Do you have these 3 financial goals covered?

Meagan Dow, Senior Strategist, Client Needs Research, CFA®, CFP®

Many of our financial goals are unique to who we are, what we want to accomplish and where we’re at in our lives. But there are three goals that we believe everyone should address. Have you incorporated them into your financial strategy?

1. Retirement

This is where many of us start, so it’s likely you’ve given at least some thought to your retirement.

Saving for retirement

It can be difficult to save for retirement when it seems so far away, but time is your friend when it comes to saving money.

- Are you taking full advantage of any employer matches for retirement savings?

- Are you increasing your contributions each year?

- If you don’t have access to employer plans, have you talked to a financial advisor about other tax-advantaged savings options?

- Are your investments allocated properly?

You may not feel like you can contribute as much as you want or should, but any progress is better than none. The investments you make now can significantly reduce how much you’ll have to save later.

Getting ready for retirement

You can see the light at the end of the tunnel! In the years leading up to retirement, you should be able to make your retirement plan more specific. You have a better idea of what your expenses will look like, how much you’ll have saved and what your retirement priorities are. If you’re behind, this is the time to try to catch up.

You’ll also want to start thinking about key decisions:

- If you’re retiring before 65, what’s your plan for health insurance?

- When will you start taking Social Security?

- Should you start shifting your investments to reduce the amount of risk you’re taking?

This transition comes with many decisions, so being intentional as you work through them can go a long way as you prepare for the retirement you’ve been hoping for.

Living in retirement

Achieving many financial goals is like crossing a finish line. You saved up for your dream vacation, finally booked the trip and made lifelong memories. But retirement is different. On the other side of the retirement finish line, there are potentially decades of living off your savings, which is why you should revisit your retirement strategy even after you’ve achieved it.

On the one hand, you don’t want to run out of money. A financial advisor can help you find a sustainable withdrawal rate and identify areas in which to make adjustments to help keep you on track.

On the other hand, many people struggle to make the switch from saving for retirement to tapping into it. They have trouble enjoying the retirement they’ve worked so hard for. This is where a financial advisor can run scenarios and help illustrate, for example, that you really can afford to take the entire family on a trip.

Revisiting this goal while retired is all about making the most of your retirement.

2. Preparing for the unexpected

Planning is important to achieving our goals, but we all know life doesn’t always go to plan. Preparing for the unexpected is about creating guardrails to minimize the impact of unexpected challenges and ultimately create better financial stability for you and your family.

Have you identified relevant protection strategies?

