Fed and BoC Signal March Liftoff, Reaffirming Hawkish Stance

| 1-Day | 1-Year | |

|---|---|---|

| TSX | -0.15% | 13% |

| S&P 500 | -0.30% | 0.80% |

| Gov't Bonds | -0.30% | -5.20% |

| 10-yr Rate | 8 bps | 83 bps |

Source: Bloomberg. TSX Index, S&P 500 Index and 10-year Government of Canada rate as of 1/25/22. An index is not managed and is unavailable for direct investment. Past performance is no guarantee of future results.

Central banks set the table for rate hikes – All eyes were on the Fed and Bank of Canada (BoC), as the central banks move to end their pandemic support in order to fight inflation. Both banks kept rates steady, as expected, but signaled they will start raising interest rates in March. The Fed will end its quantitative easing (bond buying) in early March and plans to reduce its near $9 trillion balance sheet after it begins raising rates, but Fed Chairman Powell gave no hint on when that might begin. With inflation running at an almost 40-year high in the U.S. and the unemployment rate declining below 4%,1 the Fed has made a hawkish pivot, which Wednesday's meeting validates. With inflation in Canada also elevated (30-year high) and a faster rebound in employment,1 the BoC made that pivot earlier than the Fed but opted not to hike rates at yesterday's meeting, likely because of the omicron-variant uncertainty.

Elevated inflation keeps the pressure on – With upside risks to prices and an inflation outlook that has slightly worsened since December according to Fed Chairman Powell, he did not rule out the possibility that rates could be increased at every Fed Committee meeting, thus keeping the Fed's options open for a faster rate-hiking pace. After having started the day higher, boosted by solid U.S. tech earnings, Canadian and U.S. stocks pared gains to end the day slightly lower. The 10-year U.S. yields rose to an almost two-year high, pulling Canadian yields higher, and the yield curve flattened, both indicating a potentially more aggressive Fed tightening than is expected. We continue to think that inflation will likely peak in the coming months and moderate more meaningfully in the second half of the year as supply-chain bottlenecks ease. Because of that, we see the Fed having room to move less aggressively than what the market is already pricing in, which is now almost five interest-rate hikes this year.

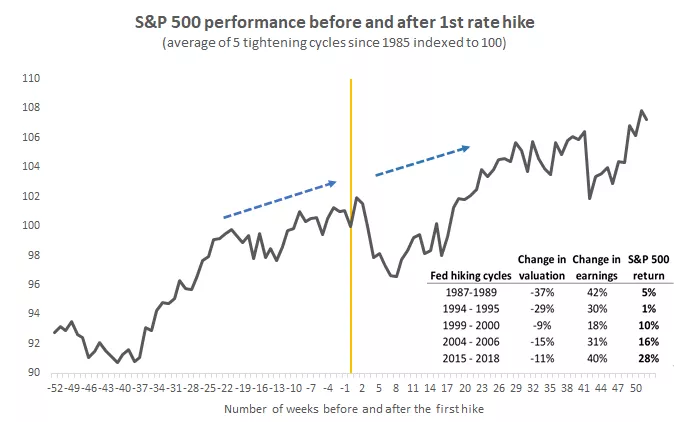

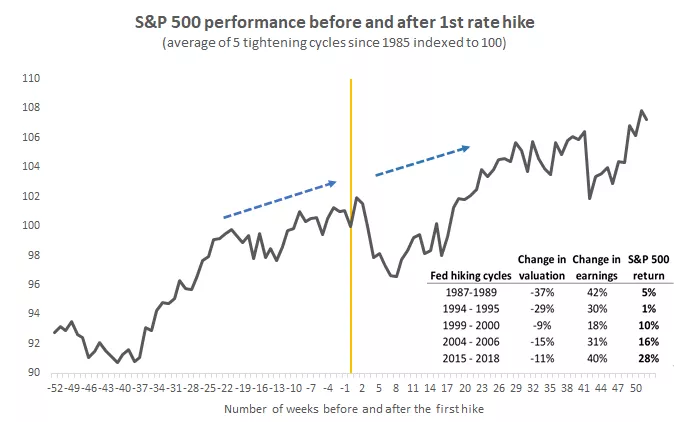

Valuation pressures vs. rising earnings - After a volatile start to the year, with the S&P 500 experiencing its first correction in almost two years and the TSX pulling back more than 5%, market sentiment remains fragile. The prospects of tightening monetary policy has triggered an adjustment to valuations across the board, with speculative investments and unprofitable, high-growth stocks bearing the brunt of the sell-off. Historically, stocks have experienced some volatility around the first interest-rate hike but generally maintained their upward trajectory six months and a year out.

While central bank tightening is likely to continue to weigh on valuations, we believe that this headwind can be offset by rising corporate earnings, as has happened in the past. In each of the last five rate-hike cycles since 1985, the S&P 500 was able to generate moderate but positive returns between the first rate hike and the last, supported by a growing economy and rising earnings. Considering a strong labour market, robust consumer finances, and the pent-up demand for services, as well as the ramp-up in corporate share repurchases, we expect earnings to continue to rise despite profit margins likely peaking. Elevated volatility could persist, but given the still-solid fundamental backdrop and not yet restrictive BoC and Fed policies, the recent pullback and any potential further weakness could present a compelling opportunity for investors, in our view.

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.