% of Canadians own homes, and among these homeowners, about 60% have mortgages.1 The structure of the domestic mortgage market is unique: The majority of mortgages are either variable-rate or fixed-rate with shorter terms (usually five years or less), compared with a market like the U.S., where the average home loan is a 30-year fixed-rate mortgage. This housing-market structure also poses a unique risk to the Canadian economy, particularly given the recent surge in interest rates. With domestic mortgage rates at 15-year highs, downward pressure on consumer spending (the biggest driver of GDP growth) and housing investment will likely increase, given that more homeowners face rising mortgage bills, as mortgage rates reset higher or mortgages are rolled over at higher rates.2

Figure 1. The Canadian mortgage market is made up largely by variable-rate and shorter-term fixed-rate loans

This chart shows the breakdown of Canadian mortgages outstanding by type as of August 2023.

This chart shows the breakdown of Canadian mortgages outstanding by type as of August 2023.

Figure 2: Canadian residential mortgages now represent over 70% of nominal GDP, compared with about 40% in the 1990s

This chart shows Canadian residential mortgage loans as a percentage of nominal GDP.

This chart shows Canadian residential mortgage loans as a percentage of nominal GDP.

Impact on households and the economy as mortgage rates rise: Given that the Bank of Canada (BoC) has raised interest rates 10 times since March 2022, mortgage rates in Canada have climbed substantially, averaging about 5.8% at the end of second-quarter 2023, versus around 2.0% in early 2022.1 The recent rise in mortgage rates has implications for both Canadian households and the broader economy.

