Weekly market wrap

Key Takeaways:

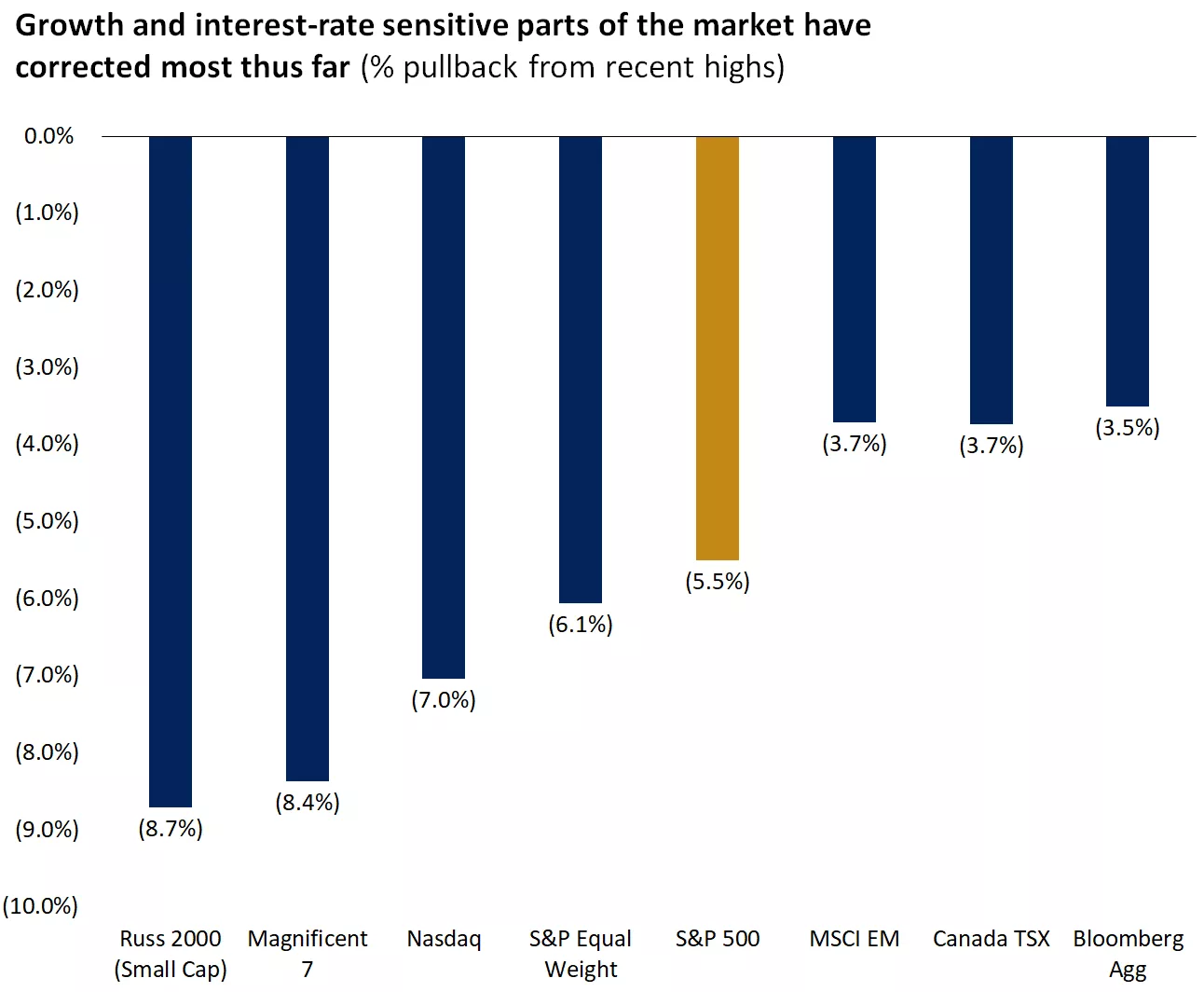

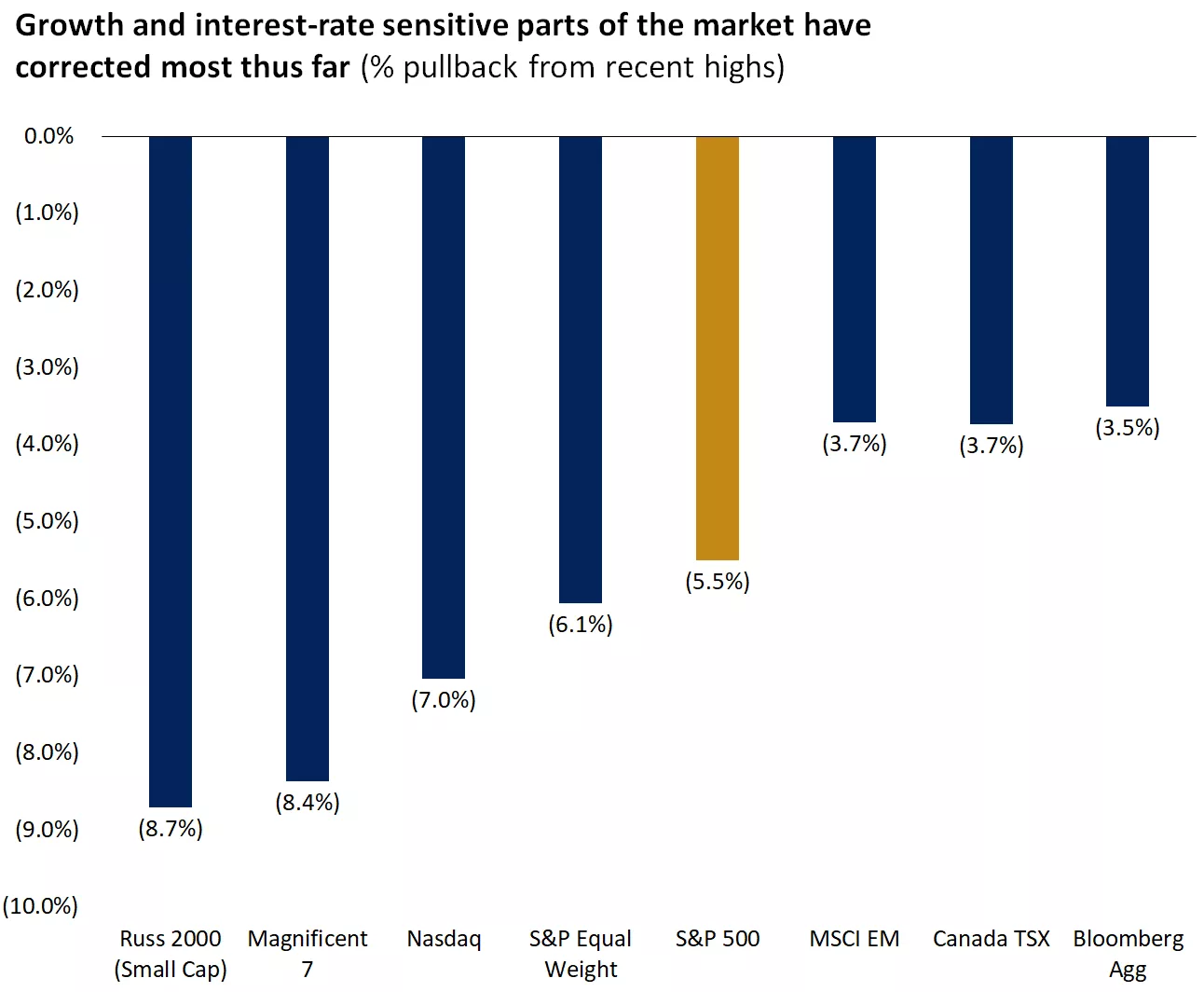

- After a 25% run higher in the S&P 500 over the past six months, the tone in the markets in recent weeks seems to have shifted. The S&P 500 closed lower for the third straight week, while the technology-heavy Nasdaq was lower for the fourth week in a row. The magnitude of the pullback thus far has been relatively contained: The S&P 500 is down about 5.5% from recent highs, while the Nasdaq is down around 7%. However, the interest-rate-sensitive parts of the market, including small-cap stocks and the real estate sector, have pulled back more. And the VIX volatility index, sometimes referred to as the "fear index," has climbed toward highs of the year.

