Your market volatility playbook

What you need to know

- Rising interest rates drove weakness across stocks and bonds in April, driving an unsurprising — though still unpleasant — pickup in market volatility.

- Despite the pullback, markets gave back only a portion of the gains well-diversified portfolios have enjoyed recently.

- Stay focused on your goals through volatility by monitoring how far your portfolio has drifted from your target allocations and risk/return objectives.

- If appropriate for your portfolio, be opportunistic by overweighting U.S. equity investments, given the relative strength of the U.S. economy and the potential for markets to broaden.

- Consider slightly underweighting fixed-income investments in favour of greater opportunities within equities. But also consider increasing interest rate risk within your fixed-income holdings as we approach central bank rate cuts.

Portfolio tip

Market volatility is unpleasant, but it’s a normal part of investing. Appropriate diversification can help align your portfolio’s fluctuations with your comfort with risk and financial goals.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

Markets cooled in April despite underlying economic strength. Following a period of lower volatility in the first quarter, financial markets were shaky last month on indications inflation may take longer to fall than hoped, especially in the U.S. Sticky inflation increases the likelihood the Federal Reserve may take a more cautious approach to cutting interest rates than previously expected, particularly given ongoing strength in labour markets and consumer spending. The Bank of Canada, on the other hand, may decide to move earlier, given the country's weaker economic outlook.

Interest rates rose as a result, hitting new highs for 2024. This drove an unsurprising pickup in volatility. The increased potential for rates to stay high for longer and further weigh on economic growth drove weakness across nearly all asset classes.

Equity asset classes gave back only a portion of their recent gains. Pullbacks are never pleasant, but they shouldn’t be unexpected. And while, on average, stocks generally dropped more than bonds in April, their 12-month returns are solidly positive, with most still showing much more than 10%.

Backed by strength from mega-cap technology stocks and the economy more broadly, U.S. equities held on to a convincing lead over the year, despite leading to the downside last month. U.S. small- and mid-cap stocks fell the most, given their greater sensitivity to interest rates and economic growth. U.S. large-cap stocks also lagged the rest of the asset classes. Emerging-market stocks stood out with positive returns in April, helping offset negative returns weighing on well-diversified portfolios elsewhere.

Rising rates pressured bond investments but can enhance forward return potential. Rising interest rates pull bond prices lower. Given that interest rates jumped back toward levels that are higher than they’ve been in over a decade, high-quality bonds continue to be a drag on returns. Following last month’s weakness, Canadian investment-grade bond returns are flat over a five-year period, as are international bonds. While this has weighed on bond-heavy portfolios, forward-looking bond investors are likely to find today’s higher rates beneficial, providing a brighter starting point for future returns. Lower-quality bonds have outperformed recently, benefiting well-diversified portfolios. Higher-quality bonds are likely to bounce back as a central bank rate-cutting cycle approaches.

What do we recommend going forward?

Stay focused on your goals and maintain a well-diversified portfolio, including when incorporating timely market opportunities. Your goals and investment objectives should drive your portfolio’s design. We recommend taking a diversified approach when building your investment strategy. As recent market performance has demonstrated, allocating to a variety of asset classes can help smooth — but not eliminate — volatility.

During portfolio reviews, evaluate your allocations against the mix of equity and fixed-income investments that aligns with what you’re trying to achieve. If you find you’re misaligned, consider if the additional risks are intentional or if rebalancing could help bring you back into alignment with your goals.

Need a starting point for your portfolio? Talk with your financial advisor about our strategic asset allocation guidance below, which could guide your diversification. From there, consider incorporating the timely opportunistic guidance that follows, while continuing to manage how far you deviate from your strategic targets.

When appropriate, be opportunistic by favouring U.S. equity investments, partially reallocating from fixed income. Despite inflation demonstrating stickiness in the first quarter of 2024, we expect the broader trend lower to allow central banks to begin cutting interest rates later this year. This is likely to result in broadening market leadership, particularly in the U.S., benefiting segments that have lagged.

