Craig Fehr, CFA, Angelo Kourkafas, CFA

Volatility from the latest bank failures may make the market’s strong start to 2023 feel like a distant memory. While this is a new wrinkle in an old bear market, troubles in the banking sector should not be dismissed. They come at a precarious stage in which markets were already digesting the crosswinds of Federal Reserve rate hikes and emerging softness in the economy alongside persistent (and encouraging) strength in the labor market.

That said, we don’t think this is the beginning of a financial crisis that sets a new, sustained course lower for equities. In fact, while volatility is likely to continue in the near term as challenges within the banking system unfold, we think investors can be confident in a broader outlook. Recent market weakness can present a compelling case for not only remaining invested, but also capitalizing on opportunities during short-term pullbacks.

Here are three things to know about what’s happening and the implications for our market outlook:

1. Worries over bank failures won’t disappear overnight, but they won’t spark a 2008-style crisis.

Markets have endured new ups and downs in a roller-coaster week spurred by the failure of a few U.S. regional banks. An additional character joined this episode March 15, as concerns have spread to a large Swiss bank, Credit Suisse.

We’d note that Credit Suisse has been enduring challenges for several years, however: The most recent news stems from an announcement that the bank found material weaknesses in internal controls related to financial reporting for prior years. Although this is an institution-specific issue, we have little doubt that recent banking system risks exacerbated the challenges. More broadly, we view this as part of the likely evolution of this situation, in which worries over vulnerable banks broaden out.

It’s important to note that while anxiety may spread over which institutions could be in the spotlight next, there are distinct and critical differences between this environment and the banking crisis in 2008.

Then, the collapse of the housing bubble led to defaults and asset-value write-downs on exotic mortgage securities, which crippled the banking system. Today, rapid rate hikes by the Fed have depressed the value of bond securities that banks hold as part of their funding for their loan books. Then, bank capital levels were impaired by losses, and financial institutions had trouble accessing necessary funding. Today, capital levels across the banking sector are dramatically higher and more sound. This cushion — along with swift action by U.S. policymakers to backstop depositors and extend access to funding for banks — has helped restore some confidence.

The bottom line: We think financial market anxiety around the banking system will persist until the dust settles on deposit movements and funding uncertainties. This won’t, in our view, spill over into a more structural crisis across the industry.

While additional niche or smaller lenders may approach a similar situation to what Silicon Valley Bank (SVB) has endured, we think forecasts of a banking sector collapse are overdone. The vast majority of the U.S. banking system is adequately capitalized to navigate this environment.

2. This may add to the economic slowdown that was already underway, but we don’t think it changes the broader outcome for the economy.

We expect the economy to endure a mild, shallow recession this year as activity naturally slows in response to the Fed hitting the brakes with interest rate hikes over the past 12 months. The surprisingly persistent health of the labor market will, in our view, play a significant role in supporting only a mild downturn. Consumer spending makes up the majority of GDP, and employment conditions drive spending. We also expect renewed economic expansion in the year ahead.

The banking turmoil that has emerged will likely increase lending standards, raising loan rates and tightening overall credit conditions, which should have a cooling effect on the economy. While the prospects of an economic slowdown are hardly inspiring, there is a silver lining: A softer economy will help accelerate the downward path of inflation. This, in turn, will support a policy shift from the Fed, reducing the need for an extended string of Fed rate hikes — the very catalyst that has driven these disruptions in the banking sector.

The bottom line: The Fed has had a firm grip on the wheel of the financial markets as it has stomped on the brake to quell elevated inflation. We think this situation complicates the Fed’s rate decision at its meeting March 21-22 as it seeks to balance the need for further inflation-fighting policies against the new financial risks presented by bank failures.

Regardless of the March meeting’s outcome, we think these recent developments will limit further rate hikes from here and introduce a less restrictive monetary policy backdrop that, over time, will be necessary for an economic and financial market recovery.

3. Emotional headlines and market swings reflect immediate uncertainties, which frequently create opportunities for those with a wider view.

Uncertainties and market volatility are always uncomfortable, but applying a more disciplined approach is, in our view, one way long-term investors create an advantage. We expect larger daily swings as new developments unfold, so realistic expectations are important. But we think investors have an opportunity to lean into market weakness with opportunistic rebalancing and additions to long-term allocations. We continue to see a compelling case for a durable rebound as we progress into and through the second half of the year.

