Start by asking yourself how a recession could affect your income. Are you on a fixed or variable income? Do you run your own business? Are you in an industry that is sensitive to economic downturns? If you conclude a recession is likely to impact your livelihood, it might be good to start thinking how you can earn extra income if needed. Alternatives can include freelancing, taking up a side hustle, joining the gig economy, tutoring or even renting a spare room in your basement are ideas.

Now might also be a good time to strengthen your professional network and update your resume. Don’t wait until your hours are cut or you lose your job to prepare for the job search.

After considering how your income might change, you might conclude that you will need to reduce your spending during a recession. If so, start to review your budget to identify areas where you could trim spending if your income were to decline. For example, canceling subscription services you don’t use often, switching to generic brands or reducing spending on entertainment and eating out are areas where you can save money without sacrificing too much of your lifestyle. It might also be a good idea to postpone large purchases (like buying a new car). Instead, you can use that money to build or strengthen your emergency fund. If you need to make a large purchase, try to avoid taking on new debt to pay for it.

As part of reviewing your spending, be sure to review all your debts, including the amount owed, term, interest rate and required minimum payments, and formulate a plan to pay them down. Prioritize making all the minimum payments first and then focus on your high interest rate debt.

If you have multiple debts with high interest rates and a good credit score, you can explore whether consolidating debt makes sense. Consolidation can lower your monthly payments and interest rates, but you may incur fees and it could negatively impact your credit score.

Even if you manage to earn extra income and cut back on spending, there might still be a gap between your take-home pay and the amount needed to cover your essential needs during a recession. Having an emergency fund in place can help you cover any gaps without having to sell investments, tap into your retirement account or take on debt.

We recommend having 3 to 6 months of living expenses in an emergency fund. So, if you don't have an emergency fund, now is the time to start building one. If you already have one, evaluate whether you are still comfortable with the amount saved based on your income stability and flexibility to adjust spending.

If you were to lose your job or your hours were reduced, you might also lose any insurance tied to your employer, such as health, disability, or life insurance. It’s important to maintain any coverage lost as unexpected events can derail your financial strategy.

So, you might want to start looking now into alternatives and costs of maintaining these coverages on your own when planning your recession budget. By knowing your options, you can prevent gaps in coverage and prepare for the higher costs of obtaining this coverage individually.

For any insurance policies you’ve purchased individually, such as home or auto insurance, now might be a good time to see if you can lower your premiums without sacrificing coverage. This could help create more room in your budget.

When fears of a recession are high, it can stir an emotional response and a call to action when it comes to investing. The instinct is to sell stocks or bonds with the thought that they will underperform during a recession and then buy back into the market when it is over. However, this could lead to underperformance in investor portfolios. Looking closely at stock market performance, we see that stocks typically act as a leading indicator of a recession. That is, by the time a recession materializes, stocks have already priced in much of the slowing growth and the pain has already been felt.

Equity market performance can be quite good at the tail end of a recession, as this is when stocks tend to bottom and even start to rebound. However, investors may not have the opportunity to buy into the more favourable market prices once the recession is over. We also see that some of the best performance days in stock market history come during bear markets and recessions. Missing out on the best days can mean lower long-term returns.