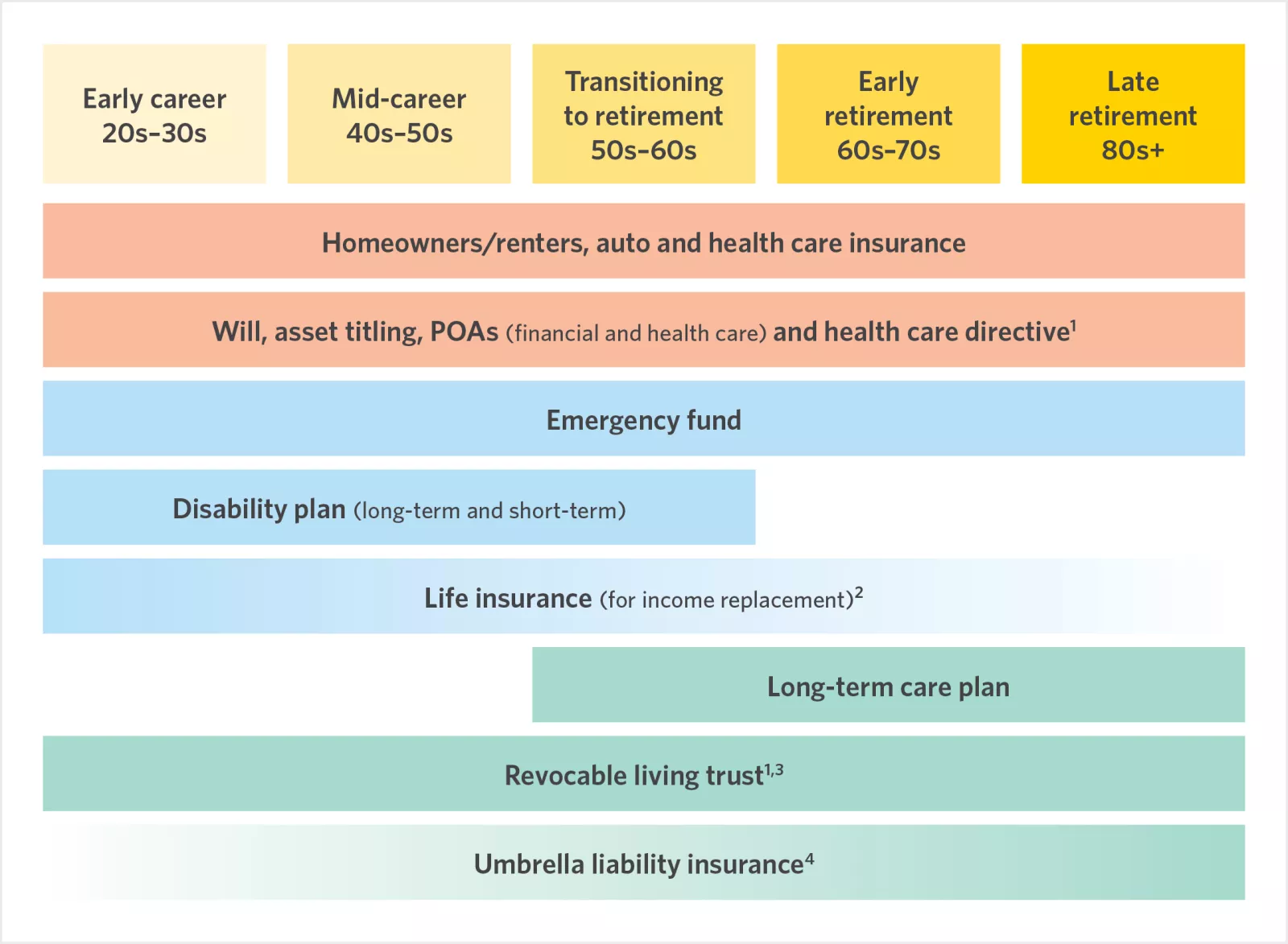

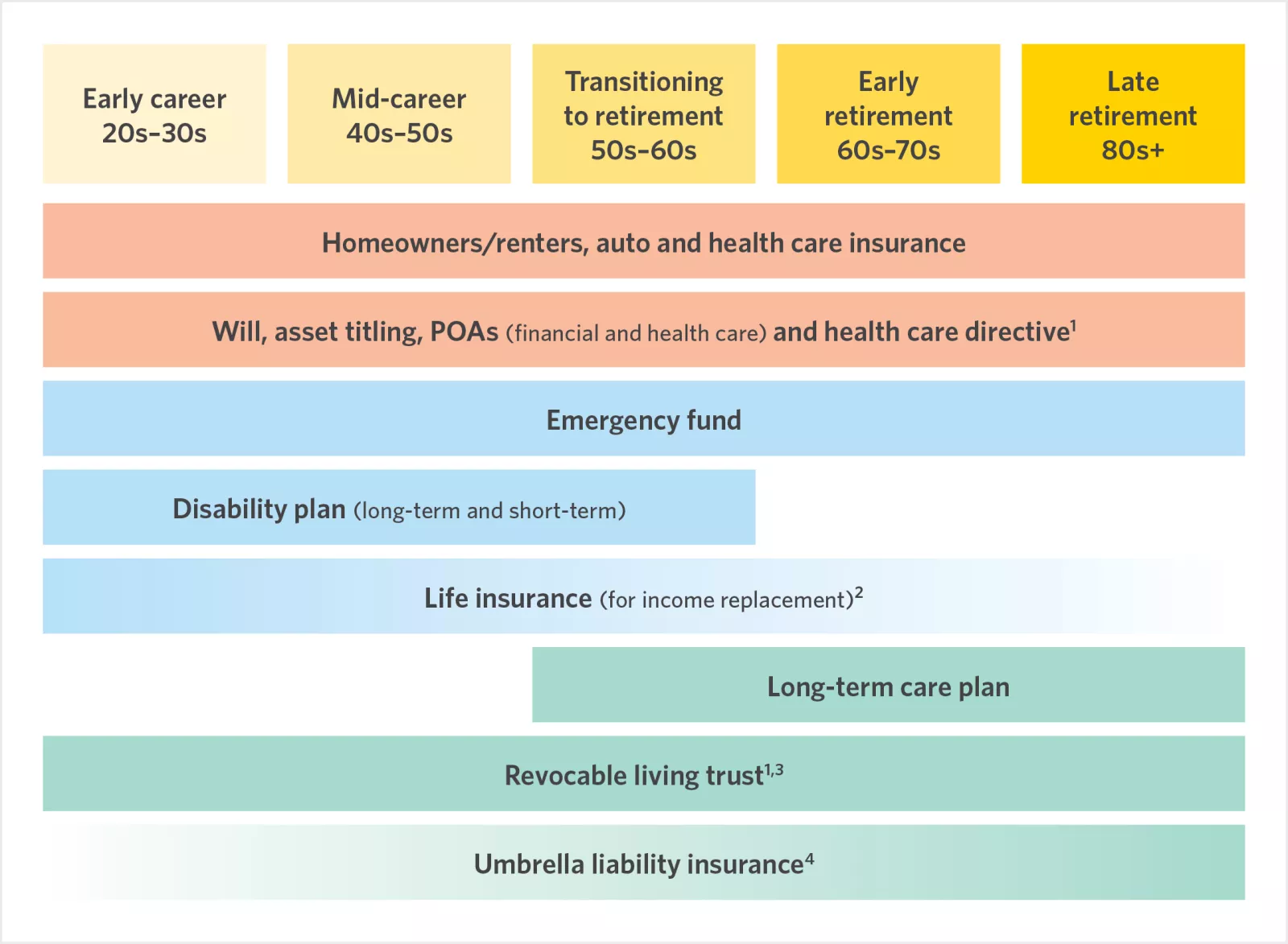

Disability insurance may be important while you’re working but won’t be helpful if you’re retired. Conversely, a long-term care plan may not be your top priority in your 20s but becomes more important as you reach retirement.

Protection strategies over time

1 In some cases, a revocable living trust might be prioritized along with you other estate documents (e.g., you have a dependent with special needs). An attorney can help draft your estate documents, advise whether a trust is appropriate and provide guidance on how to title assets and designate beneficiaries.

2 Only considers the use of life insurance to cover your family's needs in case of untimely death of you or your partner (e.g., to replace lost income or pay off debts). Doesn't include using life insurance for legacy or wealth transfer purposes.

3 The importance of a revocable living trust depends on your family situation. A revocable living trust is more relevant if you have larger or complex assets or special family concerns (e.g., minor child, dependent with special needs or blended or nontraditional family).

4 The importance of umbrella liability insurance depends on your overall assets. The more assets you have, the more relevant this insurance is for you.

For those strategies, do you have gaps?

You may be missing a protection strategy, such as not having anything saved for an emergency fund. But it could also be that your strategy doesn’t adequately meet your needs. If it’s been five years since you reviewed your life insurance, you may now be underinsured.

If you have multiple gaps, do you know which to prioritize?

Because there are multiple strategies, many of us have more than one gap that we could work toward improving. A financial advisor can work with you to determine which ones you should start making progress toward.

While most of us prefer not to think about the things that can throw us off track, preparing for the unexpected can help provide comfort that you’ve done everything you can in the event something goes wrong.

3. Estate planning

Many people mistakenly think that either they don’t have enough money or aren’t old enough to need an estate plan. Let’s bust that myth: Every adult, regardless of financial or life situation, should have a basic estate plan. If you’re a young adult, you need to specify who can speak for you should you become unable to speak for yourself. If you’re a parent, naming guardians may be important. And if you do have assets to pass along, you likely want a say over how they’re inherited.