Equities are still markedly above this past October’s bear market low, and we think there is credible support for those lows to hold because:

- The trend of disinflation has been established,

- The Fed is almost done hiking, and

- Earnings estimates now better reflect a realistic macroeconomic outlook.

The bottom line: We are now 15 months into this bear market. Although it’s been a challenging path to this point, we are approaching the opportunity for markets to look across the valley. The most challenging periods in the market often sow the seeds for the best opportunities.

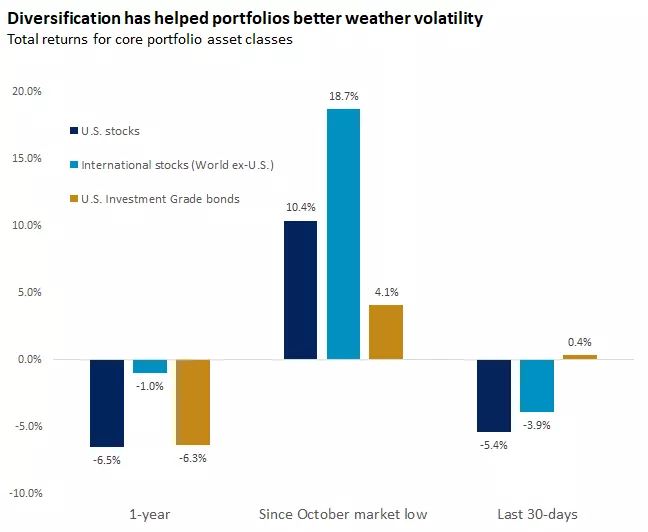

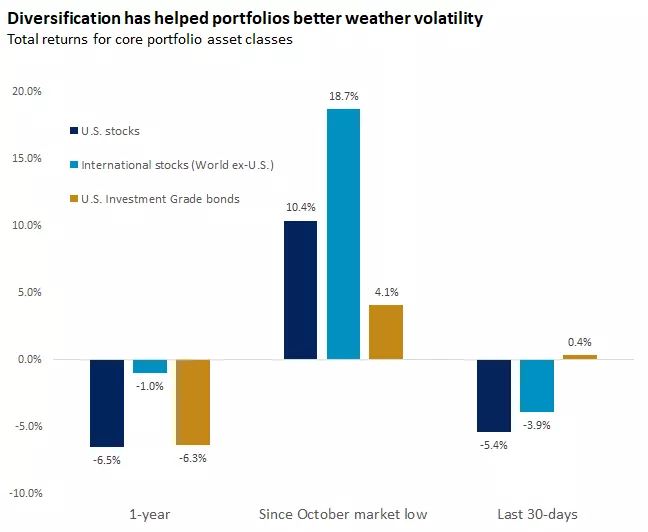

Lost in the recent turmoil has been the value that has been derived from a quality-oriented, well-diversified approach. Bonds have provided a more traditional ballast against equity market weakness. Global allocations have outperformed. Quality investments have held up better than speculative areas, which have suffered amid rising uncertainty. We haven’t seen the last of the choppy waters, but investors can employ a broader perspective and systematic investing strategies to take advantage of pullbacks and best position for a more sustainable rebound ahead.

Source: Bloomberg, U.S. stocks represented by the S&P 500, international stocks represented by the MSCI ACWI ex-US and bonds represented by the U.S. AGG. Indexes are unmanaged and cannot be invested in directly. Past performance is not a guarantee of future returns.

The graph shows returns for U.S. stocks, international stocks, and U.S. bonds over the past one-year, since the October market low, and the past 30-days. Diversified portfolios have held up better than domestic stock-only portfolios, supported by international returns and a fall in bond yields.

Craig Fehr

Craig Fehr is a principal and the leader of investment strategy for Edward Jones. Craig is responsible for analyzing and interpreting economic trends and market conditions, along with constructing investment strategies and asset allocation guidance designed to help investors reach their financial goals.

He has been featured in Barron’s, The Wall Street Journal, the Financial Times, SmartMoney magazine, MarketWatch, the Financial Post, Yahoo! Finance, Bloomberg News, Reuters, CNBC and Investment Executive TV.

Craig holds a master's degree in finance from Harvard University, an MBA with an emphasis in economics from Saint Louis University and a graduate certificate in economics from Harvard.

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.