The benefits of investing in stocks

Ask any investor why they own a particular stock, and you may hear about how it feels to own a piece of a well-known company or receive regular dividends. But how can stocks benefit your portfolio? Let’s take a look.

Equities can add diversification and serve as a growth engine to help build value over time:

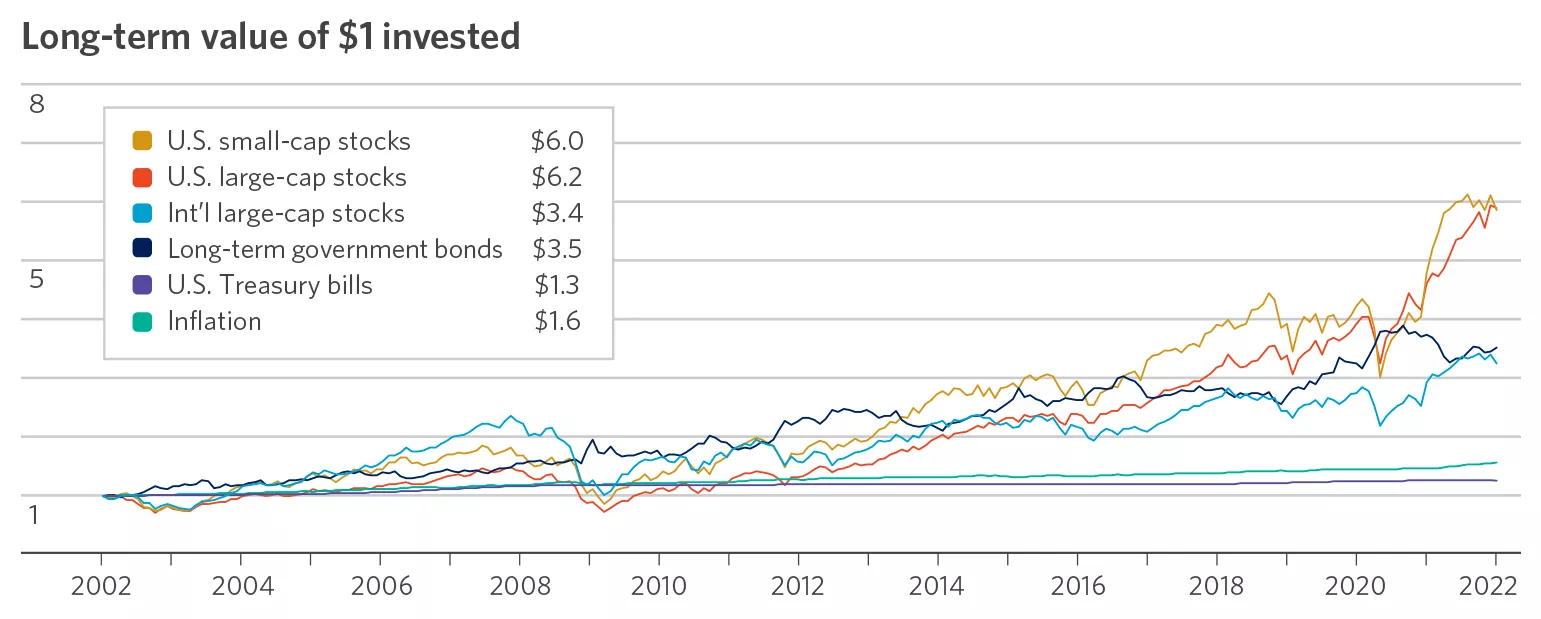

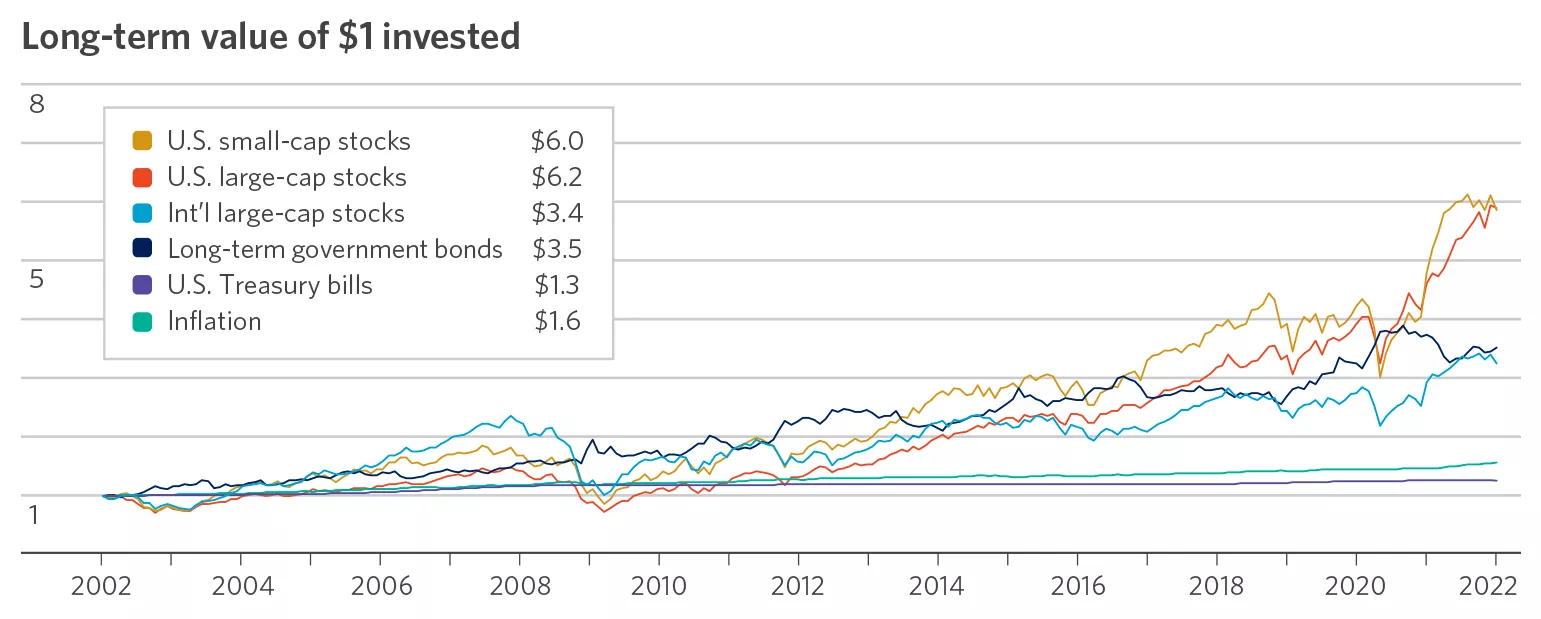

Higher growth potential — Equities serve as a cornerstone for many portfolios because of their potential for growth. In the chart below, you can see that stocks have a long track record of providing higher returns than bonds or cash alternatives. In fact, large domestic stocks have provided an average annualized return of 9.5 over the last 20 years.

But remember — you need to balance reward with risk. Generally, stocks with higher potential return come with a higher level of risk. Investing in equities involves risks. The value of your shares will fluctuate and you may lose principal.

Source: Morningstar. Hypothetical value of $1 invested beginning 1/1/2002 through 12/31/2021. U.S. small-cap stocks represented by the Russell 2000 TR USD Index. U.S. large-cap stocks represented by the S&P 500 TR USD Index. Developed int’l large-cap stocks represented by the MSCI EAFE NR USD Index. Long-term government bonds represented by the IA SBBI U.S. LY Government Index. U.S. Treasury bills represented by the IA SBBI U.S. 30 Day Tbill Index. Inflation represented by the IA SBBI U.S. Inflation Index. An index is unmanaged , not available for direct investment and not meant to depict an actual investment. Returns assume reinvestment of interest and dividends back into the index. Returns do not incorporate the impact of trading, liquidity, costs, fees or taxes a client may experience when investing, which may lower performance results. Historic average annual return incorporates the impacts of compounding over time. Small-cap stocks carry greater risk and have greater market fluctuation than large-company stocks. Treasury bills and government bonds are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and fixed principal value. Special risks are inherent to international investing including currency risks, political social and economic risks. Past performance does not guarantee future results. Diversification does not guarantee a profit or protect against loss in a declining market.