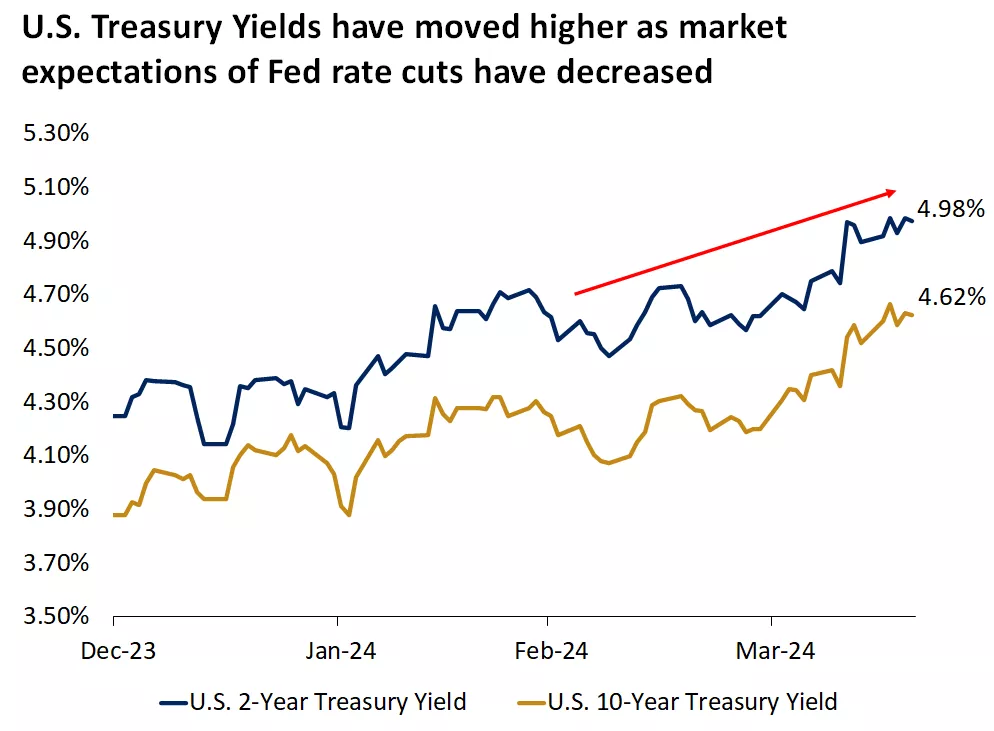

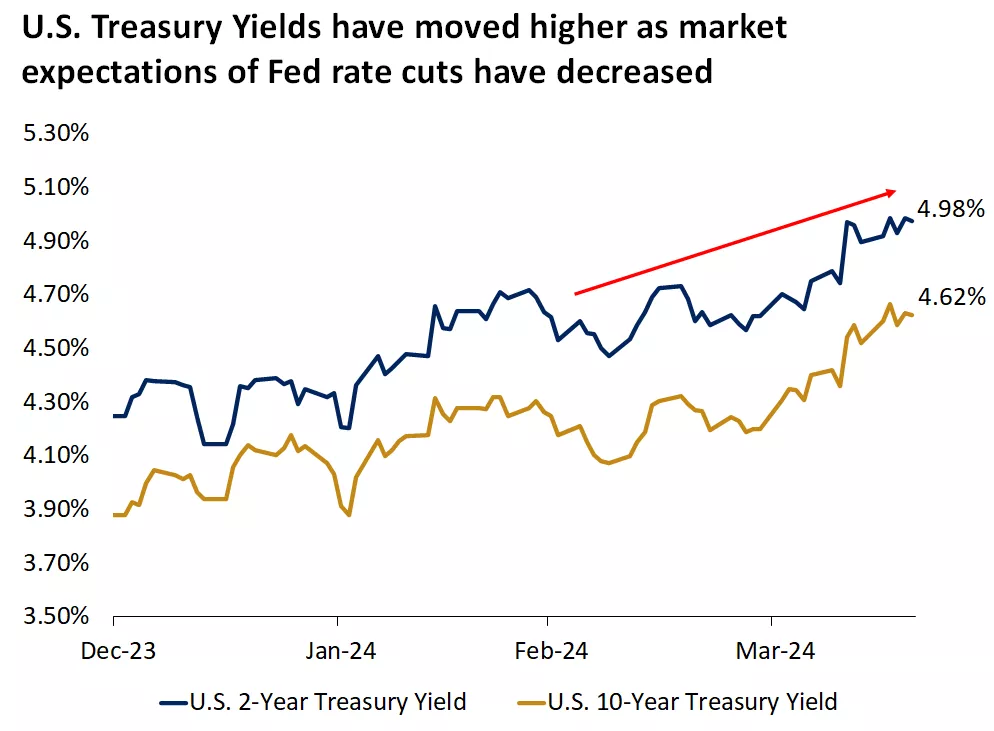

- In our view, volatility has been sparked by a trifecta of recent data and news. First, the market has repriced Fed rate cuts and is now expecting just one rate cut in 2024, and it is adjusting to this new "higher for longer" interest-rate regime. Second, geopolitical tensions have been rising, particularly in the Middle East, which has also put upward pressure on oil and commodity prices in recent weeks. And third, S&P 500 first-quarter earnings season is underway, and while companies are beating forecasts, the outlooks they are offering have been softer than expected. Mega-cap technology firms, including Microsoft, Google, and Meta will all be reporting earnings next week, with investors closely watching for signs of any weakness.

