Understanding your Social Security options

Your Social Security and retirement decisions typically go hand in hand. And one of the biggest retirement-related decisions you'll make is when to start taking Social Security. That's why we believe it's important to talk with your financial advisor before making this decision. We'll ask questions and listen to better understand your situation. Then we can help outline what options you may have when it comes to Social Security.

This isn't a choice we think you should take lightly. That's because Social Security is one of the most valuable retirement assets you have. Think about it this way: Using the average individual benefit of $1,827 per month in 2023, finding a similar investment paying the same amount for as long as you live, with inflation adjustments and survivor benefits for your spouse, would cost nearly $500,000.*

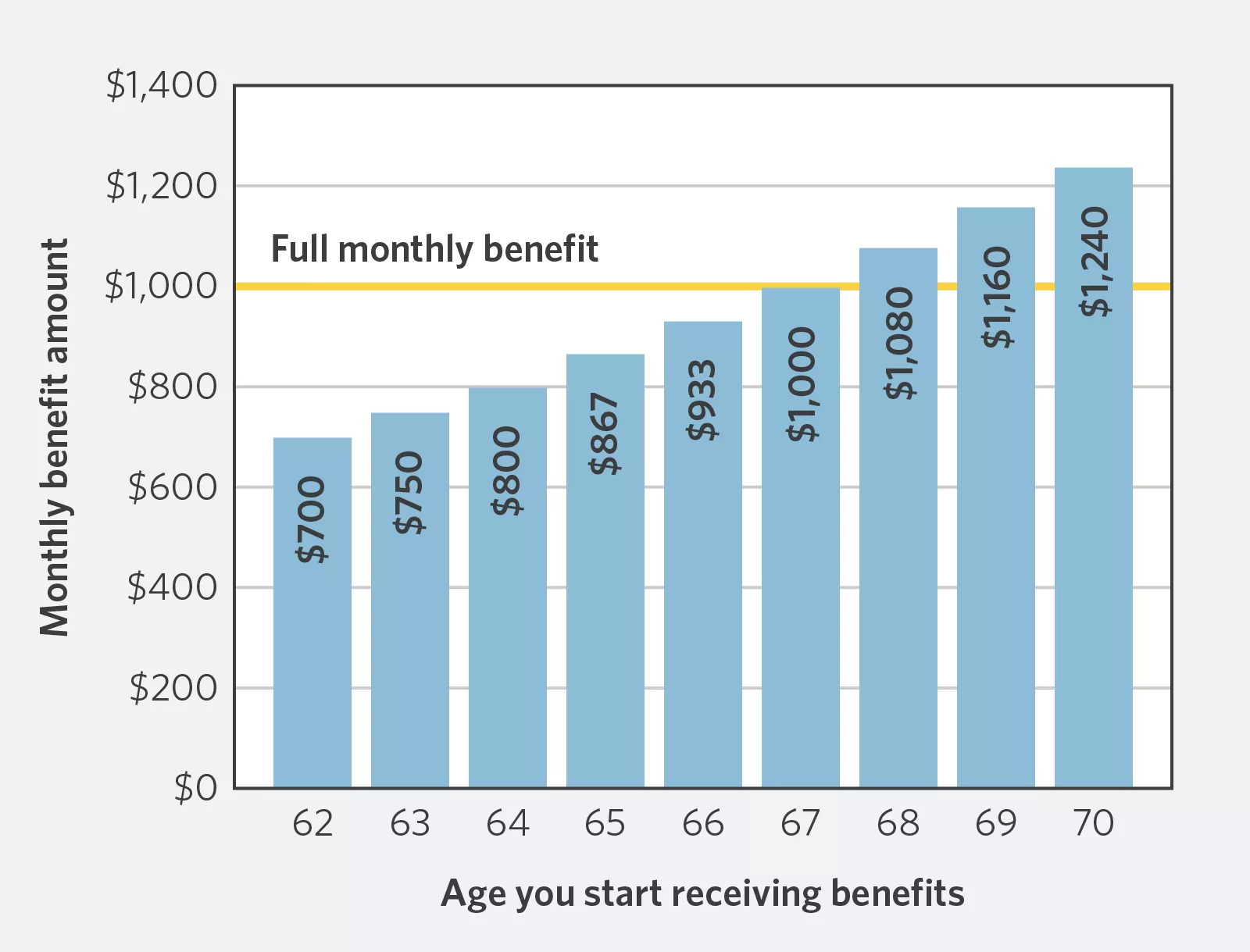

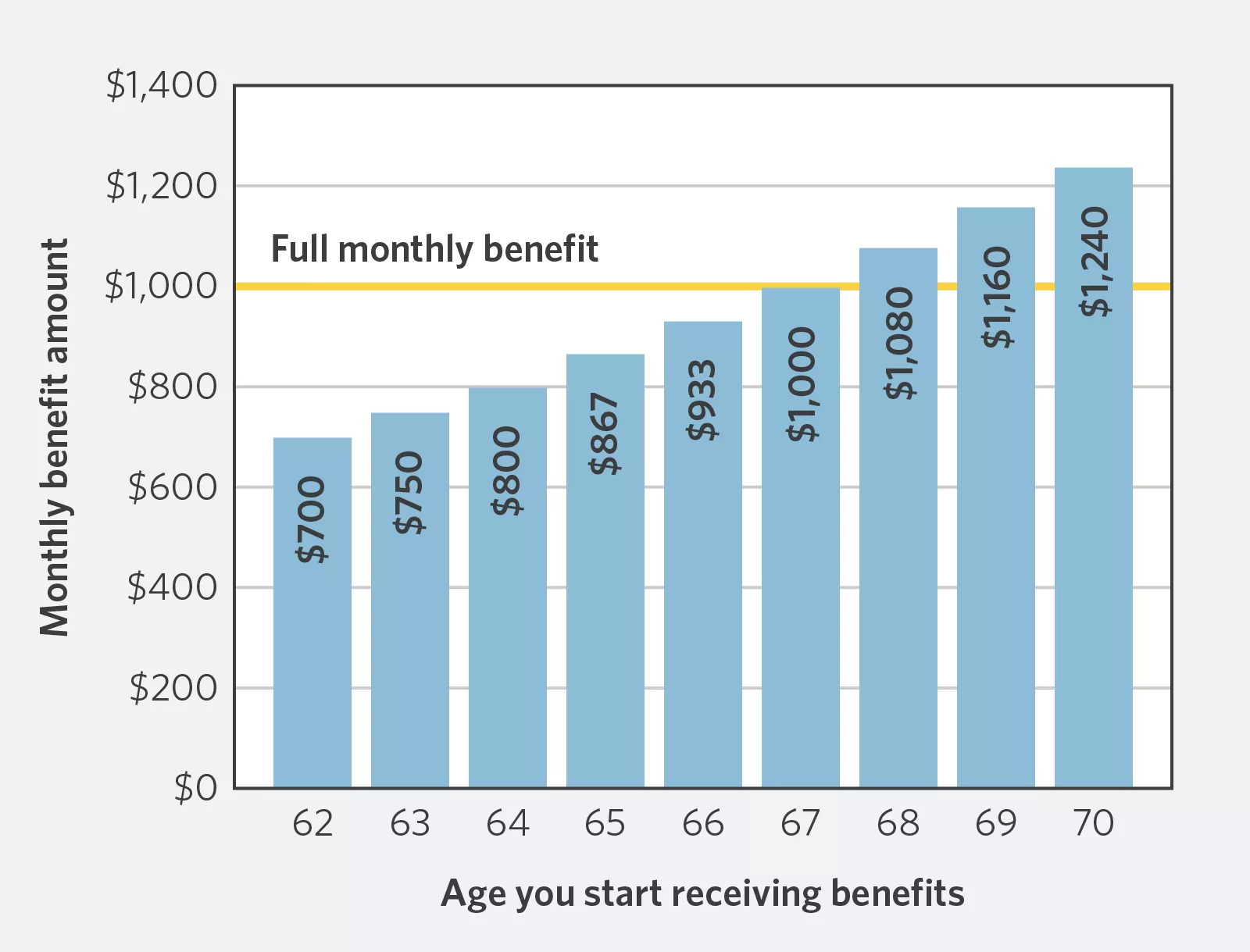

This chart shows how your monthly Social Security benefit differs based on the age you start receiving your benefits. Assuming a $1,000 monthly benefit at full retirement age of 67, you would receive $700 a month if you started receiving benefits at 62. But the benefit can increase incrementally to $1,240 a month – or a 24% increase – if you wait until age 70.