Compounding can work to your advantage when you invest for the long-term.

When you reinvest dividends or capital gains, you can earn future returns on that money in addition to the original amount invested.

Let’s say you purchase $10,000 worth of stock. In the first year, your investment appreciates by 5%, for a gain of $500. If you simply collected the $500 in profit each year for 20 years, you would have accumulated an additional $10,000. However, by allowing your profits to stay invested, a 5% annualized return would grow to $26,533 after 20 years, thanks to the power of compounding.1

Many companies pay dividends on a regular basis, most often quarterly.

Dividends can be used to supplement your income or may be reinvested to buy additional shares:

Keep in mind that dividends can be increased, decreased or eliminated at any point without notice.

Purchasing power is the value of your money shown as the number of goods or services that one unit of money can buy.

Inflation increases the cost of goods and services over time, decreasing the amount your money can purchase.

Equities offer two key benefits that help mitigate the effects of inflation: growth of principal and rising income.

Stocks that regularly increase their dividends give you a pay raise to help balance the higher costs of living over time.

Before your financial advisor recommends a stock, it must pass Edward Jones’ disciplined analysis. We look at factors including balance sheet strength and management’s track record to assess a company’s quality. We think about past, present and future opportunities and challenges for each sector to identify the companies we believe have sustainable competitive advantages for the long term.

Then, we apply strict valuation analysis and consider any specific risks to determine a fair price for the stock. This is how we determine a buy, hold or sell recommendation. Our certified financial analysts and investment professionals challenge one another throughout the process to make thoughtful, well-informed decisions.

Our guidance can be summed up in three points:

1. Focus on quality

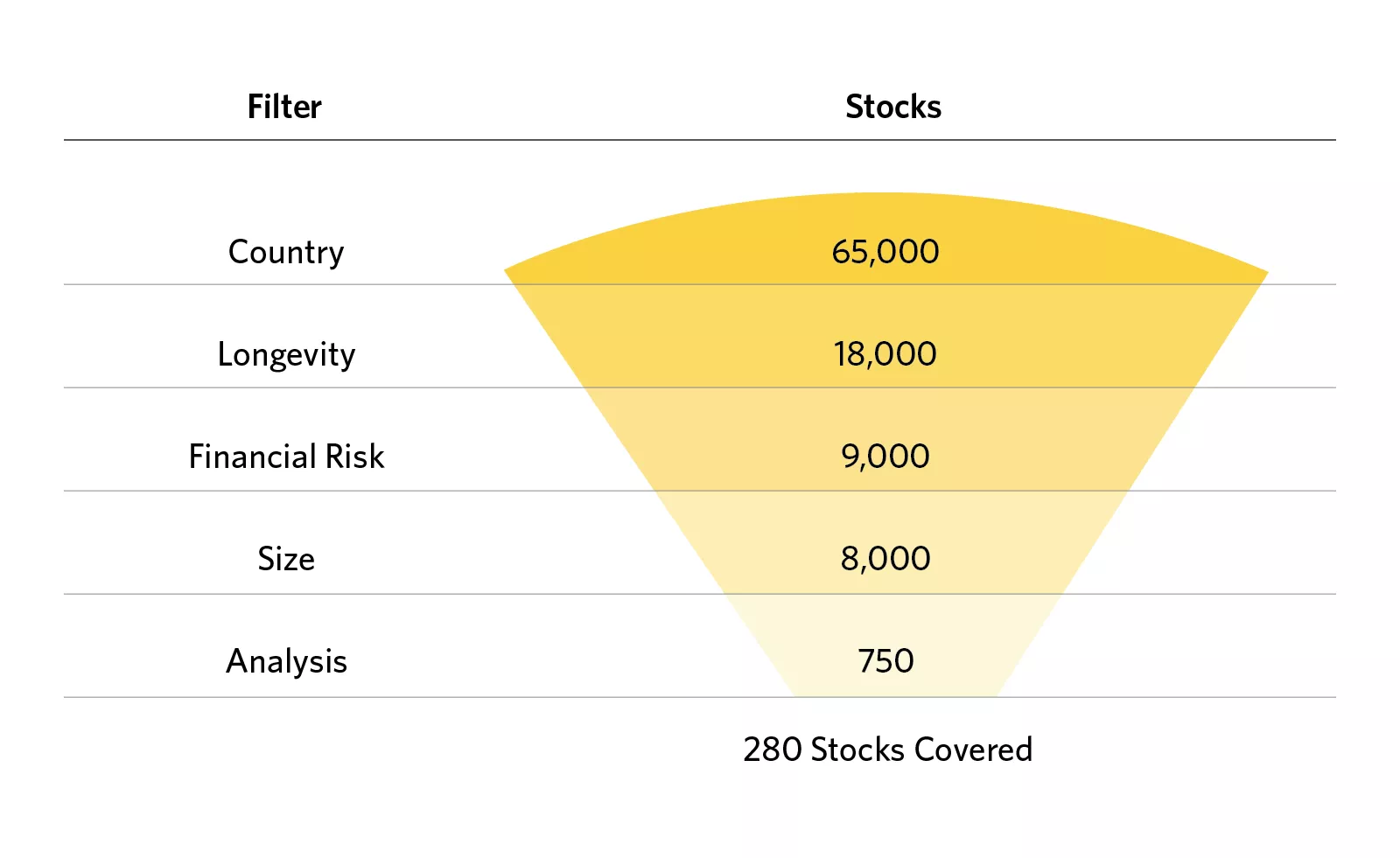

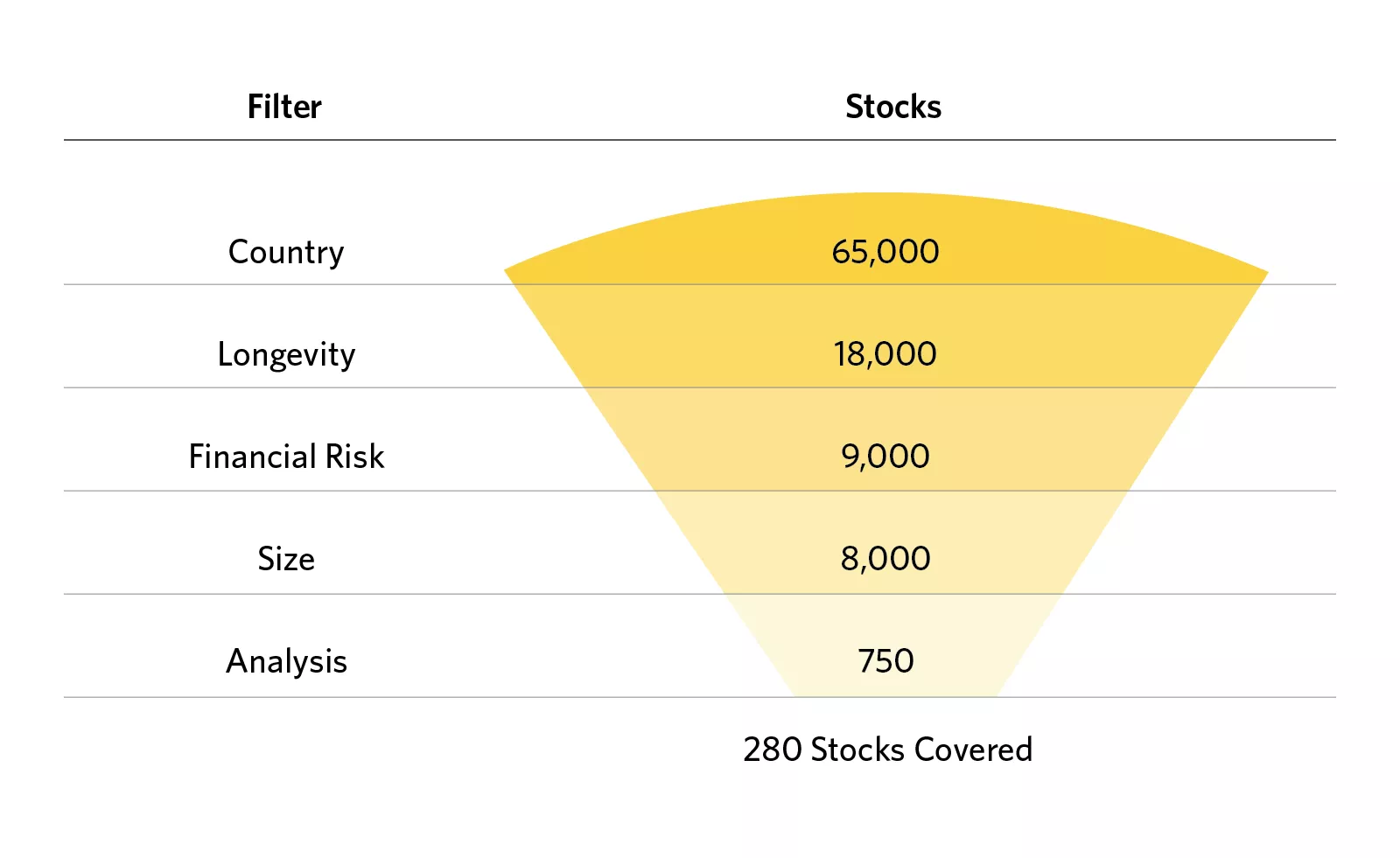

We filter stocks based on geography, longevity, financial risk and a company’s size before applying fundamental and valuation analysis.

Source: Edward Jones

The above chart shows how Edward Jones narrows down a list of 65,000 stocks to arrive at the list of 280 stocks it recommends. The chart features two columns: the left-hand column lists the kind of filter that Edward Jones employs on available stocks, while the right-hand column shows the number of stocks remaining after going through the corresponding filter. The chart show that:

Country: We consider companies primarily based in the U.S., Canada and Europe that follow familiar accounting standards and reporting requirements.

Longevity: The companies we follow need a solid track record — typically at least 10 years of operating history. This means that the company is likely to have faced at least one economic downturn and that management has experience with adversity as well as success.

Financial health: We seek to exclude companies that have a credit quality below investment grade and weak financial strength.

Size: Larger companies usually have a longer track record of success, a broader base of customers and sales, and management depth. We consider companies with at least $2.5 billion in market valuation and at least $1 billion in annual revenue for coverage.

Fundamental analysis: Once companies meet the above criteria, our analysts perform a deep dive into a company’s financial and operating history and project future earnings, cash flow and a fair value of the company.

We believe paying dividends is one important measure of a quality stock. A company’s ability to raise dividends consistently can demonstrate profitability. Companies that have excess cash flow and strong financial positions often choose to pay dividends to attract and reward their shareholders. As a result, they’re often less volatile than stocks that don’t pay dividends.

But beware of reaching for high yields. A higher-yielding stock could be the result of a declining stock price and a signal that investors are concerned about whether the company can continue to pay its dividend. We’ve found these stocks are most at risk of cutting their dividends.

2. Diversify your stock positions

Diversifying your investment portfolio can help protect against market fluctuation. Look at the following factors as you plan to diversify:

Asset allocation: Your portfolio’s asset class mix is one of the most important factors in determining performance. Look at the size of a company (or its market capitalization) and its geographical market — U.S., developed international or emerging market.

When owning individual securities, we recommend that you consider a diversified portfolio of domestic large-cap and mid-cap stocks. To invest in the potentially more volatile asset classes including international, emerging-market and small-cap equities, we favor a diversified investment such as a mutual fund or ETF to help manage risk. Remember, while diversification cannot guarantee a profit or prevent a loss, it can help smooth out performance over time.