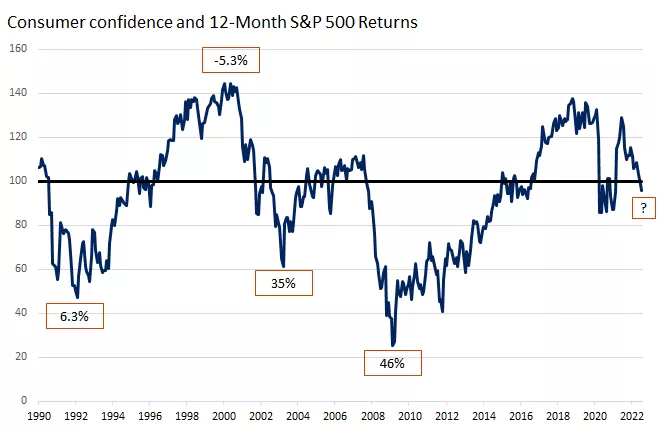

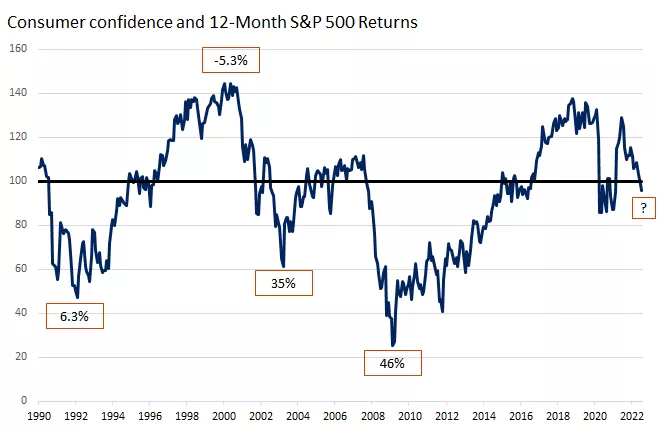

Finally, trying to time the market amid souring consumer confidence can mean getting out at the wrong time or anticipating a recession that never materializes. Falling sentiment and confidence doesn't always lead to a recession, and in fact, recessions sometimes can happen when sentiment is high.

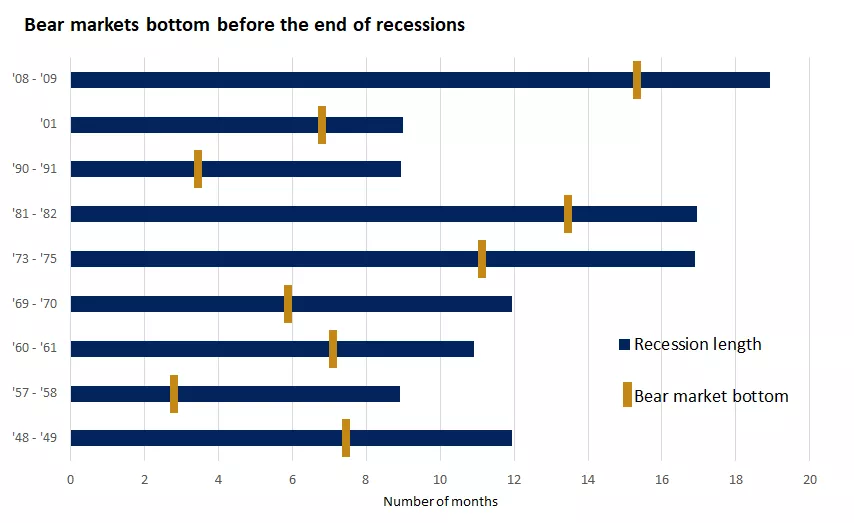

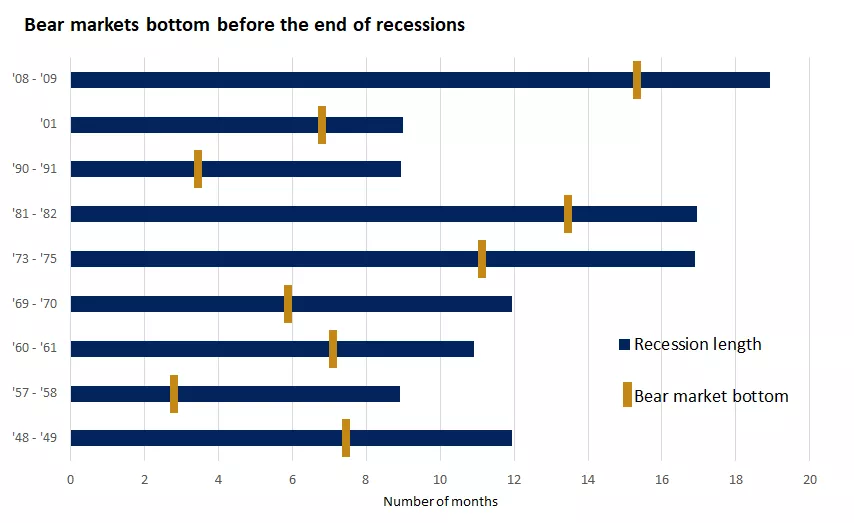

We recommend remaining fully invested and exercising investor discipline, even though it might seem like there are dark economic clouds ahead. And the good news is that the bear markets that are usually associated with recessions tend to be short-lived. These bear markets last, on average, about 7 months, while the bull markets that follow have historically lasted more than 12 months.

Source: FactSet, past performance is not a guarantee of future results. The S&P 500 index is unmanaged and cannot be invested in directly.

This chart displays the general trend that equity markets have tended to do well in periods of low consumer confidence in the past while performed poorly when confidence is very high. For example, the 12-month performance of the S&P 500 in 2009 at the lowest consumer confidence data point was 46%.

Source: FactSet, Edward Jones

The graph shows the duration of past recessions and the point in time when bear markets bottomed.