This chart shows how your monthly Social Security benefit differs based on the age you start receiving your benefits. Assuming a $1,000 monthly benefit at full retirement age of 67, you would receive $700 a month if you started receiving benefits at 62. But the benefit can increase incrementally to $1,240 a month – or a 24% increase – if you wait until age 70.

Ultimately, when to take Social Security is a personal and complex decision that we recommend viewing through this LENS: — Life Expectancy, Employment, Need and Spouse.

This chart shows four capital letters spelling LENS, which stands for the four things to consider for Social Security: Life Expectancy, Employment, Need and Spouse.

This chart shows four capital letters spelling LENS, which stands for the four things to consider for Social Security: Life Expectancy, Employment, Need and Spouse.

Since benefits change based on what age you begin taking Social Security, this decision is in some respects a question of receiving a smaller amount for a longer period of time or a larger amount for a shorter time. So, how long you (and your spouse) expect to live plays an important role.

The better your health and the longer you and your spouse expect to live, the more it may make sense to take Social Security later. This assumes you don’t need your benefit now and aren’t putting undue strain on your investments to make up the difference, as the “life expectancy” of your portfolio also can be affected by your decision.

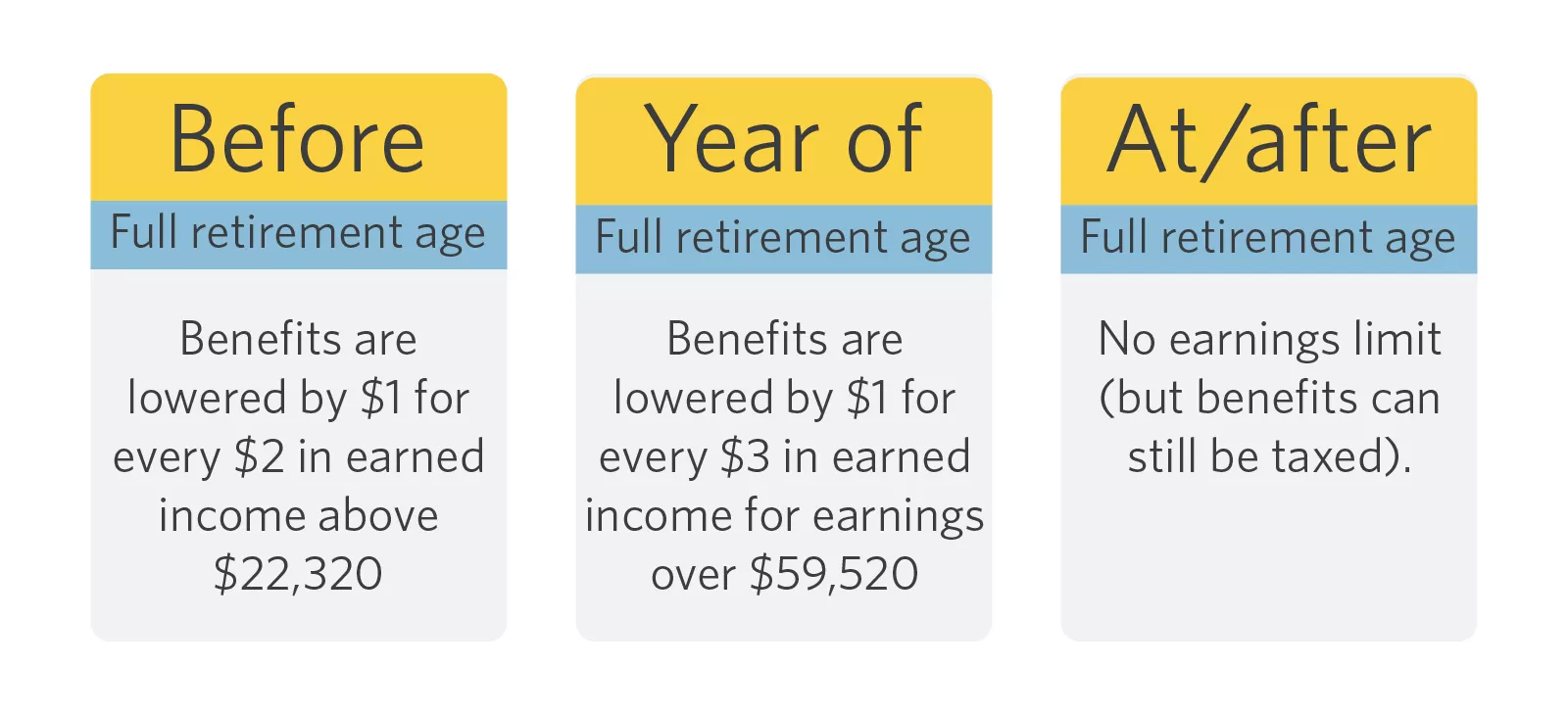

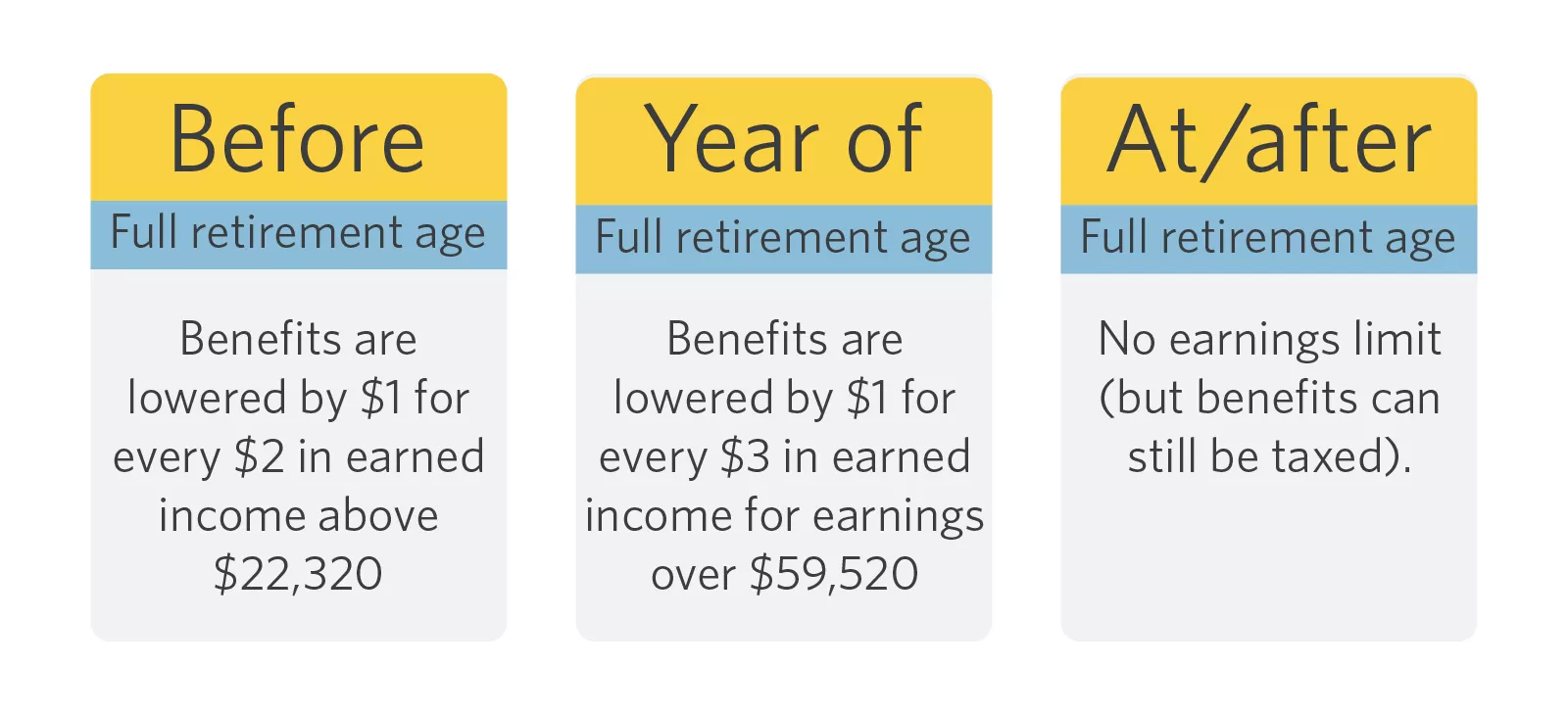

You probably don’t plan on slowing down when you retire and may even plan to continue working. However, if you take Social Security early, working at the same time can really affect your benefits.