- We recommend overweighting U.S. small- and mid-cap stocks, offset with a reduction to international bonds. We expect U.S. small- and mid-cap stocks, which tend to be more economically sensitive, to benefit from the relative strength of the U.S. economy. This is particularly true if growth reaccelerates later this year. They are also of higher quality than other, more cyclical asset classes.

- We also favour U.S. large-cap stocks, particularly over the challenges within Canadian large-cap stocks and emerging-market equity. We believe the growth prospects of artificial intelligence (AI) will continue providing a tailwind for tech-oriented growth stocks in the U.S. More cyclical and value-style U.S. stocks could benefit from the economy reaccelerating later this year, supporting the ongoing momentum of the asset class overall. Emerging markets, on the other hand, face regulatory and policy uncertainty within China. And we believe risks are relatively elevated for Canadian large-cap stocks, given our expectation for high interest rates to negatively impact economic growth to a greater degree than in the U.S.

Consider increasing interest rate risk to benefit from today’s higher rates. Only two fixed-income asset classes — international high-yield bonds and cash — have generated positive returns over the past three years, despite the weight of rising interest rates. However, rates are likely to head lower if inflation eases and central banks become less restrictive, as we expect in the quarters ahead. In this environment, we expect higher levels of interest rate risk – an investment's sensitivity to interest rate changes – to benefit portfolios. Therefore, we recommend reallocating from shorter-term toward longer-term high-quality bonds. Short-term bonds and cash-like investments carry greater reinvestment risk, which we recommend reducing. Longer-term bonds could help lock in the benefits of higher interest rates for longer and appreciate more as rates drift lower.

We’re here for you

Market volatility can be uncomfortable. But a disciplined, well-diversified approach to investing that keeps your financial goals in the driver’s seat can help you control emotions when markets get tough. Talk with your financial advisor about your risk and return objectives, as well as your financial goals behind them. Then, discuss how strategic diversification paired with opportunistic adjustments can help you stay on track.

If you don’t have a financial advisor and would like help identifying an appropriate investment strategy aligned with your risk and return objectives, we invite you to meet with an Edward Jones financial advisor to discuss what you find most important when it comes to your financial goals.