Experiencing short-term market declines can be difficult. Understanding the time horizon for your financial goals and revisiting appropriate long-term performance expectations for your portfolio can make it easier to ride the ups and downs of an economic cycle.

Taking a closer look at consumer sentiment and stock market performance, we see that stocks tend to do well when sentiment is souring and bottoming. Not all periods of falling investor and consumer sentiment lead to recessions, but valuations typically fall as sentiment falls, which can translate into better long-term performance for buyers of stocks. As stocks moved into the bear market territory, lower valuations but still-strong consumer spending have set up strong support for equity market returns, which we believe improves long-term return potential.

Similarly, bonds have seen a run-up in yields this year while prices have fallen. We think yields have probably already peaked and will trade in a range-bound fashion for the rest of this year. In our view, much of the rapid move higher in bond yields is likely behind us, and historically this could offer a good time to buy bonds, particularly for long-term investors. If a recession does materialize, bonds tend to hold up better than equities and offer diversification benefits as well. In addition, yields will likely fall, and prices will rise, translating into better returns for investors. While lower stock valuations and higher bond yields provide support to forward return potential, periods of volatility should continue to be expected as we progress through the cycle.

The amount of risk appropriate for your portfolio is unique to you and your life circumstances. Income, goals, debt, investment horizon, and age can all impact the amount of risk you should take when investing. Too much risk in your portfolio, and you risk losses in the short-term that you might not have expected or were prepared for. Not enough risk in your portfolio, and long-term goals might not be achieved.

We think now is a good time to revisit your comfort with risk as circumstances can change, and your capacity for risk might have increased or decreased since the last time you looked at it. Your risk tolerance plays a crucial role during periods of market volatility as it can affect your investment goals. Investing is all about balance, including balancing the return you need to reach your goals in relation to your comfort level with risk. Determining the most appropriate balance for you will help you build and maintain an investment portfolio for your situation. Check-in with your financial advisor if anything has changed in your life circumstances.

Diversifying your investments across a variety of stock and bond asset classes, Which is often called asset allocation, can help you manage your portfolio’s risk. Determining an appropriate mix of asset classes can help ensure your portfolio is aligned with your comfort with risk and financial goals.

Bonds have historically had lower levels of volatility and risk accompanied by lower total returns, while stocks have higher levels of risk and returns. Additionally, higher-quality bonds, such as Government of Canada bonds, are more likely than high-yield bonds to move in the opposite direction of stocks, which can enhance diversification when financial conditions are worsening. International investments can provide additional diversification benefits.

Therefore, we believe it’s important to look at your exposure to each asset class to ensure your portfolio is diversified across various segments of the market, helping to prepare you for changing market conditions.

A focus on quality investments can help cushion the impact economic downturns may have on a well-diversified portfolio. Higher-quality segments of the market tend to be more stable than lower-quality investments. Additionally, as we progress through the later stages of the economic cycle, we believe higher-quality asset classes are more likely to outperform lower-quality counterparts.

Therefore, in our view, investors are likely to benefit from a focus on large-cap stocks over small-cap stocks and companies with strong balance sheets. We also favor U.S. investment-grade bonds, particularly given the higher yields relative to the beginning of 2022.

Rebalancing is a good option to keep your portfolio in line with your risk tolerance and return expectations. Your portfolio mix of stocks, bonds, sectors, and styles can shift as different asset classes have non-uniform performance over time. Bringing your portfolio back to your optimal mix helps to mitigate any performance or drawdown surprises during periods of falling stock or bond prices. It has the added benefit of selling high and buying low. For example, if stocks fall significantly, rebalancing will allow for the sale of bonds (relatively expensive) and the purchase of stocks (relatively cheap). Rebalancing also helps with diversification as a single investment with strong outperformance can start representing more of your portfolio than your ideal mix of investment would suggest is appropriate.

There are generally two approaches to rebalancing:

- Threshold rebalancing — This occurs when your portfolio mix drifts by more than a set rate (such as 5% or 10%) from your original target. Threshold rebalancing occurs whenever your portfolio shifts, rather than a set schedule, but can have higher trading fees and tax implications.

- Calendar rebalancing — Calendar rebalancing is a scheduled option with a pre-defined set of dates (such as quarterly) where rebalancing takes place. This can result in more portfolio drift than threshold rebalancing but can help limit fees and taxable gains.

Whether calendar or threshold rebalancing, bringing your portfolio mix back into line is a smart move, in our view, that helps to keep your portfolio aligned with your comfort with risk and financial goals in periods of heightened economic uncertainty.