That's because your benefits are lowered by $1 for every $2 in earned income above a certain amount ($22,320 for 2024). This changes to $1 for every $3 in earned income the year you reach your FRA for earnings exceeding $59,520.

It's important to note that this is only earned income and doesn’t include income from investments, pensions or Social Security itself.

If you plan to continue working (and have meaningful earned income), it may not make sense to take Social Security early. After you reach FRA, there is no adjustment in benefits based on how much you earn.

Before your full retirement age, your benefits are lowered by $1 for every $2 in earned income above $22,320. In the year of full retirement age, your benefits are lowered by $1 for every $3 in earned income for earnings over $59,520. At and/or after full retirement age, there's no earning limit but your benefits can still be taxed.

Before your full retirement age, your benefits are lowered by $1 for every $2 in earned income above $22,320. In the year of full retirement age, your benefits are lowered by $1 for every $3 in earned income for earnings over $59,520. At and/or after full retirement age, there's no earning limit but your benefits can still be taxed.

If you have control over when you retire, analyze what it would cost to live your desired lifestyle after you stop working full time. Then, add up where the money comes from to provide for this lifestyle – such as outside income, Social Security and investment resources – to determine whether these sources will cover your spending needs.

Ultimately, you may determine that your income, including Social Security and portfolio withdrawals, isn't going to be enough, and it may make sense to delay retirement. This additional time could increase your potential income in retirement by providing:

There are two types of benefits for spouses: spousal and survivor.