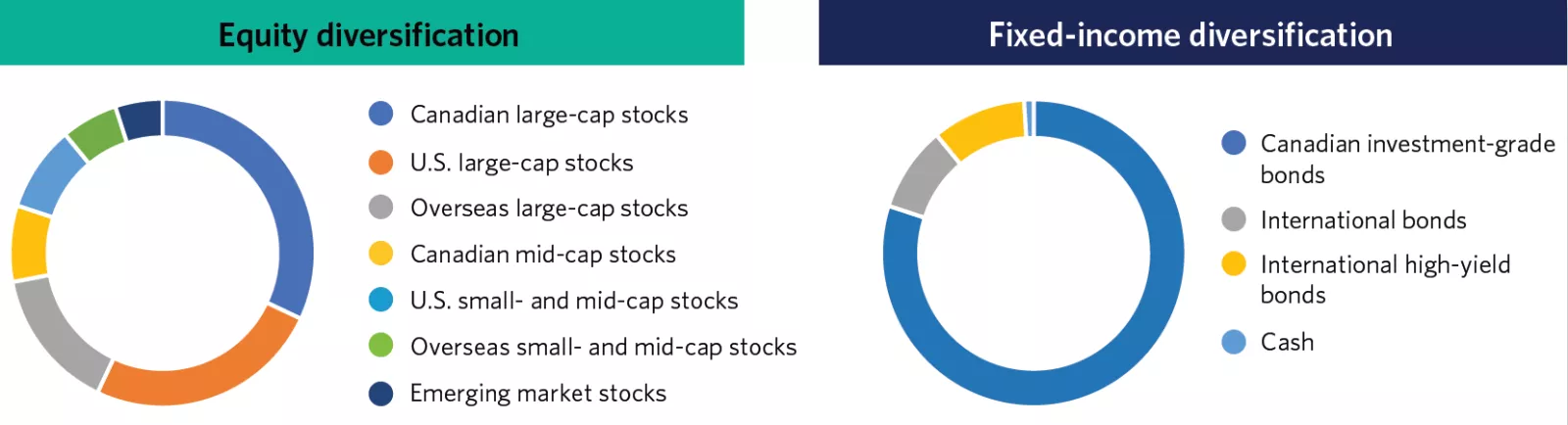

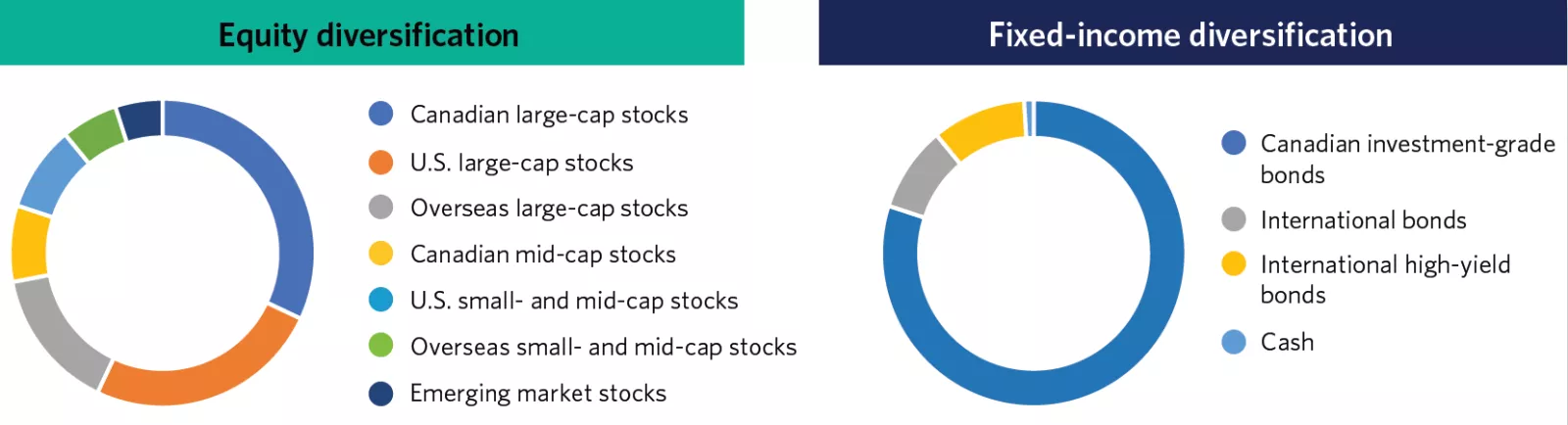

Strategic portfolio guidance

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, overseas large-cap stocks, Canadian mid-cap stocks, U.S. small- and mid-cap stocks, overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, overseas large-cap stocks, Canadian mid-cap stocks, U.S. small- and mid-cap stocks, overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

