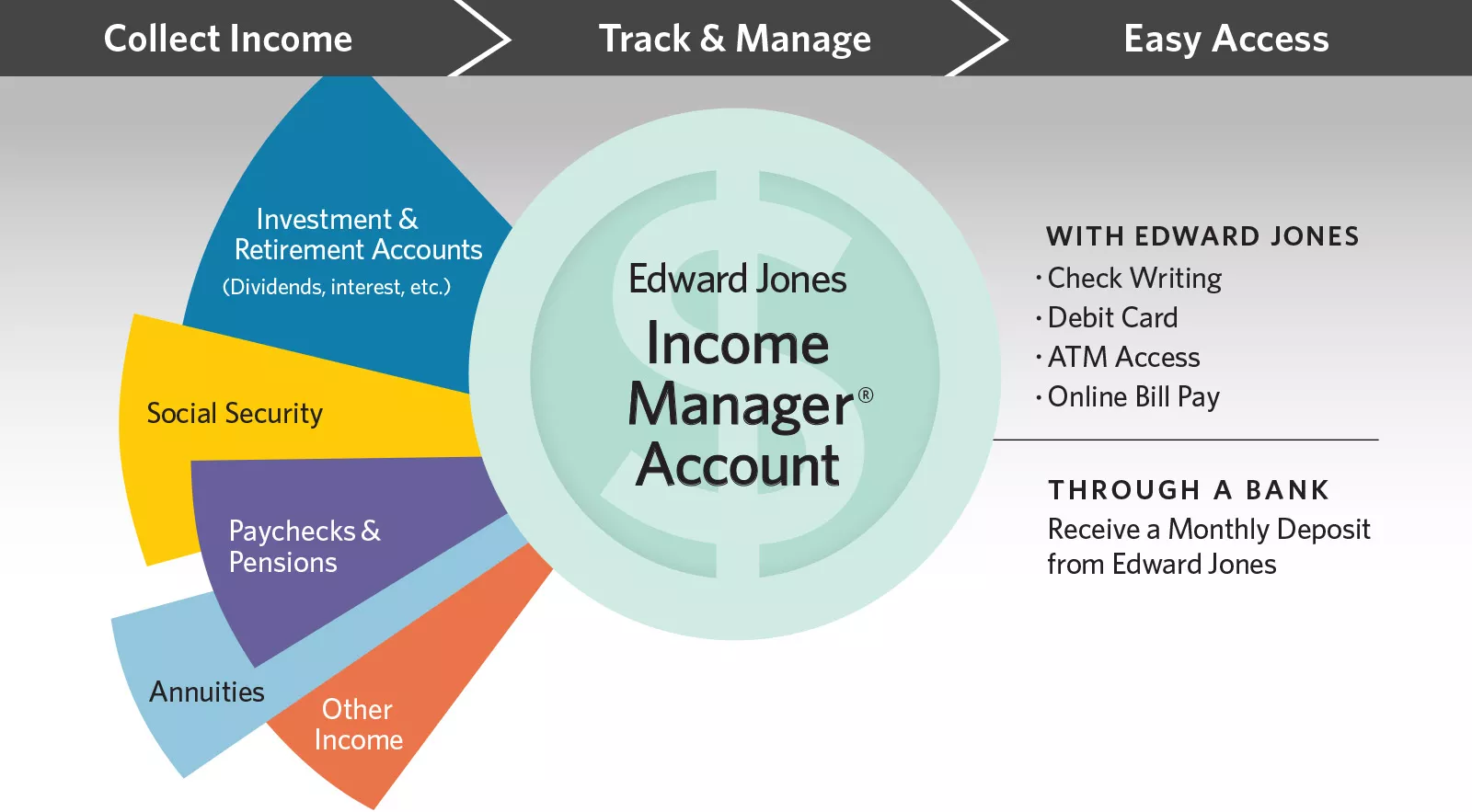

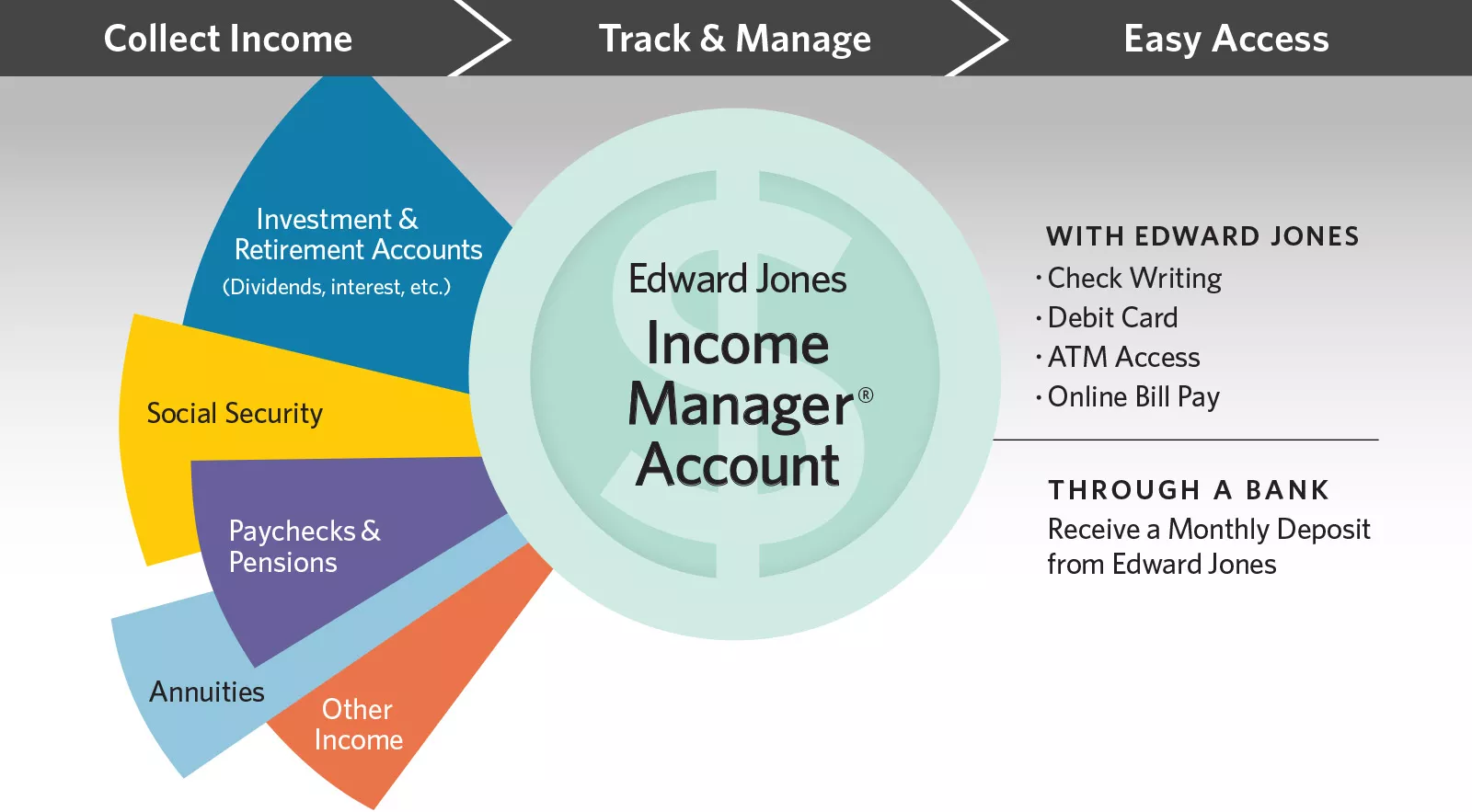

The graphic illustrates the three key ways the Edward Jones Income Manager® account can help you. First, the account collects your income from sources such as investment and retirement accounts, Social Security, paychecks, pensions and annuities. Next, the account helps you track and manage your income. Third, the account enables you to access your money in multiple ways, including check writing, debit cards, ATM access, online bill pay and a monthly deposit to your bank.

Edward Jones Income Manager® account

Simplify, track and access your accounts with the Edward Jones Income Manager® account.

Whether you're nearing retirement or already living it, you’ll need income to cover everyday expenses as well as unexpected costs. If you have multiple income sources – such as paychecks, annuities, retirement accounts or Social Security – it can be difficult and time-consuming to keep track of it all.

Simplify, track and access

The Edward Jones Income Manager® account can help you:

- Simplify – by making it easier to collect income from multiple sources.

- Track – by estimating your income and spending for the next 12 months. This will help you identify and address potential shortfalls before they happen.

- Access – by providing access to your money through checks, debit card, online bill pay and other convenient options.

Our Income Manager also helps keep your everyday spending money organized and separate from your long-term investments. The Income Manager account only holds cash – not investments like stocks, bonds or mutual funds. So you can use the money within Income Manager toward everyday expenses while your long-term investments continue to work for you.

Features

- Personalized cash flow analysis reports