- Market volatility after a strong run is not unexpected. While calling the bottom of a pullback is notoriously difficult, we know that corrections in the 5% - 15% range are typical in any given year. In our view, the more important consideration is whether a pullback could morph into a deep or prolonged bear-market environment (typically with 20% or higher losses). We don't see this as a high-probability outcome, particularly given that the U.S. economy remains fairly robust, supported by strong consumer demand and a healthy labor market, and global economic growth is also stabilizing. Thus, investors could use this pullback to rebalance, diversify and dollar-cost average into weakness, especially those that hadn't fully participated in the recent rapid rally.

After a strong rally in the stock market, markets in recent weeks have been softening. We know that market corrections are typical in any given year, and especially so after a 25% rally in the S&P 500 over the past six months.

This chart shows that growth and interest-rate sensitive parts of the market have pulled back the most from their recent highs. Past performance does not guarantee future results.

This chart shows that growth and interest-rate sensitive parts of the market have pulled back the most from their recent highs. Past performance does not guarantee future results.

We outline three drivers for the recent market volatility, and our take on each:

This chart shows that 2- and 10-year U.S. Treasury yields have moved higher in the past several months.

This chart shows that 2- and 10-year U.S. Treasury yields have moved higher in the past several months.

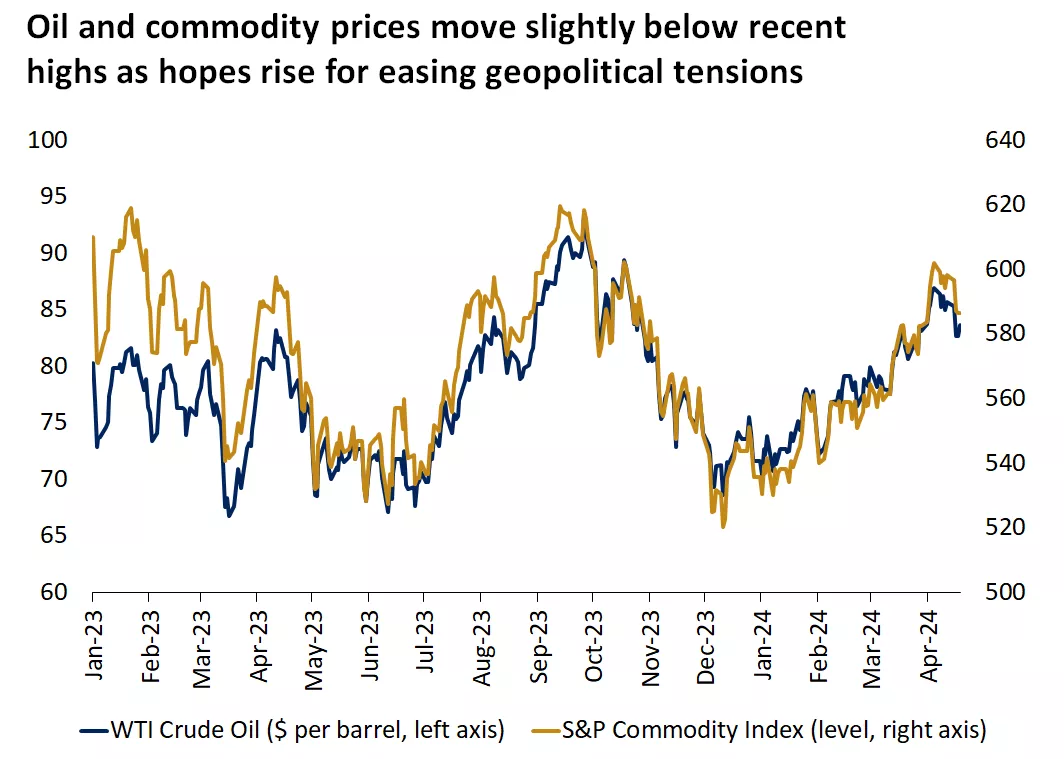

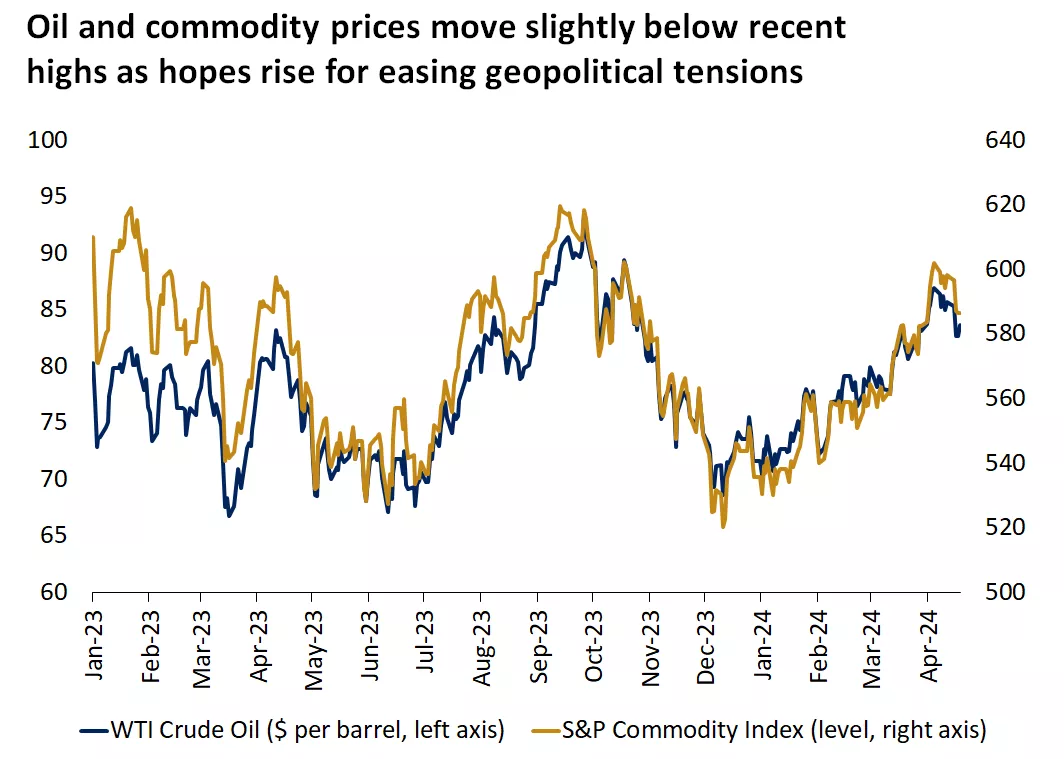

This chart shows that the price of crude oil and the S&P GSCI Commodity Index have risen year-to-date but pulled back in recent weeks as hopes rise for easing geopolitical tensions. Past performance does not guarantee future results.

This chart shows that the price of crude oil and the S&P GSCI Commodity Index have risen year-to-date but pulled back in recent weeks as hopes rise for easing geopolitical tensions. Past performance does not guarantee future results.