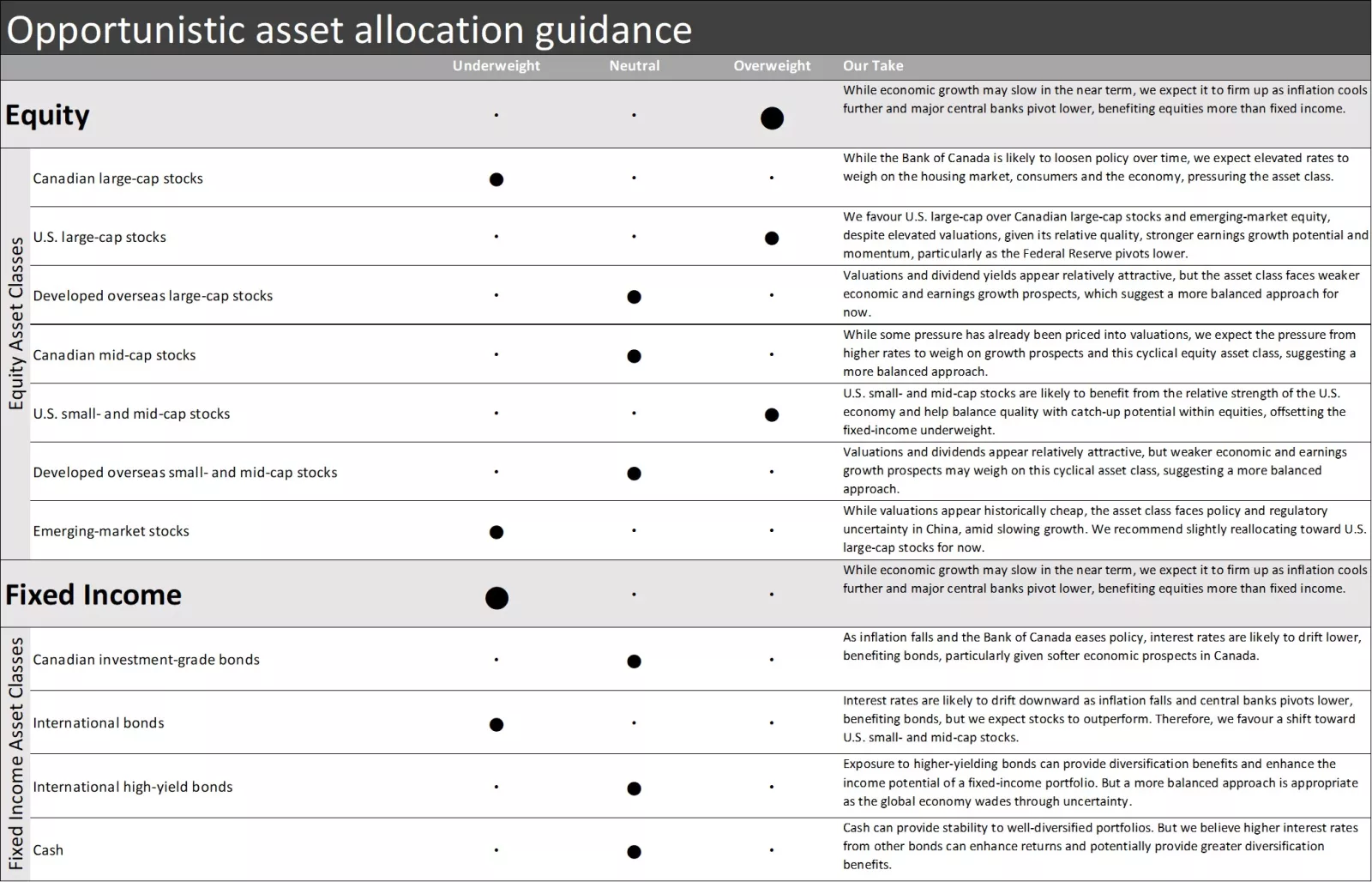

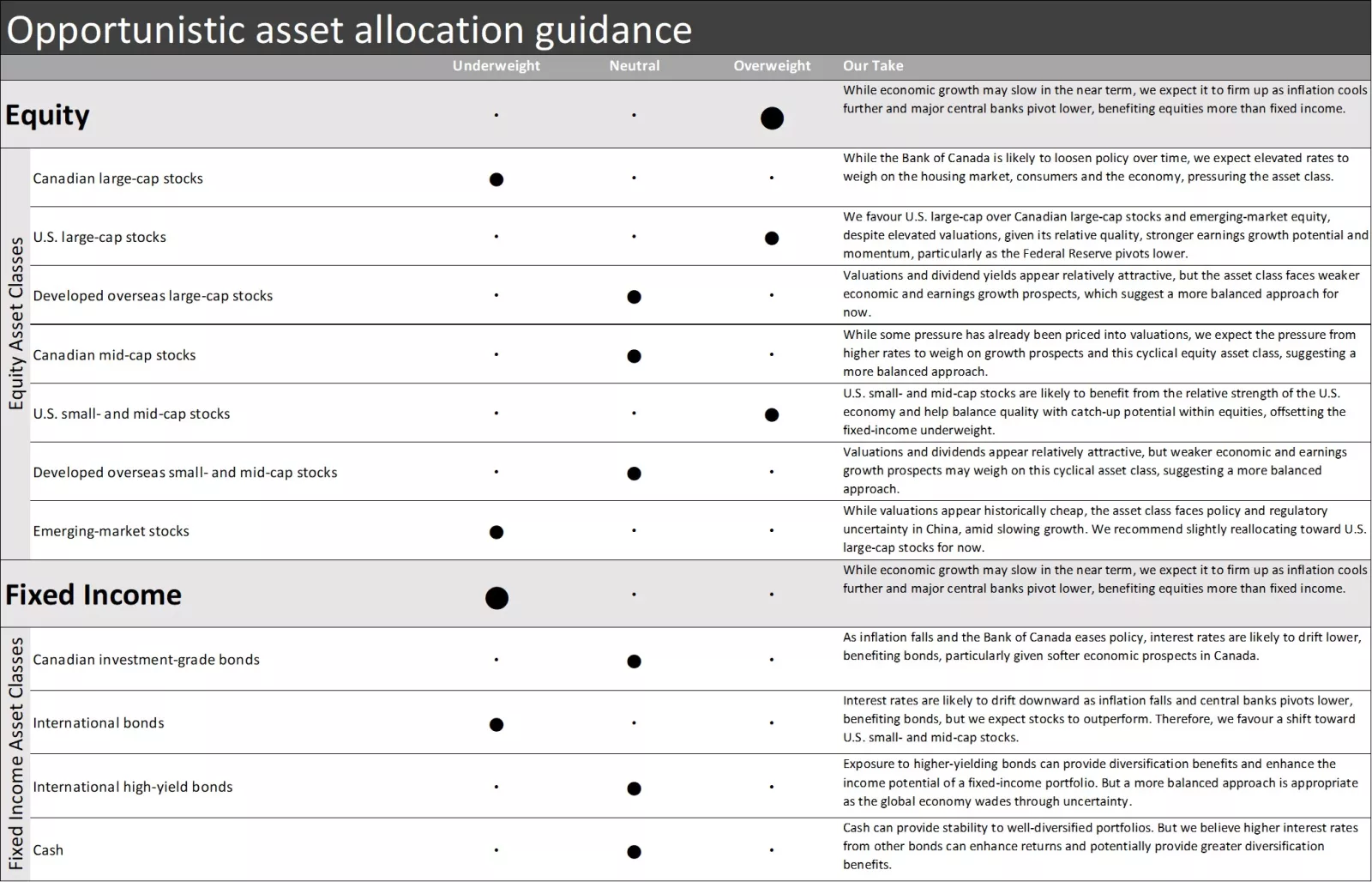

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping to keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity sector and Canadian investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance is as follows:

Equity — overweight overall; underweight — Canadian large-cap stocks and emerging market stocks, neutral — Canadian mid-cap stocks, developed overseas large-cap stocks and developed overseas small- and mid-cap stocks, overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income — underweight overall; neutral — Canadian investment-grade bonds, international high-yield bonds and cash, underweight - international bonds.

Our opportunistic asset allocation guidance is as follows:

Equity — overweight overall; underweight — Canadian large-cap stocks and emerging market stocks, neutral — Canadian mid-cap stocks, developed overseas large-cap stocks and developed overseas small- and mid-cap stocks, overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income — underweight overall; neutral — Canadian investment-grade bonds, international high-yield bonds and cash, underweight - international bonds.