Do you have the core documents of a basic estate plan?

Just having a will isn’t enough. Your core documents should include a will, health care directives, health care power of attorney and financial power of attorney. For some people, it may also include a revocable trust.

Do your beneficiary designations and account titling match your estate plan?

A common mistake is not to update beneficiary designations and account titling to match your estate plan. For instance, divorcées may update their estate plan but forget to update beneficiaries on their retirement accounts. If this happens, the beneficiary designation could take precedence over the will, meaning the retirement accounts might go to the ex-spouse.

Have you communicated your estate plan to those who play key roles?

Your estate plan largely comes into play once you’re incapacitated or have passed away, meaning you can no longer speak up. Having an estate plan that no one knows about or can’t find makes things difficult for your loved ones. You don’t have to share every detail, but at a minimum, each person who has a named role should be aware of their responsibilities and know how to access your documents and other key information, such as the identity of your advisors and location of your assets.

Does your estate plan need to be updated?

Your estate plan should be reviewed regularly to ensure it’s still meeting your needs. You should review your documents at least every three to five years and your asset titling annually. You should also review after any major life change (e.g., birth/adoption, marriage, divorce, relocation to a different state), if you have a large change in assets, or if estate/gift/tax laws change.

An estate attorney can help advise you on your estate plan, draft documents and provide directions on how to title accounts and designate beneficiaries.

Putting it all together

There’s a lot to unpack in each of these three goals, much less trying to tackle all three. But if you can pick one and start making progress toward addressing it — and then move on to the others — you’ll have a more robust and complete strategy for creating and protecting your financial future.

Meagan Dow

Meagan Dow is a Senior Strategist on the Client Needs Research team at Edward Jones. The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Meagan has nearly 15 years of financial services and investment experience. She is a contributor to the Edward Jones Perspective newsletter and has been quoted in various publications.