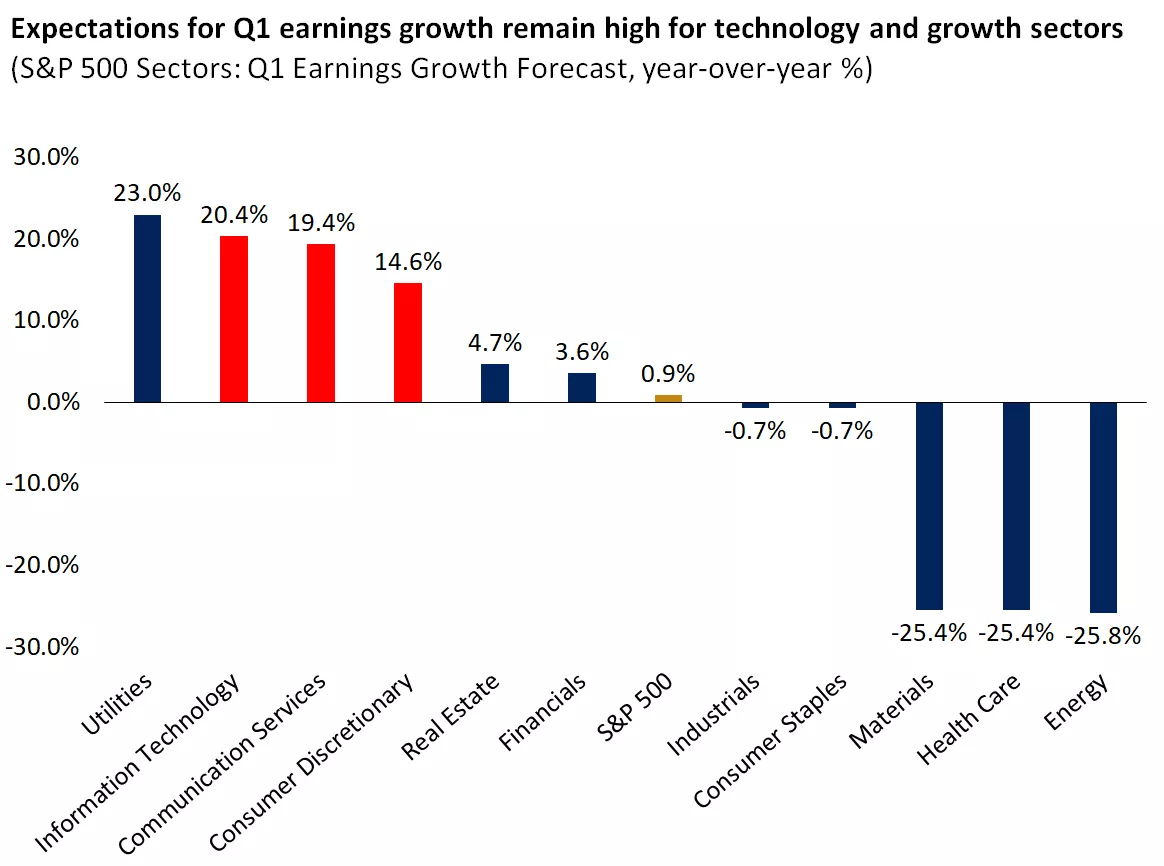

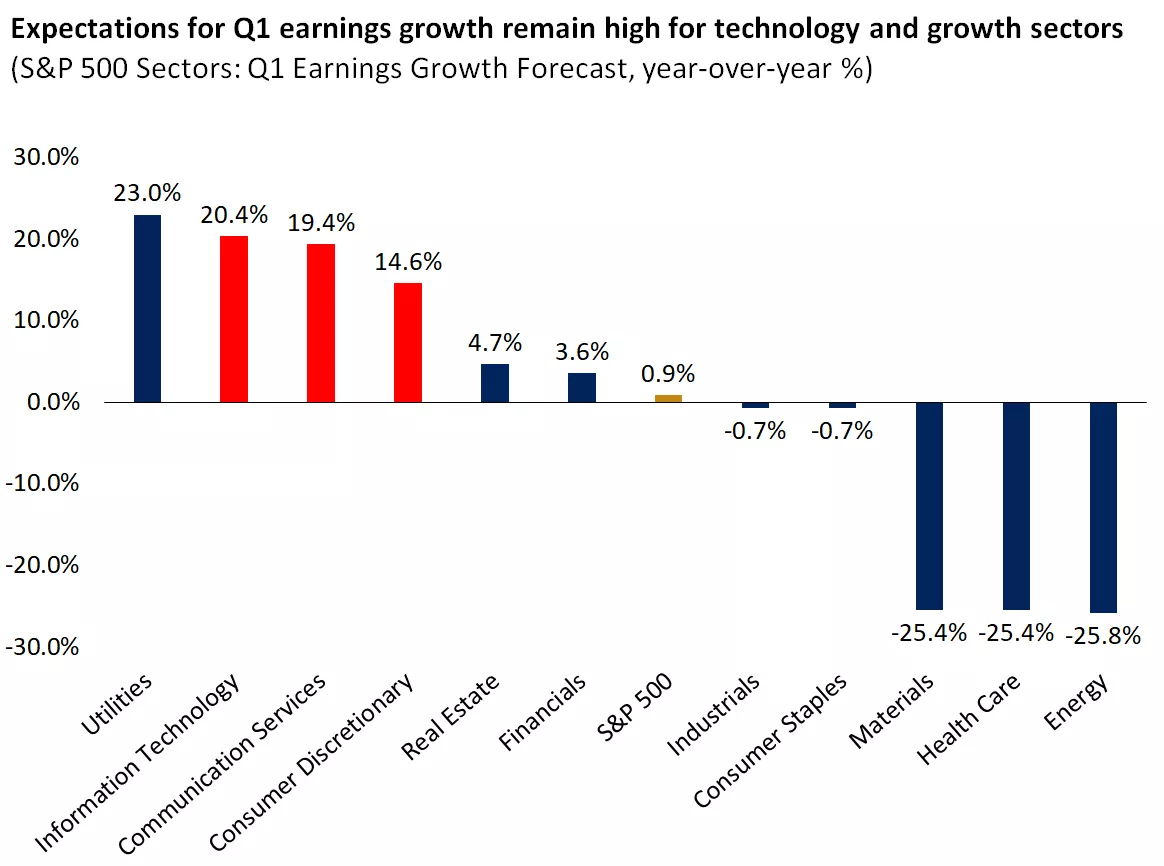

This chart shows the forecasted year-over-year earnings growth for the GICS sectors of the S&P 500 for the first quarter of 2024. Utilities, technology, communication services and consumer discretionary are expected to see the strongest year-over-year growth.

This chart shows the forecasted year-over-year earnings growth for the GICS sectors of the S&P 500 for the first quarter of 2024. Utilities, technology, communication services and consumer discretionary are expected to see the strongest year-over-year growth.