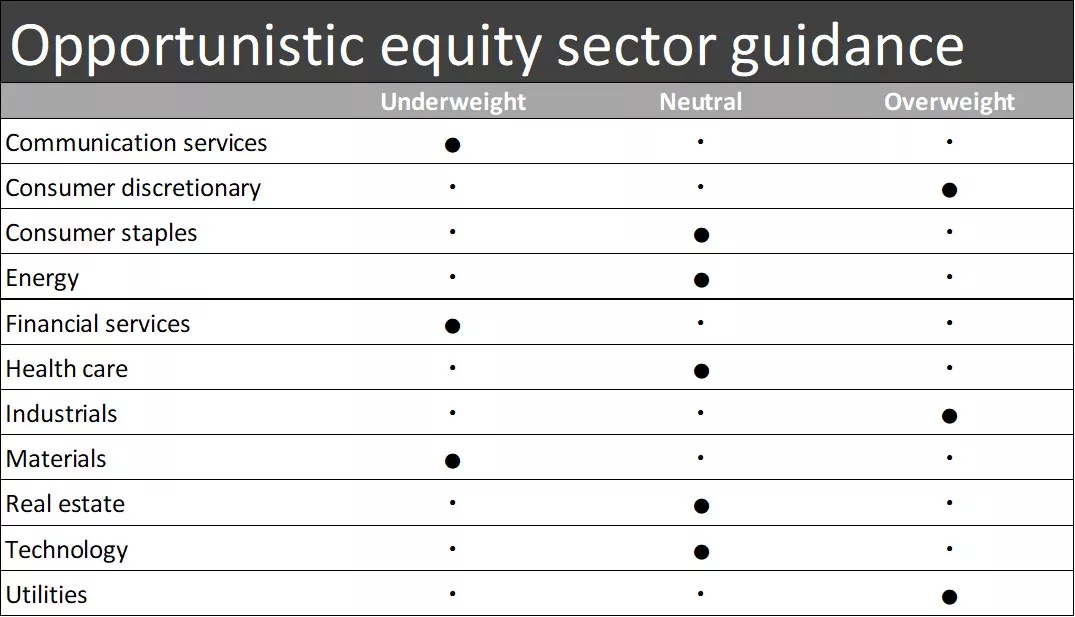

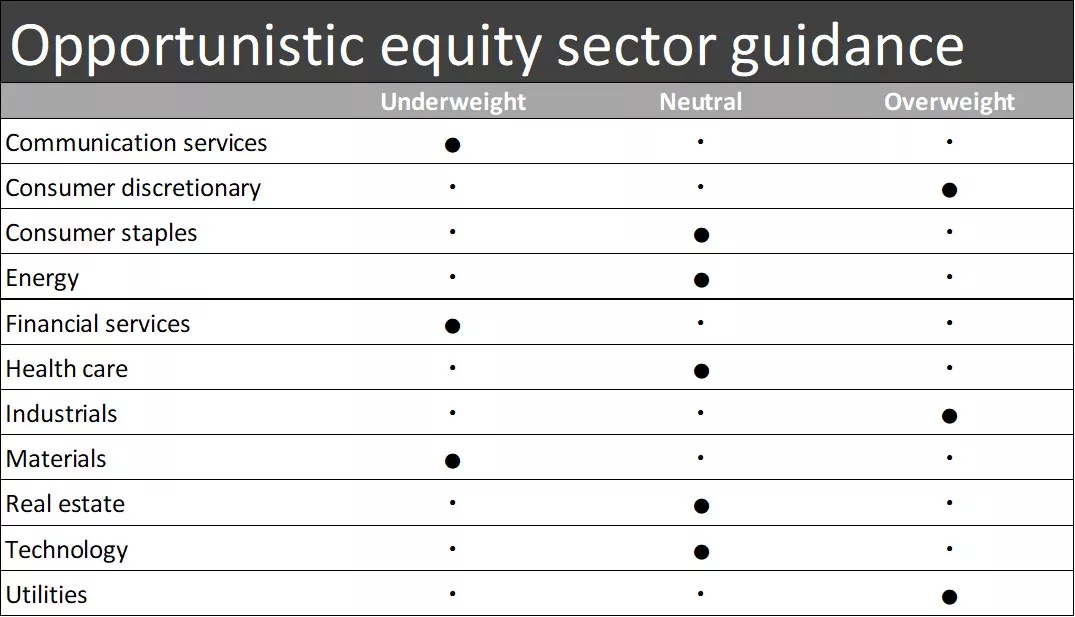

Our opportunistic equity sector guidance is as follows:

Overweight for consumer discretionary, industrials, and utilities

Neutral for consumer staples, energy, health care, real estate and technology

Underweight for communication services, financial services and materials

Our opportunistic equity sector guidance is as follows:

Overweight for consumer discretionary, industrials, and utilities

Neutral for consumer staples, energy, health care, real estate and technology

Underweight for communication services, financial services and materials

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charter holder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are inherent in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Diversification does not ensure a profit or protect against loss in a declining market.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.