Claiming Social Security later could be one way you provide for your spouse. If you are the higher wage earner (with the higher Social Security benefit) and either are older than your spouse or expect your spouse to live longer than you, it may make sense to delay taking Social Security to maximize the survivor benefit if you pass away prematurely.

For spousal benefits, you're entitled to up to 50% of your spouse's benefit or your own, whichever is higher. When it comes to survivor benefits, you're entitled to up to 100% of a deceased spouse's benefit or your own, whichever is higher.

For spousal benefits, you're entitled to up to 50% of your spouse's benefit or your own, whichever is higher. When it comes to survivor benefits, you're entitled to up to 100% of a deceased spouse's benefit or your own, whichever is higher.

Taxes shouldn’t be a key driver of when you decide to take Social Security. However, it’s important to understand how your benefits could be taxed when determining your after-tax income in retirement:

Learn more about Social Security taxes.

With all this in mind, it's important to remember that Social Security was never intended to cover everything. It provides about 40% of pre-retirement income for an average earner who claims their benefit at full retirement age, according to the Social Security Administration. That's why it's so important to work with your Edward Jones financial advisor to position your investments to help provide for your income needs throughout retirement.

Before making any decisions, be sure to check with the Social Security Administration and consult with your qualified tax advisor.

*Edward Jones estimates based on CANNEX Immediate Annuity Quote System – 4/3/2023. Example assumes a joint life annuity, 67-year-old male and female, 3% inflation rate and the 2023 average benefit level from the Social Security Administration.