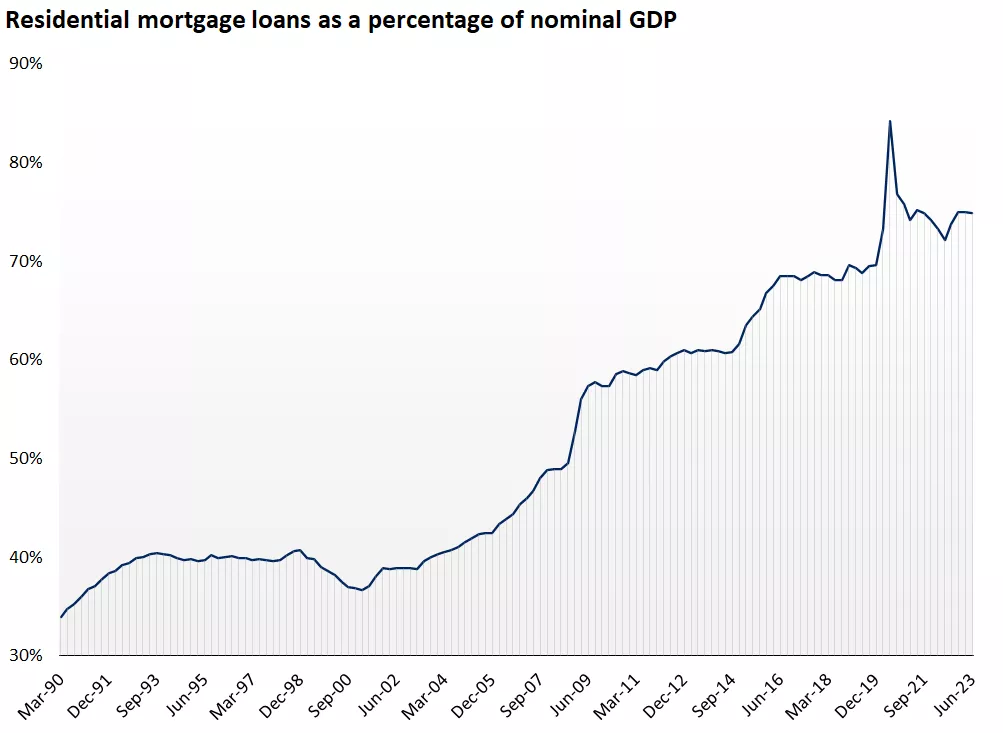

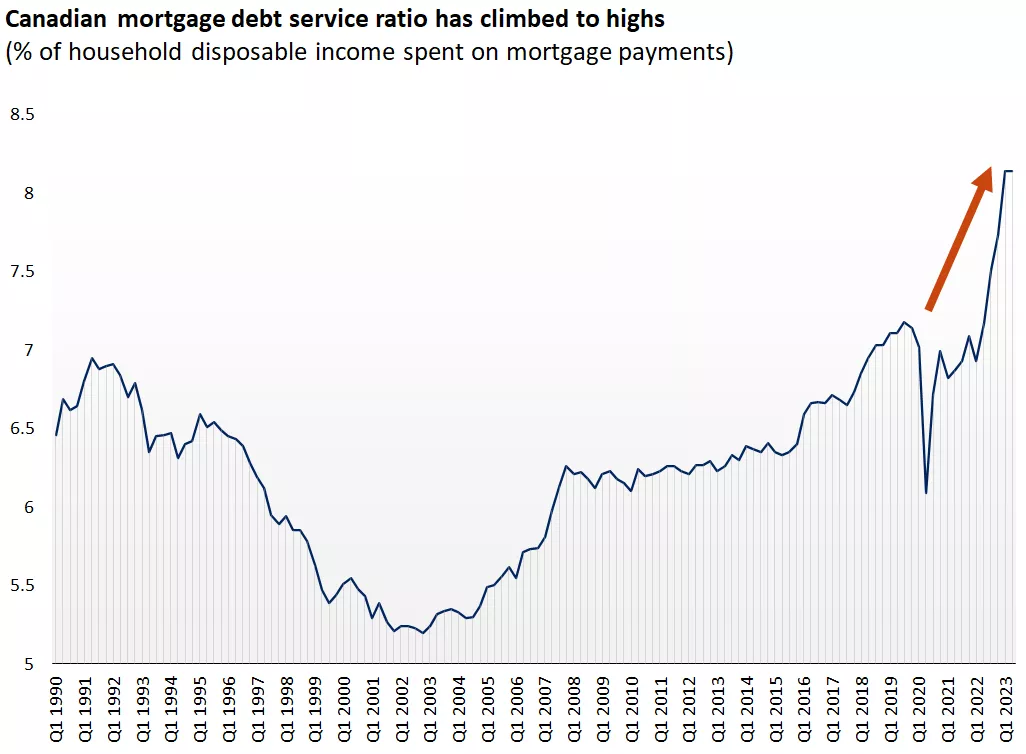

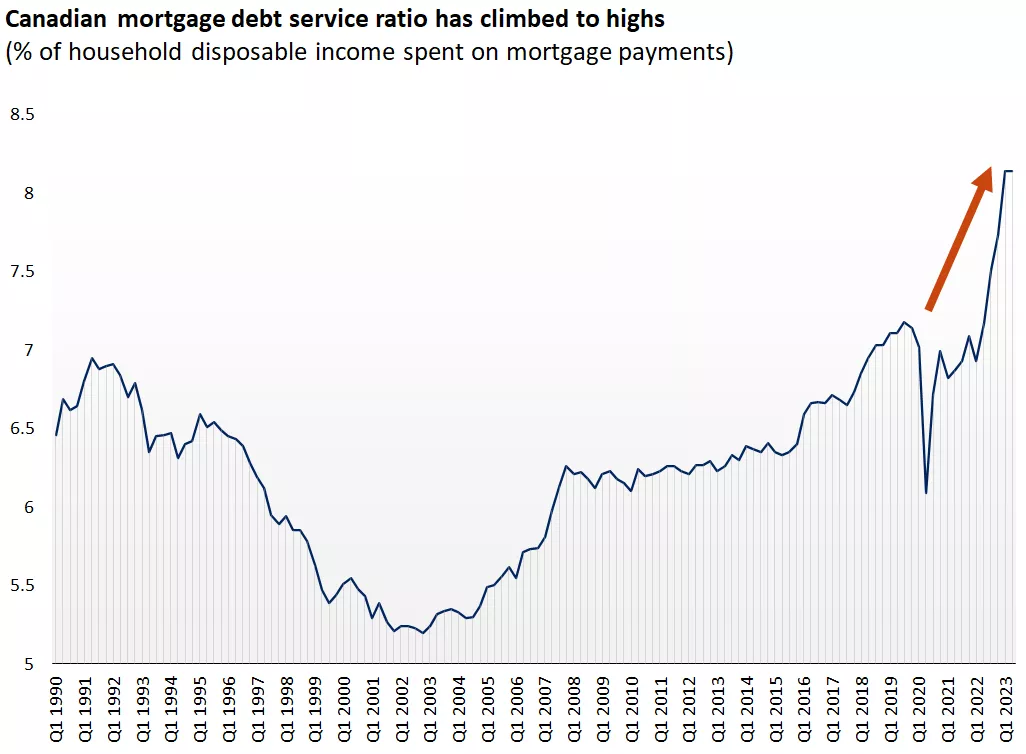

Concerning households, debt overall has increased, and mortgage debt-service ratios, or the amount that households spend on mortgage payments relative to their disposable income, have risen to their highest on record. Altogether, Canadian mortgage debt payments have risen from $94 billion in the second quarter of 2020 to over $141 billion in the second quarter of 2023 – a 50% increase in just three years. This sharp jump has led to households spending more on paying down their home mortgages and perhaps less on other discretionary purchases. We see evidence of this in household consumption expenditure data, which has cooled to under 2.0% year-over-year, well below the prior six-quarter average of roughly 4%. Canadian retail sales have also slowed over the past several months, moving gradually lower since their high in May 2022, another indication of easing household demand. This comes at a time when savings rates in Canada are near post-pandemic lows.2 The elevated mortgage-rate environment may continue to put pressure on both household savings and consumption in the near term.

Figure 3. Canadian households are spending a record percent of disposable income on paying their mortgage

This chart shows the percent of household disposable income spent on mortgage payments. Over the past several quarters, this measure has risen to multidecade highs.

This chart shows the percent of household disposable income spent on mortgage payments. Over the past several quarters, this measure has risen to multidecade highs.

From a macroeconomic perspective, the housing market in Canada overall has cooled. Housing investment now represents around 7.5% of nominal GDP, down from the peak of over 10% in 2021, but above the long-run average of roughly 6%.2 New-home price appreciation has turned negative year-over-year, and housing starts and residential building permits have declined.2 Despite these declines, home affordability in Canada remains depressed, as mortgage rates and household debt have risen, potentially putting further pressure on home prices.

As a result, the economies built around the housing market, including construction, home furnishings and home loans, may face some easing demand as well. And the financial firms and banks that offer mortgage loans could see some rise in delinquencies and softer loan demand overall – something to watch for in the months ahead.

The housing market may falter, but there are some stabilizers ahead: While we would expect continued softness in the Canadian housing market in the near term, we don’t anticipate deep or prolonged distress in the housing system, certainly not like we saw back in the U.S. housing market during the 2008 financial crisis. In fact, we see a couple of important reasons for stability and perhaps recovery ahead.