Sector allocation: Once you’ve diversified by asset class, we recommend going deeper with diversification across the major market sectors and then industry subsectors. This is because economic cycles and market shocks can affect industries very differently.

Price movement: To help understand the risk you’re taking, consider a stock price’s tendency to move up or down relative to the market. We suggest owning a balanced mix to help smooth performance over time.

Investment concentration risk: At minimum, we recommend owning 15 individual stocks to limit overconcentration in any single stock or sector. If you’re using individual stocks as the primary way to gain large-cap equity exposure for your portfolio, then up to 30 stocks may be necessary.

3. Invest for the long term

Sticking with a long-term investment view requires discipline, and we believe you should buy investments with the intention of owning them through good and bad markets. We base our investment guidance on a long-term view. For our stock recommendations, we typically use a three- to five-year outlook.

Market declines can be unnerving, but bull markets historically have lasted much longer and have provided positive returns that offset the declines.2 Also, market declines often represent a good opportunity to invest. Strategies such as dollar cost averaging and dividend reinvestment can help take the emotion out of your investing decisions.3

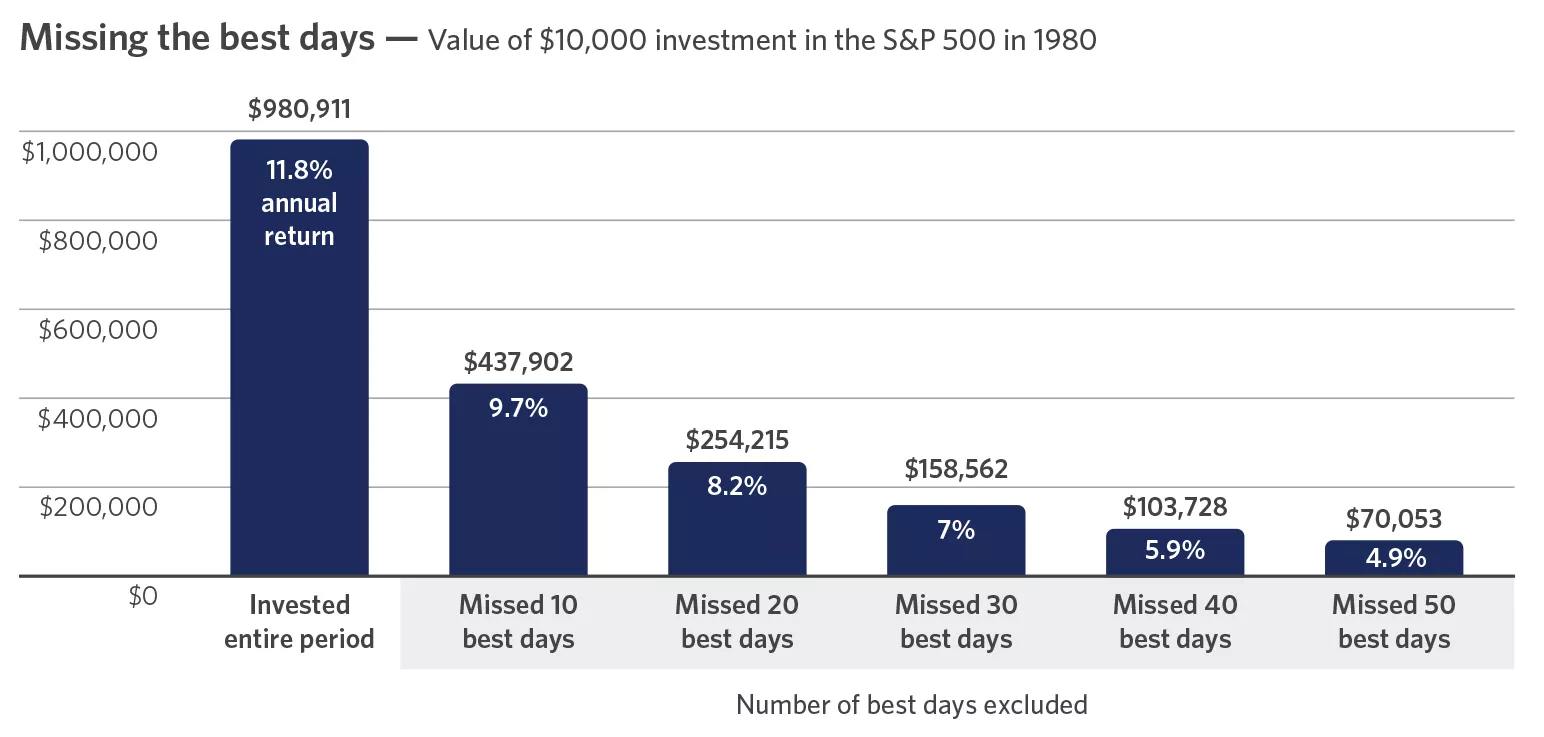

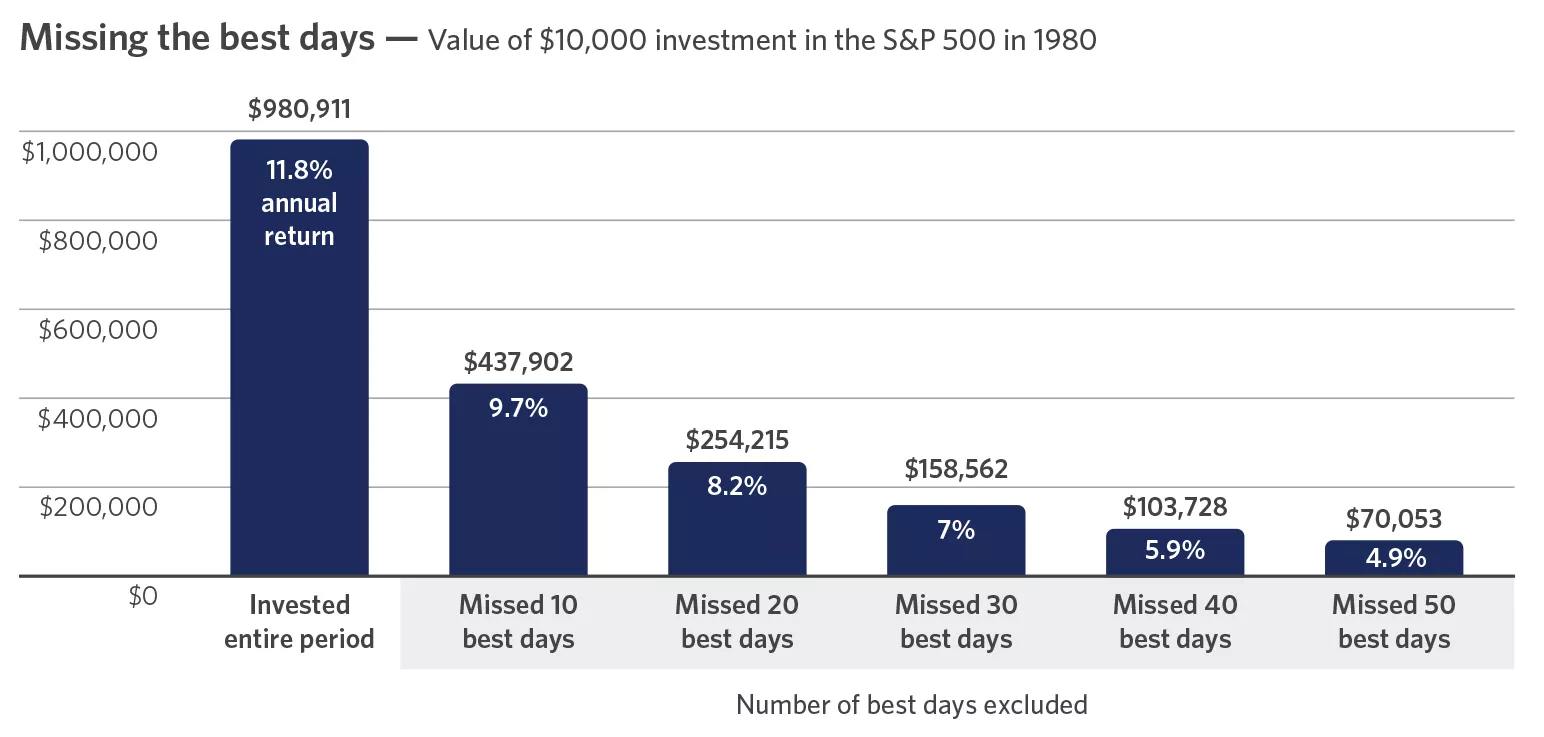

As the chart below illustrates, we believe no one can accurately time the market. An investor who missed the 10 best days of the market experienced significantly lower returns than someone who stayed invested during the entire period, which included times of market volatility. We recommend staying invested with a strategy that aligns with your financial goals.