- Earned interest on account balances through the Edward Jones Insured Bank Deposit Program1

- FDIC coverage up to $5 million ($10 million on joint accounts)1

- Check writing

- Visa® debit card with zero fraud liability

- Unlimited online bill payment

- Overdraft coverage available2

- Online access to transfer funds, being able to view and download account activity, and access to personalized cash flow analysis reports

- Easy-to-reconcile statements featuring a running balance

- No initial minimum deposit

Available benefits

If your Pricing Group Assets Under Care with Edward Jones are at least $250,000 and you have an Income Manager account, you may qualify for fee waivers on the following service within your Income Manager account:

Up to five ATM surcharge rebates per month at no charge

Talk to your financial advisor for details.

How we can help

See Edward Jones Income Manager® Terms and Conditions or Edward Jones Income Manager® Disclosure for more information, or call your local Edward Jones financial advisor.

Important information:

1FDIC coverage is available through the Insured Bank Deposit program. Up to $10 million of coverage is available for joint accounts of two or more people. For more information, including the program disclosure document, go to www.edwardjones.com/bankdeposit. For more information on FDIC insurance, go to www.fdic.gov.

2Overdraft coverage requires that an eligible Edward Jones brokerage account with an available Personal Line of Credit or an Edward Jones Flex Funds® account with an available balance be linked to your Edward Jones Income Manager® account. The Personal Line of Credit for overdraft coverage is a margin account. Borrowing against securities has its risks and is not appropriate for everyone. For more information, please refer to the Margin Disclosure Statement and Statement of Credit Terms.