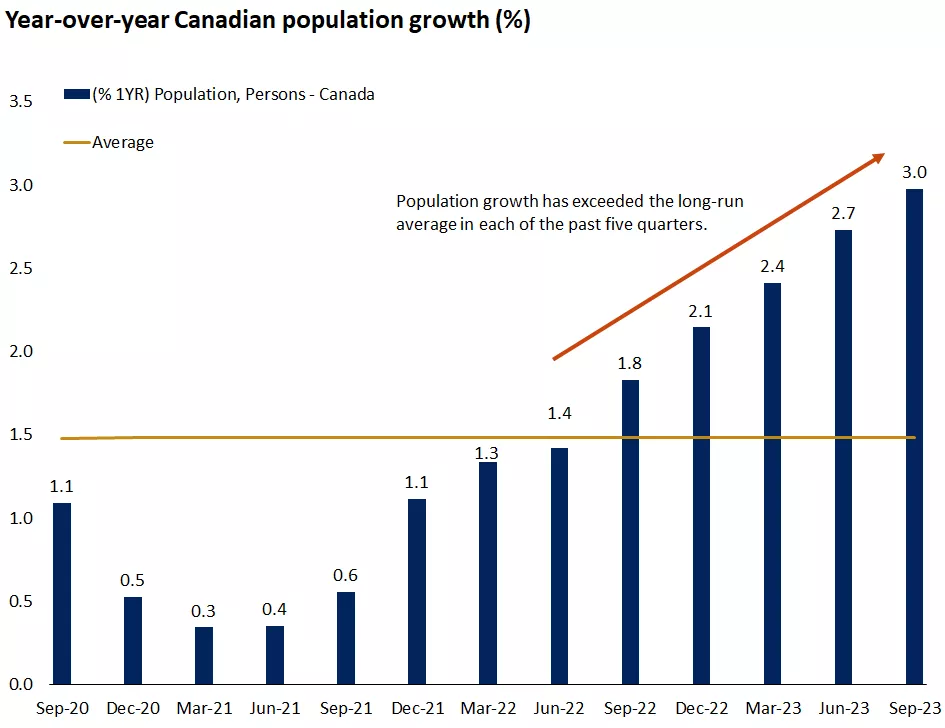

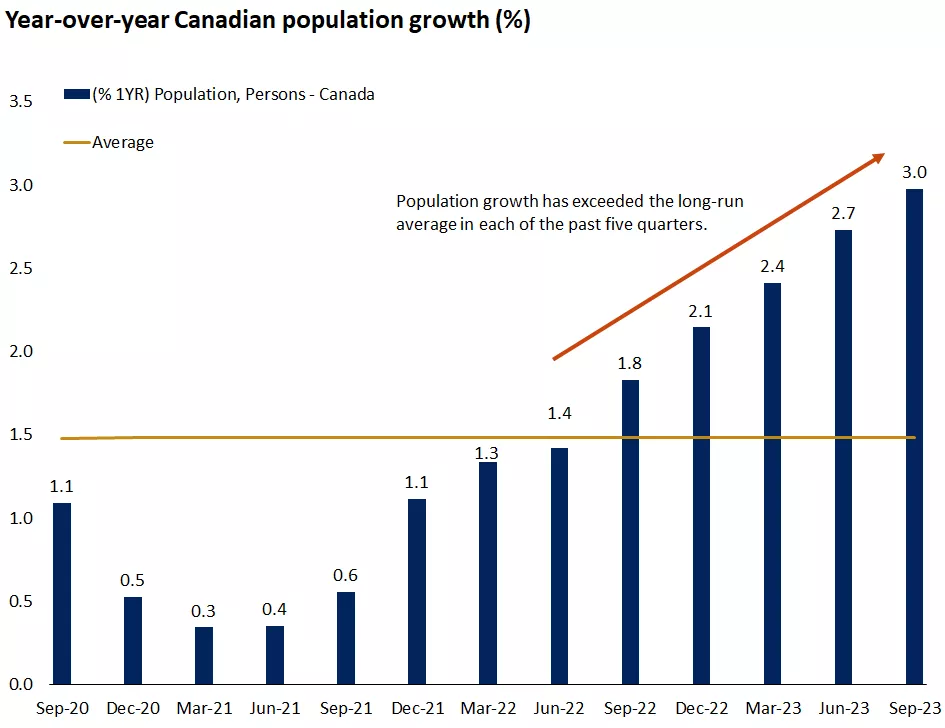

First, the Canadian population has been growing since the pandemic period, supported by steady immigration into the country. This growing population will seek both housing and home loans, which supports demand for homes over the longer term and puts some floor on home prices as well.

Figure 4. Canadian population growth has been rising, driven in part by steady immigration

This chart shows year-over-year population growth in Canada. Over the past five quarters, the population growth rate has exceeded the long-run average.

This chart shows year-over-year population growth in Canada. Over the past five quarters, the population growth rate has exceeded the long-run average.

Second, and perhaps most important, the Canadian interest-rate environment may be heading toward a peak and perhaps start a gradual move lower next year. In our view, the BoC is likely done raising interest rates, especially given the Canadian economy has already softened and inflation is trending gradually lower. The BoC may also consider cutting rates sometime in 2024, which would support lower mortgage rates in Canada as well. A potential move lower in mortgage rates may be a welcome catalyst for buyers and sellers to reenter the market.

Nonetheless, after years of low rates, Canadian consumers have made substantial investments in their homes, and historically elevated mortgages and debt overall are significant concerns. While a gradual move lower in rates would alleviate some of the pressures, it could take years for household leverage to come down, and consumption may remain restrained through this process.

Action for investors: We would expect rising mortgage rates and a cooling Canadian housing market to weigh on household consumption in the near term, which would put downward pressure on economic growth. The structure of Canadian mortgages versus the U.S. market, for example, leaves the Canadian housing economy relatively more susceptible to rising and volatile interest rates. We may see opportunities emerge as mortgage rates stabilize and potentially move lower, providing support to housing and the broader Canadian economy. Therefore, it's important to maintain allocations to Canadian investments, but to also diversify in U.S. and international markets to offset domestic economic and market risks. In the current environment, we recommend investors underweight Canadian large-cap stocks in favor of U.S. large-cap stocks.

For households, we recommend working with your financial advisor to ensure you have a plan in place to address potentially rising mortgage and debt costs, while staying on track to meet your long-term financial goals. Keep in mind that investing in a home offers utility and function beyond simple financial returns and can form a foundation for our day-to-day lives. Despite the headwinds, home ownership can also complement traditional investment portfolios and offer diversification and the potential benefits of investing in a real asset over the long term. For strategies to consider as you approach a renewal of your home mortgage, please refer to: Mortgage renewal | Edward Jones

Mona Mahajan

Investment Strategist

Brock Weimer, CFA

Associate Analyst

Source: 1. Statistics Canada, Edward Jones. 2. FactSet. Edward Jones.

Mona Mahajan

Senior Strategist, Investment Strategy

Mona Mahajan

Senior Strategist, Investment Strategy

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.