Value of a $10,000 investment in the S&P 500 in 1980

Sources: FactSet and Edward Jones calculations. 1/1/1980–12/31/2021. These calculations assume the best days, as defined as the top percentage gains for the S&P 500 for the time period designated, would not be included in the return. Total return includes reinvested dividends. These calculations do not include any commissions or transaction fees that an investor may have incurred. If these fees were included, it would have a negative impact on the return. The S&P 500 is an unmanaged index and is not available for direct investment. Past performance does not guarantee future results. Dividends can be increased, decreased or eliminated at any point without notice. This is not meant to depict a real investment.

The above chart uses a series of bars to show how an investment of $10,000 would grow from the end of 1979 until December 31, 2021. The first bar shows that investing for that entire period would turn into $980,911. The following bars show that:

This chart uses a series of bars to show that from the end of 1979 until July 1, 2020, a $10,000 investment would have been worth $980,911 if invested for the entire period. Missing just the 10 best days during that period would reduce the value by more than half, to $437,902.

Time to sell: From time to time, you may need to sell a stock to help maintain proper diversification among sectors or limit overconcentration in a stock position. Significant changes in a company’s fundamentals or a stock’s valuation may also be reasons to sell. And as your portfolio’s objective changes over time, you might also adjust the stocks you own to meet income needs or match your risk tolerance.

What is the best way to invest when you have thousands of stocks to choose from? Your financial advisor looks at the following:

You can own stocks individually or through actively managed mutual funds, index funds or exchange-traded funds (ETFs). Consider the following before you buy individual stocks:

Tax control advantages4: With individual stocks, you control when to buy and sell. Individual stock ownership may reduce your tax burden.

Cost-efficiency: If you intend to hold your equity investment for a long time, buying individual stocks may be cost-effective. Ask your financial advisor for more information on the types of accounts and costs available at Edward Jones.

Customization and transparency: If you want to be involved in the decision-making process, individual stock ownership may suit you. Individual stocks offer the customization and transparency that mutual funds, index funds and ETFs generally do not. Your financial advisor can work with you to build a stock portfolio with only the companies you want to own.

Potential for higher risks: Consider the trade-offs before investing in individual stocks. The risk of losses and price volatility may be higher, especially if your portfolio is not properly diversified.

Now that you’ve learned about stocks and how Edward Jones can help, it’s time to take action. Discuss your options with your financial advisor to find out what stock ownership can do for you.

1 Edward Jones estimates.

2 Source: Ned Davis Research, 1/1/1946-7/1/2020. S&P 500 index total return performance is for illustration only and is not meant to depict an actual investment. Past performance is not a guarantee of how the markets will perform in the future.

3 Dollar cost averaging and dividend reinvestment do not guarantee a profit or protect against loss.

4 Edward Jones cannot provide tax advice. Consult with a qualified tax specialist for professional advice on your tax situation.