Overall, while the market tone has shifted in recent weeks, with yields moving higher and most stock market indexes moving lower, thus far the magnitude of the pullback has been contained. And after a 25%+ rally in the S&P 500, a period of consolidation or some profit-taking was expected. In our view, the key consideration is whether the recent pullback could turn into a deep or prolonged bear-market environment (with greater than 20% drawdowns across multiple sectors). We don't yet see the scope for this for two primary reasons:

Thus, while the duration and magnitude of any correction is difficult to predict, we believe investors can consider using this period of volatility to rebalance, diversify, and use dollar-cost averaging to gradually add quality investments to portfolios at better prices – ahead of a potential recovery period partly driven by lower rates in the coming year.

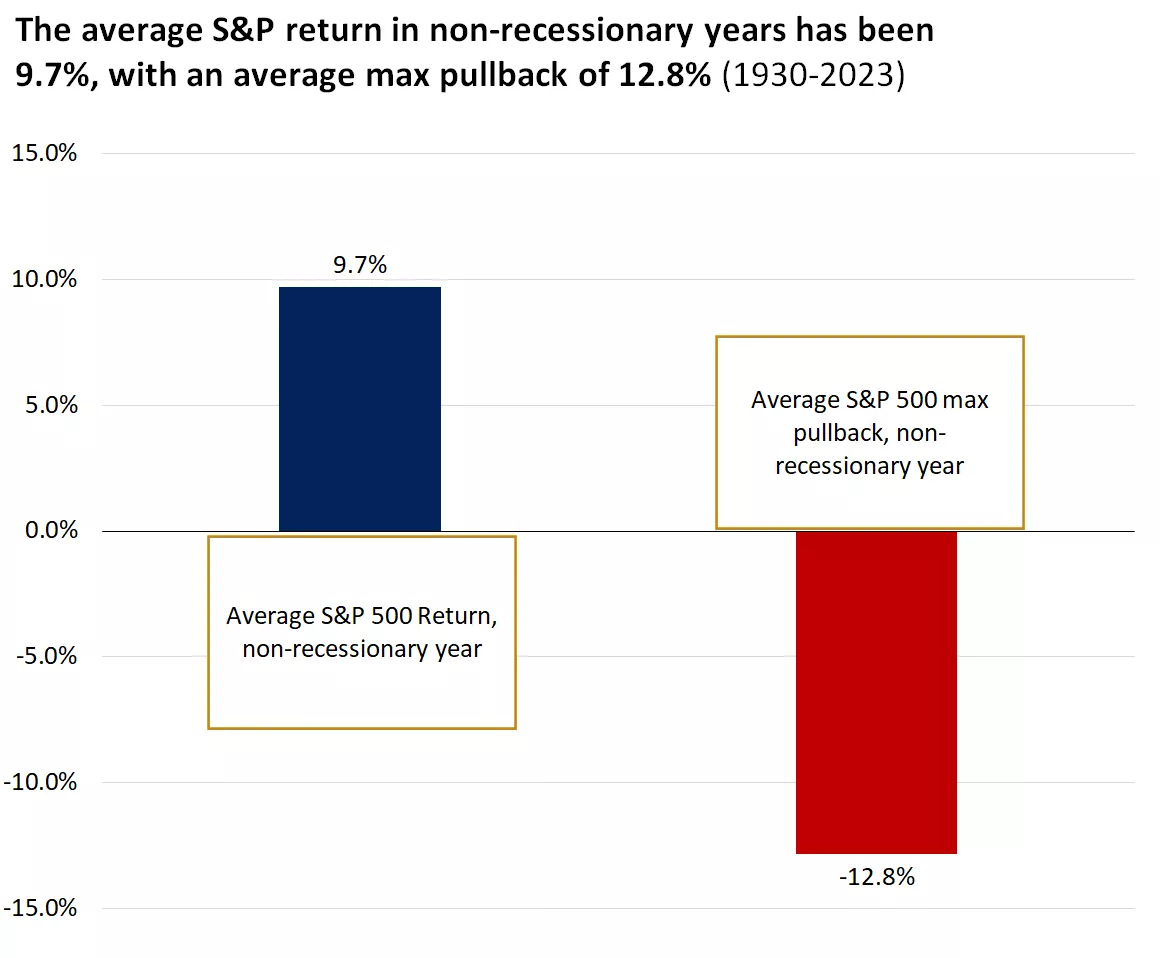

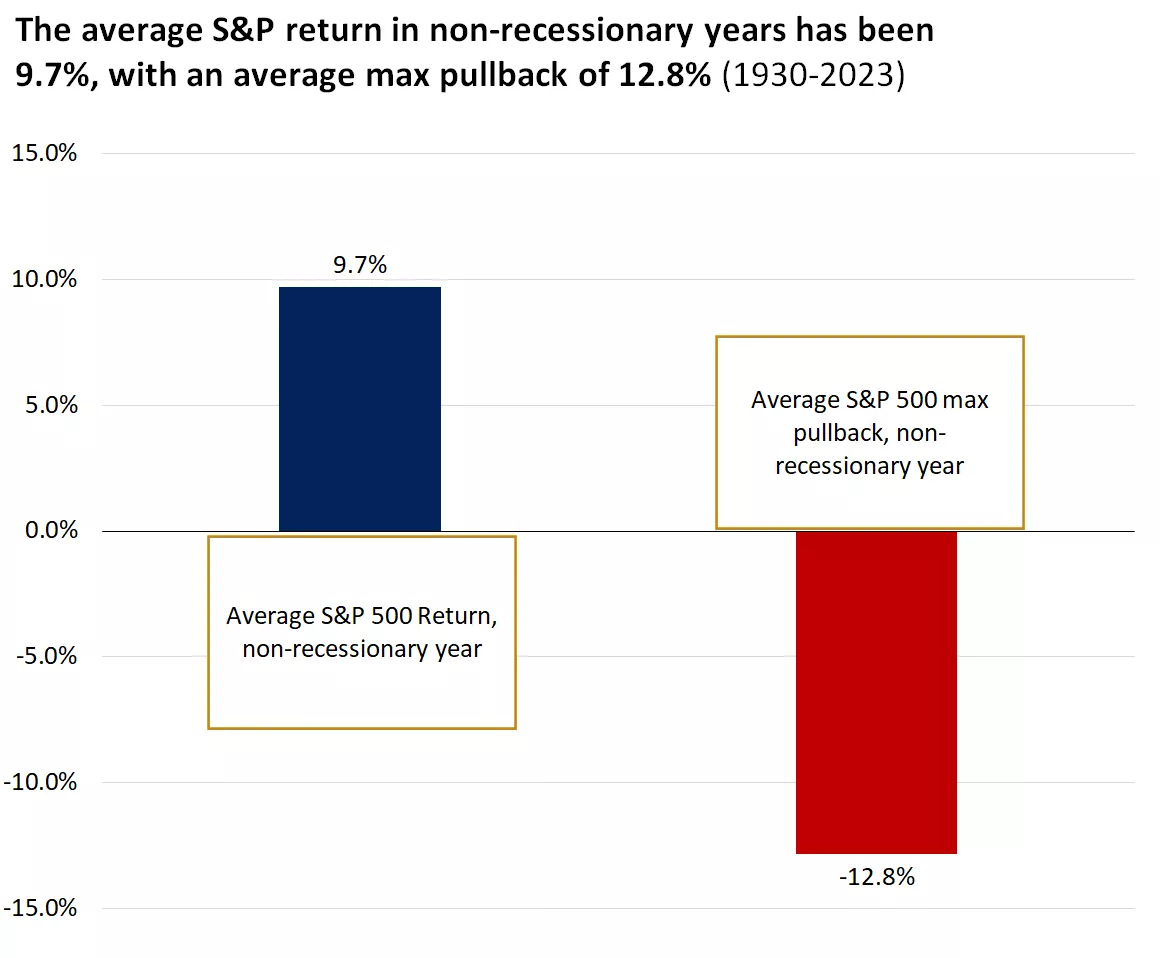

This chart shows that the average S&P 500 return in non-recessionary years since 1930 has been 9.7% while the average yearly max pullback has been 12.8%. Past performance does not guarantee future results.

This chart shows that the average S&P 500 return in non-recessionary years since 1930 has been 9.7% while the average yearly max pullback has been 12.8%. Past performance does not guarantee future results.

Mona Mahajan

Investment Strategist

Sources: 1. CME FedWatch Tool 2. FactSet 3. Bloomberg

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 37,986 | 0.0% | 0.8% |

| S&P 500 Index | 4,967 | -3.0% | 4.1% |

| NASDAQ | 15,282 | -5.5% | 1.8% |

| MSCI EAFE* | 2,236.31 | -2.3% | 0.0% |

| 10-yr Treasury Yield | 4.62% | 0.1% | 0.7% |

| Oil ($/bbl) | $82.13 | -4.1% | 14.6% |

| Bonds | $95.38 | -0.6% | -3.1% |

Source: FactSet, 4/19/2024. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 4/21/2024.

Important economic releases this week include first-quarter GDP and PCE inflation data.

Review last week's weekly market update.

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.